Insurance Aggregators Market Research, 2031

The global insurance aggregators market was valued at $19.3 billion in 2021, and is projected to reach $130 billion by 2031, growing at a CAGR of 21.2% from 2022 to 2031.

Insurance aggregator uses tracking and customer behavioral analysis to improve corporate operations. In addition, it offers a simple price-comparison service financed through ads or listing fees. Moreover, in lead generation model, aggregators generate leads and sell them to brokers or product providers and helps to educate people and let them know about the different insurance products.

Rising number of aggregators and digital brokers and the increase in internet userbase usage is boosting the growth of the insurance aggregators market. In addition, increase in digital influence is positively impacts the growth of the insurance aggregators market. However, lack of awareness among customers and lack of skilled workforce is hampering the insurance aggregators market growth. On the contrary, increased awareness among customers offers remunerative insurance aggregators market opportunity for the expansion of the insurance aggregators market during the forecast period.

The insurance aggregators market is segmented into Enterprise Size and Insurance Type.

Segment Review

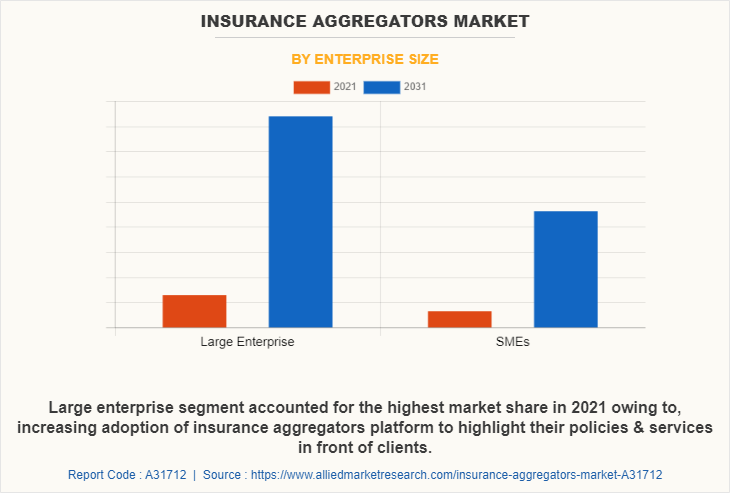

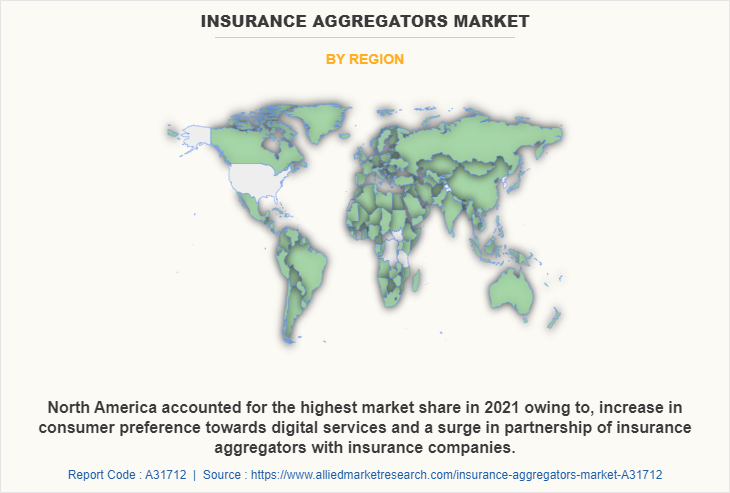

The insurance web aggregator is segmented on the basis of enterprise size, insurance type, and region. On the basis of enterprise size, the market is bifurcated into large enterprises and SMEs. On the basis of insurance type, the market is categorized into life insurance, motor insurance, health insurance and others and by end user, it is classified into insurance companies, aggregators, and third-party administrators and brokers. By region, the insurance aggregators market outlook is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

In terms of enterprise size, the large enterprise segment holds the highest insurance aggregators market share as it helps insurers to maintain transparency in the claim process, and human connections and improves the decision-making capability. However, the SMEs segment is expected to grow at the highest rate during the forecast period. These services reduce managing concerns efficiently and help to achieve their claim process & premium underwriting, and evaluation process effectively.

Region wise, the insurance aggregators market size was dominated by North America in 2021, and is expected to retain its position during the forecast period, owing to rise in the adoption of modern technologies in the insurance industry. However, Asia-Pacific is expected to witness significant growth during the forecast period, as several insurers are adopting & heavily investing in digital insurance platform to boost business efficiency, lowering compliance risk exposure and improving claim settlement process in the region.

The key players that operate in the insurance aggregator market are Allianz SE, Assicurazioni Generali Spa, AXA Group, Munich Re, Swiss Re, Aviva, Zurich Insurance Group, Esurance Insurance Services, Inc, Lemonade, Inc., and RooT. These players have adopted various strategies to increase their market penetration and strengthen their position in the web aggregator in insurance.

Digital Capabilities

Insurance aggregators market use tracking and customer behavioral analysis to improve corporate operations. In addition, the deployment paradigm enables the implementation of analytics solutions at a low cost. Executives, data analysts, team leaders, managers, and professionals use business intelligence (BI) tools to collect, analyze, visualize, and report numerous functions within a company and apply their results to their respective industries. Moreover, the insurance aggregator concludes agreements with a number of insurers to provide a comparative quote based on a pre-determined list of specified needs as disclosed by potential clients. It is a strong online presence comparing insurance quotes and coverage, supported by extensive advertising to build visibility and drive traffic to attract clients on the basis of convenience and cost.

Government Regulations

All well-governed IT industries should be able to demonstrate due diligence to ensure regulatory compliance in applicable fields, including IT. Organizations are adopting insurance aggregators to manage, store, and extract relevant and useful information from the data stored and process online applications along with price comparison. For instance, California’s Online Protection Act provides explicit privacy rights and allows users to know how their information is anticipated to be used in the future. Furthermore, the cloud security regulations are strongly adhered by almost all insurance aggregator service providers to operate as global service providers. For instance, the U.S. security regulation is mandatory to be adhered by major players located in this country.

In addition, federal and state governments are improving their track plans for various privacy laws, which are applicable for data involved in their operations. For instance, the Massachusetts Data Security regulations are majorly focused on security purpose and for increasing the privacy of big data analytics. Europe is set to take the advantage of insurance aggregators for providing data protection facilities to different organizations. For instance, the European Government adopted the new General Data Protection Regulation (GDPR). The act seeks to regulate the collection, storage, and processing of information about individuals. The key aim of GDPR is to protect critical data of the financial, banking, and insurance sectors of the European nation.

Furthermore, the GDPR act imposed by the European Government mitigates the risk of cyber security and any potential data breaches. Emerging countries of Asia-Pacific are developing stringent big data regulations, which comprise privacy, government regulatory environment, and intellectual property protection. For instance, the Cybersecurity Bill established in Singapore encouraged multiple organizations in the country to adopt big data analytics to manage the massive volume of data.

End-User Adoption

Insurance aggregators collect, compile, and provide information about different companies’ insurance policies on a website. They act as intermediaries between insurance companies and people who want to take insurance policies. Thus, increase in adoption of insurance aggregators, owing to their security is one of the most significant factors driving the growth of the market. With the surge in demand for insurance aggregator, various companies have established acquisition as a key strategy to increase their capabilities. For instance, in October 2022, One80 Intermediaries (One80), a national wholesale broker, program manager, third-party administrator (TPA), warranty and lender-based insurance provider, and insurance aggregator headquartered in Boston acquired Equity Partners Insurance Services, Inc. (EPIS), a Louisiana based managing general agent and wholesaler for commercial and personal lines to provide competitive quotes and excellent customer service.

In addition, with further growth in investment across the world and rise in demand for insurance aggregator, various companies have expanded their current product portfolio with increased diversification among customers. For instance, in October 2022, Amazon launched a portal for buying insurance in the UK, challenging established price comparison sites in the latest indication of Big Tech’s growing ambitions in financial services.

Moreover, with the increase in competition, major market players have started acquisition companies to expand their market penetration and reach. For instance, in September 2022, Union Bay acquired Farrell Insurance Associates help to bring Farrell Insurance Associates to the next level of its growth and development and also to grow its portfolio with expertise in the Philadelphia area.

Key Benefits

Insurance aggregators offer customers the facility to draw comparisons between multiple policies at the same time. In addition, they help to compare different policies on the basis of some important factors such as benefits provided, premiums, coverage provided, terms, and others. Moreover, an insurance aggregator site refers to a website that contains information from different insurance companies. Most people tend to spend time and money to contact various insurance brokers. Furthermore, one of the biggest benefits that online aggregators provide is convenience. Customers can purchase the policy from anywhere. All users need a data connection and a clear idea of what they want. Once the insureds have selected the policy, they need to provide details about themselves.

End users are increasingly preferring personalized insurance aggregator services, owing to surge in adoption of chatbots among personalized insurance services and an increase in competition among the insurance aggregator companies for garnering maximum market share. Various insurance companies are providing budget management apps powered by machine learning, which help customers to achieve their financial targets and improve their money management process; thus, driving the growth of the market.

Furthermore, robo-advisors are one of the other rapidly emerging trends in personalized insurance aggregator services, as they specifically target investors with limited resources such as individuals and small- to medium-sized businesses, for managing their funds.

Moreover, with the rise of usage-based insurance, machine learning and AI technologies are helping to calculate the premium suitable for each individual, which, in turn, propels the growth of the market.

China digital insurance landscape has been popularized by the success of Zhong An and followed by hundreds of startups working in the knowledge that a growing middle class and low insurance penetration drive the demand for insurance delivered through the internet. Moreover, Huize is an independent online product and service platform in China with a focus on long-term life and health insurance. Customers in this country are increasingly using aggregators at the start of their buying journey, to get an overview of the market, and at the end, make purchases directly from the aggregator rather than the product provider.

Top Impacting Factors Rising Number of Aggregators and Digital Brokers

Rise in number of insurance aggregators and digital brokers allows consumers to easily compare product features, carriers, coverage, and price. In addition, in insurance, it generally costs five times more to acquire a new customer versus converting an existing one. For instance, according to McKinsey analysis After grappling with aggregators for 20 years, for many European insurers, almost 50% of insurance aggregators in Europe is sold via aggregators. In addition, customers satisfied with the insurance offerings are 80% more likely to renew their policies than unsatisfied ones. Insurance aggregator policy application and renewal can be quick, hassle-free, and available 24/7, making the process seamless for insurance buyers. Therefore, insurance aggregator platforms help to earn customer loyalty which is further boosting the market growth.

Increase in Digital Influence

The digital explosion in the insurance sector is driven by the need to build direct bridges with the end consumer through the smartphone in order to survive in an era where the customer is using the phone as the primary medium of communication. The trend has been fast-paced driven partly due to the large base of phone users and partly due to the lesser weight of legacy systems. Digitalization drives the growth of the market share and profitability for insurers. It also urges insurers to apply digital technologies in new ways and offer tangible value to customers. Moreover, it presents the possible opportunities for digitalization for insurers & customers as the adoption of digital solutions for insurance policies will keep increasing in the future. Moreover, these are the factor influencing the growth of the market in the upcoming year.

Key Benefits for Stakeholders

• The study provides an in-depth analysis of the insurance aggregators market forecast along with current & future trends to explain the imminent investment pockets.

• Information about key drivers, restraints, & opportunities and their impact analysis on global insurance aggregators market trends is provided in the report.

• The Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the insurance aggregators industry.

• The insurance aggregators market analysis from 2022 to 2031 is provided to determine the market potential.

Insurance Aggregators Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 130 billion |

| Growth Rate | CAGR of 21.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 166 |

| By Enterprise Size |

|

| By Insurance Type |

|

| By Region |

|

| Key Market Players | Small Umbrella Insurance Brokers, Insurify, Inc., Huize Holding Ltd, Insurance Zebra, Moneysupermarket.com Ltd, Compare Policy Insurance Web Aggregators Pvt Ltd., VERIVOX, Gabi, Ping An Insurance, CHECK24 Comparison Portal GmbH Munich |

Analyst Review

Insurance aggregator is defined as an insurance intermediary compile and provide information about insurance policies of various companies on a website. In addition, it also provides price comparisons and facilitates the purchase of insurance on behalf of insurance companies.

The global insurance aggregator market is expected to register high growth owing to increasing digitization, rising uptake of the Internet of Things technology, and transition of insurance companies from product-based towards consumer-centric strategies drives the growth of the market. With surge in demand for insurance aggregator, various companies have established alliances to increase their capabilities. For instance, in September 2022, Honey Insurance (Honey) partnered with financial aggregator Specialist Finance Group (SFG) to accelerate the digitization of the home settlement process.

In addition, with further growth in investment across the world and the rise in demand for insurance aggregator, various companies have expanded their current product portfolio with increased diversification among customers. For instance, in May 2021, Choice group launched fintech aggregator platform -- ISMOS offering life, health and general insurance it offers comparable quotes from multiple insurance companies that would facilitate the customer or user to take a well-informed decision keeping his risks in mind.

Moreover, with increase in competition, major market players have started acquisition companies to expand their market penetration and reach. For instance, September 2022, Union Bay acquired Farrell Insurance Associates Inc to help and safeguard the customer in insurance process.

The insurance aggregators market is estimated to grow at a CAGR of 21.2% from 2022 to 2031.

The insurance aggregators market is projected to reach $ 129,984.71 million by 2031.

Rising number of aggregators and digital brokers and increase in internet userbase usage is boosting the growth of the insurance aggregators market. In addition, increase in digital influence contribute toward the growth of the market.

The key players profiled in the report include CHECK24 Comparison Portal GmbH Munich, Huize Holding Ltd, Gabi Personal Insurance Agency, Inc, Insurify, Inc, Moneysupermarket.com Ltd, Small Umbrella Insurance Brokers, Compare Policy Insurance Web Aggregators Pvt Ltd, Ping An Insurance, VERIVOX, Zebra Insurance Services.

The key growth strategies of insurance aggregators market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...