Interaction Sensor Market Outlook – 2030

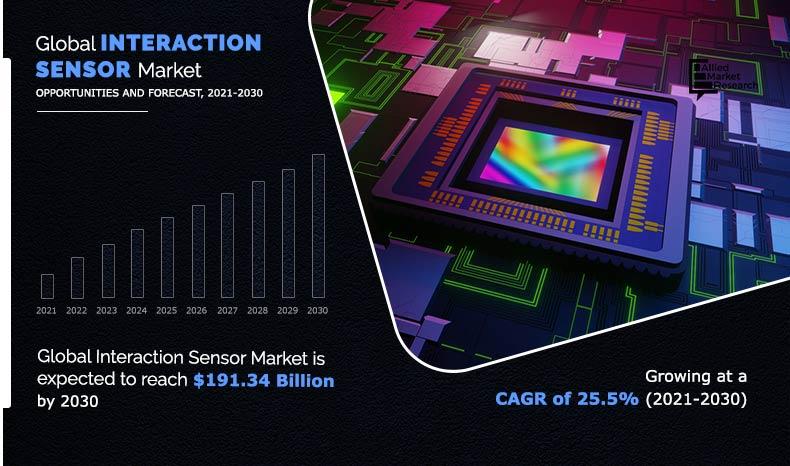

The global interaction sensor market size was valued at $22.91 billion in 2020 and is projected to reach $191.34 billion by 2030, registering a CAGR of 25.5% from 2021 to 2030. In the field of human-machine interfaces, touchless gestures are the new frontier. A computer, robot, or microcontroller can be controlled just by a swiping hand. Subsequently, interaction sensors play a vital role in touchless gestures. Human body movements are recognized and interpreted by interaction sensors, allowing the user to interact with a computer system. These are being used in the entertainment, consumer electronics, automotive, healthcare, and education sectors.

Gestures provide the user with a new form of interaction that resembles their real-world experience. They are discreet and do not require the use of an additional device or disruption. Furthermore, they do not confine the user to a single point of input, but instead, provide a variety of interaction options. Hence, gesture recognition has gained momentum in recent years. Interaction sensors are used to detect these gestures and provide the user with a seamless experience.

Market players are focusing on the development of various interaction sensors to develop next-generation devices using gesture recognition technology. For instance, Google launched an interaction sensor that uses radar to convert hand movements into gesture controls for electronic devices. This sensor can be installed within a chip and can be used to track hand gestures with high speed and accuracy using radar.

An interaction sensor is used to control electronic devices without physical contact, eliminating the need for designing knobs and buttons into the surface of products such as watches, phones, and radios. Significant expenditure from the market players, a surge in R&D activities, and various product launches are anticipated to drive the market growth during the forecast period.

An increase in the demand for interactive gaming majorly drives the growth of the interaction sensor market. Furthermore, the increase in safety and security features in the automotive industry accelerates the growth of the interaction sensor market. Moreover, advancements in sensors and their increasing usage in smartphones and other electronic devices are opportunistic for market growth. Considering these factors, the interaction sensor market is estimated to experience exponential growth in the future.

Growth in the popularity of gesture technology is expected to offer lucrative growth opportunities for the market during the forecast period. However, high manufacturing costs hamper the market growth. Moreover, some of the other factors that boost the market growth include a rise in demand for connected devices, an increase in disposable income, as well as several products launched by market players.

COVID-19 has a significant influence on both consumers and the economy. Manufacturing hubs have temporarily worked at low efficiency to limit the COVID-19 spread. This has had a significant impact on the supply chain of the market by creating a shortage of materials, components, and finished goods. Lack of business continuity has ensured a significant negative impact on shareholder returns and revenue, which are expected to create financial disruptions in the interaction sensor industry.

Moreover, electronic components, such as sensors, PCBs, LED chips & wafers, ICs, and other semiconductor devices, are mostly imported from China. Attributed to the temporary shutdown of manufacturing units, the prices of semiconductor components have increased by 2-3%, owing to a shortage of supplies. Despite the economic slowdown, Industry 4.0 & IIoT and 5G demand in several industries have been accelerating, which in turn, is estimated to create opportunities for interaction sensor market growth post recovery from the pandemic.

By Technology

Camera-Based segment is projected to be the most lucrative segment during 2021 - 2030

Segment Overview

The interaction sensor market is segmented based on technology, industry vertical, and region. Based on technology, the market is fragmented into camera-based, voice recognition, and others. The camera-based segment dominated the market in terms of revenue in 2020, and is expected to follow the same trend during the forecast period. Based on industry verticals, the market is divided into consumer electronics, entertainment, automotive, and others. The consumer electronics segment held the largest market share in 2020, while the automotive segment is expected to increase at a significant CAGR from 2021 to 2030.

By Industry Vertical

Entertainment segment is expected to secure the leading position during the forecast period

Region-wise, the interaction sensor market trends are analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, UK, France, Italy, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). North America dominated the interaction sensor market in 2020 and is projected to register a significant growth rate during the forecast period. However, the Asia-Pacific region is expected to witness the highest growth rate during the forecast period, followed by Europe.

By Region

North America region will dominate the market throughout the forecast period

Top Impacting Factors

Significant factors that impact the growth of the interaction sensor market include an increase in demand for interactive gaming, advancements in sensors and their increasing usage in smartphones & other electronic devices, and a surge in safety and security features in the automotive industry. However, high manufacturing costs hamper the market growth. On the contrary, an increase in the popularity of gesture technology is expected to offer lucrative opportunities for the interaction sensor market during the forecast period.

Competitive Analysis

Competitive analysis and profiles of the major interaction sensor market players such as Acconeer AB, Google Inc., Infineon Technologies, KEMET Corporation, Microchip Technology Inc., Neonode Inc., NXP Semiconductors NV, Robert Bosch GmbH, TDK Corporation, and Texas Instruments are provided in this report. These key players have adopted various strategies, such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations, to increase their market penetration and strengthen their foothold in the industry.

Key Benefits For Stakeholders

- This study comprises an analytical depiction of the interaction sensor market along with the current trends and future estimations to depict the imminent investment pockets.

- The overall interaction sensor market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current interaction sensor market forecast is quantitatively analyzed from 2020 to 2030 to benchmark financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the market.

- The report includes the interaction sensor market share of key vendors and market trends.

Interaction Sensor Market Report Highlights

| Aspects | Details |

| By Technology |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Google Inc., NXP Semiconductors NV, KEMET Corporation, Neonode Inc., Acconeer AB, Robert Bosch GmbH, TDK Corporation, Microchip Technology Inc., Infineon Technologies, Texas Instruments |

Analyst Review

The interaction sensor is a component that interprets subtle hand gestures into signal controls required by the electronic gadgets so the gadget can be changed and required to perform as intended. It is suitable for tracking millimeter hand gestures at high speed and accuracy as well as controlling electronic gadgets such as smartphones and watches, without the prerequisite for actual contact. Further, the increase in interest in intuitive gaming is one of the primary drivers for the market growth.

According to industry experts, the interaction sensor market is still in its infancy, and the future is projected extremely bright and exciting. There are immense possibilities and opportunities for the application of interaction sensors in gesture recognition technology. The increased per capita income, improvement in technology, and the increase in the demand for digitization contribute to the market growth across different industry verticals.

Key players profiled in the report include Acconeer AB, Google, Inc., Infineon Technologies, KEMET Corporation, Microchip Technology, Inc., Neonode Inc., NXP Semiconductors NV, Robert Bosch GmbH, TDK Corporation, and Texas Instruments. These key players have adopted various strategies, such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations, to increase their market penetration and strengthen their foothold in the industry.

The Interaction Sensor Market is estimated to grow at a CAGR of 25.5% from 2021 to 2030.

The Interaction Sensor Market is projected to reach $191.34 billion by 2030.

Increase in demand for interactive gaming, advancements in sensors and its increasing usage in smartphones etc. boost the Interaction Sensor market growth.

The key players profiled in the report include Acconeer AB, Google Inc., Infineon Technologies, KEMET Corporation, and many more.

Asia-Pacific region would grow at a highest CAGR of 28.0% during the forecast period.

Loading Table Of Content...