Instrument Transformers Market Research, 2032

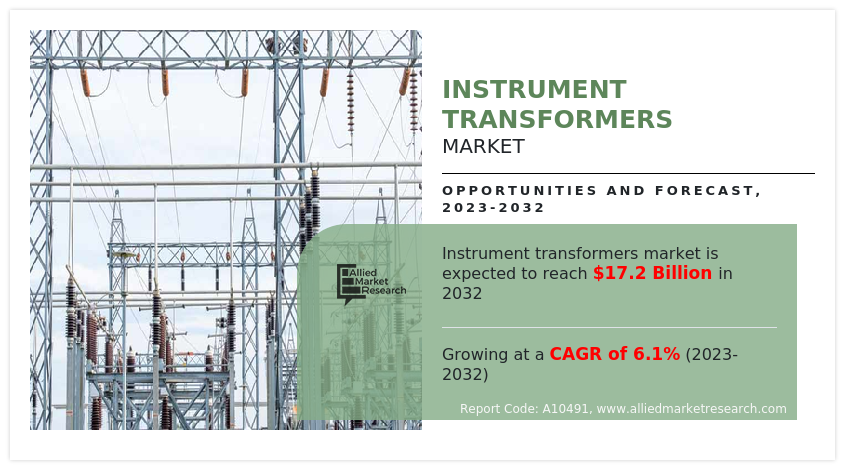

The global instrument transformers market was valued at $9.6 billion in 2022, and is projected to reach $17.2 billion by 2032, growing at a CAGR of 6.1% from 2023 to 2032.

Instrument transformers are electrical appliances used to alter or isolate current or voltage levels with very high accuracy. They are used in AC (alternate current) systems for measurement of electrical parameters such as current, voltage, energy, power factor, and frequency. The primary function of instrument transformer is to lower current and voltage of AC systems; however, with the use of instrument transformers, measurement of large electrical quantities becomes possible by coupling instrument transformers with general electrical measuring devices.

The instrument transformer industry is experiencing significant growth owing to several key factors that shape the modern power industry. One of the primary drivers is increase in demand for electricity globally, fuelled by industrialization, urbanization, and technological advancements. Instrument transformers play a crucial role in power transmission and distribution systems by stepping down high voltages for measurement and protection purposes.

With the global push toward renewable energy sources, such as solar and wind power, instrument transformer is crucial for integrating these intermittent energy sources into the grid efficiently. In addition, the emphasis on grid modernization and smart grid initiatives further augments the demand for instrument transformers equipped with advanced technologies for accurate monitoring, control, and protection of the electrical infrastructure further drives global instrument transformers market.

Ongoing transition toward cleaner energy sources such as wind and solar power is expected to continue to drive the need for sophisticated instrument transformers capable of handling variable and distributed energy inputs. Moreover, integration of digital technologies such as IoT (Internet of Things) and AI (Artificial Intelligence) into power systems will open avenues for smart instrument transformers market trends to offer real-time data analysis, predictive maintenance, and remote monitoring capabilities. This evolution towards smarter and more efficient transformers aligns with the broader trend of digital transformation within the energy sector, creating opportunities for companies to develop cutting-edge solutions.

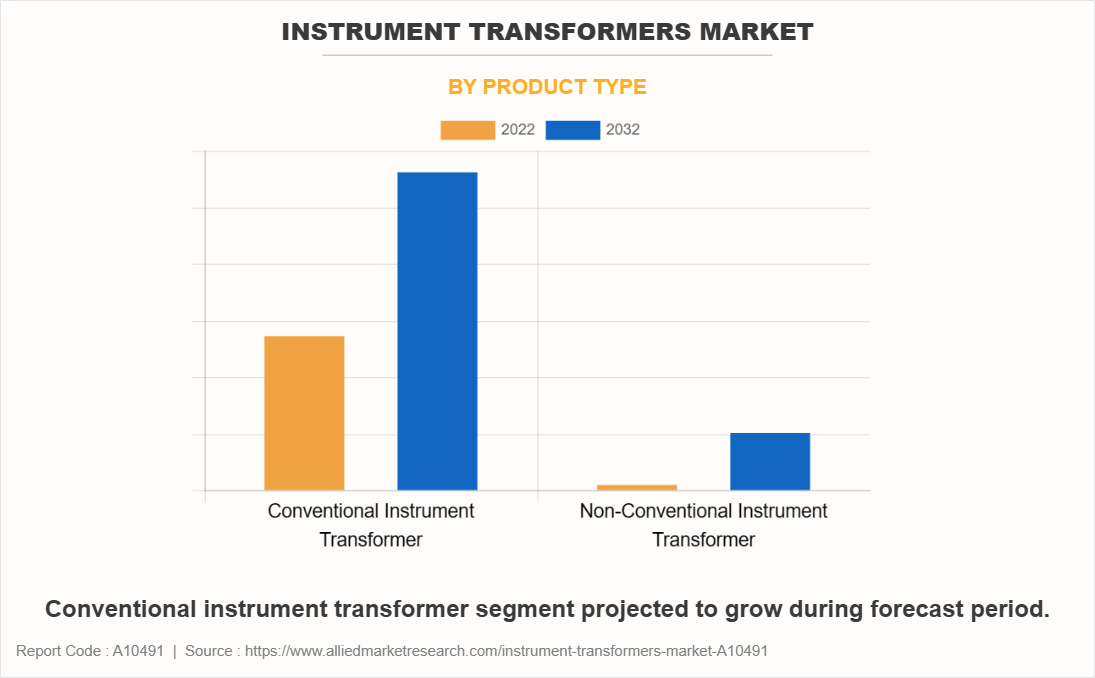

The conventional instrument transformer segment held the highest market share in 2022, and is estimated to maintain its leadership status throughout the instrument transformers market forecast period. Owing to rise in energy demand from various industries such as HVAC systems, substations, railways, and power utilities drives the demand for conventional instrument transformer. The global instrument transformers market is expected to grow due to increase in demand for electricity, grid modernization, renewable energy integration, and the need for accurate monitoring and protection of power systems.

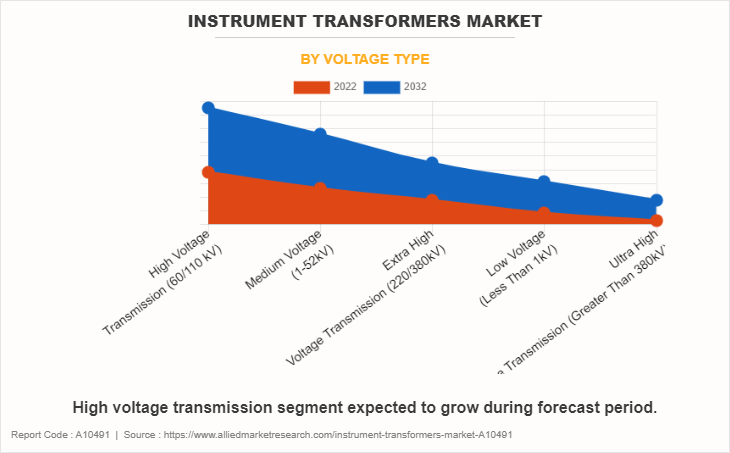

Surge in investments and government-initiated programs to provide continuous electricity supply to rural areas, especially across developing economies is anticipated to increase the demand for medium voltage instrument transformers during the forecast period. Furthermore, deployment of smart, energy efficient, and reliable technologies along with ease in installation further strengthen the product penetration. Moreover, ongoing R&D focuses on developing new insulation materials capable to withstand higher voltages, reduce dielectric losses, and enhance overall performance of transformer.

Growth in industrialization and increase in global population boost the demand of electricity. In addition, shift in trend toward the reliable renewable energy sector is expected to uplift demand for protective relay, owing to its utilization in power generation processes. Furthermore, increase in power substation construction to supply electricity for domestic and commercial usage require protective relays to trigger alarm switches and circuit breakers during voltage fluctuation. Growing demand for protective relay from power generation sector further led to surge in demand for instrument transformers during the forecast period.

Power utilities rely on the automation process as it provides better monitoring, increases profitability, and reduces timelines. Furthermore, number of smart grids in North America and Europe increase significantly over the last decade owing to the implementation of artificial intelligence and Internet of Things (IoT)-based systems in the power sector in these regions. Moreover, expanding network of smart grids and digitization of substations are anticipated to provide significant opportunities for the instrument transformers market in the future.

Furthermore, expansion of electric vehicle (EV) infrastructure and electrification of transportation are expected to contribute to increase in demand for reliable power distribution networks, thus creating a need for specialized instrument transformers tailored for EV charging stations and related infrastructure. Overall, the instrument transformer market stands poised for sustained growth, driven by technological innovation, renewable energy adoption, grid modernization, and the evolving needs of the power sector.

The global demand for instrument transformers is primarily driven by rise in alternative energy programs, refurbishment of aging power infrastructure, and huge investments in smart grids and energy systems. Rise in need for electricity, growing electrification activities across the rural areas across the developing economies such as China and India, and renovation of existing grid network coupled with rise in concerns pertaining to grid stability boosts the global instrument transformers market. Increase in grid complexities across electric infrastructure in conjunction with emerging peak electricity demand from end users propel the global instrument transformers market growth.

Increase in utilization of renewable energy in Australia is a major growth factor as Australia receives highest average solar radiation per square meter. India and China, two fastest growing economies, are the biggest producers of electricity and have vast transmission networks. Both of these countries have put their focus on integrating power from renewable sources with national power grid as well as developing smart grids.

China invested heavily on construction of three UHV AC transmission networks and one UHV DC power transmission network. Aa per Xinhua News Agency, China will invest $900 billion in the next five years to help further develop the country's power grids. These factors are expected to drive demand for instrument transformers across the region.

However, increase in competition from unorganized sectors of the instrument transformer market is expected to hamper instrument transformers market growth during the forecast period. Furthermore, rise in investments in transmission & distribution infrastructure is expected to provide instrument transformers market opportunities during the forecast period.

The instrument transformers market is segmented on the basis of product type, voltage, application, end-user, and region. By product type, it is bifurcated into conventional instrument transformer and non-conventional instrument transformer. On the basis of voltage type, it is segmented into low voltage (<1kV), medium voltage (1-52kV), high voltage transmission (60/110 kV), extra high voltage transmission (220/380kV), and ultra high voltage transmission (>380kV).

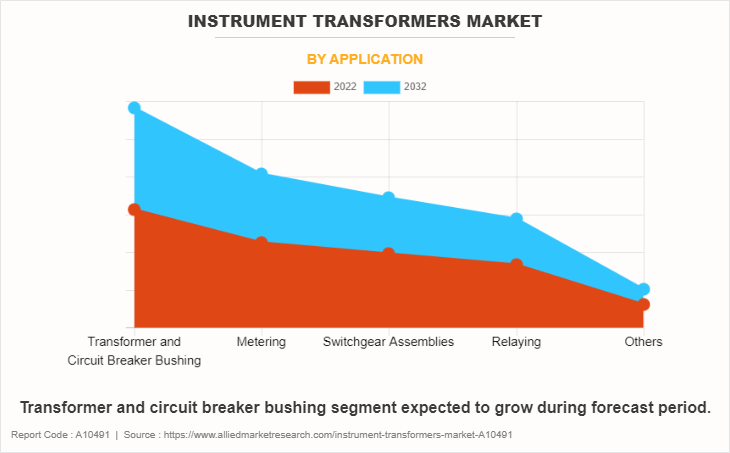

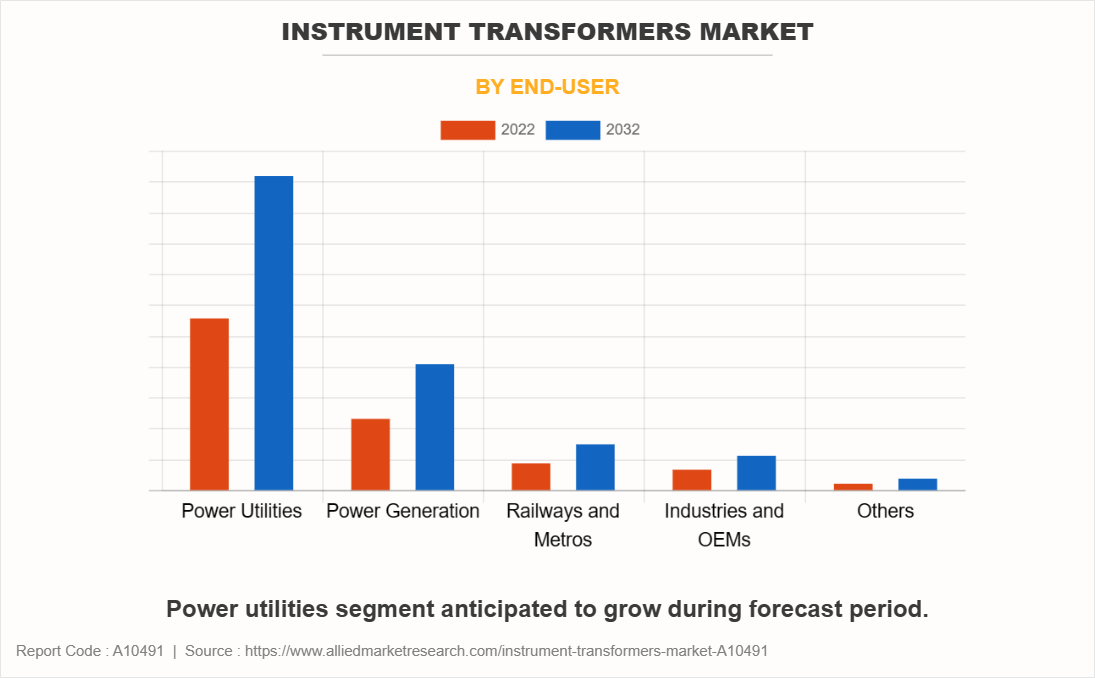

On the basis of application, it is divided into transformer and circuit breaker bushing, switchgear assemblies, relaying, metering, and others. By end-user, it is segmented into power utilities, power generation, railways & metros, industries & OEMs, and others.

Region-wise, it is studied across North America, Europe, Asia-Pacific, and LAMEA. Asia-Pacific accounted for a major instrument transformers market size in 2022, owing to increased power consumption, government initiatives to increase power generation capacity using renewable energy sources, and replacement of aging power plants are expected to drive the instrument transformers market in the region.

The major companies profiled in this report include ABB Ltd., General Electric, Schneider Electric, Siemens, CG Power and Industrial Solutions Ltd, Mitsubishi Electric Corporation, Instrument Transformer Equipment Corporation, Inc., Arteche, Nissin Electric, Hitachi Ltd, Ritz Instrument Transformers, Pfiffner Group, ALCE Elektrik San. Tic. A.Åž., ELEQ B.V., Enpay, Narayan Powertech Pvt Ltd., Pragati Electricals Pvt Ltd., Dayihu, Epoxy House, and Bharat Heavy Electrical Limited.

The report provides a detailed instrument transformers market analysis of these key players. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their instrument transformers market share and maintain dominant shares in different regions. Further, key strategies adopted by potential market leaders to facilitate effective planning have been discussed under instrument transformers market scope in this report.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the instrument transformer market segments, current trends, estimations, and dynamics of the instrument transformers market analysis from 2022 to 2032 to identify the prevailing instrument transformers market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the instrument transformers market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global instrument transformers market trends, key players, market segments, application areas, and market growth strategies.

Instrument Transformers Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 17.2 billion |

| Growth Rate | CAGR of 6.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 643 |

| By Application |

|

| By Product Type |

|

| By End-User |

|

| By Voltage Type |

|

| By Region |

|

| Key Market Players | Pragati Electricals Pvt Ltd., GENERAL ELECTRIC, Epoxy House, Arteche, ABB Ltd., Mitsubishi Electric Corporation, ENPAY, Narayan Powertech Pvt.Ltd., Pfiffner Group, Ritz Instrument Transformers, Hitachi, Ltd., Schneider Electric, Siemens AG, Dayihu, CG Power and Industrial Solutions Ltd., Nissin Electric Co., Ltd., ALCE Elektrik San. Tic. A.?., ELEQ B.V., Instrument Transformer Equipment Corporation, Inc., Bharat Heavy Electricals Limited |

Analyst Review

According to CXOs of leading companies, the global instrument transformers market is anticipated to witness growth during the forecast period, driven by rapid expansion in power grid network across emerging energy markets and growth in renewable power generation facilities are expected to drive the market.

A number of governments of both emerging and underdeveloped nations across the world are increasingly focusing on expanding their power grid network toward rural areas. Regions such as Africa that have low access to electricity initiated various road maps to lay down electricity grid toward its remote places. Power Africa, an initiative led by the U.S., is planning to have 30.0 GW of electricity generation by 2030 and is expected to provide electricity to around 60.0 million homes in the remote areas of the region.

However, increase in competition from the unorganized sector of the instrument transformer market is expected to hamper growth of the instrument transformers market during the forecast period. Furthermore, rise in investments in the transmission & distribution infrastructure is expected to provide growth opportunities for the instrument transformers market during the forecast period.

Transformer and circuit breaker bushing is the leading application of instrument transformers market.

The upcoming trends in instrument transformers market across globe are digital transformation, renewable energy integration, smart grid initiatives, upgradation of aging infrastructure and focus on energy efficiency.

Asia-Pacific is the largest regional market for instrument transformers.

The instrument transformers market was valued for $9.6 billion in 2022 and is estimated to reach $17.2 billion by 2032, exhibiting a CAGR of 6.1% from 2023 to 2032.

ABB Ltd., General Electric, Schneider Electric, Siemens, CG Power and Industrial Solutions Ltd, Mitsubishi Electric Corporation, Instrument Transformer Equipment Corporation, Inc., Arteche, Nissin Electric, Hitachi Ltd, Ritz Instrument Transformers, Pfiffner Group, ALCE Elektrik San. Tic. A.?., ELEQ B.V., Enpay, Narayan Powertech Pvt Ltd., Pragati Electricals Pvt Ltd., Dayihu, Epoxy House, and Bharat Heavy Electrical Limited are the top companies to hold the market share in instrument transformers.

Loading Table Of Content...

Loading Research Methodology...