Infrastructure as a Service (IaaS) Market Statistics, 2030

The global infrastructure as a service (iaas) market was valued at $51.3 billion in 2020, and is projected to reach $481.8 billion by 2030, growing at a CAGR of 25.3% from 2021 to 2030.

Growth in demand for low-cost IT infrastructure and faster data accessibility propels growth of the global infrastructure as a service market. In addition, increase in cloud adoption across several industry verticals is also positively impacting growth of the IaaS market. However, security concerns over private cloud deployment hampers the market growth. On the contrary, growth in cloud adoption among SMEs is expected to offer remunerative opportunities for expansion of the IaaS market during the forecast period.

Infrastructure as a service (IaaS) is a cloud computing service in which businesses rent servers in the cloud for compute and storage. These web services provide high-level APIs that may be used to dereference various low-level features of network infrastructure, such as physical computer resources, data partitioning, scaling, location, security, backup, and so on. IaaS allows users to run any operating system or application on leased servers without having to pay for the operation and upkeep of servers.

The global infrastructure as a service market is segmented on the basis of component type, deployment mode, enterprise size, industry vertical, and region. By component, it is divided into storage, network, compute, and others. By deployment model, it is divided into private, public, and hybrid models. According to enterprise size, it is categorized into small & medium enterprises (SMEs) and large enterprises. As per industry vertical, it is divided into banking, financial services and insurance (BFSI), government & education, healthcare, telecommunication & IT, retail, manufacturing, media & entertainment, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key players that operate in the infrastructure as a service market include Alibaba Group Holding Limited, Amazon Web Services, inc., Dell Technologies, Inc., Google Corporation, Hewlett Packard Enterprise Development LP, IBM Corporation, Microsoft Corporation, Oracle corporation, RACKSPACE TECHNOLOGY, INC., and Redcentric Plc.

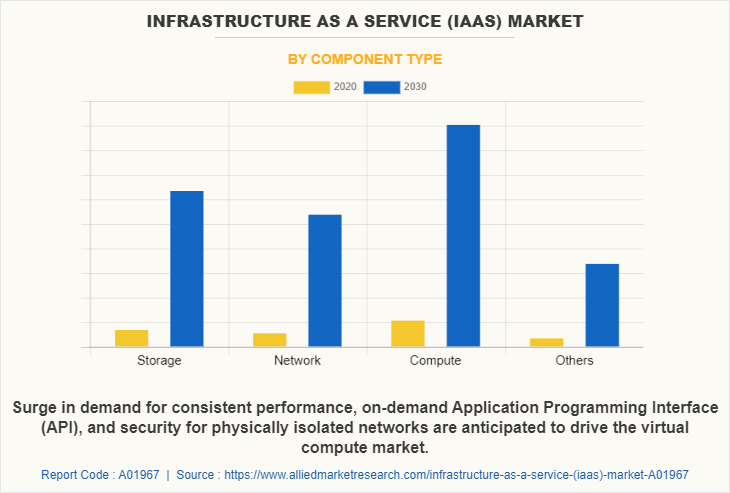

In terms of component type, the compute segment holds the largest infrastructure as a service market share, owing to surge in demand for consistent performance, on-demand Application Programming Interface (API), and security for physically isolated networks. However, the others segment is expected to grow at the highest rate during the forecast period, owing to increase in need to manage data throughout the lifespan, from conception and storage to archiving at the appropriate time, which stimulates the need for managed IaaS services, and hence the infrastructure as a service industry.

Region wise, the infrastructure as a service market share was dominated by North America in 2020, and is expected to retain its position during the forecast period, owing to the fact that leading vendors are focused on development of novel solutions, strategic alliances, and geographical expansion to strengthen their market presence globally. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to increase in adoption of fast internet connectivity including 4G connections, large population base, rise in competition among telecom & IT service providers, and increase in GDP.

Top Impacting Factors

Growth in demand for low-cost IT infrastructure and faster data accessibility

Businesses all around the world are focusing on developing mobile workforces, in which employees may access data from remote locations via internet services, necessitating virtualized IT components such as servers, storage, networks, and others. Due to a common IT infrastructure installation, IaaS offers faster data access regardless of data center location.

Furthermore, IaaS has a minimal initial investment cost as it does not require an on-premise data center, as well as ongoing services and maintenance expenditures. As part of their integrated cloud service offering, managed service providers such as Amazon Web Services, Inc., Microsoft Corporation, and IBM Corporation provide constantly available cloud service throughout the year. End customers see IaaS as a major cost savings service, owing to the fact that most responsive scalability characteristic of pooled cloud servers. Clients pay only for what they use. Furthermore, end users avoid the cost of getting individual servers up, which would otherwise be incurred. This is a primary aspect that is expected to fuel the IaaS infrastructure as a service market growth during the forecast period.

Increase in cloud adoption across several industry verticals

Several business sectors, including banking, financial services, and insurance (BFSI), retail, healthcare, manufacturing, telecommunications & information technology, and media & entertainment are rapidly adopting cloud services. Furthermore, the banking industry has embraced IaaS on a big scale, owing to cost savings, data protection, and disaster recovery services.

Furthermore, technical improvements in the IT industry and their applications in major organizations and SMEs in developed countries such as North America and Europe provide sufficient room for market development. For instance, in April 2022, NTT DOCOMO, INC. (DOCOMO), the largest mobile operator in Japan partnered with Oracle Cloud Infrastructure (OCI) to build its new development environment for ALADIN to improve service quality and enable faster delivery through automation of operation management utilizing Oracle Container Engines for Kubernetes.

COVID-19 Impact Analysis

The COVID-19 pandemic boosted the IaaS market size, owing to increased adoption of cloud-computing services. For instance, according to a survey by ManageEngine, almost 97% of Indian enterprises increased their reliance on cloud technology as a result of the COVID-19 pandemic with enterprises accelerating use of solutions such as SaaS software as a service, IaaS infrastructure as a service and PaaS platform as a service. In addition, rise in deployment of hybrid cloud that is an integration of both private and public cloud acts as another growth-inducing factor. This enables organizations to process data at high-speed, share large amounts of information over cloud, and minimize the overall operational costs, which, in turn, are major factors that led the growth during COVID-19 pandemic.

Key Benefits for Stakeholders:

- The study provides an in-depth analysis of the global infrastructure as a service market forecast along with current & future trends to explain the imminent investment pockets.

- Information about key drivers, restraints, & opportunities and their impact analysis on global infrastructure as a service market trend is provided in the report.

- The Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

- The quantitative analysis of the market from 2021 to 2030 is provided to determine the market potential.

Infrastructure as a Service (IaaS) Market Report Highlights

| Aspects | Details |

| By Component Type |

|

| By Deployment Model |

|

| By Enterprise Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP, GOOGLE LLC, INTERNATIONAL BUSINESS MACHINES CORPORATION, ALIBABA GROUP HOLDING LIMITED, RACKSPACE HOSTING, INC., AMAZON WEB SERVICES, INC., DELL EMC, ORACLE CORPORATION, MICROSOFT CORPORATION, REDCENTRIC PLC |

Analyst Review

The IaaS market is predicted to develop significantly throughout the forecast period, owing to growing trend of server less computing, increase in demand for hybrid cloud services, and increase in internet penetration. As top cloud service providers incline toward hybrid environments, which are a cooperation of diverse infrastructures, integrated IaaS offerings are projected to fuel the next wave of cloud infrastructure adoption.

Key providers of the infrastructure as a service market include Amazon Web Services, Inc., Dell EMC, Google LLC, International Business Machines Corporation, Microsoft Corporation, Oracle Corporation, Rackspace Hosting, Inc., Red Hat, Inc., Redcentric plc., and VMware, Inc. The market players are also adopting different organic and inorganic business strategies such as product development, business expansion, acquisitions, and partnerships to increase their market penetration. For instance, in February 2021, Amazon Web Services, Inc. (AWS), an Amazon.com, Inc. company, announced that it has entered into an agreement with the National Hockey League (NHL) to become the Official Cloud, Artificial Intelligence, and Machine Learning Infrastructure Provider of the NHL. The NHL will be able to automate video processing and content delivery in the cloud and leverage its Puck and Player Tracking (PPT) System, which runs on AWS cloud infrastructure to better capture the details of game play for its fans, teams, and media partners.

In addition, in April 2022, Google Cloud and Boeing announced a partnership that supports cloud transformation of leading aerospace company by migrating hundreds of applications across multiple business groups and aerospace products to Google Cloud. The partnership will enable Boeing to address challenges that come with traditional on-premises IT implementations, taking advantage of the scalability and flexibility of the cloud, along with the ease-of-use and innovation of Google Cloud's data analytics and artificial intelligence/machine learning (AI/ML) tools. Google Cloud will help modernize applications; empower people with the latest technology, tools and expertise; and continuously innovate with rapid software changes," said Susan Doniz, Boeing chief information officer and senior vice president of Information, Technology & Data Analytics.

Furthermore, with further growth in investments across the world there is an increase in demand for infrastructure as a service. Hence, various companies are expanding their current capabilities by entering into product launch with increasing diversification among customers. For instance, in March 2022, Alibaba Cloud, a digital technology and intelligence backbone of Alibaba Group, launched its cloud computer, including both the pocket-sized Wuying Cloud Computer, and Elastic Desktop Service (EDS) in Singapore. The cloud computer brings businesses Desktop-as-a-Service (DaaS) for faster IT deployment, increased device flexibility, enhanced security, and reduced downtime for technical support as the setup, maintenance, connectivity, and storage issues are all managed by Alibaba Cloud.

Growth in demand for low-cost IT infrastructure and faster data accessibility propels growth of the global infrastructure as a service market. In addition, increase in cloud adoption across several industry verticals is also positively impacting growth of the IaaS market. However, security concerns over private cloud deployment hampers the market growth. On the contrary, growth in cloud adoption among SMEs is expected to offer remunerative opportunities for expansion of the IaaS market during the forecast period.

Region wise, the infrastructure as a service market share was dominated by North America in 2020, and is expected to retain its position during the forecast period, owing to the fact that leading vendors are focused on development of novel solutions, strategic alliances, and geographical expansion to strengthen their market presence globally.

The global infrastructure as a service market was valued at $51.28 billion in 2020, and is projected to reach $481.83 billion by 2030, growing at a CAGR of 25.3% from 2021 to 2030.

Key players that operate in the infrastructure as a service market include Alibaba Group Holding Limited, Amazon Web Services, inc., Dell Technologies, Inc., Google Corporation, Hewlett Packard Enterprise Development LP, IBM Corporation, Microsoft Corporation, Oracle corporation, RACKSPACE TECHNOLOGY, INC., and Redcentric Plc.

Loading Table Of Content...