Industrial Power Supply Market Research, 2033

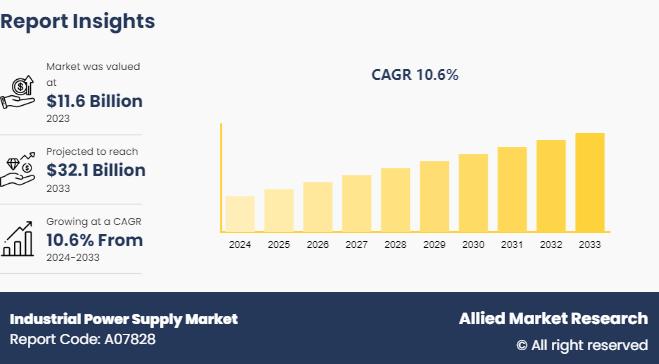

The global industrial power supply market was valued at $11.6 billion in 2023, and is projected to reach $32.1 billion by 2033, growing at a CAGR of 10.6% from 2024 to 2033.

Market Introduction and Definition

An industrial power supply is a critical component used to convert electrical energy from one form to another, making it suitable for use in various industrial applications. These power supplies are designed to deliver reliable and consistent power to equipment and machinery in industrial settings, ensuring smooth operation and minimizing downtime. Industrial power supplies come in various forms, such as AC-DC converters, DC-DC converters, and uninterruptible power supplies (UPS) , each tailored to specific requirements and applications.

Key Takeaways

The industrial power supply market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 2,500 product literatures, industry releases, annual reports, and other such documents of major industrial power supply industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

Increasing awareness of energy conservation and sustainability has led industries to adopt more efficient power solutions. As companies aim to reduce their carbon footprint and operational costs, they are turning to advanced power supplies that offer higher efficiency and lower energy waste. This is noticeable in energy-intensive sectors such as manufacturing, data centers, and telecommunications. In addition, technological advancements have enabled the development of more sophisticated and efficient power supply units. Innovations in power electronics, such as wide-bandgap semiconductors and digital control systems, have significantly improved the efficiency and performance of industrial power supplies. These advancements offer additional benefits such as improved power density and reliability. All these factors are expected to drive the industrial power supply market growth.

However, the complexity of modern industrial power supply systems contributes significantly to their high maintenance costs. These systems often incorporate advanced technologies such as digital controls, power factor correction, and sophisticated monitoring capabilities. While these features enhance performance, they also require specialized knowledge and tools for maintenance and troubleshooting. This specialization increases the cost of routine maintenance and repairs. All these factors are expected to hamper the industrial power supply market growth.

The rapid expansion of EV manufacturing is increasing demand for industrial power supplies in automotive production facilities. Assembly lines for electric vehicles require robust, efficient power systems to operate advanced robotics, welding equipment, and other specialized machinery. In addition, advanced robotics play a crucial role in EV manufacturing, handling tasks such as battery assembly, motor installation, and complicated wiring. These robots require precise, stable power supplies to ensure accuracy and consistency in their operations. The power systems must be capable of handling rapid load changes and providing clean power to prevent any disruptions that could affect product quality. All these factors are anticipated to offer new growth opportunities for the industrial power supply market throughout the forecast period.

Market Segmentation

The industrial power supply market is segmented into type, product, application, and region. By type, the market is classified into switching power supplies, unregulated power supplies, linear power supplies, and others. By product type, the market is divided into panel mount, DC/DC converters, LED drivers, battery chargers and others. By application, the market is categorized into industrial automation, medical devices, telecommunication, data centers, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

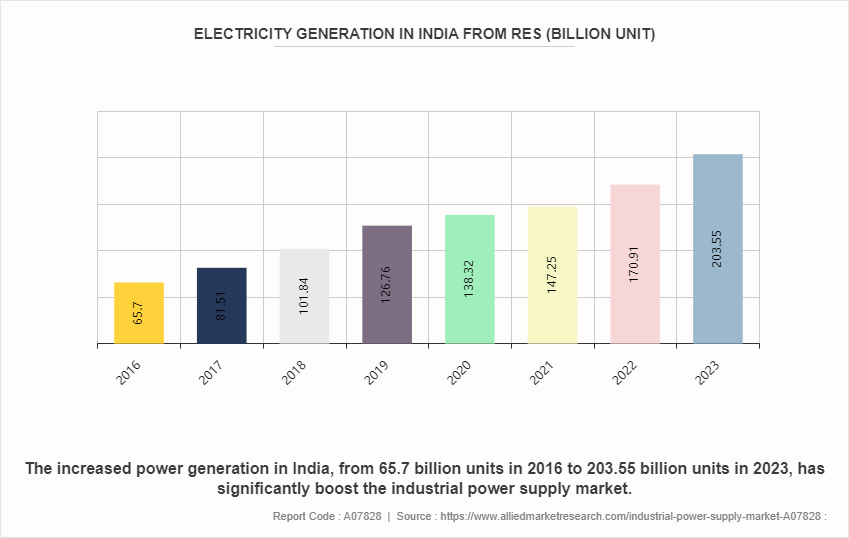

Rapid industrialization in countries such as China, India, Japan, and South Korea is a primary driver. These countries are experiencing significant growth in manufacturing, infrastructure, and urbanization, which necessitates a reliable and efficient power supply to support the continuous operation of industrial activities. The expansion of industries such as automotive, electronics, and heavy machinery further boosts the need for high-quality industrial power supplies to ensure operational efficiency and minimize downtime. India's power generation experienced its highest growth rate in over 30 years in FY23, increasing by 6.80% to 1, 452.43 billion kilowatt-hours (kWh) as of January 2024. According to data from the Ministry of Power, the country's power consumption reached 1, 503.65 billion units (BU) in April 2023.

Competitive Landscape

The major players operating in the industrial power supply market include Siemens AG, ABB Ltd., General Electric Company, Schneider Electric, Eaton, Advanced Energy, Bel Fuse Inc, Delta Electronics, Inc., Murata Manufacturing Co., Ltd., Power Integrations.

Electricity generation in India from RES (Billion Unit)

The steady increase in electricity generation in India, reaching 1, 452.43 billion kilowatt-hours in FY23, significantly impacts the industrial power supply market. As power generation has grown from 65.7 billion units in 2016 to 203.55 billion units in 2023, industries have benefited from a more reliable and abundant power supply, facilitating uninterrupted operations and promoting industrial growth. This increase supports the expansion of industrial activities, boosting productivity and encouraging investments in energy-intensive sectors. In addition, the enhanced power generation capacity helps meet the rising demand for electricity in India.

Industry Trends

As of January 31, 2024, India’s installed renewable energy capacity (including hydro) stood at 182.05 GW, representing 42.3% of the overall installed power capacity. As of January 31, 2024, Solar energy contributed 72.31 GW, followed by 44.95 GW from wind power, 10.26 GW from biomass, 4.99 GW from small hydropower, 0.58 from waste to energy, and 46.93 GW from hydropower.

AC-DC power supplies are extensively utilized in a wide range of electronic devices, including computers, cell phones (such as wall chargers) , and televisions. These power supplies are commonly employed in various settings and conditions, with consumer electronics being a significant application area. The increasing adoption of consumer electronic devices is expected to boost the demand for power supply devices.

According to Indian Budget for 2024, the government's power sector initiatives have been allocated funds that are 50% higher. Increased funds have been allocated to green hydrogen, solar power, and green-energy corridors.

As per the National Infrastructure Pipeline 2019-25, energy sector projects accounted for the highest share (24%) out of the total expected capital expenditure of Rs. 111 lakh crore (US$ 1.4 trillion) . Total FDI inflow in the power sector reached US$ 16.58 billion between April 2000-March 2023.

Key Sources Referred

Invest India

International Renewable Energy Agency (IREA)

International Energy Agency (IEA)

India Brand Equity Foundation (IBEF)

Power Sources Manufacturers Association

Energy Star

European Power Supplies Manufacturers' Association

Indian Electrical & Electronics Manufacturers'? Association

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the industrial power supply market analysis from 2024 to 2033 to identify the prevailing industrial power supply market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the industrial power supply market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global industrial power supply market trends, key players, market segments, application areas, and market growth strategies.

Industrial Power Supply Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 32.1 Billion |

| Growth Rate | CAGR of 10.6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 340 |

| By Type |

|

| By Product |

|

| By Application |

|

| By Region |

|

| Key Market Players | General Electric Company, Delta Electronics, Inc., Murata Manufacturing Co., Ltd., Bel Fuse Inc, Eaton, Power Integrations, Schneider Electric, Advanced Energy, Siemens AG, ABB Ltd |

Industrial automation is the leading application of Industrial Power Supply Market

Asia-Pacific is the largest regional market for Industrial Power Supply

$32.1 Billion is the estimated industry size of Industrial Power Supply by 2033.

Increasing demand for energy-efficient solutions, development of modular power supplies are the upcoming trends of Industrial Power Supply Market in the world.

Siemens AG, ABB Ltd, General Electric Company, Schneider Electric, Eaton, Advanced Energy, Bel Fuse Inc, Delta Electronics, Inc., Murata Manufacturing Co., Ltd.,

Loading Table Of Content...