Protective Clothing Market Research, 2033

The global protective clothing market was valued at $10.3 billion in 2023, and is projected to reach $18.6 billion by 2033, growing at a CAGR of 6.1% from 2024 to 2033.

Introduction

Protective clothing plays a crucial role in ensuring the safety and well-being of workers in a range of environments. It refers to garments specifically designed to shield the body from hazards or potential injury. These hazards are chemical, biological, thermal, mechanical, or radiological in nature, and they are commonly present in industrial applications, healthcare facilities, laboratories, and emergency response scenarios. Protective clothing prevents harm from accidents, exposure to dangerous substances, extreme temperatures, or impacts, and it ranges from basic safety wear such as gloves and aprons to more sophisticated suits that provide comprehensive coverage.

Protective clothing is essential in the chemical and pharmaceutical sectors. Workers dealing with corrosive substances, solvents, or hazardous biological agents require full-body chemical suits, gloves, and face shields to prevent exposure. In pharmaceutical production, sterile clothing, such as coveralls and shoe covers, are used to maintain cleanroom standards and prevent contamination of products. The focus in these industries is on protecting workers and on ensuring the integrity & quality of products. As regulatory standards in the chemical and pharmaceutical sectors become stricter, the demand for advanced protective clothing solutions is expected to grow.

In the firefighting industry, protective clothing is most visibly and critically used. Firefighters are exposed to extreme heat, flames, smoke, and toxic gases, necessitating the use of specialized suits made from flame-resistant and heat-resistant materials. These suits, typically composed of layers of protective fabric, provide insulation and minimize heat transfer to the body, allowing firefighters to work in hazardous conditions. In addition to the suit, helmets with visors, gloves, and sturdy boots are standard components of a firefighter's ensemble. This protective gear provides safety and enhances the operational efficiency of firefighters, enabling them to save lives and property more effectively.

Key Takeaways

- The protective clothing market has been analyzed in terms of value ($billion). The analysis in the report is provided on the basis of application, end-use industry, 4 major regions, and more than 15 countries.

- The global protective clothing market report includes a detailed study covering underlying factors influencing industry opportunities and trends. The key players in the protective clothing market are VF Corporation, TEIJIN LIMITED, 3M, DuPont, Glen Raven, Inc., Ballyclare International, TenCate Protective Fabrics, Lakeland Inc, ANSELL LTD, and Honeywell International Inc.

- The report facilitates strategy planning and industry dynamics to enhance decision-making for existing market players and new entrants entering the alternators industry.

- Asia-Pacific region holds a significant share in the global protective clothing market.

Market Dynamics

Rise in awareness of health and safety is expected to drive the growth of protective clothing market during the forecast period. Occupational health and safety have gained immense importance across industries, particularly those with higher risks, such as construction, oil & gas, manufacturing, and healthcare. Companies have become increasingly proactive in ensuring that workers are adequately protected, not only to comply with regulatory standards but also to promote a safer and more productive work environment. Awareness campaigns and training programs have played a significant role in highlighting the importance of using personal protective equipment (PPE). These initiatives educate both employers and employees about the dangers present in the workplace and the protective measures required to mitigate them. As employees become more informed about the risks associated with their jobs, whether they are dealing with hazardous chemicals, heavy machinery, or potential fire hazards, they are more likely to insist on using proper protective clothing. In May 2024, KARAM Safety, a global leader in PPE and fall protection solutions, expanded its market presence and product portfolio by acquiring Midas Safety India, a prominent manufacturer of hand protection safety products. This strategic acquisition aims to strengthen KARAM Safety’s offerings and broaden its reach in the safety solutions industry.

However, compliance with strict safety standards is expected to restrain the growth of the protective clothing market. Compliance with strict safety standards poses a significant challenge for the protective clothing market, especially for small and medium-sized enterprises (SMEs). In many industries, protective clothing must meet rigorous health and safety regulations designed to ensure that workers are safeguarded from various occupational hazards. These regulations often involve extensive testing and certification processes, such as those required by organizations like OSHA (Occupational Safety and Health Administration) in the U.S., CE standards in Europe, or country-specific safety norms. Compliance with strict safety standards significantly restrains market expansion. The high costs associated with developing and manufacturing specialized protective clothing are a primary concern. Advanced materials used in protective apparel, such as aramid fibers, are prohibitively expensive, ranging from $20,000 to $40,000 per metric tons This high cost is compounded by the extensive testing and certification processes required to meet safety standards, which further increase production expenses.

Segments Overview

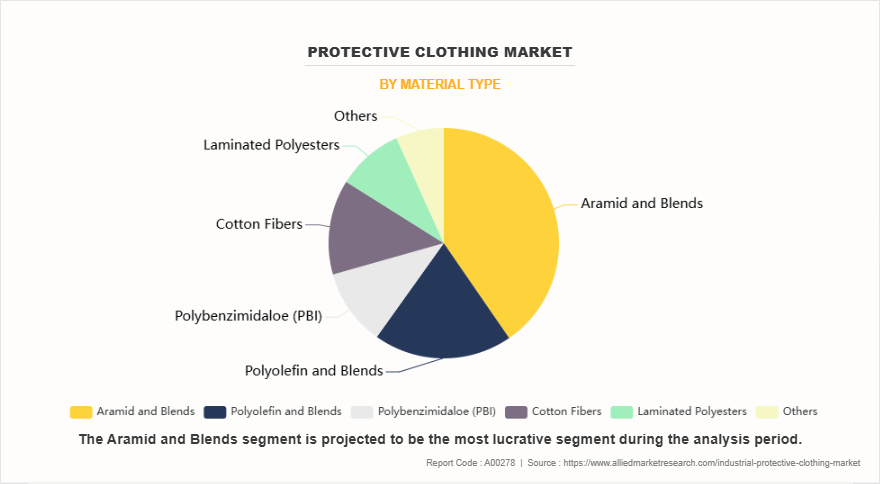

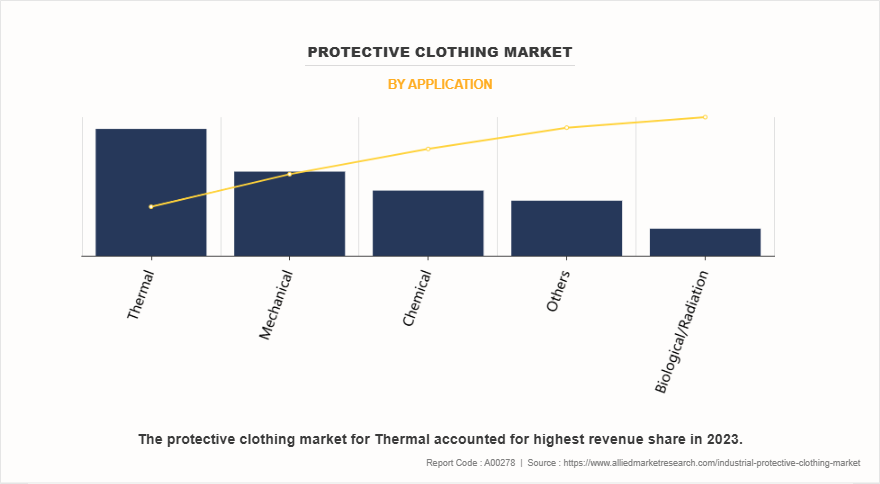

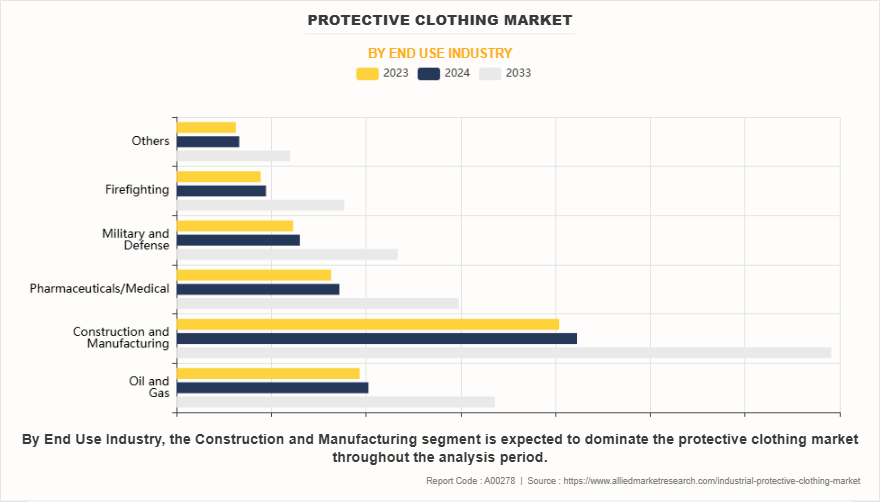

The protective clothing market is segmented into material type, application, end-use industry, and region. By material type, the market is segregated into aramid & blends, polyolefin & blends, polybenzimidaloe (PBI), cotton fiber, laminated polyesters, and others. By application, the market is divided into thermal, mechanical, chemical, biological/radiation, and others. By end-use industry, the market is classified into oil & gas, construction & manufacturing, pharmaceuticals/medical, military & defense, firefighting, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By material type, aramid and blends segment dominated the protective clothing market growing with a CAGR of 5.6% during the forecast period. Aramid fibers, such as Nomex and Kevlar, are commonly used in protective clothing due to their excellent heat and flame resistance, along with strength and durability. Aramid fibers are synthetic polymers that are highly resistant to heat, abrasion, and cuts, making them ideal for applications where workers are exposed to high temperatures or hazardous materials. In industries like firefighting, military, and industrial applications, aramid-based protective clothing offers critical protection against fire, heat, and impact. In June 2022, Teijin Aramid B.V. unveiled its innovative Woven Matrix concept, designed to simplify the production of diverse ballistic protection solutions. The company utilizes its high-performance para-aramid fiber, Twaron, to create this woven matrix. This new fabric-based technology aims to help Teijin's defense and security clients enhance their manufacturing efficiency by minimizing the need for pre-pegging processes.

On the basis of application, thermal segment was the highest revenue contributor in the protective clothing market in 2023. Protective clothing used in thermal applications plays a critical role in safeguarding workers from extreme heat, flames, and thermal hazards in various industries, such as manufacturing, firefighting, and energy production. Thermal protective clothing is specifically designed to prevent burns, heat stress, and injuries from high temperatures. It is commonly made from materials with high resistance to heat, flame, and sometimes electrical hazards, ensuring that workers remain safe in environments with elevated temperature conditions. In industries such as steel manufacturing, metalworking, and glass production, where workers are exposed to molten metals or high-temperature machinery, thermal protective clothing is essential. These garments typically include aluminized fabrics or other heat-resistant materials that reflect radiant heat and provide insulation. Additionally, many of these garments are designed to be lightweight to reduce heat stress, offering comfort and mobility without compromising protection.

Based on end-use industry, construction and manufacturing segment dominated the protective clothing market representing the CAGR of 5.6% in 2023. Protective clothing plays a critical role in both the construction and manufacturing industries, ensuring the safety and well-being of workers exposed to a wide range of hazards. In the construction industry, workers face various risks such as falling objects, sharp materials, heavy machinery, and environmental factors like heat, cold, or rain. As a result, personal protective equipment (PPE), including hard hats, high-visibility vests, safety boots, and gloves, is essential to prevent injuries. These garments are designed to safeguard against head trauma, slips, trips, falls, and exposure to hazardous substances like dust, chemicals, or electrical currents. Additionally, protective clothing in construction is often tailored to specific tasks, with reinforced fabrics for durability, flame-resistant materials, or waterproof clothing to manage weather-related challenges.

Region wise, Asia-Pacific dominated the market representing the CAGR of 6.3% during the forecast period. In the Asia-Pacific (APAC) region, the usage of protective clothing has seen significant growth across various industries due to increasing safety awareness, stringent regulations, and rising industrial activities. In countries like China, India, and Japan, where manufacturing and industrial activities are prominent, the demand for protective clothing has surged due to the risks posed by exposure to chemicals, heat, machinery, and other physical hazards. Personal protective equipment (PPE) such as flame-resistant clothing, high-visibility vests, and protective gloves are commonly used to ensure worker safety. With the adoption of stricter occupational health and safety regulations, these countries are increasingly prioritizing the implementation of protective clothing to reduce work-related injuries and fatalities. In countries with robust oil & gas and chemical industries, such as Australia, Malaysia, and Indonesia, workers are exposed to a range of environmental hazards, including exposure to toxic chemicals, high temperatures, and fire risks. Protective clothing such as chemical-resistant suits, flame-retardant garments, and head protection are essential to mitigate risks associated with hazardous materials and extreme work environments.

Competitive Analysis

Key players in the protective clothing industry include VF Corporation, TEIJIN LIMITED, 3M, DuPont, Glen Raven, Inc., Ballyclare International, TenCate Protective Fabrics, Lakeland Inc, ANSELL LTD, and Honeywell International Inc.

- In March 2023, Ansell Ltd. revealed that the initial phase of its new Kovai manufacturing facility in India, designed for packing and irradiation operations, is expected to commence. While the primary focus of the facility is anticipated to be on surgical and life science products, it is strategically designed with significant expansion potential. This is projected to enable the facility to accommodate a broad spectrum of their products, including the examination glove line, and support the company’s long-term growth goals in the protective clothing market.

- In May 2023, DuPont revealed that it entered into an agreement to acquire Spectrum Plastics Group from AEA Investors, a transaction that was finalized in August 2023. This partnership is strategically positioned to continue delivering innovative solutions for critical healthcare applications while maintaining a high standard of customer service.

- In April 2023, TenCate Protective Fabrics introduced Tecasafe360+, an inherently flame-resistant (FR) fabric featuring XLANCE stretch technology. This innovative fabric offers exceptional stretching and recovery, maintaining its shape after multiple washes without sagging or bagging. Tecasafe360+ is designed to enhance worker safety by ensuring a snug fit that retains its form, even after repeated use.

- In May 2022, Honeywell expanded its line of personal protective equipment (PPE) for healthcare workers by introducing two new NIOSH-certified respiratory products. Leveraging its extensive experience in respiratory protection solutions, Honeywell continues to enhance safety offerings for healthcare professionals.

- In June 2022, Health Supply U.S., a government contracting and medical supply firm, announced plans to set up new manufacturing operations in Greenville County. The company produces FDA-compliant products, including Class I medical devices and items such as medical isolation gowns and nitrile gloves. The new facility is expected to manufacture 4.3 billion nitrile gloves annually, significantly boosting the domestic supply of this essential medical product.

- In April 2022, Toray Industries, Inc. announced the development of LIVMOA™ 4500AS, a new type of disposable personal protective clothing. This product meets the JIS T 8115 Type 4 standard for spray-tight chemical protection apparel. Owing to the application of seam tape, it delivers enhanced water resistance, breathability, and dust protection.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the protective clothing market analysis from 2023 to 2033 to identify the prevailing protective clothing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the protective clothing market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global protective clothing market trends, key players, market segments, application areas, and market growth strategies.

Protective Clothing Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 18.6 billion |

| Growth Rate | CAGR of 6.1% |

| Forecast period | 2023 - 2033 |

| Report Pages | 300 |

| By Material Type |

|

| By Application |

|

| By End Use Industry |

|

| By Region |

|

| Key Market Players | ANSELL LTD, Honeywell International Inc., Ballyclare International, VF Corporation, DuPont, 3M, TEIJIN LIMITED., Lakeland Inc., TenCate Protective Fabrics, Glen Raven, Inc. |

Analyst Review

According to the opinions of various CXOs of leading companies, the protective clothing market is expected to witness significant growth in the upcoming years. Increasing government regulations around occupational safety and health are expected to drive the growth of protective clothing market. Workplace Safety Regulations play a pivotal role in driving the adoption of protective clothing across various industries. Governments worldwide have introduced stringent occupational safety and health regulations to safeguard workers from the risks associated with hazardous working conditions. In industries such as construction, chemicals, and oil & gas, where workers are often exposed to dangerous environments, the implementation of these regulations is crucial in minimizing workplace accidents and injuries. For instance, regulations such as the Occupational Safety and Health Administration (OSHA) standards in the U.S. require employers to provide personal protective equipment (PPE), including protective clothing, to workers exposed to physical, chemical, and environmental hazards. These laws mandate that businesses in high-risk sectors implement safety measures, including the use of protective clothing designed to shield workers from burns, chemical spills, falling debris, and extreme temperatures.

However, discomfort and restriction is expected to restraint the growth of protective clothing market. Discomfort and Restriction are significant barriers to the widespread adoption of protective clothing, particularly in industries where mobility and comfort are essential. Traditional protective gear, while designed to provide safety, often comes with the downside of being bulky, heavy, and uncomfortable to wear for extended periods. Workers in sectors such as construction, manufacturing, and oil & gas, where physical labor is intensive, often find this clothing difficult to wear for long shifts due to its restrictive nature. The weight and stiffness of conventional protective clothing can limit a worker’s range of motion, making it harder to perform tasks that require flexibility, dexterity, and agility. For instance, in jobs that require lifting, bending, or working in confined spaces, the added bulk of protective gear can hinder efficiency and increase physical strain. This discomfort may lead to workers removing or not wearing protective clothing altogether, which undermines its effectiveness and puts them at greater risk of injury.

The global protective clothing market was valued at $10.3 billion in 2023, and is projected to reach $18.6 billion by 2033, growing at a CAGR of 6.1% from 2024 to 2033.

The report covers the profiles of key industry participants such as VF Corporation, TEIJIN LIMITED, 3M, DuPont, Glen Raven, Inc., Ballyclare International, TenCate Protective Fabrics, Lakeland Inc, ANSELL LTD, and Honeywell International Inc.

Asia-Pacific is the largest region for protective clothing market.

Thermal segment is the leading application of of protective clothing market.

The increase in demand for eco-friendly protective clothing are the upcoming trends of protective clothing market.

Loading Table Of Content...

Loading Research Methodology...