Insurtech Market Overview

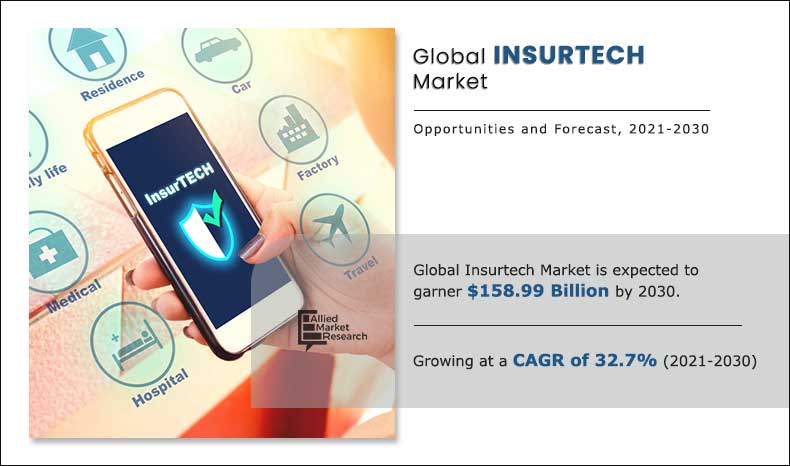

The global Insurtech market size was valued at $9,415.28 million in 2020, and is projected to reach $158,994.52 million by 2030, growing at a CAGR of 32.7% from 2021 to 2030. Rapid digitalization, evolving customer demands, AI and data analytics, cost-efficiency goals, mobile-first solutions, personalized coverage, supportive regulations, and strong venture capital funding are contributing to the growth of the market.

Market Dynamics & Insights

- By technology, the cloud computing segment held the largest share in the insurtech market for 2020.

- By application, the sales & marketing segment held the largest share in the insurtech market for 2020.

- Asia-Pacific is expected to witness the highest CAGR during the forecast period.

Market Size & Future Outlook

- 2020 Market Size: $9.41 Billion

- 2030 Market Size: $158.99 Billion

- CAGR (2021-2030): 32.7%

- North America: Dominated market share in 2020

- Asia-Pacific: Highest CAGR during the forecast period

What is Meant by Insurtech

InsurTech (Insurance Technology) refers to the use of technology that engages in the creation, distribution and administration of insurance product & services. Insurtech is discovering solutions such as offering ultra-customized policies, social insurance, and using new streams of data from Internet-enabled devices to dynamically price premiums. Insurtech helps insurers to collect and analyze customer data, which can be specifically used to target right customer, with affordable price quotation. Moreover, with the use of machine learning, artificial intelligence, and cloud computing, Insurtech helps in making better predictions of consumer needs, purchase quantity, and improves decision making and insurance planning.

Technologies such as artificial intelligence, machine learning, blockchain and cloud computing enables real-time tracking & monitoring information regarding the activity of insured for particular business lines and streamline & modernize business operations, which acts as key driving factor of the global Insurtech market growth. In addition, due to changing business models, insurance companies are leveraging innovative digital solutions to scale their business and developing product lines based on requirement by niche customers, which notably contributes toward the market growth. However, different standards & regulations toward the insurance industry and privacy & security concerns are some of the factors that limit the market growth. Furthermore, developing economies offer significant opportunities for Insurtech market to expand & develop their offerings, especially among emerging economies such as Australia, China, India, Singapore, and South Korea. In addition, incorporation of technologies such as cloud computing, artificial intelligence, and blockchain, for facilitating loss prediction & prevention, risk monitoring, and simplifying claims processing is becoming a major factor that is expected to provide lucrative opportunities for the expansion of the Insurtech market growth in the coming years.

The report focuses on growth prospects, restraints, and trends of the Insurtech market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the Insurtech market outlook.

Insurtech Market Segment review

The Insurtech market share is segmented on the basis of offering, deployment model, technology, end user, application, and region.

By offering, it is divided into solution and service. By deployment model, it is bifurcated into on-premise and cloud. Based on technology, the market is segmented into artificial intelligence, cloud computing, blockchain, big data & business analytics, IoT, and others. On the basis of end user, the market is divided into life & health insurance and property & casualty (P&C) insurance. In addition, property & casualty (P&C) insurance is further segmented into auto insurance, buildings insurance, marine insurance, liability insurance, and others. The buildings insurance is bifurcated into commercial buildings insurance and home insurance. On the basis of home insurance, the market is further divided into dwelling coverage and contents coverage. By application, it is segmented into product development & underwriting, sales & marketing, policy admin collection & disbursement, and claims management. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Offering

Solution segment accounted for the highest market share in 2020

The report analyses top Insurtech market players such as Damco Group, DXC Technology Company, Majesco, Oscar Insurance, OutSystems, Quantemplate, Shift Technology, Trov Insurance Solutions, LLC, Wipro Limited, and Zhongan Insurance. These players have adopted various strategies to increase their market penetration and strengthen their position in the Insurtech industry.

By Technology

Cloud Computing segment is projected as one of the most lucrative segments.

COVID-19 Impact Analysis

The COVID-19 pandemic had a positive impact on the Insurtech market growth as importance of insurance policies has tremendously increased among customers. Customers have opted for multiple insurance policies such as health insurance, home insurance, personal insurance, and others. Therefore, with rise in demand for insurance policies, usage of advance technological solutions among insurance carriers has increased rapidly in the market, to provide advanced tech-based services to the customers. Therefore, demand for Insurtech solutions has increased significantly during the global health crisis.

What are the Top Impacting Factors in Insurtech Market

Rapid digitalization of business models

Insurance is one of the most conservative industries and Insurtech companies are starting to disturb the insurance sector globally. For instance, according to Accenture, which provides consulting and professional services projected that in 2020, nearly 86% of insurers are aiming at innovating & developing existing business models for increasing insurance demands and maintain a competitive profile. Moreover, with changing business models, insurance companies across the globe are leveraging innovative digital solutions to scale their business and offer more personalized customer experience. Therefore, rapid digitalization in existing business models of insurance companies are propelling the Insurtech market growth.

Changes to the legal & regulatory framework

Various laws set different standards & regulation across different jurisdictions with an increased unified approach taken by financial centers toward regulation. This becomes a crucial factor for Insurtech companies to elaborate solutions across manifold regulations such as MiFID II, GDPR, and others, which brings an inter-regulation conflict and therefore, hinders the growth of the insurtech market. For instance, in the U.S., insurance industry and its development are controlled and regulated by National Association of Insurance Commissioners (NAIC); while in Europe MiFID II regulations are considered for insurance companies under its jurisdiction. This is one of the major factors that hampers the market growth.

Untapped potential of emerging economies

Developing economies offer significant opportunities for Insurtech solutions providers to expand their offerings as several insurers are adopting new business models. In addition, demand for niche & customized insurance continue to rise, which therefore accelerates the adoption of Insurtech among insurance companies. High investments for digital transformation, adoption of new technologies such as artificial intelligence, analytics, big data, machine learning, & chatbots, and rapid expansion of domestic business, especially among countries such as Singapore, Hong Kong, China, and South Korea, are expected to create potential for the Insurtech market revenue in the coming years. As a result, emerging economies across the Asia-Pacific region are expected to create an immense opportunity in the market in upcoming years.

By Region

Asia-Pacific would exhibit the highest CAGR of 36.7% during 2021-2030

What are the Key Benefits for Stakeholders

- The study provides in-depth analysis of the global Insurtech market share along with current & future trends to illustrate the imminent investment pockets.

- Information about key drivers, restrains, and opportunities and their impact analysis on the global insurance technology market size are provided in the report.

- Porter’s five forces analysis illustrates the potency of buyers and suppliers operating in the Insurtech market.

- An extensive analysis of the key segments of the industry helps to understand the Insurtech market trends.

- The quantitative analysis of the global Insurtech market forecast from 2021 to 2030 is provided to determine the market growth potential.

Insurtech Market Report Highlights

| Aspects | Details |

| By Offering |

|

| By Deployment Model |

|

| By Technology |

|

| By End User |

|

| By Application |

|

| By Region |

|

| Key Market Players | Zhongan Insurance, Oscar Insurance, Damco Group, Wipro Limited, OutSystems, Quantemplate, Trov Insurance Solutions, LLC, Shift Technology, Majesco, DXC Technology Company |

Analyst Review

Insurance companies investing in technologies such as cloud computing, artificial intelligence (AI), & blockchain, enhancing digital capabilities, driving operational efficiency, and providing better customer experience are becoming major trends in the Insurtech industry. Moreover, Insurtech is evolving rapidly and helps insurers to satisfy the consumer needs and changing the insurance industry’s reputation from conservative & inflexible to highly personalized and user-friendly.

Moreover, during the COVID-19 health crisis, Insurtech market has experienced significant growth, as pandemic has prompted insurers to emphasize their digital transformation efforts and adopt Insurtech which can help accelerate virtual interactions in sales & claim settlements and reducing overall operating expenses. In addition, advanced digital technologies help insurance carriers to create new & innovative offerings and sustain in the competitive business environment.

The Insurtech market is fragmented with the presence of regional vendors such as DXC Technology Company, Shift Technology, and Trov Insurance Solutions, LLC. North America dominated the Insurtech market, in terms of revenue in 2020, and is expected to retain its dominance during the forecast period. However, Asia-Pacific is anticipated to experience significant growth in the future, owing to the presence of emerging economies and increase in government support toward digitalized insurance industry. This is projected to accelerate the demand for Insurtech in the region. Some of the key players profiled in the report include Damco Group, Majesco, Oscar Insurance, OutSystems, Quantemplate, Wipro Limited, and Zhongan Insurance. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The Insurtech Market is estimated to grow at a CAGR of 32.7% from 2021 to 2030.

The Insurtech Market is projected to reach $158,994.52 million by 2030.

To get the latest version of sample report

Technologies such as AI, machine learning, blockchain and cloud computing enables real-time tracking & monitoring information regarding the activity of insured for particular business lines and streamline & modernize business operations, which acts as key driving factor of the global Insurtech market growth

The key players profiled in the report include Damco Group, DXC Technology Company, Majesco, Oscar Insurance, OutSystems, Quantemplate, Shift Technology, Trov Insurance Solutions, LLC, Wipro Limited, and Zhongan Insurance.

On the basis of top growing big corporations, we select top 10 players.

The Insurtech Market is segmented on the basis of offering, deployment model, technology, end user, application, and region.

The key growth strategies of Insurtech Market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

On the basis of application, the claims management segment is expected to exhibit the fastest growth rate during the forecast period.

Loading Table Of Content...