Industrial Refrigeration Market Research - 2032

The Global Industrial Refrigeration Market size was valued at $21.9 billion in 2020, and is projected to reach $41.7 billion by 2032, growing at a CAGR of 5.2% from 2023 to 2032.

Industrial refrigeration systems are widely used in various industries, including food and beverage processing, cold storage facilities, chemical and petrochemical, pharmaceuticals, and other sectors that produce products which require cold and controlled temperatures during storage and transportation. By using refrigeration systems, industries can ensure the quality, freshness, and longevity of perishable goods, and facilitate the seamless functioning of various industrial operations.

Market Dynamics

The industrial refrigeration market is primarily driven by various factors such as growth in food and beverages and pharmaceutical industries, rise in cold-chain industries, and increase in industrialization in developing economies. In these industries, industrial refrigeration is used for maintaining a conducive environment for the storage and transportation of perishable goods, as well as volatile chemicals. In addition, various industries use refrigeration systems such as chillers, compressors, and other components to keep the machines cool in industries as well as in data centers.

Furthermore, world trade is rising at a rapid pace, which is expected to increase the demand for cold-chain industries. According to the World Trade Organization, the overall monetary value of international trade involving physical goods reached value of $25.3 trillion in the year 2022. Projections indicate a gradual expansion of 1.7% in 2023, which is expected to grow substantially by 3.2% in 2024. A significant portion of this extensive trade include perishable products that require specific temperature conditions to maintain their quality and prevent spoilage.

These goods are typically from sectors such as pharmaceuticals, both frozen and non-frozen food and beverages, chemicals, and various other industries. In addition to this, the demand for frozen and non-frozen foods & beverages such as ice-creams, desserts, meat, poultry, dairy, and others is also rising across the world. According to the American Frozen Food Institute (AFFI), the retail sales of frozen food increased significantly by 23% in 2021, as compared to 2019. Furthermore, similar development can be seen in Europe also.

For instance, based on data provided by the Freshfel Europe's Consumption Monitor, the European Union witnessed a notable surge in fruit and vegetable consumption in 2021. The per capita daily consumption of these fruit and vegetable products reached 364.58 grams, marking a substantial growth of 2.2% compared to the previous year i.e., 2020. Furthermore, this figure surpasses the average consumption of the European Union over the last five years by 1.27%.

This upward trend indicates an increasing preference for, and awareness of the health benefits associated with the consumption of fruits and vegetables within the European Union population. Thus, owing to growth in trade and consumption of perishable products, various companies involved in providing cold-chain logistics are expanding their capabilities. These facilities significantly require industrial cooling system; therefore, many companies in the refrigeration market have launched their refrigeration products for cold-chain industry.

On the other hand, as per the to the U.S. Environment Protection Agency, a typical food retail store leaks an estimated 25% of refrigerant annually, leading to negative impact on the environment. This emphasizes the importance of regulating the use of refrigerants to protect the planet. Thus, governments across the world have implemented strict regulations on a wide range of refrigerants that have adverse effects on the environment which is expected to restrain the market growth. For instance, the U.S. government has also planned to ban the use of high GWP refrigerants, including R134a, R410A and R407C, from use in new chillers in the U.S. from January 1, 2024.

Furthermore, technological development is a major industrial refrigeration market opportunity that is expected to provide lucrative opportunities for the key market players. For instance, technologies such as Artificial Intelligence (AI), the Internet of Things (IoT), cloud connectivity, and others are also being incorporated into industrial refrigeration.

For example, the Danfoss iMCHE allows different circuits to use a single coil's heat transfer area, eventually boosting the efficiency of the system by over 20%. This also helps in maximizing heat-transfer efficiency, and reducing refrigerant charge in a compact, lightweight design. Moreover, it also offers the CO2 Adaptive Liquid Management (CALM) Solution for its Refrigeration category.

The industrial refrigeration market is witnessing various obstructions in its regular operations due to the COVID-19 pandemic and the economic slow-down due to inflation across the world. Earlier, the worldwide lockdowns due to COVID-19 resulted in reduced industrial activities, eventually leading to reduced demand for industrial refrigeration from various sectors such as food and beverages sectors. However, COVID-19 has subsided, and the major manufacturers in 2023 are performing well. Contrarily, the rising global inflation which is soon expected to cause recession in major economies is a new major obstructing factor for the entire industry.

The inflation caused by the Ukraine-Russia war, as well as the few long-term effects of the coronavirus epidemic, has caused instability in the pricing of food and oil and gas, including raw materials required to manufacture industrial refrigeration systems. Furthermore, nations in Europe, Latin America, North America, the Middle East, and Sub-Saharan Africa are suffering from significant negative effects on industrial output, including the manufacture of industrial refrigeration systems. However, India and China are doing pretty well, and the future for the industrial refrigeration industry in these nations is good.

Furthermore, inflation is projected to worsen in the following years as the likelihood of the war between Ukraine and Russia diminishes. Moreover, the cost of food products has risen substantially, discouraging their trade, which is also expected to have slight negative effects on the industrial refrigeration market growth. However, with the continued talks between different countries, a peace agreement between Ukraine and Russia can be devised.

Segmental Overview

The industrial refrigeration market is segmented on the basis of component, refrigerant type, application, type, sales type, and also region. Depending upon the component, the market is categorized into compressor, condenser, control, as well as evaporator, and also others. On the basis of refrigerant type, it is divided into ammonia, carbon dioxide, hydrofluorocarbons (HFC), as well as hydrochlorofluorocarbons (HCFC), and also others. As per application, the market is classified into fresh fruits and vegetables, and also meat, poultry and fish, as well as dairy and ice cream, beverages, chemicals, pharmaceuticals, petrochemicals, and also others.

Furthermore, on the basis of type, it is divided into stationary refrigeration and also transport refrigeration. According to sales type, the market is classified on the basis of new sales as well as aftermarket. Region wise, it is analyzed across North America which includes countries such as the U.S., Canada, and Mexico. Europe includes Germany, France, Italy, UK, and rest of Europe. Asia-Pacific is among the largest regions including China, Japan, India, South Korea, Australia, Malaysia, Indonesia, Singapore, and rest of Asia-Pacific. LAMEA consists Latin America, Middle East, and Africa.

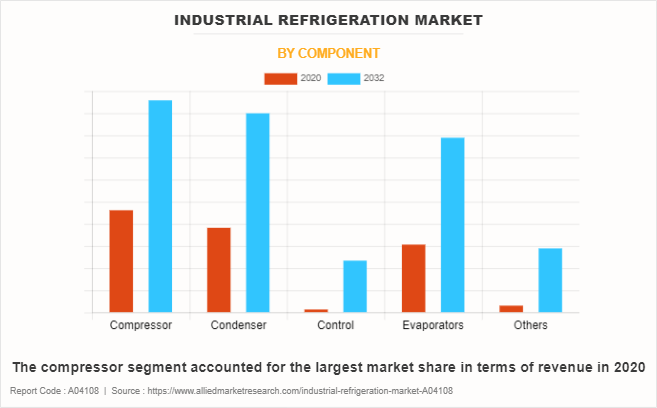

By Component:

Compressor, condenser, control, and other segments comprise the industrial refrigeration market. In terms of revenue, the compressor segment held the industrial refrigeration market share in 2022, while the others sector is predicted to rise at a faster CAGR during the forecast period. A compressor is a key component of a refrigeration system that consumes a lot of energy. As a result, prominent manufacturers are developing compressors that deliver energy-efficient, dependable, and long-term refrigeration.

Furthermore, refrigeration systems are extremely fundamental and require modern control systems in order to accomplish automated, energy-efficient, and dependable refrigeration system operation, consequently fueling the demand for varied control systems.

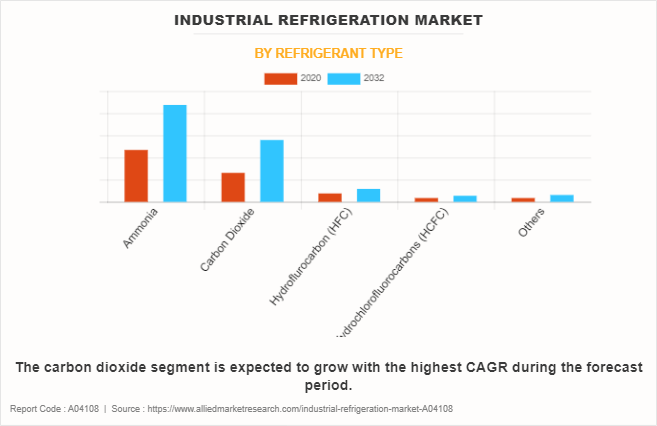

By Refrigerant Type:

The industrial refrigeration market is divided into ammonia, carbon dioxide, hydrofluorocarbons (HFC), hydrochlorofluorocarbons (HCFC), and others. In 2022, the ammonia segment dominated the industrial refrigeration market, in terms of revenue, and the carbon dioxide segment is expected to witness growth at a higher CAGR during the forecast period. Ammonia is a natural refrigerant and does not cause any harm to the environment; therefore, it is witnessing an increased demand. In adidtion, Hydrofluorocarbon (HFC) refrigerants are being phased out from commercial applications due to increasing concerns of environmental issues such as the depletion of the ozone layer and global warming. Furthermore, carbon dioxide is a cheap refrigerant, widely available and easily obtainable from the combustion of hydrocarbons, which is a reason for its high CAGR throughout the forecast period.

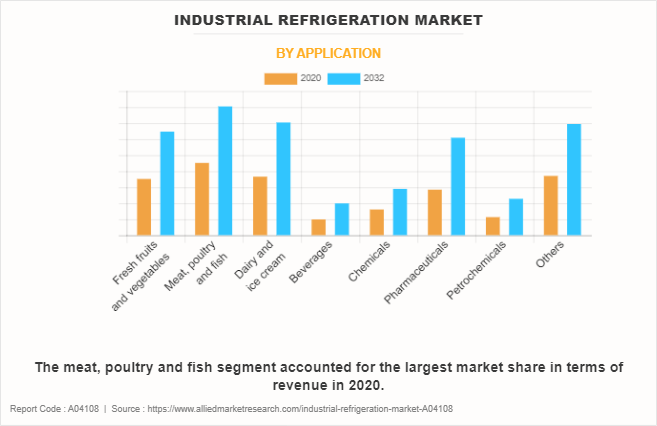

By Application:

The industrial refrigeration market is categorized into fresh fruits and vegetables, meat, poultry and fish, dairy and ice cream, beverages, chemicals, pharmaceuticals, petrochemicals, and others. The meat, poultry and fish segment accounted for a higher market share in 2022. This is attributed to increased consumption of these products driven by the rising disposable income of people. However, the pharmaceuticals segment is anticipated to register a higher growth rate throughout the forecast period, owing to the increased demand for chemicals from almost all types of manufacturing industries, including textiles, petrochemicals, electronics, plastic, and other industries.

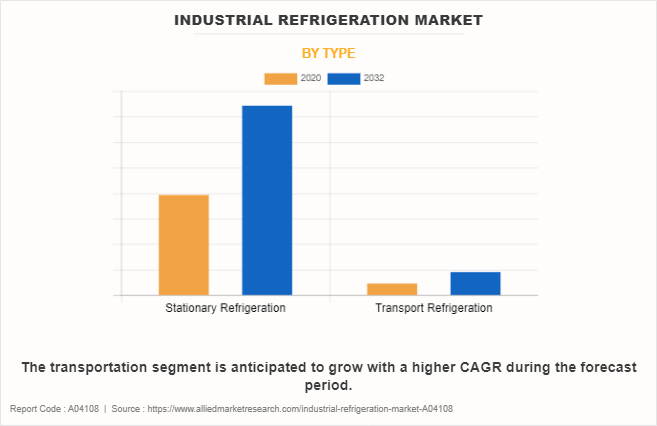

By Type:

The industrial refrigeration market is divided stationary refrigeration and transport refrigeration. In 2022, the stationary refrigeration segment dominated the industrial refrigeration market, in terms of revenue, and the transport refrigeration segment is expected to witness growth at a higher CAGR during the forecast period. Stationary refrigeration systems are immovable and are permanently fixed in their places. Relatively, they are big and have larger capacities than the transport ones. Rapid expansion of refrigerated warehouses for storing and processing food and beverages has fueled the demand for industrial stationary refrigeration. On the other hand, rise in trade of perishable goods is driving the growth of transport refrigeration.

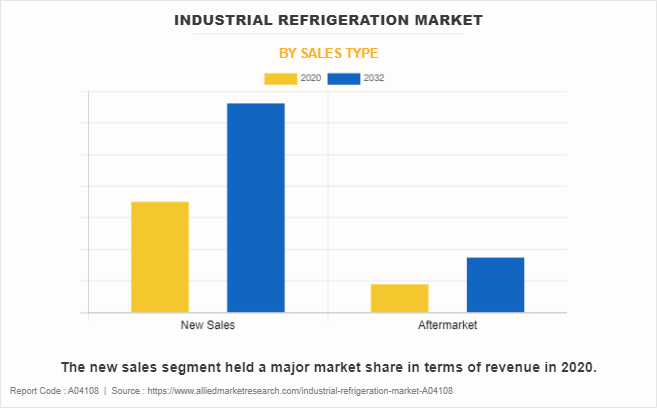

By Sales Type:

The industrial refrigeration market is categorized into new sales and aftermarket. The new sales segment accounted for a higher market share in 2022, owing to an increase in the number of new cold warehouses, and food and beverages and pharmaceutical manufacturing facilities. However, the aftermarket segment is anticipated to register a higher growth rate throughout the forecast period. This is attributed to the high requirement of the repair and maintenance of refrigeration systems.

By region Asia-Pacific was the greatest contributor to worldwide market revenue in 2022, and this dominance is likely to continue throughout the forecast period. LAMEA, on the other hand, is predicted to emerge as a region with the greatest development potential in the next years. The Asia-Pacific industrial refrigeration industry is the fastest expanding. The expansion of the industrial refrigeration industry has been supported by an increase in food consumption, development in the cold storage sector, and an increase in the number of refrigerated warehouses in the region. Significant demand is produced, particularly from China and Japan. Moreover, the surge in demand for frozen and processed food items in LAMEA has boosted the growth of the industrial refrigeration market. Further, the increase in the export of perishable products to the U.S. has supplemented the growth of the industrial refrigeration market in LAMEA.

Competition Analysis

Competitive analysis and profiles of the major players in the industrial refrigeration market are provided in the report. Major companies in the report include Daikin Industries, Ltd., Danfoss A/S, GEA Group AG, Mayekawa Mfg. Co., Ltd., Swegon AB, Dover Corporation, Gordon Brothers Industries Pty. Ltd., EVAPCO, Inc., Munters, Kirby HVAC&R Pty Ltd., LU-VE Group, BITZER Group, Emerson Electric Co., Johnson Controls International plc, Refplus, Trane Technologies plc (Thermo King), ABB Ltd., Baltimore Aircoil Company Inc., Carrier Global Corporation, Dorin S.p.A., and Rivacold srl.

To remain competitive, major players adopt various development strategies such as product launch, business expansion, acquisition, and others. For instance, in March 2023, Danfoss A/S acquired BOCK GmbH which is a leading manufacturer of compressors and is based in Germany. This acquisition will strengthen the Danfoss product portfolio with CO2 and low-GWP compressors. Similarly, in May 2022, Emerson Electric Co. introduced Copeland scroll compressor for a variety of applications that uses low-temperature refrigerants such as A1 and A2L.

Key Benefits for Stakeholders

- The report provides an extensive analysis of the current and emerging industrial refrigeration market trends and dynamics.

- In-depth industrial refrigeration market analysis is conducted by constructing market estimations for key market segments between 2022 and 2032.

- Extensive analysis of the industrial refrigeration market is conducted by following key product positioning and monitoring of top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- The industrial refrigeration market forecast analysis from 2023 to 2032 is included in the report.

- The key players within the industrial refrigeration market are profiled in this report and their strategies are analyzed thoroughly, which helps understand the competitive outlook of the industrial refrigeration industry.

Industrial Refrigeration Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 41.7 billion |

| Growth Rate | CAGR of 5.2% |

| Forecast period | 2020 - 2032 |

| Report Pages | 300 |

| By Component |

|

| By Refrigerant Type |

|

| By Application |

|

| By Type |

|

| By Sales type |

|

| By Region |

|

| Key Market Players | GEA Group AG, Gordon Brothers Industries Pty Ltd., BITZER Group, Rivacold srl, LU-VE S.p.A., Mayekawa Mfg. Co., Ltd., Emerson Electric Co., Dover Corporation, SPX Technologies, Inc., EVAPCO, Inc., Baltimore Aircoil Company Inc., Investment AB Latour (Swegon AB), Dorin S.p.A., ABB Ltd., Daikin Industries, Ltd., Johnson Controls International plc, Munters Group AB, Refplus, Trane Technologies plc (Thermo King), Danfoss A/S, Carrier Global Corporation |

Analyst Review

The industrial refrigeration market has witnessed significant growth in the past few years owing to an increase in global trade of goods including perishable goods such as food and beverages, and pharmaceuticals.

Furthermore, the demand for energy-efficient and eco-friendly refrigerants such as CO2 and ammonia is on the rise owing to various government regulations that restrict their usage. In addition, other natural refrigerants; pentane, propane, and butane are also experiencing a relatively higher adoption rate.

Moreover, the demand for CO2 refrigerants in the U.S. is not very widespread, and is mostly driven by very few companies as well as retail stores that are strictly following their sustainable development policies. Contrarily, it is expected to change, owing to phasing-out policies related to hydrofluorocarbon (HFC) refrigerants. However, countries in Europe are leading in the adoption of CO2-based refrigeration systems. Japan is also among the top countries to adopt CO2-based refrigeration systems in Asia-Pacific. Moreover, according to the statement made by the president of the Association of Ammonia Refrigeration (AAR) India in 2019, around 90% of the industrial refrigeration in India is using ammonia as a safe and reliable refrigerant, and this trend is expected to grow further in the coming years.

On the contrary, according to a report published in 2020 by the Clean Energy Manufacturing Analysis Centre, China is extensively increasing its production of conventional refrigerants for domestic use as well as export.

In addition, high maintenance costs and negative impacts of global inflation are expected to have negative impacts on market growth. Contrarily, various technological developments in the industrial refrigeration market are expected to provide lucrative growth opportunities to the key players.

The growth of the cold-chain industry, the growth of food and beverages and pharmaceutical industries, and industrialization in developing economies drive the growth of the global industrial refrigeration market.

The latest version of the global industrial refrigeration market report can be obtained on demand from the website.

The global tire recycling market size was valued at $21,904.1 million in 2020.

The global industrial refrigeration market size is estimated to reach $41,710.9 million by 2032, exhibiting a CAGR of 5.2% from 2023 to 2032.

The forecast period considered for the global industrial refrigeration market is 2023 to 2032, wherein, 2022 is the base year, 2023 is the estimated year, and 2032 is the forecast year. In addition, the historical period from 2020-2021 is also analyzed.

Asia-Pacific is the largest regional market for industrial refrigeration market.

Key companies profiled in the tire recycling market report include Daikin Industries, Ltd., Danfoss A/S, GEA Group AG, Mayekawa Mfg. Co., Ltd., Swegon AB, Dover Corporation, Gordon Brothers Industries Pty. Ltd., EVAPCO, Inc., Munters, Kirby HVAC&R Pty Ltd., LU-VE Group, BITZER Group, Emerson Electric Co., Johnson Controls International plc, Refplus, Trane Technologies plc (Thermo King), ABB Ltd., Baltimore Aircoil Company Inc., CARRIER GLOBAL CORPORATION, Dorin S.p.A., and Rivacold srl.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance in terms of revenue, various strategies, and recent developments.

Loading Table Of Content...

Loading Research Methodology...