Infrared Detector Market Overview:

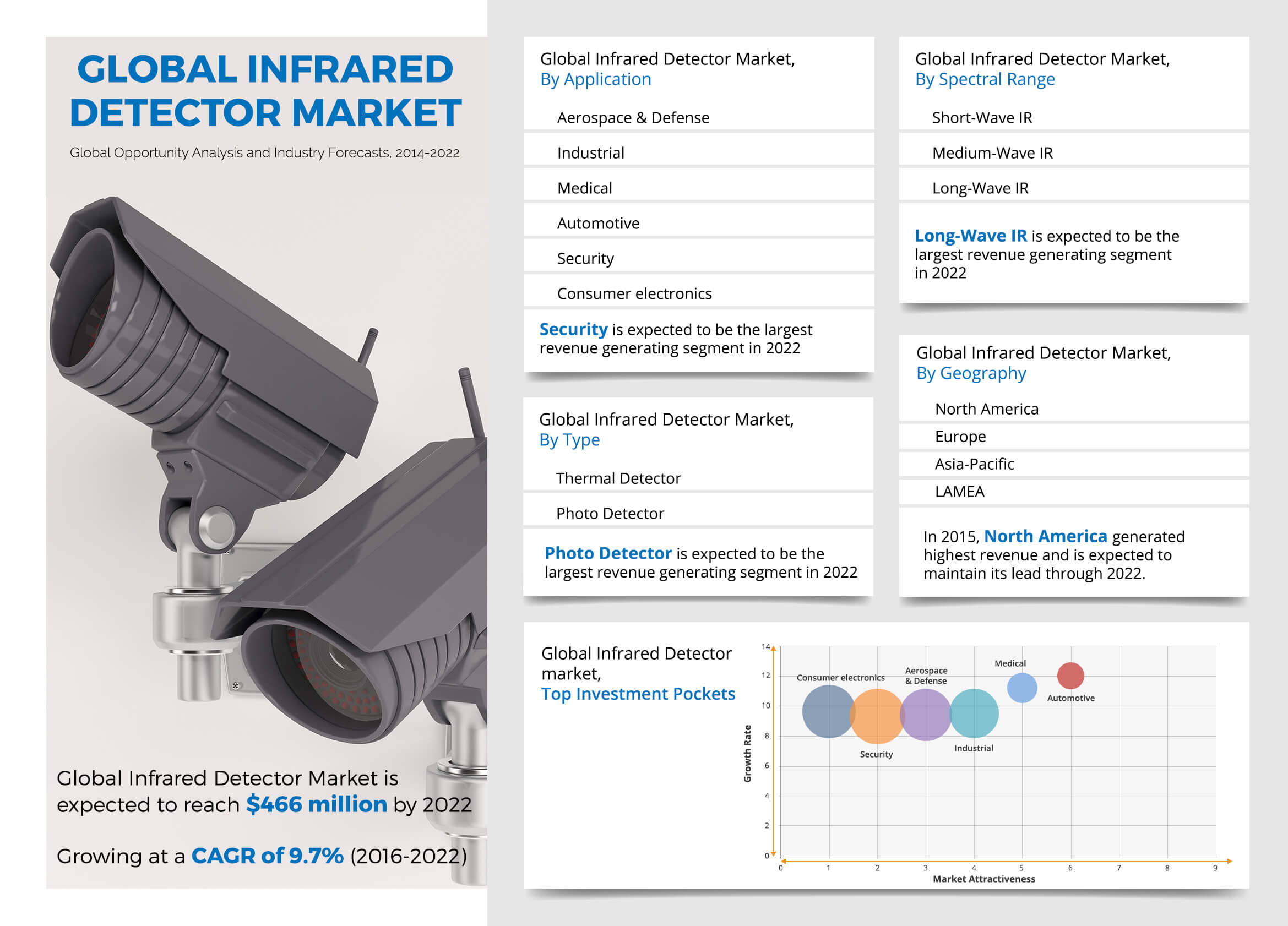

Infrared Detector Market is expected to garner $466 million by 2022, registering a CAGR of 9.7% during the forecast period 2016 - 2022.

Infrared detector is used to detect infrared radiation to measure heat and detect motion. It is integrated with different devices used in surveillance, automobiles, testing, detection, and measurement. Infrared detectors that convert infrared radiation into electrical signal are one of the most significant group of sensors in defense system applications. These detectors also play a major role in applications such as medical, automotive, industrial, security, and consumer electronics. Fast growing industrial sector, government investment, and economic incentives for defense sector have further supported the growth of global infrared detector market. These are highly effective as compared to other detectors for safety and monitoring purposes due to their compact size and ability to detect infrared light from far distances. However, high installation cost and limited accuracy in certain conditions could limit the market growth. Technological advancements in the infrared detector technology and decline in prices in future could provide potential growth opportunities for the market.

Segment Overview:

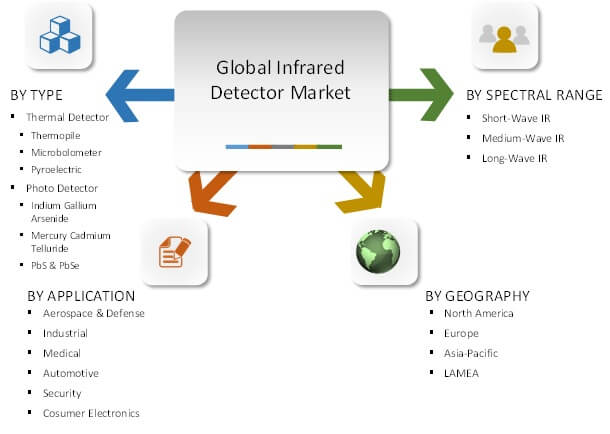

The global infrared detector market is segmented on the basis of type, spectral range, application, and geography.

Global infrared detector market segmentation

By type, photo infrared detectors dominated due to its wider application. Moreover, thermal detectors have been considerably less exploited in commercial and military systems. Among various spectral range, Long-Wave IR detectors dominated the global market due to their ability to sense thermal signs and provide excellent detection capability in low-light-level conditions.

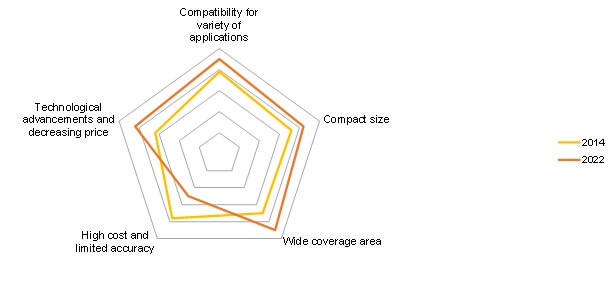

Top Factors Impacting Global Infrared Detector Market

Compatibility for Variety of Applications

Infrared detectors are recognized for their compatibility in various applications. They are used for security and monitoring purposes, non-contact temperature sensing, infrared gas analysis, flame detection, temperature control systems, detection of human presence, and infrared spectroscopy. In addition, they are also used in several every day events and can be found in houses, cars, and shopping malls.

High Cost and Limited Accuracy

Infrared detectors are more expensive than other detectors as they require additional semiconductor components for increased sensitivity. Cooling techniques also increase their overall cost. In addition, temperature change and extreme air turbulence may affect their performance. The environment needs to be clean, without dust, and less humid for more accurate results. Infrared detectors detect infrared images based on the temperature variations of objects so they cannot detect differences in objects that have a very similar temperature range. This leads to inaccuracy in many circumstances.

Asia-pacific is Expected to Be the Most Lucrative Market for Infrared Detectors

Asia-Pacific infrared detector market is expected to grow at the fastest CAGR during the forecast period owing to robust governmental support and a huge consumer electronic industry. Large scale adoption of the infrared detectors in the latest range of applications such as security, consumer electronics, and smart homes has fueled the market growth. Furthermore, the presence of various key companies have catalyzed the market.

Competitive Landscape

The report provides a comprehensive analysis of major market players such as Texas Instruments Inc., Honeywell International Inc., Omron Corporation, Excelitas Technologies Corp., Hamamatsu Photonic K.K., FLIR Systems Inc., Murata Manufacturing Co., Ltd., Raytheon Company, Sofradir, and Nippon Avionics and the prominent strategies adopted by them.

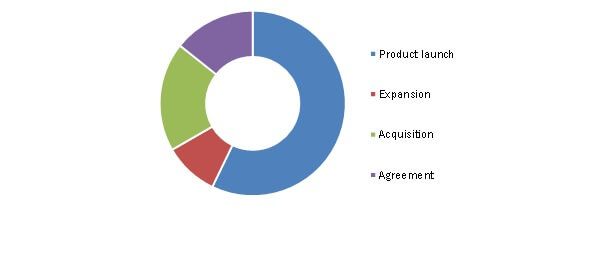

Top Winning Strategies

Infrared detector market is largely driven by product launch and acquisition. For instance, Honeywell International Inc. and Omron Corporation have acquired local infrared detector manufacturer companies to enhance their global outreach and increase their market share. Moreover, expansion and agreement are other wining strategies adopted by key players.

Top Winning Strategies in Global Infrared Detector Market

Key Benefits

- The study provides an in-depth analysis of the global infrared detector market to elucidate the prominent investment pockets in the market.

- Current and future trends are outlined to determine the overall market scenario and single out profitable trends

- The report provides information regarding key drivers, restraints, and opportunities with impact analysis

- Geographically, the market is analyzed based on four regions namely, North America, Europe, Asia-Pacific, and LAMEA

- Analysis of value chain is conducted for better understanding of the role of intermediaries

Infrared Detector Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Spectral Range |

|

| By Application |

|

| By Geography |

|

| Key Market Players | NIPPON AVIONICS CO., LTD., SOFRADIR, HAMAMATSU PHOTONICS K.K., OMRON CORPORATION, MURATA MANUFACTURING CO., LTD., HONEYWELL INTERNATIONAL INC, RAYTHEON COMPANY, TEXAS INSTRUMENTS INC., EXCELITAS TECHNOLOGIES CORP, FLIR SYSTEMS, INC. |

Analyst Review

Manufacturing of highly sensitive infrared detector requires high initial cost. The process of integrating the infrared detectors with expensive semiconductor components costs a lot more than the actual price of the infrared sensors. However, many manufacturers have developed low cost, compact, affordable, and energy efficient infrared detectors. These detectors serve small to medium sized enterprises. In addition, government initiatives in defense sector are also expected to provide a major growth opportunity. There have been substantial investments for R&D by public and private organizations to explore further technologies and applications of infrared detectors. However, high prices, complex technologies, and less accuracy could restrict the market growth. Furthermore, deteriorated performance in harsh conditions also limit their adoption. North America generated the maximum revenue, followed by Asia-Pacific

Loading Table Of Content...