Injection Pen Market Research, 2031

The global injection pen market size was valued at $ 37,899.00 million in 2021 and is projected to reach $80,511.51 million by 2031, growing at a CAGR of 7.8% from 2022 to 2031. An injection pen is a medical device used to administer injections. It consists of a needle, a syringe and a pen-like device with a plunger that controls the amount of medication administered. It is commonly used to administer insulin and other medications. There are disposable and reusable types of injection pens available in the market. Disposable pens are preloaded with drug and are thrown away after the drug cartridge is empty. Whereas reusable pens work with drug cartridges that can be loaded into the pen and then thrown away once the drug is used, leaving the pen ready for the next cartridge.

Market Dynamics

The key factors that drive the growth of the injection pen market share are increase in prevalence of chronic diseases such as cancer and diabetes, and surge in geriatric population. For instance, according to the report published by International Diabetes Federation in 2021, approximately 537 million adults (20-79 years) are living with diabetes. The total number of people living with diabetes is projected to rise to 643 million by 2030 and 783 million by 2045. Almost 1 in 2 (240 million) adults living with diabetes are undiagnosed. In addition, more than 1.2 million children and adolescents (0-19 years) are living with type 1 diabetes and 541 million adults are at increased risk of developing type 2 diabetes. Thus, increase in prevalence of chronic diseases, and rise in awareness of self-injectables devices are the major factors driving the growth of the injection pen market growth.

Moreover, the rise in adoption of technologically advanced reusable injection pens among patients suffering from diabetes is the key factor that boosts the market growth. For instance, in 2020, Medtronic Plc launched InPen, a reusable smart injection pen for people living with diabetes. The pen uses Bluetooth technology to calculate insulin doses and to estimate carbohydrates for meals.

Furthermore, the increase in adoption of automated injection pens is driving the growth of the injection pen market share. Automated injection pens are designed to be easy to use and are gaining popularity among healthcare providers, as they can provide accuracy, safety, and convenience in drug delivery. The demand for injection pens is not only limited to developed countries, but is also being witnessed in developing countries, owing to rapid increase in geriatric population which is prone to chronic diseases such as diabetes and cancer. These are the factors that fuel the growth of the market.

However, high cost of injection pen in some regions such as North America and availability of alternative methods for drug delivery restrain the growth of the injection pen market size. Conversely, rise in prevalence of chronic diseases and increase in demand for injection pen for insulin from emerging economies owing to rise in diabetic cases may open up new market potential for injection pen and is expected to provide a lucrative opportunity for the growth of the market during the forecast period.

Injection Pen Market Segmental Overview

The injection pen market is segmented on the basis of type, therapy, end-user, and region. By type, the market is bifurcated into disposable injection pen and reusable injection pen. By therapy, the market is divided into diabetes, growth hormone, osteoporosis, fertility, and others. By end user, the market is categorized into home-care settings and hospital & clinics. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

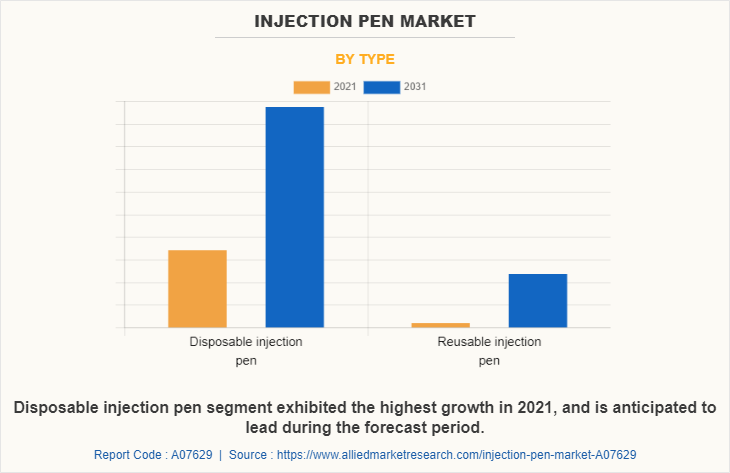

By Type

The injection pen market is segmented into disposable injection pens and reusable injection pens. The disposable injection pens segment accounted for the largest share of the market in 2021 and is anticipated to remain dominant during the forecast period, owing to rise in the adoption of disposable injection pens across the world to prevent the risk of cross-contamination and needle stick injuries associated with reusable injection pens.

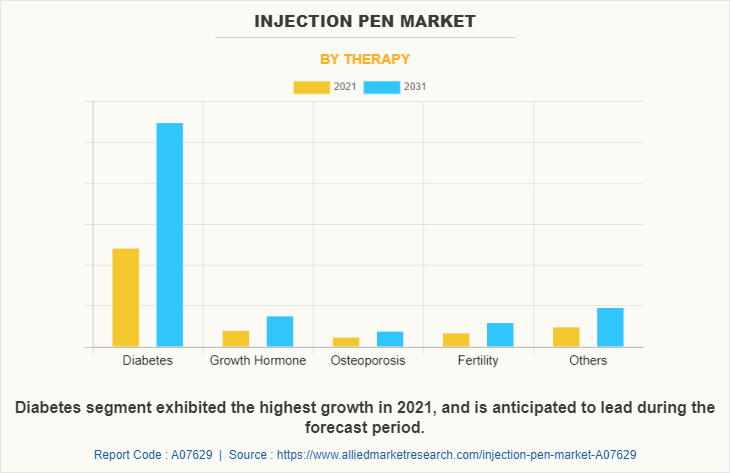

By Therapy

The injection pen market is segmented into diabetes, growth hormones, osteoporosis, fertility and others. The diabetes segment accounted for the largest share of the market in 2021 and is anticipated to remain dominant during the forecast period This is attributed to rise in the prevalence of diabetics and increase in the number of geriatric population. According to Caspersen et al, in 2020, about 10.9 million people aged above 65 years were estimated to have been diagnosed with diabetes in the U.S, and this number is projected to reach 26.7 million by 2050.

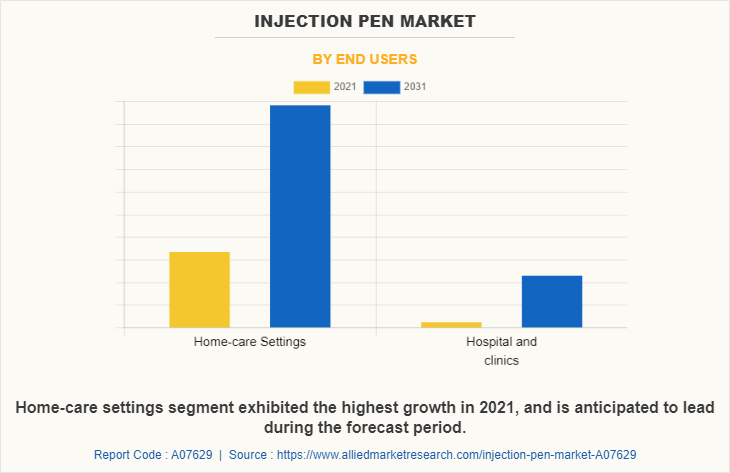

By End User

The injection pen market is bifurcated into home-care settings and hospital & clinics. The home-care settings segment exhibited the highest growth in 2021, and is anticipated to lead during the forecast period, owing to increase in awareness regarding injection pens, rise in disposable income, surge in consumer expenditure on healthcare, and rise in adoption of innovative drug delivery devices among the patients to manage diseases by staying at home.

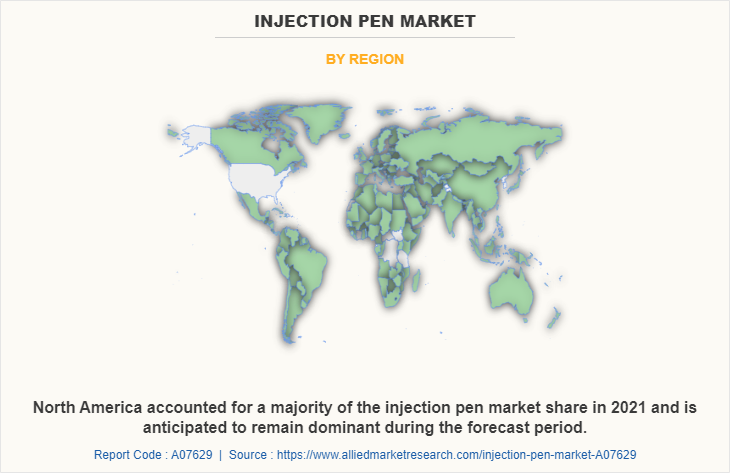

By Region

The injection pen market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the injection pen market in 2021 and is expected to maintain its dominance during the forecast period. The U.S. has been the biggest contributor to the growth of the injection pens market in North America due to the increase in prevalence of chronic diseases and rise in demand for safe and effective delivery of medications. North America also benefits from the presence of several major players in the injection pens market, such as Sanofi, Eli Lilly, Novo Nordisk, and Becton Dickinson, which have invested heavily in research and development to come up with innovative products.

Asia-Pacific is expected to witness growth at the highest rate during the injection pen market forecast. The market growth in this region is attributed to rise in the prevalence of chronic diseases like diabetes and cancer among the adult population, increase in number of geriatric patient population, and surge in the investment for injection pen products development drive the growth of the Asia-Pacific injection pen market. In addition, an increase in the adoption of key strategies like acquisition, product launch, and product approval by market players boost the market growth. For instance, in 2021, Biocon Biologics Ltd., a subsidiary of Biocon Ltd., and Viatris Inc. launched interchangeable biosimilars SEMGLEE injection pen, to help control high blood sugar in adult and pediatric patients with type-1 diabetes and adults with type-2 diabetes.

Competition Analysis

The report provides competitive analysis and profiles of the major players in the injection pen market, such as Eli Lily and Company, Novo Nordisk A/S, Sanofi, Biocon Limited, AstraZeneca, Pfizer Inc, Becton, Dickinson and Company, Ypsomed AG, Novartis AG and Merck KGaA.

Recent Product Upgrade/Development in Injection Pen Market

- In February 2023, AstraZeneca and Amgen’s Tezspire (tezepelumab) pre-filled pen was approved in the U.S. by the U.S. Food and Drug Administration (FDA). Tezspire pre-filled pen is used for self-administration in patients aged 12 years and older with severe asthma. Thus, launch of the new injection pen device will help the company to gain a strong foothold in the injection pen industry.

- In October 2020, Ypsomed AG developed the YpsoMate Zero the world’s first zero carbon emission prefilled autoinjector.

Recent Collaborations in Injection Pen Market

- In March 2020, Ypsomed AG collaborated with Teva Pharmaceutical Industries Ltd. to launch Teva's drug product AJOVY in the pre-filled YpsoMate 2.25 autoinjector. This collaboration with Teva marks the first commercial market entry of Ypsomed’s YpsoMate 2.25 autoinjector.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the injection pen market analysis from 2021 to 2031 to identify the prevailing injection pen market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the injection pen market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global injection pen market trends, key players, market segments, application areas, and market growth strategies.

Injection Pen Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 80.5 billion |

| Growth Rate | CAGR of 7.8% |

| Forecast period | 2021 - 2031 |

| Report Pages | 428 |

| By Therapy |

|

| By End Users |

|

| By Type |

|

| By Region |

|

| Key Market Players | Pfizer Inc., Sanofi, Merck Group, Ypsomed AG, Becton, Dickinson and Company, AstraZeneca, Biocon, Novartis AG, Eli Lilly and Company, Novo Nordisk A/S |

Analyst Review

According to the insights of CXOs, an increase in awareness about self-injection devices, rise in prevalence of chronic diseases, surge in technological advancement in the field of medical devices, and rise in geriatric population are the factors that drives the growth of the market.

The injection pen market is expected to witness steady growth in the future. The rise in the prevalence of chronic disease and the increase in demand for home healthcare as well as the rise in cost of hospital visits has made injection pen devices a viable option for many patients. Moreover, increase in the demand for self-injection medical devices and rise in advancement in technology have allowed for the development of injection pen devices that are more accurate and reliable. This, in turn, fuels the market growth. In addition, surge in healthcare expenditure, and rise in reimbursement policy for medical devices are the key factors driving the growth of the market. However, the high cost of the injection pen in some regions and availability of other drug delivery methods hamper the growth of the market during the forecast period.

North America is expected to dominate the global injection pen market during the forecast period, followed by Europe. In addition, emerging economies such as India, China, Mexico, and Brazil are expected to offer lucrative opportunities owing to rapidly improving healthcare facilities, rise in geriatric population, and increase in prevalence of chronic disease.

An injection pen is a medical device used to administer injections. It consists of a needle, a syringe and a pen-like device with a plunger that controls the amount of medication administered. It is commonly used to administer insulin and other medications. There are disposable and reusable types of injection pens available in the market. Disposable pens are preloaded with drug and are thrown away after the drug cartridge is empty. Whereas reusable pens work with drug cartridges that can be loaded into the pen and then thrown away once the drug is used, leaving the pen ready for the next cartridge.

Increase in the prevalence of chronic disease, surge in awareness for self-injectable devices and rise in the technological advancement.

The factors that restrain the growth of the market are preference for alternative drug delivery mode and increase in number of needlestick injury.

Top companies such as Eli Lily and Company, Novo Nordisk A/S, Sanofi, Biocon, AstraZeneca, Pfizer Inc, Becton, Dickinson and Company, Ypsomed AG, Novartis AG and Merck KGaA held a high market position in 2021.

The total market value of the Injection Pen market is $37,899.00 million in 2021.

Yes, the competitive landscape is included in the injection pen market report.

The forecast period for Injection Pen market is 2022 to 2031.

The overall impact of COVID-19 remains positive on the injection pen market. Owing to an increase in the number of diabetes patients who are at higher risk of getting affected by COVID-19.

Loading Table Of Content...

Loading Research Methodology...