Inflammatory Bowel Disease Drugs Market Research, 2031

The global inflammatory bowel disease drugs market size was valued at $21 billion in 2021, and is projected to reach $34.5 billion by 2031, growing at a CAGR of 5.1% from 2022 to 2031. Inflammatory bowel disease is a disorder that involves chronic infection to the digestive tract. It involves two types such as ulcerative colitis and crohn’s disease. Crohn’s disease causes pain and swelling in the digestive tract. It generally affects the small intestine and upper part of the large intestine. Moreover, ulcerative colitis causes swelling and sores in the large intestine. In ulcerative colitis there is always mucosal inflammation which leads to edema, bleeding, ulcers and electrolyte losses. These types of inflammatory bowel disease occur among the individuals who have inappropriate immune response to the intestinal flora. The prolonged inflammation of these disease leads to damage the gastrointestinal tract. There is genetic predisposition for inflammatory bowel disease and patients who suffer from this condition are more prone to having the development of malignancy.

Growth of the global inflammatory bowel disease drugs market size is majorly driven by rise in prevalence of ulcerative colitis and crohn’s disease. In addition, the growing occurrence of consciousness of the disease across the world are few of the aspects to develop the treatment for inflammatory bowel disease fuel the market growth. Furthermore, the availability of drugs such as infliximab, adalimumab, golimumab, and cetrolizumab for the treatment of inflammatory bowel disease drives the growth of the market. Moreover, as per the article published by NCBI 2020, it was estimated that there were 9 to 20 cases per 100,000 per year of ulcerative colitis and its prevalence is 156 to 291 cases per 100,000 per year in North America and Europe region. Thus, rising number of cases of ulcerative colitis lead to rise in demand for inflammatory bowel disease treatment significantly drives the inflammatory bowel disease drugs market growth.

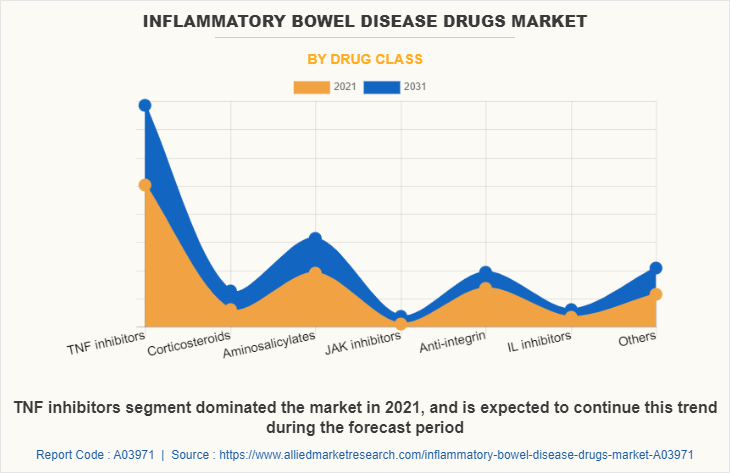

In addition, for instance, in March 2022, Pfizer Inc acquired Arena Pharmaceuticals Inc, a clinical stage company which develops innovative potential therapies for the treatment of inflammatory bowel disease. Arena’s portfolio involves promising development stage therapeutic candidates in gastroenterology and others. Thus, constant focus of market players to adopt growth strategies in order to launch new drugs is expected to boost the market growth. Moreover for instance, in May 2021, Scripps Research an American medical research facility which focus on research and education in biomedical sciences has received FDA approval for Ozanimod drug in U.S. This drug is used for the treatment of ulcerative colitis. Thus, increasing number of drug approvals for the treatment of inflammatory bowel disease fuel the growth of the market. In addition, the TNF inhibitor are used as the second line of treatment when other medications do not work effectively to reduce symptoms of IBD. Thus, growing adoption of TNF inhibitor owing to its efficient therapeutic results for the management of inflammatory bowel disease expected to drive the growth of the market during the forecast period.

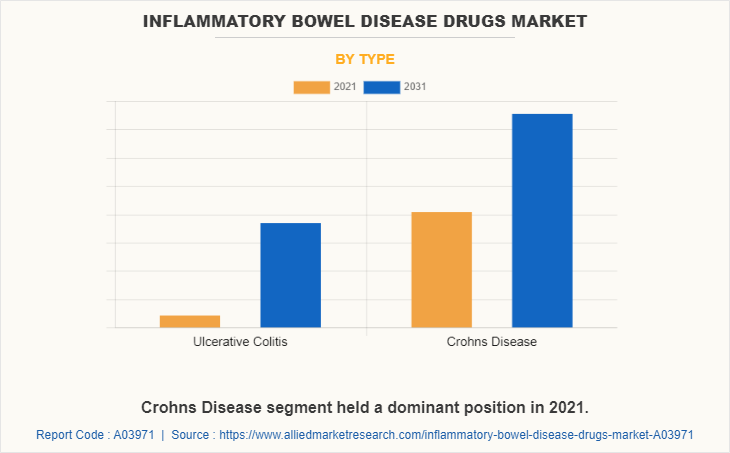

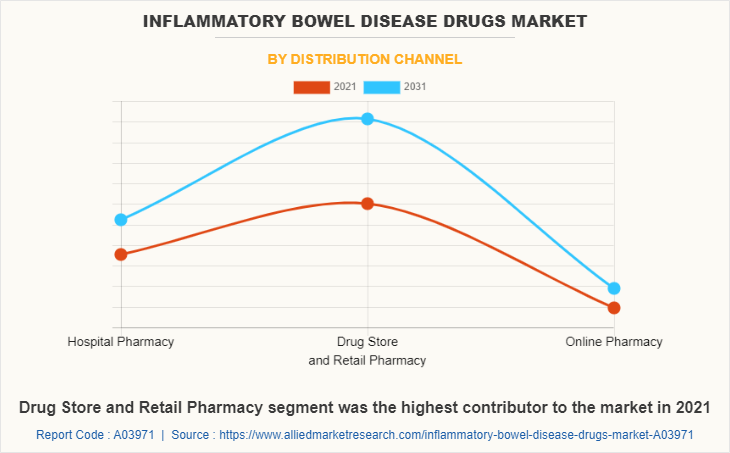

The inflammatory bowel disease drugs market is segmented into Type, Drug Class and Distribution Channel. By type, the market is categorized into ulcerative colitis and crohn’s disease. On the basis of drug class TNF inhibitor, Corticosteroids, Aminosalicylates, JAK inhibitors, Anti-integrin, IL inhibitors, and others. By end user, it is categorized into hospital pharmacy, drug store & retail pharmacy, and online pharmacy.

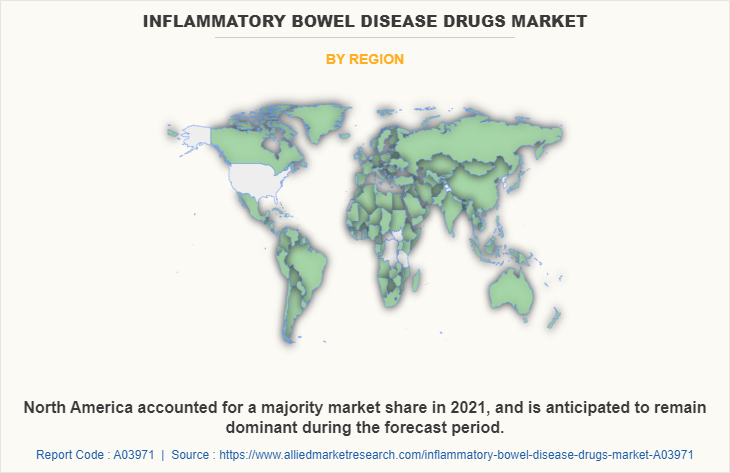

Region wise, the inflammatory bowel disease drugs industry is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, and rest of LAMEA).

Segment Review

Depending on type, the chron’s disease segment dominated the market in 2021, and this trend is expected to continue during the forecast period. The dominance is due to rise in prevalence of crohn’s disease. However, the ulcerative colitis segment is expected to witness considerable growth during the forecast period, owing to increase in prevalence of ulcerative colitis.

Depending on drug class, the TNF inhibitor segment captured for major inflammatory bowel disease drugs market Share in 2021, owing to increase in drug approvals of TNF inhibitor expected to continue during the forecast period. However, the JAK inhibitor segment is expected to witness considerable growth during the forecast period, owing to rise in demand from patients to treat IBD.

Depending on distribution channel, the drug store & retail pharmacy segment dominated the market in 2021 owing to rise in demand for drugs such as JAK inhibitor, corticosteroid which is easily available in retail pharmacies, and this trend is expected to continue during the forecast period. Furthermore, the online pharmacy segment is expected to witness considerable growth during the forecast period, owing to rise in number of patients with IBD and surge in usage of online pharmacy as it is convenient way of buying medicine for old age people, physically challenged and working professionals.

Region wise, North America garnered the major inflammatory bowel disease drugs market share in 2021, and is expected to continue to dominate during the forecast period owing to increase in drugs launches. Moreover, growth in number of regulatory approvals in developed countries of North America positively impacted the market growth. However, Asia-Pacific is expected to register the highest CAGR of 6.9% from 2021 to 2031, owing to increase in cases of ulcerative colitis.

The key players that operate in the inflammatory bowel disease drugs industry include AbbVie Inc., Bristol Myers Squibb, Celltrion Healthcare, Eli-Lilly, Johnson & Johnson Services Inc., Merck & Co, Inc., Novartis AG, Pfizer Inc., Takeda Pharmaceutical Company Ltd., and UCB S.A.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the inflammatory bowel disease drugs market analysis from 2021 to 2031 to identify the prevailing inflammatory bowel disease drugs market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the inflammatory bowel disease drugs market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global inflammatory bowel disease drugs market trends, key players, market segments, application areas, and market growth strategies.

Inflammatory Bowel Disease Drugs Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Drug Class |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Johnson & Johnson Services, Inc., AbbVie Inc., UCB S.A., ELI-LILLY, Bristol Myers Squibb, Celltrion Healthcare Co.,Ltd. , Pfizer Inc., Merck & Co. Inc., Takeda Pharmaceutical Company Limited, Novartis AG |

Analyst Review

This section provides the opinions of the top level CXOs in the inflammatory bowel disease drugs market. According to the CXOs, inflammatory bowel disease is defined as a repetitive inflammation of the gastrointestinal tract. It involves two types such as ulcerative colitis and Crohn’s disease. It occurs in genetically susceptible individuals who have inappropriate immune response to the intestinal flora.

As per the CXOs, the pharmaceutical industry is undertaking rapid and exceptional measures to bring more innovative drugs for inflammatory bowel disease patients and has opened new approaches in the pharmaceutical industry. For instance, in August 2020, The University of California and VA San Diego Healthcare System used strategies such as antigen receptor and transcriptomic to characterize the immune cell features in patients who suffer from ulcerative colitis. Thus, increase in development of personalized medicine approach for inflammatory bowel disease patients is expected to boost the growth of the inflammatory bowel disease drugs market.

The CXOs further added that Crohn’s disease segment is expected to remain dominant during the forecast period, owing to strong availability of this product among large number of key players in the market. Moreover, North America is expected to offer lucrative opportunities to the market during the forecast period. As per Centers for Disease Control and Prevention, in 2020, it was estimated that around 3.1 million adults have been diagnosed with inflammatory bowel disease in the U.S. Thus, rise in number of inflammatory bowel disease cases increase the usage of inflammatory bowel disease drugs across the region. However, Asia-Pacific registered the fastest growth rate during the forecast period, owing to the surge in healthcare infrastructure, rise in disposable incomes, and well-established presence of domestic companies in the market

Increase in number of patients with inflammatory bowel disease and rise in number of ulcerative colitis incidences are some of the factors that propels the growth of the market.

Among type, crohn’s disease dominated the inflammatory bowel disease drugs market in 2021

North America is the largest regional market for Inflammatory Bowel Disease Drugs

The estimated industry size of Inflammatory Bowel Disease Drugs was US$ 21 billion in 2021

Johnson & Johnson Services, Inc., AbbVie Inc., and Takeda Pharmaceutical Company Limited are the top companies to hold the market share in Inflammatory Bowel Disease Drugs

Loading Table Of Content...