Industrial Vehicle Market Insights, 2031

The global Industrial Vehicle Market size was valued at USD 45.1 billion in 2021, and is projected to reach USD 76.5 billion by 2031, growing at a CAGR of 5.6% from 2022 to 2031.

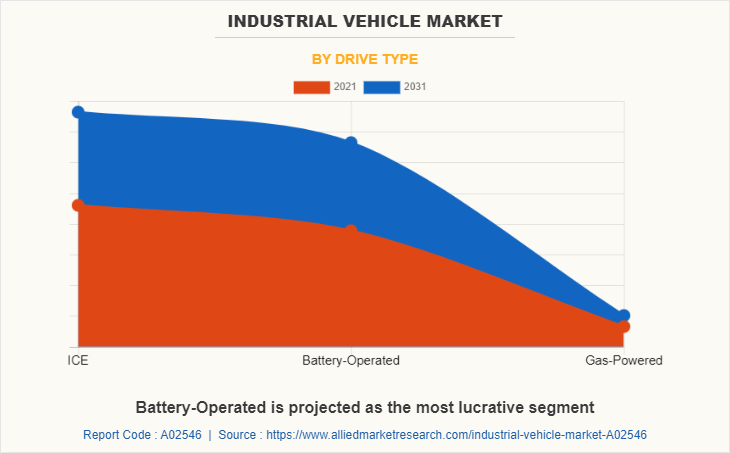

Industrial vehicles are designed to transport raw materials, finished goods, and production materials within industrial sectors. These industrial vehicles come in various sizes to move different types of goods and materials. Currently, battery-operated industrial vehicles are being increasingly adopted over internal combustion engine-driven and gas-powered industrial vehicles, as they are economical, compact, environmentally friendly, reliable, and efficient. Moreover, these vehicles are used with a variety of attachments such as platforms and grippers for efficient handling of goods and for reducing operation costs.

In addition, the adoption of industrial vehicles has expanded dramatically in recent years because they offer a reliable solution for material handling, resulting in enhanced production capacity of enterprises. These material handling technologies are designed to reduce physical damage to commodities (typically caused by human operators) and boost operation efficiency. Industrial vehicles are used in nearly every industry, including logistics, automotive, food and beverage, manufacturing, and others.

Adoption of electric-powered forklifts is increasing over the past few years and manufacturers are making remarkable efforts to exceed the performance of internal combustion (IC) engines. In addition, environmental concerns and the availability of natural resources such as natural gas, oil, coal, and others are also boosting the need to find long-term and sustainable renewable energy solutions. When material handling equipment, factories, and automobiles are considered, hydrogen fuel stands as a remarkable replacement for conventional means of powering equipment and machinery.

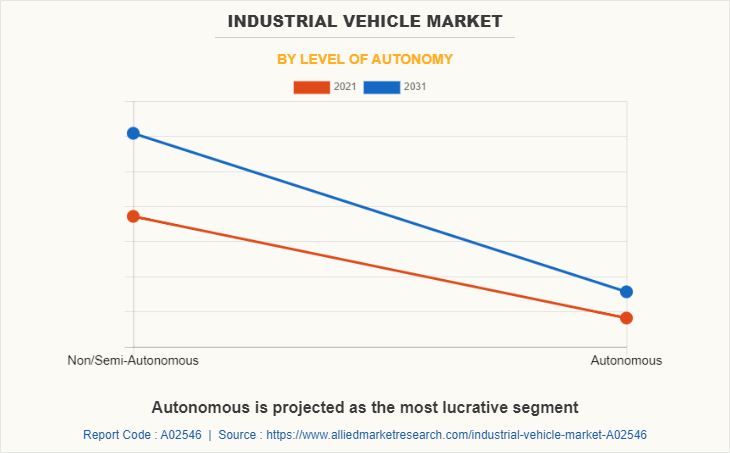

Surge in demand for industrial vehicles in various industries, reduction of labor costs in organizations, and production of hydrogen fuel cell forklifts, industry are the major factors that propel the industrial vehicles market growth. However, the increase in safety issues related to forklift trucks and other industrial vehicles, and high initial investment and installation costs are the major factors that hamper the growth of the market. Furthermore, the rise in demand for autonomous industrial vehicles, incorporation of industry 4.0., and rise in demand for battery-operated industrial vehicles are the factors expected to offer growth opportunities during the forecast period.

The industrial vehicle market segmentation is based on the drive type, level of autonomy, application, and region. By drive type, it is divided into ICE, battery-operated, and gas-powered. Based on the level of autonomy, it is classified into non/semi-autonomous and autonomous. By application, it is categorized into manufacturing, warehousing, freight & logistics, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Asia-Pacific comprises China, India, Japan, South Korea, and Rest of Asia-Pacific has one of the most advanced manufacturing sectors across the globe. Rest of Asia-Pacific includes Australia, Singapore, Malaysia, Thailand, Indonesia, New Zealand, and others. Countries such as China, Japan, India, and others in the region are highly developed in terms of manufacturing facilities. In addition, the Asia-Pacific is one of the leading markets for industrial vehicles, owing to an increase in investments in the automation sector and prospering automobile and electronics industries. This rise is attributed to the extensive efforts of governments of emerging economies in the region for the development and digitalization of the manufacturing industry.

Some leading companies profiled in the industrial vehicle market report comprises Anhui Heli Co., Ltd., Cargotec Corporation, CLARK MATERIAL HANDLING, Crown Equipment Corporation, Hangcha Forklift, Jungheinrich AG, Kion Group AG, Komatsu Ltd., Mitsubishi Logisnext Co., Ltd., Toyota Industries Corporation.

The leading companies are adopting strategies such as product launch, product development, contract, agreement, and collaboration to strengthen their market position. In March 2022, Cargotec Corporation signed an agreement with Pfeifer Holding GmbH, one of the leading European suppliers of timber products to supply three medium electric forklift trucks to handle the loading and unloading of wooden products onsite in Austria and Czech Republic. In January 2022, Crown Equipment Corporation developed its Wave Work Assist Vehicle with the new V – Force lithium-ion technology batteries which have better efficiencies, and which result in an increase in overall productivity while consuming less energy. In January 2022, Toyota Material Handling, a subsidiary of Toyota Industries Corporation launched 22 New Electric Forklift Models. The expanded lineup includes four different operator compartments; 24V, 36V, and 48V models; a Multidirectional model for handling long loads in narrow aisles; High-Capacity models with a maximum fork height of 45 feet.

Surge in demand for industrial vehicles in various industries

In recent years, the adoption of industrial vehicles industry has increased significantly as they are a reliable solution for material handling, which in turn results in increased production capacity of the industries. These material handling solutions are used to decrease the physical damage to the goods (usually caused due to human operators) and increase the efficiency of the operation. Industrial vehicles are adopted in all the industries such as logistics, automotive, food & beverages, manufacturing, and others. For instance, in March 2022, Cargotec Corporation finalized an agreement with Pfeifer Holding GmbH, one of the leading European suppliers of timber products to supply three medium electric forklift trucks to handle the loading and unloading of wooden products onsite in Austria and Czech Republic.

In addition, companies operating in the e-commerce industry globally are increasing the adoption of automated guided vehicles to enhance productivity and reduce labor costs. For instance, in February 2020, Flipkart is using artificial intelligence (AI) powered bots that enable bots and humans to work together efficiently. Around 350 AI-powered bots – monikered Automated Guided Vehicles (AGVs) assists operators to process almost 4,500 shipments per hour at twice the speed with remarkable accuracy. Further, the company claims that with the adoption of these bots the throughput and storage capacity has doubled as well. Thus, the growth in the use of industrial vehicles in several industries is expected to propel the growth of the industrial vehicles market during the forecast period.

Reduction of labor costs in organizations

Cost related to human labor includes payroll taxes, salary increase, vacation time, healthcare coverage, and others. However, by replacing human labor with industrial vehicles, a company is required to pay a single expense for the equipment, which is considered an initial investment. The adoption of industrial vehicles increases efficiency and reduces costs by automating the process in warehouses as well as on production lines. In addition, industrial vehicles can provide the most value in long-term cost-benefit by addressing labor challenges and scaling businesses to meet demands ensuring productivity and profitability. Thus, a reduction in the labor cost of a company, owing to the adoption of automated guided industry vehicles drives the growth of the industrial vehicles market .

Furthermore, industries frequently use industry vehicles to aid with inventory locating, picking, and shifting to free up employees to focus on high-value activities such as customer care. These help to overcome challenges such as real-time fluctuations in demand & labor shortage and offer fleet performance data for productivity improvement. When productivity is critical, many firms resort to low-powered automated vehicles that use less energy to operate. As vehicles require less power to operate, they can recharge and return to work faster, decreasing downtime and allowing production & fulfillment to continue. Such factors are expected to drive the adoption of autonomous industrial vehicles during the forecast period.

Increase in safety issues related to forklift trucks and other industrial vehicles

The rate of accidents related to forklifts trucks and other industrial vehicles market has increased over the past few years, increasing from around 1,000 per year to 1,300 per year. More than half of the injured people are drivers or pedestrians who stepped down from the vehicle. In addition, of all the vehicles that are used in the workplace, a forklift is one of the most dangerous as it is often used around pedestrians and is more likely to become unstable, specifically if it is not operated and loaded appropriately. For instance, according to the National Safety Council, in 2020, forklifts were responsible for 78 job-related deaths and 7,290 fatal and non-fatal-fatal injuries that resulted in days away from work. Also, according to Occupational Safety and Health Administration (OSHA), around 85 deaths and 34,900 serious injuries happened due to forklift accidents. Also, according to the National Institute for Occupational Safety and Health (NIOSH), rolling or overturning of forklift, a falling operator from a forklift, and workers are hit, crushed, or pinned by a forklift are the three most common type of injuries that occur. Furthermore, approximately out of 850,000 forklifts present in the U.S., 11% of them are involved in an accident. Thus, increasing safety issues and accidents related to forklift trucks are anticipated to hinder the growth of the industrial vehicles market .

By Application

Freight and Logistics is projected as the most lucrative segment

Rise in demand for autonomous industrial vehicles

Autonomous industry vehicles operate without human supervision and use sensors to perform different industrial operations such as picking & placing and transporting objects and others. Autonomous vehicles with artificial intelligence (AI) and the ability to carry out operations with minimal human interaction are being developed and deployed across the globe. For instance, in April 2022, Gideon Robotics launched Trey, an autonomous forklift that can load and unload pallets from truck trailers. With this product, they claim that autonomous forklifts can save 80% of a human worker's time and operate safely, consistently, and reliably in dynamic environments, working side by side with people.

Moreover, a self-driving forklift is a computer-enabled system integrated with artificial intelligence that takes real-time decisions about material handling & picking and can move around obstacles and workers safely, these features help to reduce accidents in the workplace. However, autonomous vehicles and mobile robots enhance the precision and agility of regular industrial tasks, especially in warehousing & industrial environments.

In addition, the increase in global rivalry necessitates smart manufacturing systems integrated with flexible logistical solutions. This creates requirements for advanced autonomous indoor transportation vehicles. Owing to this, many automotive manufacturers adopted autonomous vehicles, owing to their high efficiency, productivity, flexibility, and other capabilities. For instance, in November 2020, Toyota Material Handling, a subsidiary of Toyota Industries Corporation introduced Toyota High-Capacity Core IC Pneumatic forklift in five different models ranging in capacity from 22,000 to 30,000 pounds which are ideally suited for lumber, steel, and automotive customers, but designed with the versatility to perform all heavy-duty tasks where major strength is required. Such developments are anticipated to fuel the growth of the industrial vehicles market during the forecast period.

By Region

Asia-Pacific would exhibit the highest CAGR of 6.3% during forecast period

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the industrial vehicles market segments, current trends, estimations, and dynamics of the industrial vehicle market analysis from 2021 to 2031 to identify the prevailing industrial vehicle market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the industrial vehicle market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global industrial vehicles market .

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global industrial vehicle market trends, key players, market segments, application areas, and market growth strategies.

Industrial Vehicle Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 76.5 billion |

| Growth Rate | CAGR of 5.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 299 |

| By Drive Type |

|

| By Level of Autonomy |

|

| By Application |

|

| By Region |

|

| Key Market Players | CLARK MATERIAL HANDLING, Mitsubishi Logisnext Co., Ltd., Cargotec Corporation, Toyota Industries Corporation, Crown Equipment Corporation, Anhui Heli Co., Ltd., KION Group AG (KION), Komatsu Ltd., Jungheinrich AG, Hangcha Group Co., Ltd, Hyster-Yale Materials Handling, Inc. |

Analyst Review

The industrial vehicle market is expected to witness remarkable growth in the future, owing to an increase in profitability and precision of operations. The key factor that drives the growth of the market is the surging demand for automatic transmission in vehicles, and the rise in the trend of autonomous vehicles are anticipated to propel the growth of the industrial vehicle market. However, the high cost of maintenance and safety issues related to industrial vehicles hinder market growth. Furthermore, the production of active shift control transmission is expected to provide remarkable growth opportunities for players operating in the industrial vehicle market.

Furthermore, in the past years, the improved performance and high productivity, battery-powered industrial vehicles have seen an increase in demand. Furthermore, electric industrial vehicles have better emission control and are more cost-effective than ICE industrial vehicles. Electric lift trucks are preferred by end-users as they meet Tier 4 emission requirements and produce no in-plant emissions. In addition, the performance gap between ICE and electric trucks is closing. Most companies are producing eco-friendly industrial vehicles in eco-friendly plants in response to emission and energy efficiency preferences. For instance, in 2019, Toyota Industrial Equipment Manufacturing Inc. reduced its energy consumption by 40%, while Nissan Forklift Corporation reduced its carbon dioxide emissions by 51%. Furthermore, electric industrial vehicles are becoming more popular due to their increased reliability and acceleration when compared to ICE-powered industrial vehicles. Moreover, companies in the industrial vehicle market are focusing on new product development, particularly electric industrial vehicles. For instance, in February 2022, Clark launched the TWLi20 three-wheel electric lithium-ion powered lift truck to its industrial lift truck product portfolio. Similarly, in July 2021, Hangcha Group Co., Ltd. launched its XH series 2.0t-3.5t electric forklift truck with high-voltage lithium-ion batteries. This truck outperforms in terms of productivity and efficiency, as well as reduced noise and zero emissions.

The global Industrial Vehicle Market size was valued at USD 45.1 billion in 2021, and is projected to reach USD 76.5 billion by 2031,

The global industrial vehicle market is projected to grow at a compound annual growth rate of 5.6% from 2022 to 2031.

Asia-Pacific is the largest regional market for industrial vehicle

Surge in demand for industrial vehicles in various industries, reduction of labor costs in organizations, and production of hydrogen fuel cell forklifts, industry are the major factors that propel the industrial vehicles market growth. However, the increase in safety issues related to forklift trucks and other industrial vehicles, and high initial investment and installation costs are the major factors that hamper the growth of the market. Furthermore, the rise in demand for autonomous industrial vehicles, incorporation of industry 4.0., and rise in demand for battery-operated industrial vehicles are the factors expected to offer growth opportunities during the forecast period.

Some major companies operating in the market include Anhui Heli Co., Ltd., Cargotec Corporation, CLARK MATERIAL HANDLING, Crown Equipment Corporation, Hangcha Forklift, Jungheinrich AG, Kion Group AG, Komatsu Ltd., Mitsubishi Logisnext Co., Ltd., and Toyota Industries Corporation

Loading Table Of Content...