IOT in Agriculture Market Summary

The global IOT in agriculture market size was valued at $27.1 billion in 2021 and is projected to reach $84.5 billion by 2031, growing at a CAGR of 12.6% from 2022 to 2031. The IOT in agriculture market is being driven by a number of factors, including the expanding demand for real-time data analytics, the rising use of cloud-based services, and the rising demand for automation and control systems in a variety of sectors, including manufacturing, healthcare, and transportation.

Key Market Trends and Insights

Region wise, Asia-Pacific generated the highest revenue in 2021.

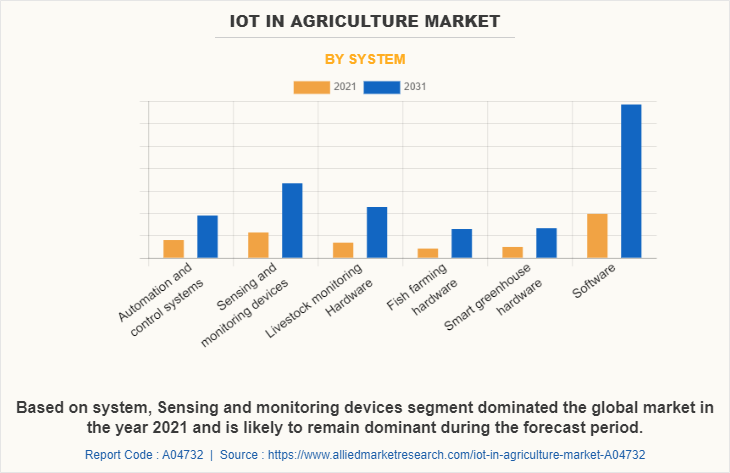

The global IOT in agriculture market share was dominated by the software segment in 2021 and is expected to maintain its dominance in the upcoming years

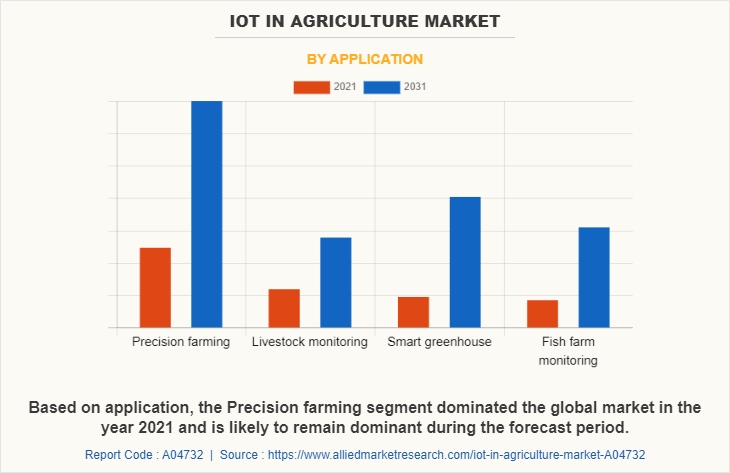

The precision farming segment is expected to witness the highest growth during the forecast

Market Size & Forecast

- 2021 Market Size: USD 27.1 Billion

- 2031 Projected Market Size: USD 84.5 Billion

- Compound Annual Growth Rate (CAGR) (2022-2031): 12.6%

- Asia-Pacific: Generated the highest revenue in 2021

Market Dynamics

The IoT in agricutlure market is a quickly expanding sector that entails connecting real-world items and gadgets to the internet so they can exchange and gather data. Then, by utilizing this data, it is possible to increase productivity, automate procedures, and develop new software and services.

Internet of things (IoT) technology in agriculture is anticipated to play a significant role in increasing the current agricultural productivity to cater to the growing demand for food. IoT in the agriculture industry incorporates IoT-based advanced technological tools, systems, equipment, and solutions to enhance operational efficiency, maximize yield, and minimize wastage of energy through real-time field data collection, data storage, data analysis, and the development of a control platform. Diverse IoT-based applications such as precision farming, livestock monitoring, smart greenhouse, and fish farm monitoring, are expected to be instrumental in increasing the speed of the agriculture processes. IoT technology can address agriculture-based issues and optimize the quantity and quality of agriculture production, by connecting farms through a single platform and making them more intelligent by sharing, storing, and analyzing the information.

The demand for a variety of devices, including sensors, gateways, and networking devices, is increasing in the IoT industry. Also, by enabling faster and more dependable connectivity for IoT devices, the spread of 5G technology is anticipated to fuel the expansion of the IOT in agriculture market. As more devices are connected to the internet and new use cases and applications arise, the IoT industry is anticipated to grow and change quickly over the next several years.

To satisfy growing food demand, IoT technology is essential for boosting present agricultural output. Using real-time field data collecting, storage, analysis, and the creation of control platforms, IoT in agriculture integrates IoT-based complicated technical tools, systems, equipment, and solutions to improve operational efficiency, optimize output, and reduce energy waste. Among the IoT-based applications that speed up agricultural processes are precision farming, animal monitoring, smart greenhouses, and fish farm monitoring. Additionally, by linking farms through a single platform and enhancing their intelligence by sharing, storing, and analyzing data, IoT technology can manage issues related to agriculture and maximize both the quantity and quality of agricultural production.

Agriculture and climate change are interrelated, thus climate change on global scale significantly impacts the agricultural production. The climate change that effects agriculture includes change in average temperature, atmosphere, rainfall, and extreme weather such as heat wave, change in ozone concentration, and change in nutritional quality of food. For instance, the agriculture zone that is said to be affected by such climate issues is Brazil, is expected to witness a decline of 10% in maize production by 2055. Similarly, Eastern Australia and Midwestern U.S. are projected to experience decline in agriculture production owing to extreme heat. Whereas, in Central and Eastern Europe, forest productivity of the region is expected to decrease owing to scarcity of water. These severe climatic conditions play an important role in the deployment of IoT-based technology in agriculture to optimize the production and efficiency of the farm.

Factors such as the rise in global population and increase in demand for food across the globe have fueled the adoption of new technology to optimize agriculture production, and are expected to boost the IOT in agriculture market growth. In addition, climate change plays a significant role in impacting global agriculture production. Thus, severe weather condition supports the deployment of IoT-based technology to optimize agriculture production. However, the agriculture industry comprises of numerous small players that provide solutions for various stages of the agriculture value chain. As a few of the agricultural processes achieve economic feasibility, the growth of the market is expected to be hampered during the IOT in agriculture market forecast period.

The agriculture industry consists of various small players that offer solution for various stages of agriculture value chain. Moreover, the industry does not have a major player that provides solution for the complete agriculture value chain. Thus, farmers find it difficult to achieve economic scalability by deployment of solution and services that are offered by smaller players. For instance, solution on reduction of cost for storage or transportation do not help farmers to achieve economic feasibility or maximize return on investment (ROI). Thus, fragmented agriculture market restrains the growth of the market.

Nevertheless, an increase in smartphone users and internet penetration among farmers boost their awareness about the latest developments in the agriculture market, which is anticipated to drive IOT in agriculture market growth.

A surge has been witnessed in the adoption smartphones and other mobile devices among the farmers, as these provide the farmers with latest development in the field of agriculture. Moreover, farmers depend on broadband and other wireless technologies to catch the latest news in their field of interest and participate in practical knowledge sharing initiatives in the agriculture industry. Owing to rising in internet penetration, agriculture resources are available in a wide range of local languages, which help farmers to create awareness on agriculture industry skills.

The web-based agriculture institutes, such as Agricultural Learning Repositories Task Force that introduces software and analytic tool skills to farmers have gained huge popularity among the farmers. Thus, adoption of smartphone and internet among farmers have created a new avenue for the development of IoT in agriculture.

Segments Overview

The global IoT in agriculture market is segmented based on system, application, and region. Based on the system, it is classified into automation and control systems, sensing and monitoring devices, livestock monitoring hardware, fish farming hardware, smart greenhouse hardware, and software. Based on application, it is divided into precision farming, livestock monitoring, smart greenhouse, and fish farm monitoring. Based on region, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (Sweden, Finland, Germany, The Netherlands, and the rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, KSA, South Africa, and rest of LAMEA).

Based on the system, the market is categorized into automation and control systems, sensing and monitoring devices, livestock monitoring hardware, fish farming hardware, smart greenhouse hardware, and software. In 2021, software was the leading segment in the global market, as it consists of numerous tools to control hardware such as yield monitors, soil sensors, water sensors, and climate sensors that are used in a wide range of precision farming, smart greenhouse farming, and fish farming applications.

The number of connected devices in IoT for agriculture application is expected to increase rapidly during the forecast period. These devices provide information to the software for human analyses, thus providing growth opportunity for the software market. Software development, innovation, and adoption will remain the prime area of focus. This drives the growth of the software market. The development of enhanced tools and reduction in cost of software further escalate the market growth.

The precision farming segment dominates IoT in agriculture market in 2021. Precision farming enables IoT, information technology, and communication to revolutionize the global agriculture sector, by optimizing its production and efficiency. Livestock monitoring and integration of IoT system technology for the detection of livestock location and health are expected to grow significantly during the forecast period.

In 2021, the precision farming segment used IoT for field application as well as in farm equipment to collect data that can be analyzed and used to optimize production and save energy is projected to lead the IOT in agriculture market during the forecast period. The livestock monitoring segment, which includes global positioning systems (GPS), and sensors are anticipated to be the fastest-growing segment. IoT in livestock helps growers to monitor livestock health by detecting illness and taking preventive measures is anticipated to drive the market growth during the forecast period.

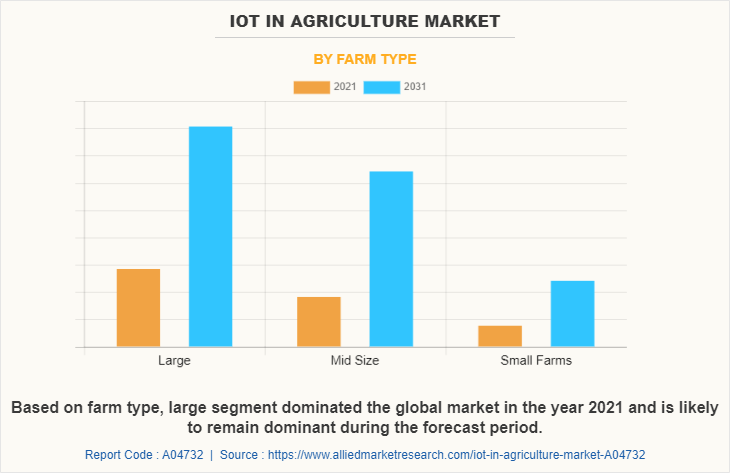

On the basis of farms, the large farm segment dominated the global Internet of Things (IoT) in agriculture market in the year 2021 and is likely to remain dominant during the forecast period.

By region, Asia-Pacific was the largest IOT in agriculture market share in 2021 owing to the rise in population coupled with increased IOT in agriculture market demand for food in the region. In addition, a government initiative to use remote sensing technology to collect ground data information and satellite image to detect agriculture conditions in various regions is expected to further boost the market growth.

The growth in population coupled with increase in food demand is expected to boost the IoT in agriculture market in the region. Government initiative to use remote sensing technology to collect ground data information and satellite image to detect agriculture condition in various region is expected to further escalate the IOT in Agriculture Industry growth.

Competitive Analysis

The top IOT in agriculture market players include Cisco Systems, Inc., International Business Management Corporation (IBM), Telit, Hitachi, Ltd, Decisive Farming, Trimble Inc., OnFarm Systems Inc., Farmers Edge Inc., SlantRange, Inc., and The Climate Corporation.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the IOT in agriculture market analysis from 2021 to 2031 to identify the prevailing iot in agriculture market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the IOT in agriculture market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the IOT in Agriculture Industry players.

- The report includes the analysis of the regional as well as global IoT in agriculture market trends, key players, market segments, application areas, and market growth strategies.

IOT in Agriculture Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 84.5 billion |

| Growth Rate | CAGR of 12.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 250 |

| By System |

|

| By Farm Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Telit Corporate Group, Trimble Inc., SWIIM System, Ltd., Decisive Farming Corp., Farmers Edge Inc., International Business Machines Corporation, SlantRange, Inc., Cisco Systems, Inc., Climate LLC, Hitachi, Ltd |

Analyst Review

According the CXO’s perspective, Internet of Things (IoT) ecosystem in agriculture has been helping farmers and growers to increase production and reduce wastage of energy. However, digital agriculture is expected to be defined by IoT in future. In the coming years, intelligence is expected to be embedded into the operation and design of every device & machine, connecting real-time farming processes with data input from sources as diverse as weather stations, soil, water quality, and consumers. This enables the farmer to make more informed decisions. Analytic tools and software, such as complex event processing (CEP), help process and analyze data on a real-time basis, which drives timely decision making and action.

According to a recent study, food and agribusiness have a massive social, economic, & environmental footprint and represent 10% of the global consumer expenditure. Although productivity improvements in the past have enabled an increase in food supply in many parts of the globe, feeding the global population has reemerged as a critical issue. According to the report by the United Nations, the world population is expected to increase from 7,630 million in 2018 to 9,772 million by 2050. This is anticipated to increase the crop demand, human consumption, and animal feed stock demand by two-folds. Moreover, in the coming years, various emerging constraints such as labor shortage and water scarcity are expected to impact the agriculture production. In addition, more than 20% of arable land is estimated to be degraded by various sources of erosion such as water erosion and soil erosion. Such scarcity of natural resources hampers agriculture production. Thus, development of IoT in the agriculture industry is projected to increase productivity in various regions, such as Africa, Eastern Europe, South America, and Asia.

However, finding a good investment opportunity is not an easy task as it requires deep understanding of crops, regions, food supply chain, and IoT technology development in the agriculture industry.

The global IOT in agriculture market Size was valued at $27.1 billion in 2021 and is projected to reach $84.5 billion by 2031

The global IOT in Agriculture market is projected to grow at a compound annual growth rate of 12.6% from 2022 to 2031 $84.5 billion by 2031

The top IOT in agriculture market players include Cisco Systems, Inc., International Business Management Corporation (IBM), Telit, Hitachi, Ltd, Decisive Farming, Trimble Inc., OnFarm Systems Inc., Farmers Edge Inc., SlantRange, Inc., and The Climate Corporation.

By region, Asia-Pacific was the largest IOT in agriculture market Share in 2021

The increase in the demand for automation and control systems in a variety of sectors, The rising use of cloud-based services, The rise in global population and the increase in the demand for food across the globe

Loading Table Of Content...

Loading Research Methodology...