Insurance Fraud Detection Market Overview

The global insurance fraud detection market size was valued at $3.3 billion in 2021, and is projected to reach $28.1 billion by 2031, growing at a CAGR of 24.2% from 2022 to 2031. Rising insurance fraud cases and adoption of advanced analytics, technology, and cybersecurity solutions driven by the demand for fraud detection tools to prevent fake claims and enhance market integrity contribute to the growth of the market.

Market Dynamics & Insights

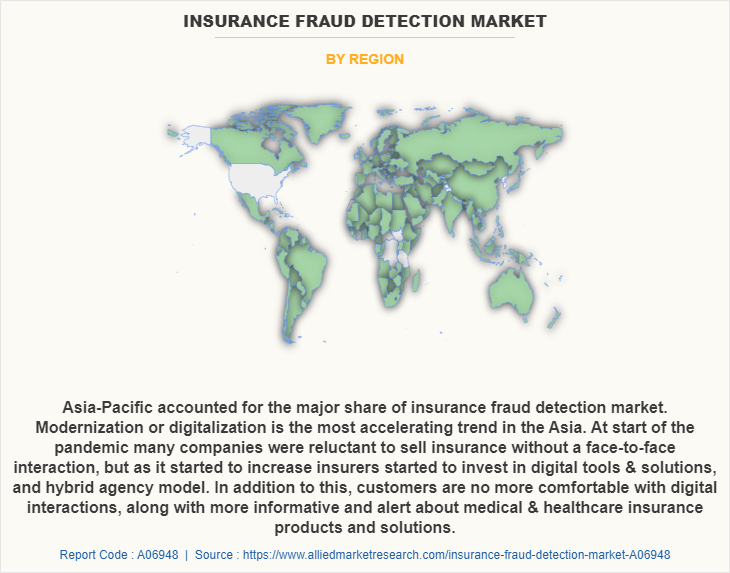

- The insurance fraud detection industry in Asia-Pacific held a significant share of 34% in 2021.

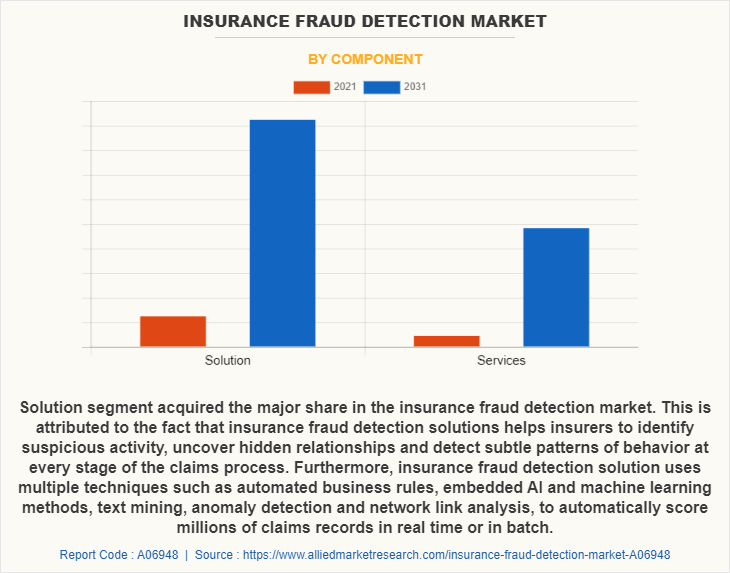

- By component, the solution segment is one of the dominating segment in the market, accounting for the revenue share of 74% in 2021.

- By deployment mode, the on-premises segment dominated the industry in 2021 and accounted for the largest revenue share of 67%.

- By application, the payment fraud and billing fraud dominated the market, accounting for 39% in 2021.

Market Size & Future Outlook

- 2021 Market Size: $3.3 Billion

- 2031 Projected Market Size: $28.1 Billion

- CAGR (2022-2031): 24.2%

- Asia-Pacific: dominated the market in 2021

- North America: Fastest growing market

What is Meant by Insurance Fraud Detection

The ultimate goal of fraud detection is to save insurers from incurring fraud-related losses. And when fraud is detected before it is processed, or in a manner that allows carriers to act quickly, less loss is incurred. Fraud detection greatly increases the speed at which insurers are identifying fraudulent claims or potentially fraudulent claims. This is critical in today’s economy, especially in cases of workers’ compensation where fraud is increasing. The faster that fraud is identified, the faster insurers can respond and prevent any loss.

The increasing use of advance analytics and technology has led to increase in use of insurance fraud detection. Moreover, surge in number of insurance fraud including fake medical records, inaccurate claims, abductions, and others, has led to the rise of fraud detection products and solutions in the insurance market to reduce fraudulent claim settlement activities. In addition, increasing adoption of advanced analytics and technology are some of the factors propelling the insurance fraud detection market growth. Moreover, rise in cyber security infrastructure for insurance fraud detection is a major driving factor for the growth of the market. However, many insurance companies use outdated internal systems and rely on manual process including knowledge workers or business rules for detecting the fraud on excel sheets. In addition, improper handling of data and privacy of the clients are some of the major factors limiting the insurance fraud detection market. On the contrary, advances in technology and adoption of artificial intelligence and machine learning in detection of fraud in insurance claims are expected to provide lucrative growth opportunities in the coming years.

Insurance Fraud Detection Market Segment Overview

The insurance fraud detection market is segmented into component, deployment mode, enterprise size, application, and region. By component, it is segmented into solution and services. By deployment mode, it is bifurcated into on-premises and cloud. Based on enterprise size, it is segregated into large enterprises, and small and medium-sized enterprises. By application, the market is divided into payment fraud and billing fraud, identity theft, claims fraud, and money laundering. By region, it is analyzed across Asia-Pacific, Europe, North America, and LAMEA.

By component, the solution segment attained the highest insurance fraud detection market share in 2021. This was attributed to the fact that insurance fraud detection solutions help insurers to identify suspicious activity, uncover hidden relationships and detect subtle patterns of behavior at every stage of the claims process.

Region wise, Asia-Pacific attained the highest growth in 2021. This is attributed to the fact that modernization or digitalization is the most accelerating trend in the Asia-Pacific. At start of the pandemic many companies were reluctant to sell insurance without a face-to-face interaction, but as it started to increase insurers started to invest in digital tools & solutions, and hybrid agency model.

The report includes of key players operating in the insurance fraud detection market analysis such as BAE Systems., Duck Creek Technologies, Equifax Inc., Experian Information Solutions, Inc., FICO, FRISS, Fiserv, Inc., IBM, LexisNexis Risk Solutions Group., and SAS Institute, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the insurance fraud detection market.

What are the Top Impacting Factors in Insurance Fraud Detection Market

Increase in insurance fraud

The insurance fraud detection software provides fraud analytics, which involves a set of analytical techniques to analyze systems and databases to identify activities where fraud can happen. The increasing happenings of insurance fraud has increased the demand for fraud detection solutions. Further, increasing incidents of customer frauds, including fake medical records, inaccurate claims, abductions, and others, has led to rise of fraud detection products and solutions in the insurance market. Insurance frauds are generally done at the time of application or claims, according to the survey conducted by The Hindu- business line. Moreover, the usage of AI fraud detection insurance is increasing the chances to identify cover-ups, misinterpretation of incidents, identity fraud, and false claims. For the past few years, insurance industry has been rapidly growing, as everyone is becoming more and more informative about the insurance industry & the advantages associated with it. This has given a chance to the fraudsters for committing scams and frauds in the insurance sector. Therefore, increase in life insurance fraud detection is one of the major driving factor of the insurance fraud detection industry.

Outdated internal fraud detection systems

Insurers can take advantage from accessing more data. Data processed quickly and accurately can further enhance the speed for detecting the problematic issues with the insurance claims. Updated and advanced software can fully automate underwriting and make better pricing decisions. Unfortunately, many insurance companies use outdated internal systems and rely on manual process including knowledge workers or business rules for detecting the fraud on excel sheets. Investigation and follow up becomes easier if the data is available on one system, it would instantly present the cases that require immediate attention. Moreover, work on integrated data and advanced solutions is expected to make less errors and reduce the data inaccuracy in handling fraud detection. Therefore, outdated internal fraud system are a major setback for the insurance fraud detection market outlook.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the insurance fraud detection market forecast from 2021 to 2031 to identify the prevailing insurance fraud detection market opportunity.

- In-depth analysis of the insurance fraud detection market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- The report includes the analysis of the regional as well as global insurance fraud detection market trends, key players, market segments, application areas, and growth strategies.

Insurance Fraud Detection Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Deployment Mode |

|

| By Enterprise Size |

|

| By Applications |

|

| By Region |

|

| Key Market Players | Duck Creek Technologies, FRISS, Equifax Inc., Fiserv, Inc., Experian Information Solutions, Inc., IBM, SAS Institute Inc., LexisNexis Risk Solutions Group., FICO, BAE Systems |

Analyst Review

There is a massive shift to digitization across the globe, insurers are modernizing core systems, starting online channels and replacing manual tasks for automated ones. From a consumer perspective, there are a number of requirements that insurers should take into an account. Those range from speed of service, through a fully digital experience, to seamless integration of products. Thus, bringing in new risk to cope with for the insurers as the internal process as well as the way insurers look at fraud management (fraud detection and fraud prevention) changes. Automating fraud detection is the key and organizations need to organize this properly. Moreover, when detection methods are automated and standardized, the chances of detecting fraud are increased and false positives are limited to a minimum. Fighting fraud can be a time consuming and error prone process. Therefore, by directly recognizing claims that need further attention or require active follow-up, organizations with automated fraud detection solutions are more effective at fraud investigations. In addition, as the correct information is handed over to the fraud investigators, they can spend their time on cases that actually require attention.

Use of predictive analytics to fight fraud by the insurers has reached an all-time high, according to an insurance fraud technology study by the Coalition against Insurance Fraud and SAS. The study reveals that 80% of insurers use predictive modeling to detect fraud, up from 55% in 2019. In addition, in a new 2021 survey, the study also underscores the importance of identity verification software, cited by 40% of survey respondents. Identity analytics is quickly becoming must-have technology for insurers amid an alarming spike in malicious phishing scams, up 600% since the pandemic’s onset. The latest study is based on responses to a 20-question survey sent to 100 Coalition members in October 2021. Survey recipients are employed by insurance companies that comprised at least 80% of the estimated property and casualty premiums written in the U.S. insurance market in 2020. Some of the key players profiled in the report include BAE Systems., Duck Creek Technologies, Equifax Inc., Experian Information Solutions, Inc., FICO, FRISS, Fiserv, Inc., IBM, LexisNexis Risk Solutions Group., and SAS Institute, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The global insurance fraud detection market size was valued at $ 3,281.00 million in 2021, is projected to hit $ 28,083.29 million by 2031, growing at a CAGR of 24.2% from 2022 to 2031.

Surge in number of insurance fraud including fake medical records, inaccurate claims, abductions, and others, has led to rise of fraud detection products and solutions in the insurance market to reduce fraudulent claim settlement activities.

Payment fraud and billing fraud is the major application accounted for the highest share of insurance fraud detection market. Insurance fraud detection software helps in identifying payment and billing fraud, by offering various data analytics, artificial intelligence, and data integration solutions. There are different payment and billing frauds such as identity theft, friendly fraud, and clean fraud. The standard rule-based anti-fraud system offered by banks and institutions are used to detect and block payment frauds.

Asia-Pacific accounted for the major share of insurance fraud detection market. Modernization or digitalization is the most accelerating trend in the Asia. At start of the pandemic many companies were reluctant to sell insurance without a face-to-face interaction, but as it started to increase insurers started to invest in digital tools & solutions, and hybrid agency model. In addition to this, customers are no more comfortable with digital interactions, along with more informative and alert about medical & healthcare insurance products and solutions.

The insurance fraud detection market is segmented on the basis of component, deployment mode, enterprise size, application, and region. By component, it is segmented into solution and services. By deployment mode, it is bifurcated into on-premises and cloud. Based on enterprise size, it is segregated into large enterprises, and small and medium-sized enterprises. By application, the market is divided into payment fraud and billing fraud, identity theft, claims fraud, and money laundering. By region, it is analyzed across Asia-Pacific, Europe, North America, and LAMEA.

Loading Table Of Content...