Industrial Robotics Market Research: 2032

The Global Industrial Robotics Market Size was valued at $38 billion in 2020, and is projected to reach $163 billion by 2032, growing at a CAGR of 12.6% from 2023 to 2032.An industrial robot is a type of mechanical machine that is provided with input to perform automatically the tasks that are related to production in industries. These robots are reprogrammable, and the program can be changed many times depending on the usage and industrial requirements.

For automation applications, industrial robots help in increasing productivity by reducing costs and producing high-quality products. Most of the industrial robots consist of a drive, end-effector, robotic manipulator, sensors, and controllers. The robotic controller is the brain of the robot that helps in giving instructions. Robot sensors consist of microphones and cameras that keep the robot aware of the industrial environment. The robotic manipulator is generally the arm of the robot that helps the robot in moving and positioning, while the end effectors help in interacting the robot with the workpieces. Five types of robots used in the industries include collaborative, cartesian, SCARA, cylindrical, and articulated. The type of robot selected depends upon the degree of freedom of movement, size required, and payload capacities. Industrial robots help in optimizing manufacturing for healthy and efficient processes.

Market Dynamics

Labor charges across the UK increase by more than 12% every year, thus resulting in a shortage of workers. To overcome such problems, market players are investing in industrial robotics. For instance, in January 2022, Rishi Sunak, the chancellor of the Exchequer invested in robotics to help the UK population and the economy to tackle the crisis of inflation caused due to labor shortage. In addition, it is estimated that the labor cost will increase by more than 20% in the U.S. Hence, this leads to an increase in initiatives taken by industries to use robots to compensate with the labor charge and shortage, which drives the industrial robotics market growth. In addition, as per the data from the factories and industries of North America, manufacturers and industrial users ordered more than 35%, or more than 25,000 robots, in 2021. compared to 2019. High imports of robots are attributable to their use in the microelectronics industry that uses small robots to pick and place small components. The global microelectronic industry has grown by more than 10% since 2010. Hence, the growth in microelectronic industry requiring larger number of robots is expected to drive the industrial robot market.

In January 2022, DHL supply chain invested $15 million in robotic solutions for supply chain network in the warehouses. Robots help in easy supply chain network by decreasing long-term costs, increasing productivity, reducing error, and optimizing picking operations. It is estimated that the supply chain market will grow by more than 100% by 2026 as per the industrial robotics market trends. Hence, with growing supply chain network, surge in requirement for cost saving, and increase in efficiency are creating new opportunities for the market.

Earlier, the use of industrial robots was restricted to the automotive and manufacturing industries; however, industries such as food and beverage, metals, chemical and material industries, aerospace, and electronics have deployed industrial robots. The increase in demand from the food and beverages sector for raw material handling, packing finished products, and logistics has increased the sales of industrial robots. The precision and optics sectors use robots for analysis of a variety of food products on the basis of quality, composition, and authenticity. In the future, the adoption of robotics technology is expected to increase further, leading to market growth.

Segmental Overview

The industrial robotics market is segmented on the basis of type, end user industry, function, and region. On the basis of type, the market is segmented into articulated, cartesian, SCARA, cylindrical, and others. By end user industry, it is classified as automotive, electrical and electronics, chemical, rubber and plastics, manufacturing, food and beverage, and others. By function, it is categorized into soldering and welding; materials handling; assembling and disassembling; painting and dispensing; milling, cutting, and processing; and others.

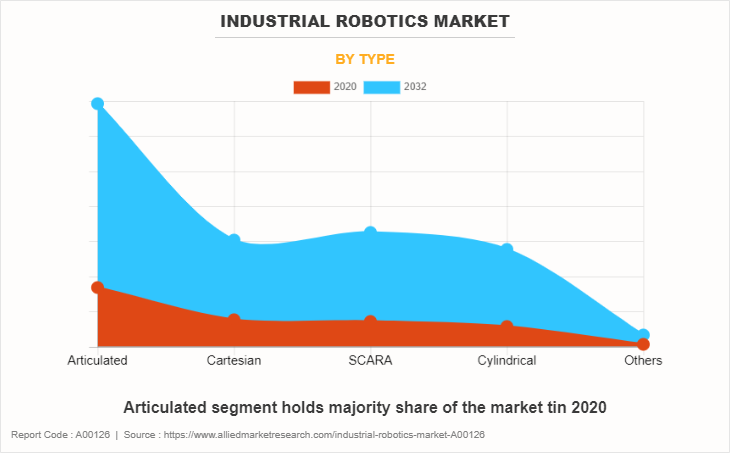

By Type:

The industrial robotics market is divided into articulated, cartesian, SCARA, cylindrical, and others. Robots with four to six axes or more are said to be "articulated," however some have as many as 10. These robots have more degrees of freedom than any other robot and can-do jobs with a higher level of expertise. These characteristics provide them adaptability and increase their allure in warehouses. Cartesian robots can travel across a horizontal plane thanks to an overhead system with a manipulator attached to it. Systems with cartesian robots have the benefit of larger workspaces and more precise positioning. Selective Compliant Assembly Robot Arm is the abbreviation for the term Scara. A circular work envelope is provided by a Scara robot.

These robots' wide range of motion adds to their flexibility. Scara robots can be constructed on a smaller size and have a small footprint. They are used for picking, packaging, and assembling-dissembling tasks. Robots with cylindrical or spherical joints, as well as smooth-functioning prismatic joints allow for easy movement in the space between the points and are installed on base bodies for cylindrical robots. The others segment includes mobile robots and parallel robots. The articulated segment is expected to exhibit the largest revenue contributor during the forecast period. The cylindrical segment is expected to exhibit the highest CAGR share in the type segment in the industrial robotics industry during the forecast period.

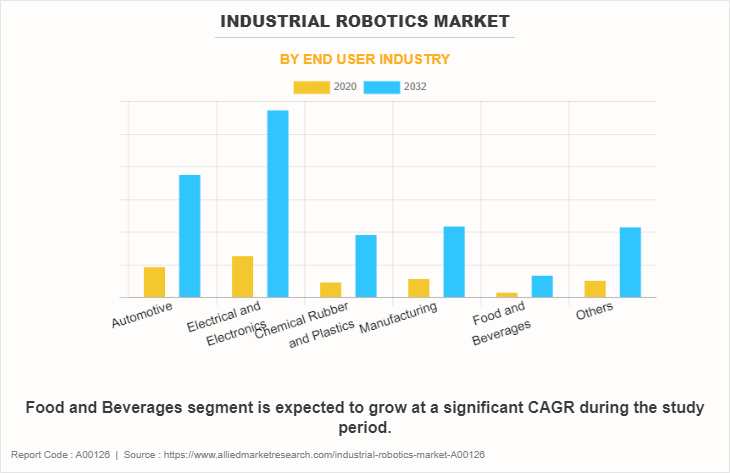

By End User Industry:

The industrial robotics market is divided into automotive, electrical & electronics, chemical, rubber and plastics, manufacturing, food and beverage, and others. Transportation, assembly-disassembly, material handling, soldering, welding, and packaging are just a few of the automobile industry's uses for industrial robotics. Manufacturing of electrical equipment, electronic goods, navigational, measuring, electromedical, and control devices are all included in the electronics and electrical sector. Industrial robots assist in picking-and-placing, assembling-dissembling, packaging, and transportation of goods because this material handling business sector requires high volume operations with commodities. The necessity of reducing total cost of ownership (TCO) is the main element promoting growth in the industrial sector.

Customized industrial robots are in high demand on the market for heavy machinery. Aerospace, logistics, and textile are some of the additional end-user sectors. The electrical & electronics segment is expected to be the largest revenue contributor during the forecast period, and the food and beverages segment is expected to exhibit the highest CAGR share in the end user industry segment in the industrial robotics market during the forecast period.

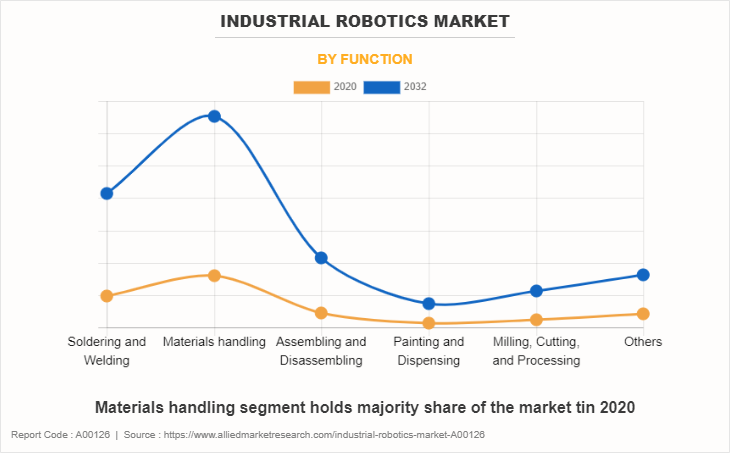

By Function:

The industrial robotics market is divided into soldering and welding; materials handling; assembling and disassembling; painting and dispensing; milling, cutting, and processing; and others. In high-production industries like manufacturing and the automotive industry, robots for soldering and welding are frequently employed for resistance spot welding, arc welding, gas metal arc welding, and other types of welding. Machine maintenance, order picking, palletizing, dispensing, machine loading, packaging, part transfer, and other tasks fall under the category of material handling.

Different material handling operations involve various types of robots. Due to an increase in construction activity as well as expansion in the manufacturing and automotive industries, the painting and dispensing industry has seen tremendous growth on a global scale. Processes including coating, sealing, finishing, extrusion, spraying, and others are covered in this area. In the metals industry, industrial robotics are utilized for precise, effective, quick, and dependable milling, sharpening, and cutting operations. The materials handling segment is expected to be the largest revenue contributor during the forecast period, and the painting & dispensing segment is expected to exhibit the highest CAGR share in the function segment in the industrial robotics market during the forecast period.

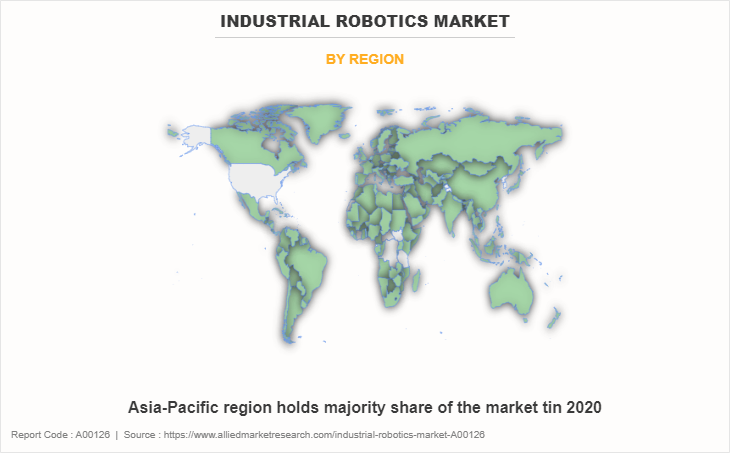

By Region:

The industrial robotics market forecast is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, the UK, Italy, France, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), LAMEA (Latin America, Middle East, Africa). In 2022, Asia-Pacific had the highest revenue in industrial robotics market share, and LAMEA is expected to exhibit the highest CAGR during the forecast period.

Competition Analysis

The major players profiled in the industrial robotics market ABB Ltd. (ABB Robotics), include Daihen Corporation, Denso Corporation (Denso Robotics), Fanuc Corporation, Kawasaki Heavy Industries Ltd., Kuka Robotics Corporation, Mitsubishi, Electric Corporation, Nachi-Fujikoshi Corporation (Nachi Robotic Systems), Panasonic Corporation, Seiko Epson Corporation, Universal Robots A/S, and Yaskawa Electric Corporation

Major companies in the market have adopted product launch, business expansion, and other strategies as their key developmental strategies to offer better products and services to customers in the Industrial robotics market.

Some examples of expansion and product launch on the market.

In June 2023, ABB Robotic announced the expansion of the GoFa cobot family the new variants GoFa 10 and GoFa 12. These cobots are equipped with enhanced efficiency, higher payload capacity, and other features.

In October 2022, ABB Robotic launched the smallest-ever industrial robot IRB1010 to meet smart device demand. The robot is specially designed for electronic gadgets manufacturing industries such as earphones, health trackers, smartwatches, and other devices.

In July 2022, Fanuc Corporation announced the expansion of the U.S. manufacturing plant in Michigan. The expansion is nearly two million square feet which includes a 655,000 square-foot state-of-the-art facility to house manufacturing, engineering, and R&D projects.

In January 2022, Fanuc Corporation launched a new robot M-1000iA for applications such as handling heavy loads for construction material, automotive components, and electric vehicle material handling sectors.

In April 2022, Kawasaki Heavy Industries, Ltd. inaugurated a new innovation hub for robotics development called “Future Lab HANEDA” based near Haneda Airport, Tokyo, Japan.

In February 2023, Mitsubishi Electric Corporation announced an investment of approximately $223 million to build a new factory in India.

In October 2022, Yaskawa Electric Corporation opened a new Robotics Technology Centre based in Turkey.

In February 2022, Yaskawa Electric Corporation launched HC10DTP and HC20DTP, two new collaborative robots for industrial applications. These robots are specialized in material handling, assembly, dispensing, packaging, machine tending, and welding applications.

In July 2022, NACHI-FUJIKOSHI CORPORATION launched two brand new robots with high efficiency, high speed MZ07F and MZ07LF. These robots will increase the productivity and precision of miniature electronic and electrical components.

In April 2021, NACHI-FUJIKOSHI CORPORATION launched “EC06” and “MZ12H” compact industrial robot to expand its product portfolio in lineup robots.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the industrial robotics market analysis from 2020 to 2032 to identify the prevailing industrial robotics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the industrial robotics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global industrial robotics market trends, key players, market segments, application areas, and market growth strategies.

Industrial Robotics Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 163 billion |

| Growth Rate | CAGR of 12.6% |

| Forecast period | 2020 - 2032 |

| Report Pages | 298 |

| By Type |

|

| By End user industry |

|

| By Function |

|

| By Region |

|

| Key Market Players | KUKA AG, ABB, Daihen Corporation Co., Ltd., Seiko Epson Corporation., Yaskawa Electric Corporation, Universal Robots A/S, Kawasaki Heavy Industries, Ltd., FANUC Corporation, NACHI-FUJIKOSHI CORPORATION (NACHI ROBOTIC SYSTEMS, INC.), Panasonic Corporation, Denso Corporation, Mitsubishi Electric Corporation |

Analyst Review

Rise in demand for automation has revolutionized the adoption of robotics technology. The global market is expected to witness a boost owing to the advent of technologies such as modular robotics and nanorobotics. A nanorobot can be defined as a small, microscopic device, which is measured on the scale of nanometers, i.e., 1 nm= 10−9m. Nanorobots are used at the atomic or molecular level to build a device and are comparatively faster and durable than larger robots.

Modular robots have the ability to adapt to the environment they operate in and consist of robotic modules that automatically and dynamically change their geometrical construction as per the requirement. However, further innovation of these technologies and potential in emerging economies are expected to provide significant opportunities for growth and expansion. Major players are developing affordable, compact, and energy-efficient robotics solutions to reach out to a wider customer base. The electrical & electronics, automotive, and food & beverage, machinery industries dominate the industrial robotics market and are estimated to maintain their dominance throughout the forecast period.

However, the demand from industries, including field, logistics, and construction is increasing and newer applications are being explored with customized robotics solutions. Application of service robots in healthcare facilities and logistics would prove to be lucrative areas for investments. Vendors are developing specialized solutions for small- and medium-sized businesses to meet their specific business requirements. The market is expected to be driven by the rise in demand for automation and the scarcity of skilled labor. Leading players aim to explore new technologies and applications to meet the growing demands from customers.

The global industrial robotics market was valued at $38,022.1 million in 2020, and is projected to reach $163,029.42 million by 2032, registering a CAGR of 12.6% from 2023 to 2032.

The forecast period considered for the global industrial robotics market is 2020 to 2032, wherein, 2020-2021 are historic years, 2022 is the base year, 2023 is the estimated year, and 2032 is the forecast year.

The latest version of global industrial robotics market report can be obtained on demand from the website.

The base year considered in the global industrial robotics market report is 2022.

The major players profiled in the industrial robotics market include ABB Ltd. (ABB Robotics), Daihen Corporation, Denso Corporation (Denso Robotics), Fanuc Corporation, Kawasaki Heavy Industries Ltd., Kuka Robotics Corporation, Mitsubishi, Electric Corporation, Nachi-Fujikoshi Corporation (Nachi Robotic Systems), Panasonic Corporation, Seiko Epson Corporation, Universal Robots A/S, and Yaskawa Electric Corporation.

The top ten market players are selected based on two key attributes - competitive strength and market positioning.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies, and recent developments.

Based on type the articulated segment was the largest revenue generator in 2022.

Loading Table Of Content...

Loading Research Methodology...