Intensive Care Unit Equipment Market Research, 2031

The global intensive care unit equipment market size was valued at $6.6 billion in 2021 and is projected to reach $9.6 billion by 2031, growing at a CAGR of 3.9% from 2022 to 2031. Intensive care unit equipment is used in the intensive care unit (ICU) for the care of critically ill patients. The intensive care unit, or ICU, is a hospital or medical center department that treats and manages patients with serious or life-threatening illnesses and injuries. Patients may be sent directly to the ICU or may transition there from the emergency room for longer-term care. It is hoped that most patients will eventually recover enough to be transferred out of the ICU. The ICU is staffed by a range of medical staff, including those that specialize in critical and intensive care. There is various intensive care unit equipment including a pulse oximeters, dialysis equipment, ventilator, catheter, tubes, pumps, bedside monitors that are used to improve the medical condition of patients.

Historical overview

The intensive care unit equipment market was analyzed qualitatively and quantitatively from 2018-2020. Most of the growth during this period was derived from Asia-Pacific owing to the increase in post-surgical complications that require critical care in ICU and increases in patient admission in ICU, rising disposable incomes, as well as the well-established presence of domestic companies in the region.

Market dynamics

The ICU equipment market size has witnessed growth, owing to an increase in the prevalence of chronic diseases, respiratory diseases are asthma, chronic obstructive pulmonary disease, cystic fibrosis, lung cancer, renal disease, heart attack, kidney and liver failure, brain cancer, tuberculosis, bronchitis, pneumonia, and emphysema.

According to the “National Center for Health Statistics”, every 20 seconds one American suffers a heart attack. According to the centers for disease control and prevention, in 2019 was estimated that heart disease is the leading cause of death in the U.S. as well, causing approximately 647,000 deaths per year. The risk of tumors is one of the biggest healthcare concerns in the world, claiming an estimated 40 million lives every year, 8.5 million of whom reside in Asia.

The global pandemic COVID-19 threatens the healthcare system, and thus impacts the ability to take care of critically injured patients and other surgical patients. An increase has been witnessed in the number of trauma centers worldwide to handle the most serious conditions such as car accident injuries, gunshot wounds, traumatic brain injuries, stab wounds, serious falls, and blunt trauma.

In addition, the growing demand for intensive care unit equipment is the result of the rise in the number of diseased people across the world. The aging population is more vulnerable to chronic diseases and requires critical care, which increases the demand for intensive care unit equipment. For instance, according to a report published by, UNFPA Asia-Pacific it was estimated that the number of older people in the Asia-Pacific will triple reaching 1.3 billion by 2050 out of which women constitute the majority (53 percent) of the population aged 60 or older in the region, and their share rises to 60 percent above age 80. With technological advancements, the designs of intensive care unit equipment have been majorly improved, thereby increasing the preference for intensive care unit equipment among patients. This factor has led to the growth of the intensive care unit equipment market.

Moreover, the rise in the prevalence of neurological diseases drives the growth of the intensive care equipment market. According to the review article by the Journal of Human Hypertension in Asia-Pacific, up to 66% of hemorrhagic strokes, 45% of ischemic strokes, and 39% of ischemic heart diseases are attributed to hypertension. In the western pacific and south-eastern Asia, the prevalence of hypertension ranges from 5–47% in men and from 7– 38% in women, which is comparable with that of western/developed countries Thus, the abovementioned factors are predicted to contribute toward the growth of the intensive care unit equipment market share during the forecast period.

Furthermore, the increase in the number of hospitals and the rise in the prevalence of preterm births contributes to the growth of the market. In addition, many governments and private organizations work toward increasing awareness regarding the effectiveness of advanced ICU equipment, which has encouraged both small and large hospitals to adopt the technology and increase the number of ICUs.

In addition, technological advancements in intensive care unit equipment; the launch of various products, and strategies among key players such as acquisition, collaboration, and agreement drive the growth of the intensive care unit equipment market. For instance, in April 2020, Getinge signed an agreement with Scania CV AB to ramp up ventilator production. Getinge announced an increase in the production of ventilators for intensive care units. Getinge has entered into a partnership agreement with Scania, covering the temporary hire of Scania personnel to support Getinge’s ongoing ramp-up of its ventilator production.

The COVID-19 outbreak is anticipated to have a positive impact on the intensive care unit equipment market as the SARS-CoV-2 virus attacks the respiratory system. When infected, a patient’s ability to breathe is compromised, which propels the demand for various medical services, including intensive care units (beds and ventilators) and personal protective equipment for healthcare. According to “The New York Times” One New York hospital has reportedly attempted to treat two patients per ventilator out of desperation. Hence, these types of news show that the COVID-19 outbreak rapidly increases the demand for intensive care unit equipment. The COVID-19 infection is associated with respiratory failure and requires critical care with ventilator support. Mechanical ventilation has regularly been employed to oxygenate seriously ill COVID-19 patients. For instance, according to the report from Imperial College London in November 2020, 30% of COVID-19 hospitalized patients are likely to require mechanical ventilation. Therefore, the demand for intensive care equipment has increased and boosted the growth of the intensive care equipment market.

Many companies have increased the production of intensive care unit equipment to fulfill the unmet medical demand due to the rise in COVID-19 cases. For instance, according to an article published by Berto Pandolfo, Senior Lecturer of Product Design, at the University of Technology Sydney, in April 2020, key players are racing to design and manufacture much-needed ventilators around the world, to address a global lack of supply.

In addition, increase in collaboration between the government and key players for increasing the production of intensive care equipment, and treating COVID-19 patients. For instance, in April 2020, Medtronic collaborated with technology partners and governments to drive new ventilator production to support COVID-19 patients across the globe. The company announced that by the end of April, it would start to manufacture more than 400 ventilators a week and over 700 by the end of May. By the end of June, Medtronic’s target is 1,000 ventilators a week. In April 2020, Philips and the U.S. Government collaborated to increase the production of hospital ventilators in its manufacturing sites in the U.S. Philips to ramp up the battle against the COVID-19 pandemic. Philips plans to double its production by May 2020 and achieve a four-fold increase by the third quarter of 2020 for supply to the U.S. and global markets.

Thus, the muted variants of COVID-19 have influenced the entire healthcare sector to meet healthcare requirements, including intensive care unit equipment such as pulse oximeters, mechanical ventilators, ICU beds, and bedside monitors. Therefore, the COVID-19 outbreak boosted the growth of the intensive care unit equipment market.

Segmental Overview

The intensive care unit equipment market is segmented on the basis of product type, application, end-user, and region. On the basis of product type, the market is classified into beds, ventilators, pulse oximeters, dialysis equipment, and others. On the basis of application, it is classified into cardiology, respiratory, oncology, accident & trauma, and others. Depending on the end user, it is fragmented into hospitals and specialty clinics. Region-wise, the market is studied across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and the rest of Europe), Asia-Pacific (Japan, China, Australia, India, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

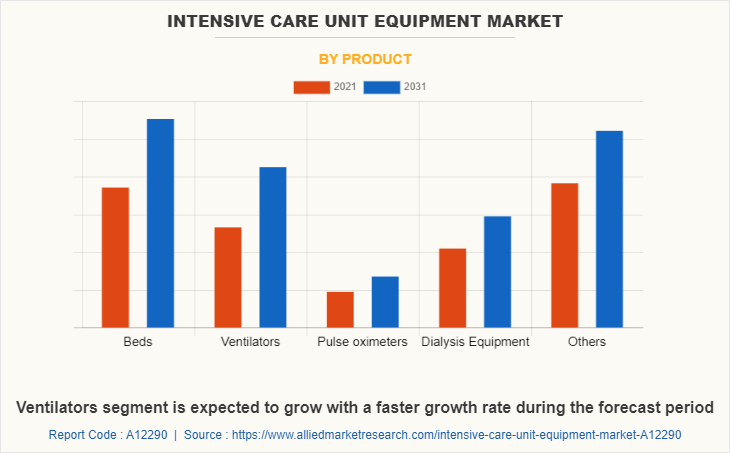

Product Type:

The intensive care unit equipment market is segmented into beds, ventilators, pulse oximeters, dialysis equipment, and others. The others segment generated maximum revenue in 2021, owing to the high adoption of bedside monitors, catheters, pumps, and tubes and the increase in technological advancements in bed side monitors.

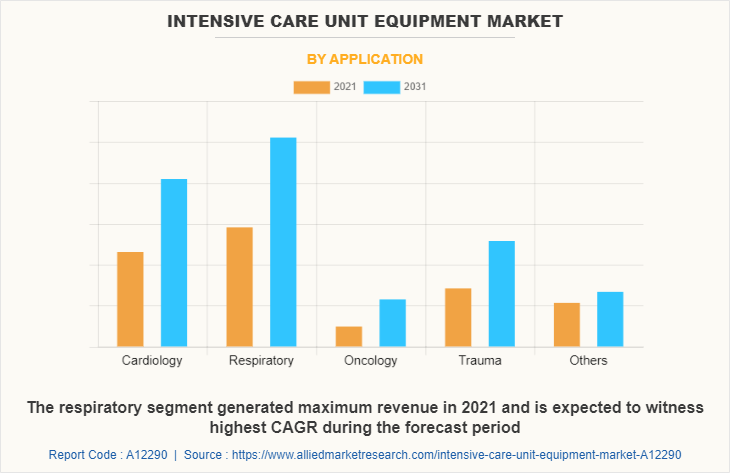

By Application:

The intensive care unit equipment market is segregated into cardiology, respiratory, oncology, accident & trauma, and others. The respiratory segment generated maximum revenue in 2021 and is expected to witness the highest CAGR during the forecast period, owing to a rise in the number of patient admission of pulmonary disease in ICUs and the high adoption of pulse oximeters and ventilators. Growth of the respiratory segment is also associated with an increase in severe cases of respiratory disease such as asthma, bronchitis, pneumonia, hypoxia, tuberculosis, and lung cancer and boosts the growth of the respiratory segment.

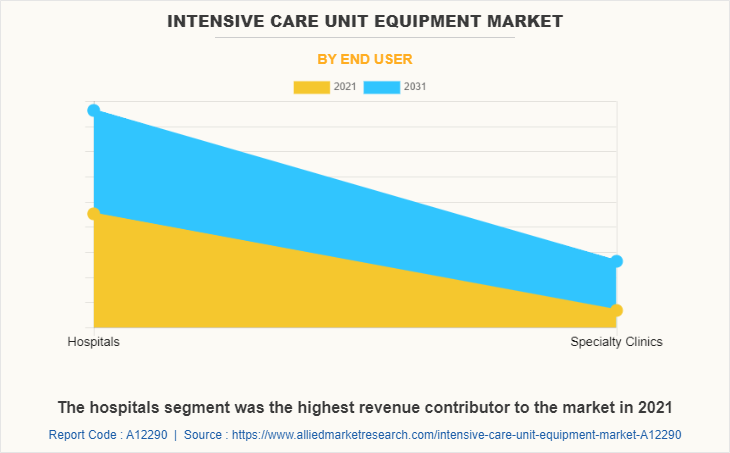

By End User:

The intensive care unit equipment market is classified into hospitals and specialty clinics. The hospital's segment was the highest revenue contributor to the market in 2021 and is expected to witness the highest CAGR during the forecast period, owing to an increase in patient admission, an increase in the number of ICUs, the presence of advanced intensive care unit equipment, and well-trained nursing staff. The rise in healthcare expenditure and the rise in the prevalence of preterm birth also boosts the growth of the hospital segment in the intensive care unit equipment market.

By Region:

The intensive care unit equipment market is studied across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the intensive care unit equipment market in 2021 and is expected to maintain its dominance during the forecast period. The presence of several major players, such as Baxter International Inc., Edward Lifesciences Corporation, Invacare Corporation, and Medline Industries. and advancement in manufacturing technology of intensive care unit equipment in the region drive the growth of the market.

This is majorly attributed to the surge in incidences of diseases such as chronic kidney disease, cancer, hypertension, and hypoxia, which further require critical care in the ICU in severe cases. Furthermore, the rise in the number of aged individuals who are highly susceptible to chronic heart diseases, cancer, and the existence of a sophisticated reimbursement structure that aims to reduce expenditure levels, drives the growth of the market. Hence, such factors propel market growth. In addition, the U.S. is anticipated to contribute to a major share of the regional market and is expected to drive the growth of the intensive care unit equipment market throughout the forecast period.

The presence of well-established healthcare infrastructure, high purchasing power, and a rise in the adoption rate of intensive care unit equipment are expected to drive market growth. Furthermore, product launches, mergers, collaborations, and acquisitions adopted by the key players in this region boost the growth of the market. Philips and the U.S. Government collaborated to increase the production of hospital ventilators in its manufacturing sites in the U.S. Philips to ramp up the battle against the COVID-19 pandemic. Philips plans to double its production by May 2020 and achieve a four-fold increase by the third quarter of 2020 for supply to the U.S. and global markets.

Asia-Pacific is expected to grow at the highest rate during the intensive care unit equipment market forecast period. The intensive care unit equipment market growth in this region is attributable to a rise in the prevalence of chronic disease, a rise in the number of hospitals, a rise in trauma and accidental cases, diabetes, cancer, and heart diseases in this region as well as growth in the purchasing power of populated countries, such as China and India. The countries in Asia-Pacific possess a huge population base, with China being the first having 1,397,715 population in 2020, and India being the second most populated country having 1,366,417.75 population in 2020. In addition, the prevalence rate of respiratory disease in Asia-Pacific is 6.3%, which primarily escalates the demand for various ventilators in the market.

COMPETITION ANALYSIS

Competitive analysis and profiles of the major players in the intensive care unit equipment industry, such as B. Braun Melsungen AG, Baxter International Inc., Edward Lifesciences Corporation, General Electric Company, Getinge AB, Invacare Corporation, Koninklijke Philips N.V., Medline Industries, Inc., Medtronic Inc., and Nihon Kohden Corporation are provided in this report. There are some important players in the market such as Baxter International Inc., A General Electric Company, Getinge AB, Koninklijke Philips N.V., and Medtronic Inc., have adopted product launch, collaboration, product approval partnership, and acquisition as key developmental strategies to improve the product portfolio of the ICU Equipment Industry.

Some examples of product launches in the market

In July 2021, Medtronic announced the launch of the Prevail drug-coated balloon (DCB) Catheter in Europe following the CE (Conformité Européene) mark. The newest coronary DCB on the market, the Prevail DCB, is used during percutaneous coronary intervention (PCI) procedures to treat narrowed or blocked coronary arteries in patients with coronary artery disease. The launch of the Prevail DCB not only underscores its global leadership and commitment to interventional cardiologists around the world but also highlights its strong focus on complex PCI.

Acquisitions in the market

In December 2021, Baxter International Inc. announced that it has completed its acquisition of Hillstrom. Baxter paid $156.00 in cash for each outstanding share of Hillrom common stock for a purchase price of $10.5 billion. Hillstrom brings a highly complementary product portfolio and innovation pipeline that will enable Baxter to provide a broader array of medical products and services to patients and clinicians across the care continuum and around the world, facilitating the delivery of healthcare that is patient- and customer-centered and focused on improving clinical outcomes.

Collaboration in the market

In April 2020, Medtronic collaborated with technology partners and governments to drive new ventilator production to support COVID-19 patients across the globe. The company announced that by the end of April, it would start to manufacture more than 400 ventilators a week and over 700 by the end of May. By the end of June, Medtronic’s target is 1,000 ventilators a week.

Partnership in the market

In April 2020, Getinge signed an agreement with Scania CV AB to ramp up ventilator production. Getinge announced an increase in the production of ventilators for intensive care units. Getinge has entered into a partnership agreement with Scania, covering the temporary hire of Scania personnel to support Getinge’s ongoing ramp-up of its ventilator production.

Product approval in the market

In May 2022, Medtronic received FDA (Food and Drug Administration) clearance for Nellcor OxySoft neonatal-adult SpO2 sensor. Nellcor OxySoft neonatal-adult SpO2 sensor is the first pulse oximetry sensor to use a silicone adhesive designed to protect fragile skin from the removal of fewer skin cells and improve repositionability and signal acquisition of the sensor.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current Intensive Care Unit Equipment Market trends, estimations, and dynamics of the intensive care unit equipment market analysis from 2021 to 2031 to identify the prevailing Intensive Care Unit Equipment Market opportunity.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the intensive care unit equipment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global intensive care unit equipment market trends, key players, market segments, application areas, and market growth strategies.

Intensive Care Unit Equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 9.6 billion |

| Growth Rate | CAGR of 3.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 240 |

| By Product |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | General Electric Company, , Medtronic Plc, Nihon Kohden Corporation, Invacare Corporation, Koninklijke Philips N.V., Baxter International Inc., B. Braun Melsungen AG, Edward Lifesciences Corporation, GETINGE AB, MEDLINE INDUSTRIES |

Analyst Review

According to CXOs, the intensive care unit equipment is used to provide care for patients who are critically or seriously ill or injured. The care provided in the ICU is specialized and provided by staff members that have been trained in this type of intensive care.

The intensive care unit equipment market has gained the interest of the healthcare industry, owing to the rise in the number of chronic heart diseases, postoperative complications, increase in the geriatric population, high incidences of chronic diseases across the globe, and increase in the number of surgical procedures being conducted. This further leads to the high adoption of intensive care unit equipment for a wide range of post-surgical complications, which are expected to significantly boost the growth of the intensive care unit equipment market. In addition, the increase in cases of chronic respiratory diseases propels to high adoption of intensive care unit equipment. However, the high cost of intensive care unit equipment restricts the growth of the market. On the contrary, unmet medical demands in developing countries are expected to provide remunerative opportunities for market expansion.

In addition, North America is expected to witness the highest growth, in terms of revenue, owing to the high adoption of intensive care unit equipment, robust healthcare infrastructure, presence of key players, and rise in healthcare expenditure.

Increased utilization of portable life-saving equipments is one of the major trends in the intensive care equipment market

The respiratory segment generated maximum revenue in 2021

North America accounted for a major share of the intensive care unit equipment market in 2021 and is expected to maintain its dominance during the forecast period.

The intensive care unit equipment market was valued at $6,603 million in 2021, and is estimated to reach $9,633.4 million by 2031, growing at a CAGR of 3.9% from 2022 to 2031.

GETINGE AB, B. Braun Melsungen AG, Baxter International Inc. and GENERAL ELECTRIC COMPANY occupied major shares in the intensive Care Unit Equipment Market.

Ventilators is the fastest growing product segment in intensive Care Unit Equipment Market.

Yes.

Asia Pacific is the fastest growing region in intensive Care Unit Equipment Market.

Loading Table Of Content...