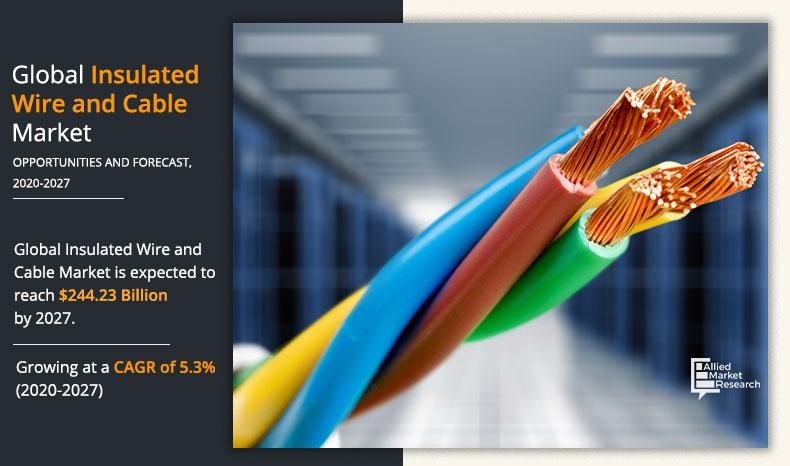

Insulated Wire and Cable Market Outlook - 2027

The global insulated wire and cable market size was valued at $160.54 billion in 2019, and is projected to reach $244.23 billion by 2027, to register a CAGR of 5.3% from 2020 to 2027. Insulated wire and cable consists of non-conductive material that provide resistant from electric current. Wire and cable insulation protects the wire material from environmental threats such as water, heat etc., and gives better insulability at hightemperatures.

An insulated wire generally used in equipment such as fire alarm, heating device, automobile,and others needs safety at a high operating temperature. The effectiveness & safety of the wire depend on its insulation. An insulated wire of this category is usually molded by a conductor, which is coated with heat resilient organic resin such as fluororesin. There are various types of insulation wire and cable materials used for insulation, whichare selected on the basis of usage such as Polyvinyl Chloride (PVC), Semi-Rigid PVC (SR-PVC), Polyurethane (PUR), Chlorinated Polyethylene (CPE), Nylon, Neoprene (Polychloroprene), Silicone, Fiberglass, Ethylene Propylene Rubber (EPR), Rubber, Polytetrafluoroethylene (PTFE), and Thermoplastic Elastomers (TPE).Insulation wire and cable materials are widely available at a reasonable price.

By Material

Optical Fiber segment would grow at a highest CAGR of 7.0% during the forecast period

The global insulated wire and cable market is anticipated to witness significant growth during the forecast period. Factors such as growth in urbanization and rise in investments toward infrastructure development projects worldwide drive the growth of the insulated wire and cable market. The working of the whole world relies upon the timely delivery of electric supply. High usage of insulated wire and cable has been seen in the power sector in the recent time. Furthermore, the expanding population leads to rise in demand for power.

By Installation

Overhead segment will secure the leading position during 2020 - 2027

However, growing wireless technologies is a major restraint to global insulated wire and cable industry. Also, the North American region is expected to create opportunities for the insulated wire and cable industry, owing to vast increase in data consumption, which has resulted in investments by major telecommunication companies such as Verizon and AT&T in fiber networks.

By Voltage

High Voltage segment will dominate the market with a highest CAGR of 7.0% during 2020 - 2027

Key Takeaways

The global insulated wire and cable market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major market industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The insulated wire and cable market is driven by the increasing demand for electricity due to urbanization and industrialization, propelling the need for high-quality insulated wires and cables. Additionally, the growing renewable energy sector, particularly in solar and wind energy, boosts the demand for insulated wiring solutions for efficient energy transmission. Stringent safety regulations regarding electrical installations further encourage the use of insulated cables to prevent accidents and ensure compliance. However, volatility in raw material prices poses a notable restraint, impacting production costs and pricing strategies. Opportunities lie in the rise of smart grids and advanced technologies like IoT, which present significant growth prospects as these technologies require reliable and efficient electrical infrastructure.

Segment Overview

The global insulated wire and cable market is segmented into material, installation, voltage, end user, and region. By material, the market is segmented into metal, plastic, and optical fiber. The installation segment is divided into overhead, underground, and submarine. By voltage, the insulated wire and cable market is fragmented into low voltage, medium voltage, and high voltage. Depending on end user, the market is segregated into telecommunication, energy & power, electronics, construction, automotive, and others.

By End User

Telecommunication segment will maintain the lead during the forecast period

Region wise, the insulated wire and cable market trends are analyzed across North America (U.S., Canada, and Mexico), Europe (U.K., Germany, France, Italy, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).APAC is expected to develop at highest rate during the forecast period, owing to growingdemand for power, light & communication in the developing regions like China, India, Japan, and South Korea.

By Region

Asia-Pacific region would exhibit the highest CAGR of 5.9% during 2020 - 2027

In India, the government initiatives such as “Make in India,” policy is expected to drive the market in the region. Additionally, Indian government planned to make the country one of the major electrical equipment manufacturer & attain business of USD 100 billion by matching the import & exports, as per “Indian Electrical Equipment Industry Mission Plan 2012-2022” of Ministry of Heavy Industries & Public Enterprises Government of India, hence, driving the demand for wires and cablesduring the forecast period.

Leading insulated wire and cable manufacturerssuch as General Cable Technologies Corporation, Nexans, and Southwire Company LLC, etc. are focusing their investment oncost-effective, technologically advanced, and more secure products for various applications.

Top Impacting Factors

The prominent factors that impact the insulated wire and cable market growth are increasing use of wires in the automotive sector, underground cables, and insulated optical fiber cables.However,Internet of Things which boost wireless technologiesmakes negative impact the market growth. On the contrary,surge in number of data centers, & development of smart cities is expected to create lucrative opportunities for the insulated wire and cable market. Each of these factors is likely to have a definite impact on the growth of the global insulated wire and cable during the forecast period.

Regional/Country Market Outlook

North America: The North American market for insulated wire and cable is driven by robust infrastructure development and increasing investments in renewable energy projects. The region's focus on upgrading electrical grids and adhering to stringent safety regulations further supports market growth.

Europe: The European insulated wire and cable market benefits from strong regulations promoting energy efficiency and safety. The push for renewable energy sources and electric vehicle infrastructure development is driving demand for high-quality insulated products across the region.

Asia-Pacific: Rapid industrialization and urbanization in the Asia-Pacific region are significant growth drivers for the insulated wire and cable market. The increasing demand for electricity and infrastructure development, particularly in emerging economies like India and China, is fueling market expansion.

LAMEA: In the LAMEA region, the insulated wire and cable market is driven by growing urbanization and infrastructure investments. The rising adoption of renewable energy solutions and improvements in electrical distribution networks present substantial growth opportunities in this insulated wire and cable market.

Competitive Analysis

Competitive analysis and profiles of the major insulated wire and cable market players such asAFC Cable Systems Inc., Alpha Wire, Amphenol Corporation, CommScopeInc., Fujikura Ltd., General Cable Technologies Corporation, Nexans, SAB Bröckskes GmbH & Co. KG, Southwire Company, LLC, and Sumitomo Electric Industries Ltd.These key players have adopted various strategies, such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations, to increase their market penetration and strengthen their foothold in the industry.

Report Coverage & Deliverables

This report delivers in-depth insights into the insulated wire and cable market, by fiber mode, service type, offering, application, and key strategies employed by major players. It offers detailed insulated wire and cable market forecasts and emerging trends.

Material Insights

The insulated wire and cable market comprises metal, plastic, and optical fiber materials. Metal wires offer excellent conductivity, while plastic insulation provides flexibility and moisture resistance. Optical fiber cables are preferred for high-speed data transmission.

Installation Insights

Installation methods include overhead, underground, and submarine. Overhead installations are cost-effective and easy to maintain, while underground installations protect against environmental factors. Submarine installations are essential for undersea communication and power transmission.

Voltage Insights

The insulated wire and cable market is divided into low, medium, and high voltage categories. Low voltage cables are used for residential applications, medium voltage cables serve industrial needs, and high voltage cables are critical for long-distance power transmission, especially in renewable energy projects.

End User Insights

Key end-user industries include telecommunications, energy and power, electronics, construction, and automotive. Each sector relies on insulated cables for efficient data transmission, electricity distribution, and advanced electrical systems.

Key Strategies and Developments

In November 2019, Sumitomo Electric Industries, Ltd. introduced "S-FREE," a new brand focusing on traveling cables and insulated wires designed for use in electric equipment and panels. The brand is centered around the concept of providing "Comfort for the site," emphasizing ease of use and enhanced functionality in various applications.

In November 2021, Maillefer, a leading global extrusion specialist, unveiled a new building wire insulation production line in Hyderabad, India. This innovative line operates at speeds of up to 1200 meters per minute, offering remarkable linearity and stability in output, thereby enhancing production efficiency and quality for building wire insulation.

Key Benefits For Stakeholders

This study comprises analytical depiction of the global insulated wire and cable market size along with the current trends and future estimations to depict the imminent investment pockets.

The overall insulated wire and cable market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current insulated wire and cable market forecast is quantitatively analyzed from 2019 to 2027 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and the insulated wire and cable market share of key vendors.

- The report includes the market trends and the market share of key vendors.

Insulated Wire and Cable Market Report Highlights

| Aspects | Details |

| By Material |

|

| By Installation |

|

| By Voltage |

|

| By End User |

|

| By Region |

|

| Key Market Players | Checkpoint Systems, Inc., iDTRONIC GmbH, ZEBRA TECHNOLOGIES CORP., APPLIED WIRELESS IDENTIFICATIONS GROUP, INC., IMPINJ, INC., INVENGO TECHNOLOGY PTE. LTD., HONEYWELL INTERNATIONAL INC., AVERY DENNISON CORPORATION, Alien Technology, NXP Semiconductors |

Analyst Review

An insulated wire and cable are basically a number of grouped conductors surrounded by a non-conductive element generally surrounding or separating two or more conductive materials. These insulated wire and cable are generally used for transmission of signals or electrical energy.

There are various types of insulted wire and cable available, which are used according to specific need of users, such as Vulcanised Indian Rubber Insulated Wires, Tough Rubber Sheathed (T.R.S.) and Cab Tyre Sheathed (C.T.S.) Wires, Metal Sheathed or Lead Sheathed Wires, Weather-Proof Wires, Wires with Thermo-Plastic Insulation (P.V.C. Wires), Twin Rubber Insulated Flexible Cord, Paper-Insulated Cable, Tropodur Cables, and Mineral-Insulated Cable.

The global insulated wire and cable market is anticipated to witness significant growth over the period of forecast. Factors such as growth in urbanization and rise in investments toward infrastructure development projects worldwide drive the growth of the Insulated wire and cable market. The working of the whole world relies upon the timely delivery of electric supply. High usage of insulated wire and cable has been seen in power sector in the recent time. Further, the expanding population leads to rise in demand for power.

However, growth in wireless technologies is a major restraint to global insulated wire and cable industry. Also, North American is expected to create opportunities for the insulated wire and cable industry, owing to vast increase in data consumption. Reasons such as growing construction and manufacturing sector, incentives in the Union Budget worldwide owing to COVID-19 pandemic, are expected to contribute toward the insulated wire and cablemarket growth in the coming years.

The key players of the market focus on introducing technologically advanced products to remain competitive in the market. Product launch, acquisition, and expansion are expected to be the prominent strategies adopted by the market players.

The Insulated Wire and Cable Market is estimated to grow at a CAGR of 5.3% from 2020 to 2027.

The Insulated Wire and Cable Market is projected to reach $244.23 billion by 2027.

To get the latest version of sample report

Increasing use of wires in the automotive sector, underground cables, and insulated optical fiber cables boost the Insulated Wire and Cable market growth.

The key players profiled in the report include AFC Cable Systems Inc., Alpha Wire, Amphenol Corporation, CommScope Inc., Fujikura Ltd., and many more.

On the basis of top growing big corporations, we select top 10 players.

The Insulated Wire and Cable Market is segmented on the basis of material, installation, voltage, end user, and region.

The key growth strategies of Insulated Wire and Cable market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Optical Fiber segment would grow at a highest CAGR of 7.0% during the forecast period.

Overhead segment will secure the leading position during 2020 - 2027.

Loading Table Of Content...