Industry 4.0 Market Overview

The global industry 4.0 market size was valued at USD 13.4 billion in 2021, and is projected to reach USD 618.4 billion by 2031, growing at a CAGR of 18.8% from 2022 to 2031.

Factors such as rise in adoption of industrial robots and increase in deployment of additive manufacturing primarily drive the growth of the market size. However, expensive deployment costs of industrial robots and complications in integration and interoperability of Industrial robot hamper the market growth to some extent. Moreover, an increase in adoption of 5G in the field of cloud automation is expected to provide lucrative opportunities for the market growth during the forecast period.

Key Market Trends & Insights

- By technology type, the blockchain segment is expected to witness the highest growth in the upcoming years

- Region wise, Asia-Pacific is expected to witness the highest growth in the upcoming years

Market Size & Forecast

- 2021 Market Size: USD 13.4 Billion

- 2031 Projected Market Size: USD 618.4 Billion

- Compound Annual Growth Rate (CAGR) (2022-2031): 18.8%

What is Industry 4.0?

Industry 4.0 is transforming how businesses produce, enhance, and disseminate their goods. The Internet of Things (IoT), cloud computing, analytics, AI, and machine learning are among the cutting-edge technologies that manufacturers are incorporating into their manufacturing processes. Advanced sensors, embedded software, and robotics are all featured in these "smart factories," which gather and analyze data to help with decision-making. When operational data from ERP, supply chain, customer support, and other enterprise systems is combined with data from production operations, even greater value from previously archived information is produced.

Moreover, a significant amount of demand is anticipated for the market as a result of the rise in adoption of automated tools and equipment in factories, warehouses, and manufacturing facilities, as well as increased investment in additive manufacturing and the emergence of new digital technologies like 5G, loT, AI, and ML.

Industry 4.0 Segment Overview

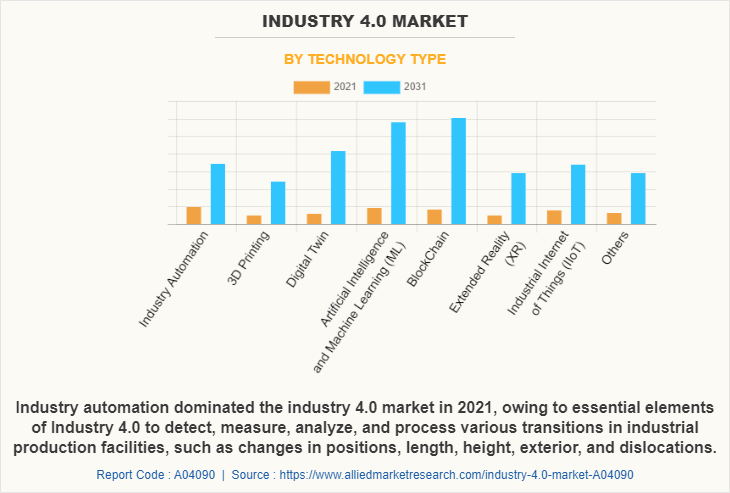

The market is segmented on the basis of technology, end user, and region. On the basis of technology, it is segregated into industry automation, 3D printing, digital twin, artificial intelligence (AI) and machine learning (ML), blockchain, extended reality (XR), industrial internet of things (IIoT), and others. On the basis of end user, it is divided into manufacturing, automotive, oil and gas, energy and utilities, food and beverages, aerospace and defense, and others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Depending on the technology type, the industry automation segment dominated the industry 4.0 market share in 2021 and is expected to continue this dominance during the forecast period, owing to essential elements of Industry 4.0 to detect, measure, analyze, and process various transitions in industrial production facilities, such as changes in positions, length, height, exterior, and dislocations. However, the blockchain segment is expected to witness the highest growth in the upcoming years, owing to enhanced security, privacy, and data openness. Moreover, blockchain technology is widely recognized to benefit the supply chain and manufacturing environments.

By Region

North America dominated the industry 4.0 in 2021, owing to the continous technological advancement and financial supports, to ensure real time quality control and real time visibility across manufacturing sector.

Region wise, the industry 4.0 market growth was dominated by North America in 2021 and is expected to retain its position during the forecast period, owing to ongoing technical breakthroughs, financial assistance from regional governments, and initiatives to achieve real-time quality control and real-time visibility across the manufacturing sector. The U.S. has a sizable industrial base and several businesses with high production capacities; hence it is anticipated to dominate the North America industry 4.0 market.

However, Asia-Pacific is expected to witness the highest growth in the upcoming years, owing to the analytics, automation, and machine-learning algorithms that have released human operators from performing a significant percentage of the detailed work. Moreover, Artificial intelligence and machine learning can generate insights that give business operations visibility, predictability, and automation.

Top Impacting Factors

Rise in Adoption of Industrial Robots

- Robots have evolved over the past few decades from being prohibitively expensive devices with limited functionality to being affordable devices capable of carrying out a variety of duties. Particularly industrial robots are extensively used by people everywhere. Industrial robots are being used more frequently in manufacturing centers, which is driving rapid advancements, development, and evolution, according to the most recent trends in the robotics industry. Moreover, rapid technological advancements in robotics have led to an increase in acceptance of robotics engineering and technology in the manufacturing sector's production processes. Industrial robots are programmable, multipurpose manipulators that operate autonomously.

- Furthermore, few common industrial robot applications include welding, heavy lifting, ironing, assembling, picking and positioning, palletizing, product inspection, and testing. All of these tasks require a lot of human endurance, speed, and accuracy. The International Federation of Robotics (IFR) estimates that in 2021, a total of 486,800 units were transported globally. Industrial robots carry out repetitive tasks and substitute for human labor where necessary. They can also work in dangerous and risky environments where humans cannot. Robotics technology will thus be a major development in the market.

Rise in Deployment of Additive Manufacturing

- Additive manufacturing, or 3D printing, is one of today's most creative tools. In recent years, 3D printing has been widely used to meet the increase in ventilator valve demand in hospitals all over the globe. Moreover, the manufacturing industry's current trends are about to alter as a result of 3D printing technology. Governments around the world are launching programs and funding organizations that conduct research and create technology to further explore the possibilities offered by 3D printing technology and to promote its growth. National programs are being implemented in the U.S., UK, and Canada to support university-level 3D printing study, which is advancing technology and spawning start-ups. Future industrialists and governments from all over the world will be drawn to 3D printing as new applications for the technology arise which is projected to provide lucrative growth opportunities for the market.

Technology Initiative

- Industry 4.0 is the next phase in the digitization of the manufacturing sector, driven by disruptive trends including the rise of data and connectivity, analytics, human-machine interaction, and improvements in robotics. It also includes productivity in manufacturing through applying technology and automation to both production and management processes. One Industry 4.0 scenario is the digital enablement of hundreds of manufacturing plants across the multi-tier manufacturing topology. This enables data collection and insights to be gathered and facilitates agile, controlled configuration and software rollouts.

- For instance, in March 2021, IBM, Samsung Electronics and M1 opened the IBM Industry 4.0 Studio, which combine advanced 5G connectivity with artificial intelligence (AI), hybrid cloud and edge computing capabilities to develop and test innovative demand for Industry 4.0 solutions for enterprises in Singapore and across the region.

Key Industry 4.0 Companies:

The following are the leading companies in the industry 4.0 market. These players have adopted various strategies to increase their market penetration and strengthen their position in industry.

- Cognex Corporation

- Schneider Electric SE

- Emerson Electric Co.

- Rockwell Automation Inc.

- Cisco Systems Inc.

- ABB Ltd.

- Siemens AG

- Honeywell International Inc.

- General Electric Company

- International Business Machines Corporation.

Key Industry Developments

- In March 2023 – Siemens introduced new Edge technologies to support Industry 4.0 in manufacturing environments. The platform allows real-time data analysis and process optimization at the production line level, enabling factories to improve productivity while reducing downtime. This development signifies a shift towards integrating edge computing with industrial IoT to foster smart manufacturing. Such factors drive the market.

- July 2023 – General Electric (GE) expanded its partnership with Amazon Web Services (AWS) to enhance digital twin technology in industrial sectors. GE’s Predix Platform combined with AWS’s cloud infrastructure now allows for better predictive maintenance and asset management. This development highlights the growing focus on AI and machine learning in market.

- May 2022 – Bosch opened a €1 billion semiconductor factory in Dresden, Germany, which is fully connected and operates with Industry 4.0 technologies. The smart factory uses AI, IoT, and real-time data to optimize production and supply chain operations. The facility is an important step in Bosch’s efforts to be a leader in Industry 4.0 in the automotive and electronics sectors.

- October 2023 – ABB launched a new Robotics-as-a-Service (RaaS) model, providing manufacturers with access to robotics without large upfront investments. This pay-per-use model integrates robotics with data analytics, enhancing production flexibility and supporting Industry 4.0 initiatives. The service allows companies to scale operations quickly while reducing capital costs.

- February 2023 – Volkswagen expanded its use of 5G private networks across several smart factories in Germany to enable autonomous vehicles, AI systems, and IoT sensors to communicate in real time. The use of 5G enhances the company’s ability to implement Industry 4.0 technologies, such as predictive maintenance and machine learning, to streamline production processes. These strategies drive the market growth.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the industry 4.0 market analysis from 2021 to 2031 to identify the prevailing industry 4.0 market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the industry 4.0 market forecast assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global industry 4.0 industry.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global industry 4.0 market trends, key players, market segments, application areas, and market growth strategies.

Industry 4.0 Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 618.4 billion |

| Growth Rate | CAGR of 18.8% |

| Forecast period | 2021 - 2031 |

| Report Pages | 411 |

| By Technology Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Siemens AG, Cisco Systems Inc., Honeywell International Inc., Schneider Electric SE, General Electric Company, Cognex Corporation, ABB Ltd., Emerson Electric Co.,, Rockwell Automation Inc., International Business Machines Corporation |

Analyst Review

According to CXOs of leading market players, the fourth industrial transformation focuses on connectivity, automation, machine learning, and real-time data. It is also known as smart production combined with clever digital technology or the Internet of Things (IoT). In addition, it makes use of machine learning and big data to create a more integrated and connected environment for companies that focus on manufacturing and SCM.

Accessing real-time insights across processes, partners, products, and people can present a challenge for numerous businesses from various sectors. Key performance indicators and loT metrics that show operational growth, consumer experience, logistics, and supply chain profits are currently being adopted by a number of significant companies. Industrial sectors are increasing their usage of superior smart industry solutions and usable device systems to control production and supply chain operations from a centralized system. The manufacturing sector's Industry 4.0 market is anticipated to be considerably driven by the increased deployment of IoT-connected machines during the forecast period.

Moreover, industrial sectors are increasing their adoption of cutting-edge smart industry solutions and practical device systems to control output and supply chain operations from a centralized system. For instance, in May 2021, Robert Bosch Engineering and Business Solutions Private Limited launched Phantom Edge to provide a real-time view of electric parameters, appliance level information, electrical energy consumption, and operating usage. The Phantom Edge combines Artificial Intelligence (AI) and the Internet of things (IoT) and can be used in various sectors, including retail, industrial manufacturing, healthcare, agriculture, and mobility.

The global Industry 4.0 market was valued at $113.39 billion in 2021 and is projected to reach $618.39 billion by 2031, registering a CAGR of 18.8% from 2022 to 2031.

The industry 4.0 market is projected to grow at a compound annual growth rate of 18.8% from 2022 to 2031

Market players operating in the industry 4.0 market include Cognex Corporation, Schneider Electric SE, Emerson Electric Co., Rockwell Automation Inc., Cisco Systems Inc., ABB Ltd., Siemens AG, Honeywell International Inc., General Electric Company, International Business Machines Corporation. Furthermore, it highlights the strategies of the key players to improve the market share and sustain competition.

Region wise, North America dominated Industry 4.0 market in 2021.

rise in adoption of industrial robots and increase in deployment of additive manufacturing primarily drive the growth of the industry 4.0 market.

Loading Table Of Content...

Loading Research Methodology...