Insurance Agency Software Market Research, 2032

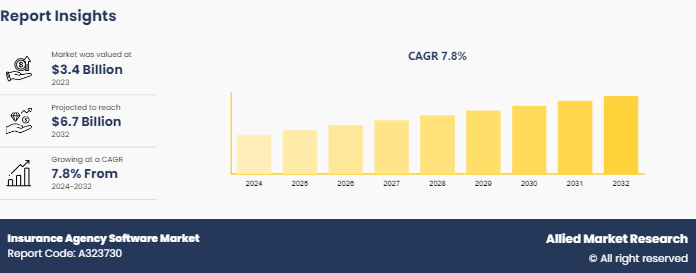

The global insurance agency software market was valued at $3.4 billion in 2023, and is projected to reach $6.7 billion by 2032, growing at a CAGR of 7.8% from 2024 to 2032.

The rising demand for streamlined operations and improved customer experiences is driving the adoption of insurance agency software market growth. Additionally, advancements in technology and increasing integration of AI and analytics in software solutions are expected to further propel the market expansion during the forecast period.

Market Introduction and Definition

The insurance agency software market includes software solutions designed to calculate insurance premiums based on risk factors and underwriting guidelines. These tools use advanced algorithms and data analytics to streamline rating processes, ensuring precise premium determinations. The insurance agency software market growth is driven by rise in demand for accuracy in premium calculations, improved customer experience, and efficient underwriting. Regulatory requirements and compliance standards further boost the adoption of these systems. The insurance agency software industry is also seeing a push towards digital transformation, with the integration of AI and machine learning driving innovation. Despite challenges such as high implementation costs and integration with legacy systems, the insurance agency software market is expanding due to the growing adoption of cloud-based solutions and the need for customizable, scalable software.

Key Takeaways

The insurance agency software market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literature, industry releases, annual reports, and other such documents of major insurance agency software industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global insurance agency software market and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Industry Trends:

In January 2024, Majesco, a global leader of cloud insurance software solutions for insurance business transformation, announced the acquisition of the Decision Research Corporation (DRC) business, a SaaS-based insurance software company delivering market-leading enterprise rating, a reinsurance solution, and core for the P&C insurance market. Majesco will add over 20 P&C customers to their growing customer community.

In February 2024, Sure, the insurance technology leader that unlocks the potential of digital insurance, announced the launch of Anywhere Insurance to liberate the insurance industry from the control of incumbent rate service organizations (RSOs) and legacy insurance product filings. Anywhere provides first of its kind insurance programs designed for carriers, MGAs, and global brands that want unique, customizable, go-to-market ready insurance products paired with end-to-end SaaS technology and APIs that can scale to hundreds of millions of customers.

Key Market Dynamics

The global insurance agency software market size is expanding due to several key factors such as rise in demand for accurate premium calculations, advancements in data analytics, and stringent regulatory requirements in the insurance industry. However, high initial implementation costs and concerns regarding data privacy pose challenges to the market growth. Moreover, the proliferation of digital insurance platforms and the development of AI-driven rating solutions is expected to provide significant opportunities for market expansion during the forecast period.

The insurance agency software market forecast has witnessed substantial growth driven by rise in the need for precise premium calculation and risk assessment in the insurance sector. Leading players such as Vertafore, Guidewire Software, and Sapiens International Corporation offer comprehensive agency software solutions that enhance underwriting accuracy, improve customer experience, and ensure regulatory compliance. The rise in digital insurance platforms and the growing focus on personalized insurance products have fueled the demand for advanced agency software. In addition, digital transformation in the insurance industry has led to the integration of AI and machine learning technologies, enabling sophisticated risk assessment and pricing models. The COVID-19 pandemic highlighted the importance of digital tools in the insurance sector, encouraging more companies to adopt advanced software agency to streamline operations, reduce costs, and improve service delivery in a rapidly evolving market environment. Therefore, these are the major factors driving the growth of the market.

SWOT Overview: Global Insurance Agency Software Market

The global market for insurance agency software offers a dynamic environment that is defined by opportunities, threats, weaknesses, and strengths. Strengths include the capacity to expedite underwriting procedures, which improves client experiences and regulatory compliance, and strong data analytics capabilities, which increase premium accuracy and risk assessment. Adoption of insurance agency software is hampered by weaknesses such as high initial installation costs and the difficulty of integrating new software with existing systems, particularly for smaller insurers. The insurance industry is undergoing a digital revolution with artificial intelligence and machine learning technologies, and demand for customized, usage-based insurance products rises. These technologies create opportunities for creative improvement and drive the insurance agency software market growth. Threats to the market include data privacy, which is discouraging the uptake, and quick adoption of technological advancement, which can exceed the capacity of certain insurers to adjust. Furthermore, obstacles that can hinder market expansion include severe regulatory restrictions and economic uncertainty. The global market for insurance agency software is expected to grow significantly due to changing consumer needs and technical advancements.

Market Segmentation

The insurance agency software market outlook is segmented into deployment mode, enterprise size, application, and region. On the basis of deployment mode, the market is divided into cloud-based and on-premises. On the basis of enterprise size, the market is divided into large enterprise and SMEs. By application, the market is divided into claims management, commission management, contract management, document management, insurance rating, quote management, and policy management. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The North America insurance agency software market share is poised for substantial growth, driven by the region's advanced technological infrastructure and high adoption rate of digital solutions among insurers. The U.S. leads the insurance agency software market due to its well-established insurance sector and regulatory environment that encourages the use of sophisticated rating tools. Key drivers include rise in demand for accurate premium calculations, improved underwriting processes, and enhanced customer experiences. The presence of major market players such as Vertafore and Guidewire Software further bolsters market development through continuous innovation and product enhancements. However, challenges such as high implementation costs and data privacy concerns hamper the growth of the market. In addition, growing focus on personalized insurance products and the integration of AI and machine learning technologies, are expected to drive the insurance agency software market growth.

In April 2023, Global data analytics provider, Verisk launched a Rating-as-a-Service (RaaS) solution to help insurers develop new commercial lines products. Instead of investing extensive time and resources into gathering, evaluating and installing rating updates, the new, cloud-based rating engine offers a streamlined process. RaaS can help insurers to customize their pricing of insurance premium and added services. Insurers can also expand the solution’s reach by integrating it with other Verisk solutions that support product development, underwriting automation and portfolio assessment.

In October 2023, Applied Systems launched embedded commercial insurance application Tarmika Insured. Using Tarmika Insured, agencies can embed commercial lines quoting capabilities online at the point of sale. Agencies can create a simpler and “more connected” commercial lines quoting experiencing, it was claimed, expected to improve productivity and speed to market with customers able to receive premiums in real time, according to a press release shared with Insurance Business by Applied.

Competitive Landscape

The major players operating in the insurance agency software market include Applied Systems Inc., Vertafore, Inc., EZLynx, HawkSoft, Sapiens International Corporation, and QQ Solutions, Inc. Other players in the insurance agency software market include Jenesis Software, AgencyBloc, LLC, Buckhill Ltd., XDimensional Technologies, Inc., and so on., and so on.

Recent Key Strategies and Developments

In August 2023, Insurity, the leading provider of cloud-based software and analytics for insurance carriers, brokers, and MGAs, announced the launch of Circ, its industry-leading regulatory offering, to monitor, analyze, interpret, and implement regulatory changes. Insurity’s regulatory solution is already trusted by over 125 commercial lines insurers that represents over $30 billion in gross written premium, expanding Insurity’s #1 market position as the software provider of regulatory services management for P&C insurers.

In June 2023, Expert.ai, the industry leader in AI-powered language solutions, announced availability of the expert.ai Platform for Insurance. The expert.ai Platform for Insurance powers underwriting and claims solutions so that insurers can use natural language processing to eliminate documents from review cycles, extract needed data and prioritize which submission or claims need an expedited review or to be assigned to a senior adjuster based on complexity.

Key Sources Referred

ACORD (Association for Cooperative Operations Research and Development)

InsurTech NY

Digital Insurance Association (DIA)

Life Insurance Marketing and Research Association (LIMRA)

Property Casualty Insurers Association of America (PCI)

Key Benefits for Stakeholders

This report provides a quantitative analysis of the insurance agency software market segments, current trends, estimations, and dynamics of the insurance agency software market analysis from 2023 to 2032 to identify the prevailing insurance agency software market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the Insurance agency software market segmentation assists in determining the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global insurance agency software market statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes an analysis of the regional as well as global insurance agency software market trends, key players, market segments, application areas, and market growth strategies.

Insurance Agency Software Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 6.7 Billion |

| Growth Rate | CAGR of 7.8% |

| Forecast period | 2024 - 2032 |

| Report Pages | 150 |

| By Deployment Mode |

|

| By Enterprise Size |

|

| By Application |

|

| By Region |

|

| Key Market Players | AgencyBloc, LLC, EZLynx, Vertafore, Inc., Applied Systems Inc., Jenesis Software, Sapiens International Corporation, QQ Solutions, Inc., XDimensional Technologies, Inc., Buckhill Ltd., HawkSoft |

The insurance agency software Market is estimated to grow at a CAGR of 7.8% from 2024 to 2032.

The insurance agency software Market is projected to reach $6.7 billion by 2032.

The insurance agency software Market is expected to witness notable growth rise in demand for accurate premium calculations, advancements in data analytics, and stringent regulatory requirements in the insurance industry.

The key players profiled in the report include Applied Systems Inc., Vertafore, Inc., EZLynx, HawkSoft, Sapiens International Corporation, QQ Solutions, Inc., Jenesis Software, AgencyBloc, LLC, Buckhill Ltd., and XDimensional Technologies, Inc.

The key growth strategies of insurance agency software Market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...