The Insurance policy software market report offers a comprehensive study on the global market size & forecast, segmental splits, and further classification into regional & country-level. Furthermore, it highlights the market dynamics & trends, Porters’ five force analysis, competitive landscape, and market share analysis.

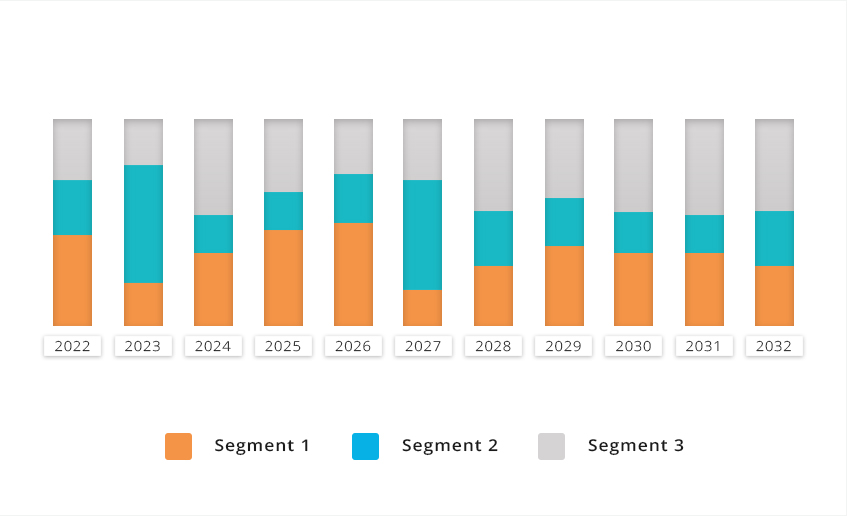

Insurance policy software market Revenue ($Million), By Segment, 2024 to 2033

Graph for representation purpose only

Segmental Outlook

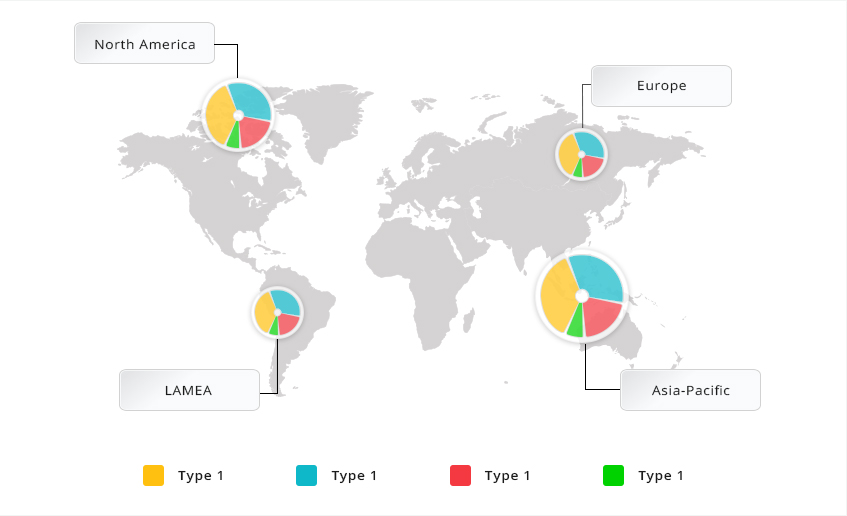

The global Insurance policy software market is segmented on the basis of by type of insurance, by application, by end-user, by deployment model. Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, Spain, Italy, and rest of Europe), Asia-Pacific (China, Japan, Australia, South Korea, India, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

The segmental analysis includes real-time and forecast in both qualitative and quantitative terms. This helps clients understand the most lucrative segments for investors to capitalize on in the market.

Insurance policy software market Revenue ($Million), By Type, 2024 to 2033

Graph for representation purpose only

Competitive Scenario

The report includes an in-depth analysis of the major market players operating across the globe, along with an outlook on top player positioning. Furthermore, the report focuses on developmental strategies such as mergers & acquisitions, product/service launches, and collaborations adopted by the market players to maintain and enhance their foothold in the market.

Key players identified in this report are IBM Corporation, SAP SE, Accenture PLC, Cognizant Technology Solutions Corp., Capgemini SE, Infosys Ltd., Tata Consultancy Services Ltd., Oracle Corporation, DXC Technology Company, Zurich Insurance Group Ltd

Report Coverage

-

Market Size Projections: 2024 to 2033

-

Major Segments Covered: by type of insurance, by application, by end-user, by deployment model

-

Market Dynamics and Trends

-

Competitive Landscape Reporting

Note

-

Clients have the liberty to customize the list as per their requirements.

-

AMR offers 20% free customization policy and clients can request AMR for a tailor-made report by considering their requirements. However, the modification will be finalized post a quick feasibility check.

Insurance Policy Software Market Report Highlights

| Aspects | Details |

| By Type of Insurance |

|

| By Application |

|

| By End-User |

|

| By Deployment Model |

|

| By Region |

|

| Key Market Players | Cognizant Technology Solutions Corp., IBM Corporation, DXC Technology Company, Tata Consultancy Services Ltd., Zurich Insurance Group Ltd, Infosys Ltd., SAP SE, Accenture PLC, Oracle Corporation, Capgemini SE |

Loading Table Of Content...