Internet Of Things (IoT) In Banking Market Research, 2031

The global internet of things (iot) in banking market size was valued at $12.7 billion in 2021, and is projected to reach $237.4 billion by 2031, growing at a CAGR of 33.9% from 2022 to 2031.

Internet of Things (IoT) is defined as a network of physical objects (often termed nodes) that are embedded with sensors, software, and other technologies for the purpose of connecting and exchanging data with other devices and systems over the internet. Banking and financial institutes often depend on IoT devices to provide unique services to their customers, such as contactless payments and gamified rewards.

The major factor driving the Internet of Things (IoT) in banking market trends include rise in demands for IoT applications are propelling the growth of the global IoT in the banking market. Furthermore, increasing penetration of IoT-powered smartphones and smart wearables is also expected to aid the Internet of Things (IoT) in banking market opportunity. However, higher installation costs and complex infrastructural requirements can hamper the IoT in banking market growth. Conversely, advancements in the field of IoT and cloud technology are expected to offer remunerative opportunities for the expansion of the Internet of Things (IoT) in banking market growth during the forecast period.

The internet of things (iot) in banking market is segmented into Offering, Deployment Model, Application and Enterprise Size.

Segment review

The Internet of Things (IoT) in banking industry is segmented on the basis of offering, deployment model, application, enterprise size, and region. Based on offering, the market is segmented into solution and services. On the basis of deployment model, the market is bifurcated into on-premise and cloud. Depending on application, the market is classified into smart ATMs, customer management and support, security and authentication, and others. Based on enterprise size, the market is segmented into large enterprises and SMEs. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players profiled in the Internet of Things (IoT) in banking market analysis are Accenture, Capgemini, Cisco Systems, Inc, Dynamics, Inc, GE Digital, IBM, Infosys Limited, Mastercard, Microsoft Corporation, Oracle Corporation, PTC, SAP SE, Software AG, Stripe, Temenos, Tibbo Systems, and Vodafone Group Plc. These players have adopted various strategies to increase their market penetration and strengthen their position in the Internet of Things (IoT) in banking industry.

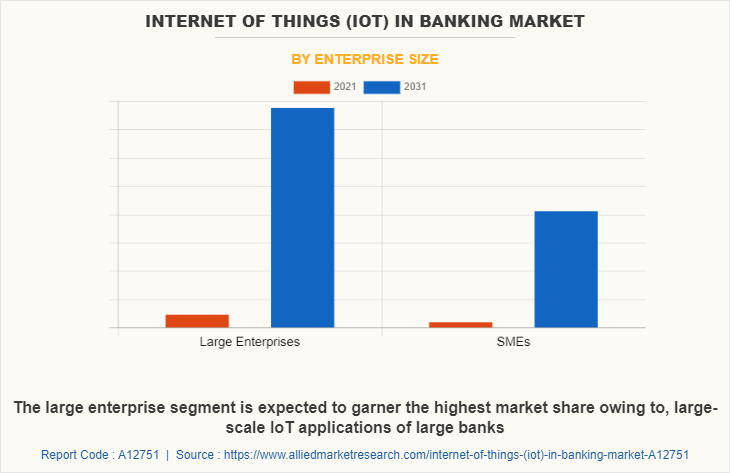

Depending on enterprise size, the large enterprise segment dominated the Internet of Things (IoT) in banking market share in 2021, and is expected to continue this trend during the forecast period owing to their large-scale operations needing highly efficient monitoring systems. However, the SMEs segment is expected to witness the highest growth in the upcoming years, owing to the growing number of technological investments by small-scale banks to make up for their smaller fleet of employees, which is anticipated to aid in the growth of IoT in retail banking.

Region-wise, the IoT in banking market was dominated by North America in 2021, and is expected to retain its position during the forecast period, owing to high concentration of IoT in banking solution vendors in the region, which is expected to drive the market for IoT in banking technology during the forecast period. However, LAMEA is expected to witness significant growth during the forecast period, owing to its growing digital and economic transformation and the developing communication network infrastructure in the region, which is expected to fuel the growth of IoT in banking trends in the region in the coming few years.

The report focuses on growth prospects, restraints, and analysis of the global IoT in banking market trends. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the Internet of Things (IoT) in banking market share.

COVID-19 Impact Analysis

The Internet of Things (IoT) in banking market is expected to grow rapidly post the period of the pandemic, owing to the rise in the adoption of work-from-home culture across the globe. The IoT in banking market has witnessed significant growth in the past few years; however, owing to the outbreak of the COVID-19 pandemic, banks were forced to rapidly shift their business toward digital platforms. This is attributed to the various lockdown and movement restrictions in the public places by governments in a majority of countries, which helped to drive the market growth as banks sped up their transformation during the period to keep up with various social distancing and hygiene challenges during the period. Such factors supported the growth of IoT in banking market globally.

Top impacting factors

Wide range of applications for IoT solutions in the banking industry

Interconnected solutions, such as edge computing devices and IoT devices, are gaining high traction in the global market for their various high-throughput and productivity-enhancing applications. Moreover, IoT devices are being produced by a wide range of vendors which is further increasing the penetration of connected devices in the modern business world. IoT solutions use standard protocols and technologies such as radiofrequency identification (RFID), near-field communication (NFC), low-energy Bluetooth, low-energy wireless, low-energy radio protocols, LTE-A, and Wi-Fi-direct. These technologies support the specific networking functionality required in an IoT system in contrast to a standard uniform network of common systems which allows for IoT solutions to be deployed in a variety of applications. For instance, banks are deploying IoT-powered automated teller machines (ATM) for their “Smart ATM” initiatives. With smart ATMs, banks can reduce the number of frauds, service differently-abled customers more efficiently, and improve the overall customer experience of the ATM. Moreover, banks are also adopting IoT technology to facilitate faster and more convenient payments with the help of RFID and NFC-powered IoT solutions embedded in modern smartwatches, smartphones, and cards.

Improving Communication Networks

As governments continue to try and enhance the present cellular networking infrastructure of their countries in order to improve communication speeds and overall connectivity for their citizens and the betterment of services, IoT applications are becoming easier to develop and deploy. This growth in many developing nations is helping newer businesses to invest in IoT applications. For instance, Ericsson, a Swedish telecommunications equipment, and services company, generated over $750 million in income in 2020 from the sale of telecom equipment and services in Southeast Asia and Australia. This was a 21% rise over the previous year of 2019. Such instances are highlighting the improving cellular connectivity, which in turn promises great opportunities for the growth of IoT-based applications in a variety of business sectors.

Moreover, modern communication technologies such as 5G communication networks that offer ultra-low latency and higher bandwidth, are empowering the use of real-time monitoring and communication systems, allowing banks and financial institutes to offer real-time payment settlement systems. Such factors are promising great opportunities for the future of IoT in modern banking applications.

KEY BENEFITS FOR STAKEHOLDERS

- The study provides an in-depth analysis of the Internet of Things (IoT) in banking market forecast along with current & future trends to explain imminent investment pockets.

- Information about key drivers, restraints, & opportunities and their impact analysis on Internet of Things (IoT) in banking market outlook is provided in the report.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

- The quantitative analysis of the Internet of Things (IoT) in Banking Market Opportunity from 2022 to 2031 is provided to determine the market potential.

Internet of Things (IoT) in Banking Market Report Highlights

| Aspects | Details |

| By Offering |

|

| By Deployment Model |

|

| By Application |

|

| By Enterprise Size |

|

| By Region |

|

| Key Market Players | IBM Corporation |

Analyst Review

Demand for IoT in banking systems has grown in past few years, and the market is expected to maintain this trend in the coming years as well, owing to increasing adoption of IoT in day-to-day life. Moreover, rise in penetration of smartphones and smart wearables is expected to further drive the demand for IoT solutions in the banking market. In addition, growth in the number of digital devices and rising internet penetration in many regions globally are promising new opportunities for growth of the IoT in banking market.

Key providers of the IoT in banking market, such as IBM Corporation, Cisco Systems, Inc., and Microsoft Corporation account for a significant share in the market. With larger requirement from IoT solutions in banking, various companies are establishing partnerships to increase their IoT in banking offerings. For instance, in July 2021, Mastercard Inc., an American multinational financial services corporation announced partnership with Verizon Business to drive transformational solutions for the global payments and commerce ecosystem. With this partnership, Verizon is expected to support Mastercard’s various services from contactless shopping and autonomous checkout technology to Cloud Point of Sale (POS) solutions.

In addition, with increase in demand for IoT in banking, various companies are expanding their current product portfolio with increasing diversification. For instance, in May 2022, Mastercard announced launch of Biometric Checkout Program. With this new program, Mastercard unleashes new era of biometric payments to enhance the checkout experience. The program was initiated as a trail in Brazil with Payface and St Marche. Moreover, market players are expanding their business operations and customers by increasing acquisitions.

For instance, in May 2022, HCL Technologies UK Limited, a wholly-owned subsidiary of the Indian multinational tech corporation, HCL Technologies (HCL) announced acquisition of Confinale AG, a Switzerland-based digital banking and wealth management consulting specialist. Through this strategic acquisition, HCL is expected to increase its footprint in the global wealth management market with emphasis on Avaloq consulting, implementation, and management capabilities.

Rise in demands for IoT applications are propelling the growth of the global IoT in the banking market. Furthermore, increasing penetration of IoT-powered smartphones and smart wearables is also expected to aid in the growth of IoT solutions in the banking industry.

Region-wise, the IoT in banking market was dominated by North America in 2021, and is expected to retain its position during the forecast period, owing to high concentration of IoT in banking solution vendors in the region, which is expected to drive the market for IoT in banking technology during the forecast period.

The global IoT in banking market size was valued at $12.68 billion in 2021, and is projected to reach $237.36 billion by 2031, growing at a CAGR of 33.9% from 2022 to 2031.

The key players profiled in the IoT in banking market analysis are Accenture, Capgemini, Cisco Systems, Inc, Dynamics, Inc, GE Digital, IBM, Infosys Limited, Mastercard, Microsoft Corporation, Oracle Corporation, PTC, SAP SE, Software AG, Stripe, Temenos, Tibbo Systems, and Vodafone Group Plc. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Loading Table Of Content...