Integrated Quantum Optical Circuits market overview:

Integrated quantum optical circuits market size was valued at $426.0 million in 2017 and is projected to reach $1,460.2 million by 2025, registering a CAGR of 16.3 from 2018 to 2025. North America accounted for the highest revenue share in 2017 and is projected to grow at a CAGR of 14.6% during the forecast period.

Integrated Quantum Optical Circuits is a device that integrates multiple optical devices to form a single photonic circuit. This device uses light instead of electricity for signal processing and computing. It consists of complex circuit configurations due to integration of various optical devices including multiplexers, amplifiers, modulators, and others into a small compact circuit. It enables efficient electrical to optical conversions and allows devices to work at high temperature. These devices are much more efficient, have higher bandwidth, higher processing speed, and lower energy loss in comparison to traditional integrated circuits. Conventional integrated circuits work by conducting electricity whereas the photonic circuit utilizes quantum of lights for the signal processing. The optical devices such as multiplexers, optical lasers, de-multiplexers, attenuators, optical amplifiers, and others are integrated on this circuit, and the wavelength range is usually 800 nm to 1700 nm, at which signal is transmitted within a circuit.

The range of fabrication devices, which are used in integration of circuits, varies as per the application of those devices. Hybrid photonic and monolithic integration are the two different types of photonic integration methods. Hybrid photonic circuits consist of package of photonic devices, which are used for the same function whereas a lot of optical devices of different functions are combined to form a single IC. The applications of Integrated Quantum Optical Circuits include fiber-optic communication, bio medical, computing, and optical sensors.

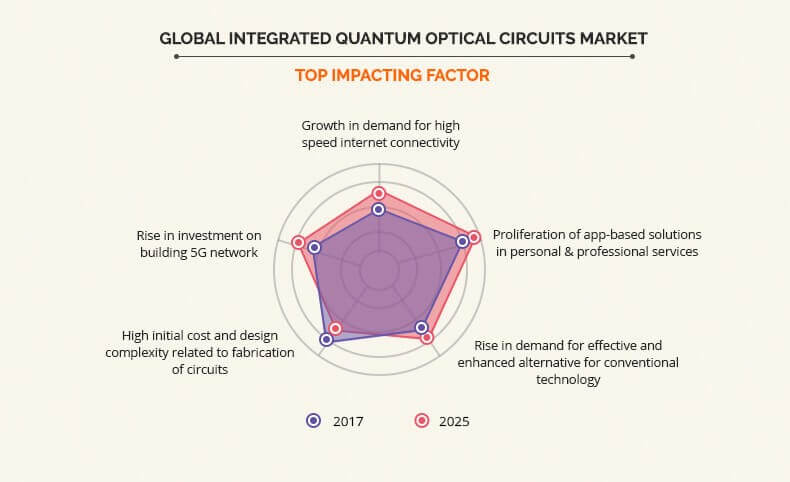

Growth in demand for high-speed internet connectivity, proliferation of app-based solutions in personal & professional services and rise in demand for effective and enhanced alternative for conventional technology are key factors that drive the growth of the global integrated quantum optical circuits market. Now a day, the developing countries such as India, China, Brazil, and others are focusing on building a high-speed internet infrastructure. Therefore, rise in investment by IT & telecom industry across these countries is expected to increase the demand for high-speed internet connectivity. Hence, various developed economies are investing in these countries to build their business globally. However, the high initial cost and design complexity related to fabrication of circuits are anticipated to restrain the growth of the global market. Furthermore, rise in investment on building 5G network is expected to provide lucrative growth opportunities for the global integrated quantum optical circuits market in near future.

The key players operating in the global integrated quantum optical circuits market are Aifotec AG, Ciena Corporation, Finisar Corporation, Intel Corporation, Infinera Corporation, Neophotonics Corporation, TE Connectivity, Oclaro Inc., Luxtera, Inc., and Emcore Corporation. These key players have adopted strategies such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations to enhance their market penetration.

Segmentation

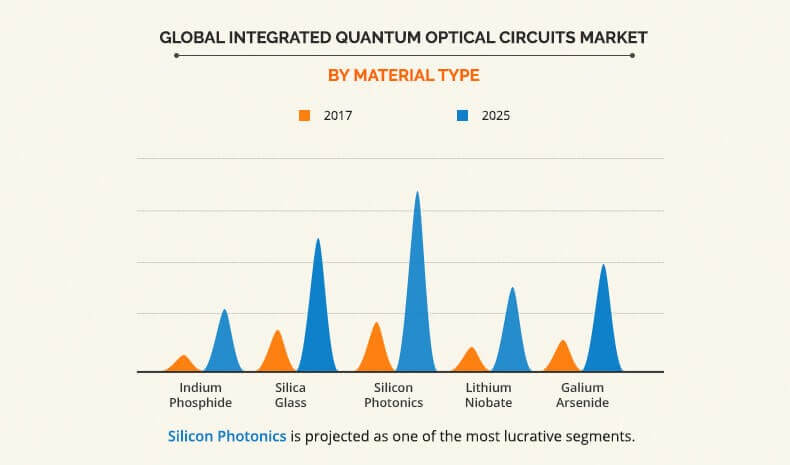

The global integrated quantum optical circuits market is segmented into application, material type, and geography. Based on application, the market is segmented into optical fiber communication, optical sensors, bio medical, quantum computing, and others. Based on market type, it is divided into indium phosphide (InP), silica glass, silicon (silicon photonics), lithium niobate (LiNbO3), and gallium arsenide (GaAs). Based on region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Growth in demand for high-speed internet connectivity, proliferation of app-based solutions for personal & professional life, rise in demand for effective & enhanced alternative for conventional technology, and increase in demand of quantum computing drive the growth of the integrated quantum optical circuits industry. However, high initial cost and design complexity restrain the market growth. Moreover, rise in investment on building 5G network across the globe is expected to provide lucrative opportunities for the growth of the global integrated quantum optical circuits market in the upcoming years.

Growth in demand for high-speed internet connectivity

According to the International Telecommunications Union, 70% of the total global youth (15-24) population is accessing the internet; whereas, in the developed countries, 90% of the total young population is using the internet. Therefore, mobile broadband subscriptions grew with the annual growth rate of more than 20% in the past six years and reached 4.3 billion globally by end of 2017. The primary reason for such a huge adoption in mobile broadband services was the affordable price. Increase in government spending on digitization, decrease in the prices of smartphones, and improved tele density are the major factors that increase the demand for high-speed internet connectivity. This is expected to influence the requirement of high bandwidth data and, in turn, drives the growth of the global integrated quantum optical circuits market.

Rise in demand for effective and enhanced alternative for conventional technology

The conventional integrated circuits available in the market have limited application as compared to quantum optical circuits. Moreover, integrated quantum optical circuits provide higher bandwidth and light-speed transmission, which is not the case with conventional sensors. Further, it also leads to size and weight reduction, reduced packaging & operations cost, improved stability, and functionality.

High initial cost and design complexity

Integrated quantum optical circuits consist of complex circuit configurations due to integration of various optical devices including multiplexers, amplifiers, modulators, and others into a small compact circuit. It enables efficient electrical to optical conversions and allows devices to work at high temperature. The circuit possesses very small size with a core diameter of 10 m. Photonic wires are of 1.3 m and 1.55 m, and photonic crystals are of few hundred nanometers, so designer faces problems in coupling the different components into a single fiber. The accuracy required for the fabrication of circuit is of the order of 10 nm and requires high set of expertise as well as high initial cost. Thus, it is expected to hamper the growth of the global market.

Key Benefits for Integrated Quantum Optical Circuits market:

- This study presents an analytical depiction of the global integrated quantum optical circuits industry along with the current trends and future estimations to depict the imminent investment pockets.

- The overall market potential is determined to understand the lucrative trends to gain a stronger foothold in the global integrated quantum optical circuits industry.

- The report includes information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current market is quantitatively analyzed for the period of 20172025 to highlight the financial competency of the global integrated quantum optical circuits market.

- Porters five forces analysis illustrates the potency of the buyers and suppliers in the market.

Integrated Quantum Optical Circuits Market Report Highlights

| Aspects | Details |

| By Material |

|

| By Application |

|

| By Region |

|

| Key Market Players | TE CONNECTIVITY, LUMENTUM OPERATIONS LLC, EMCORE CORPORATION, LUXTERA, CIENA CORPORATION, NEOPHOTONICS CORPORATION, INFINERA CORPORATION, AIFOTEC AG, FINISAR CORPORATION, INTEL CORPORATION |

Analyst Review

Integrated Quantum Optical Circuits is a device that integrates multiple optical devices to form a single photonic circuit. The device uses light instead of electricity for signal processing and computing. Integrated quantum optical circuit consists of complex circuit configurations due to integration of various optical devices including multiplexers, amplifiers, modulators, and others into a small compact circuit.

Asia-Pacific has been anticipated to be the fastest growing market in terms of adoption of integrated quantum optical circuits. Massive industrialization and rise in utilization of integrated circuits component across various applications drive the growth of the global market. The scope of this report includes the analysis of various regions namely, North America, Europe, Asia-Pacific, and LAMEA.

The key factors that drive the growth of the global integrated quantum optical circuits market include growth in demand for high-speed internet connectivity, proliferation of app-based solutions in personal & professional services and rise in demand for effective and enhanced alternative for conventional technology. Now a day, the various developing countries such as India, China, Brazil, and others are focusing on building a high-speed internet infrastructure. Therefore, rise in investment by IT & telecom industry across these countries is expected to increase the demand for high-speed internet connectivity. Hence, various developed economies are investing in these countries to build their business globally. However, the high initial cost and design complexity related to fabrication of circuits are anticipated to restrain the growth of the global market. Furthermore, rise in investment on building 5G network is expected to provide lucrative growth opportunities for the global market during the forecast period.

The major players operating in the global integrated quantum optical circuits market are Aifotec AG, Ciena Corporation, Finisar Corporation, Intel Corporation, Infinera Corporation, Neophotonics Corporation, TE Connectivity, Oclaro Inc., Luxtera, Inc., and Emcore Corporation.

Loading Table Of Content...