Intralogistics Containers Market Research, 2033

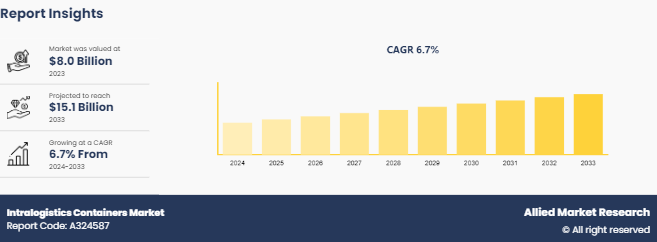

The global Intralogistics Containers Market Size was valued at $8.0 billion in 2023, and is projected to reach $15.1 billion by 2033, growing at a CAGR of 6.7% from 2024 to 2033.

Market Introduction and Definition

Intralogistics containers are specialized storage and transport units designed for efficient handling, storage, and movement of goods within a warehouse or manufacturing facility. These containers play a crucial role in optimizing internal logistics by facilitating organized, accurate, and timely movement of materials, thereby enhancing overall operational efficiency. Their importance is underscored by their adaptability to automation technologies such as Automated Guided Vehicles (AGVs) and Warehouse Management Systems (WMS) , which significantly improve the accuracy and speed of logistics processes. Additionally, the shift towards reusable and recyclable containers reflects the growing emphasis on sustainability in logistics operations, reducing environmental impact while maintaining high standards of efficiency and reliability.

Key Takeaways

TheIntralogistics Containers Market Size study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2033.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major Intralogistics containers industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Strategies and Developments

In February 2024, Gebhardt Intralogistics Group introduced two innovative products at LogiMAT 2024, the Gebhardt InstaPick and Gebhardt Omnipallet. The InstaPick is designed to enhance order picking efficiency, while the Omnipallet focuses on versatile pallet handling solutions. These products demonstrate Gebhardt’s commitment to improving intralogistics through innovative technologies.

In October 2022, the Raymond Corporation launched the high-capacity order picker, designed to pick efficiently at increased heights, with an industry-leading elevated height of 456 inches. This order picker boosts storage capacity and reduces the annual cost per pallet stored by 19%, catering to the increasing demands of e-commerce.

Key Market Dynamics

In 2023, the intralogistics containers market was primarily driven by rapid advancements in automation and artificial intelligence (AI), the exponential growth of e-commerce, and a heightened focus on sustainability. Automation technologies, such as automated guided vehicles (AGVs) and warehouse management systems (WMS) , have significantly improved the efficiency and accuracy of logistics operations. The e-commerce sector's expansion has increased the demand for efficient storage and order fulfilment solutions, further boosting the market. In addition, there is a strong shift towards sustainable practices, with businesses increasingly adopting reusable and recyclable containers to reduce their environmental footprint. These dynamics collectively underscore the Intralogistics Containers Market Growth trajectory and its adaptation to evolving technological and environmental requirements.

Market Segmentation

The Intralogistics containers market is segmented into container type, material, load capacity, end use and region. Based on container type, the market is divided into boxes & trays, nestable & stackable, bulk containers and others. As per material, the market is divided into plastic intralogistics containers, cardboard intralogistics containers, and metal/steel intralogistics containers. Based on load capacity, the market is divided into up to 50 kgs, 50-100 kgs, 100-500 kgs, and above 500 kgs. Based on end use, the market is divided into logistics & warehouses, food & beverages, retail & consumer products, chemicals, industrial manufacturing, electrical & electronics, healthcare & pharmaceuticals and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

Regional/ Country Market Outlook

As per the information published by OECD library, China is experiencing rapid growth in the intralogistics containers market due to its large manufacturing sector and significant investments in automation and smart logistics. The country's "Made in China 2025" initiative aims to enhance industrial efficiency and global competitiveness, further boosting the market.

As per the article published by ShipBob on March 5, 2024, Automation is playing a critical role in the efficient handling and storage of goods in e-commerce. Technologies such as automated guided vehicles (AGVs) and warehouse management systems (WMS) rely heavily on intralogistics containers to streamline operations and reduce human error. These technologies enhance the speed and accuracy of order fulfillment, which is vital in the fast-paced e-commerce environment?.

As per the article published by Bluehost on February 16, 2024, countries such as Brazil and Mexico are witnessing rapid growth in e-commerce, which drives the need for efficient logistics infrastructure and solutions. Investments in modernizing warehousing facilities and adopting automation are increasing the utilization of intralogistics containers in the region?.

As per the information published by HubSpot Blog on March 8, 2024, U.S. witnessed a substantial growth in e-commerce, with projected revenue increases driving the demand for efficient logistics solutions. The integration of advanced technologies in warehouses is a key trend in the U.S. market.

As per the information published by Bluehost on February 16, 2024, leading the global e-commerce market, China accounted for almost 50% of global e-commerce sales in 2021. The country’s advanced logistics infrastructure and heavy investment in automation make it a significant user of intralogistics containers.

Competitive Analysis

The major players operating in the intralogistics containers market include AUER Packaging, Bekuplast GmbH, Bito, Corplex, Deluxe Packaging, Dexion, Flexcon, Georg Utz Holding AG, Hanel Storage Systems, M.P.S SRL, Logistic Packaging, Quantum Storage System, Shanghai Join Plastic, Steel King, Gebhardt Intralogistics Group, Raymond Corporation, SSI Schaefer, and Trilogiq SA. These players adopted product launch strategies to increase their Intralogistics Containers Market Share in the global Intralogistics containers industry.

Industry Trends

As per the Research Center for Energy & Industrials information published on October 30, 2023, various warehouses use automated storage and retrieval systems (AS/RS) that rely on standardized intralogistics containers for seamless operation. These systems enhance the speed and accuracy of order fulfillment processes

As per the article published by Commercial Edge on May 29, 2024, intralogistics containers are used to transport components and assemblies between different workstations and departments within a manufacturing facility, maintaining the integrity and organization of the items.

As per the information published by Mecalux on January 28, 2021, Intralogistics container manufacturers offer tailored solutions, including custom labeling (barcode, RFID) , specific sizes, and configurations to meet the unique needs of different industries?.

As per the information published by Artios in 2024, there is a growing emphasis on sustainability within the e-commerce sector. Companies are increasingly using recyclable and reusable containers to reduce environmental impact. This shift towards sustainable practices is driven by consumer preferences and regulatory pressures?.

Key Sources Referred

OECD Library

Bluehost

Shipbob

Hubspot Blog

Artios

Gebhardt.com

Raymond Corporation.com

Commercial Edge

Mecalux

Deloitte Research Center for Energy & Industrials

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the intralogistics containers market analysis from 2024 to 2033 to identify the prevailing Intralogistics Containers Market Opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the intralogistics containers market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global intralogistics containers market trends, key players, market segments, application areas, and market growth strategies and Intralogistics Containers Market Forecast.

Intralogistics Containers Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 15.1 Billion |

| Growth Rate | CAGR of 6.7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 256 |

| By Material |

|

| By Load Capacity |

|

| By End User |

|

| By Region |

|

| By Container Type |

|

| Key Market Players | Dexion, Shanghai Join Plastic, Bito, Trilogiq SA, Gebhardt Intralogistics Group, Steel King, Hanel Storage Systems, Quantum Storage System, M.P.S SRL, Deluxe Packaging, Raymond Corporation, Bekuplast GmbH, Georg Utz Holding AG, Corplex, SSI Schaefer, Flexcon, Logistic Packaging, AUER Packaging |

As warehouses and distribution centers increasingly adopt automation technologies, there is a growing demand for containers that are compatible with automated systems like Automated Guided Vehicles (AGVs), robotics, and conveyor systems. Containers designed for easy stacking, picking, and integration with automated systems are becoming more prevalent.

The boxes & trays segment is the leading application of Intralogistics Containers Market. This is due to their widespread use in diverse industries such as e-commerce, food and beverages, and retail.

North America is the largest regional market for Intralogistics Containers. This is driven by advanced infrastructure, significant investments in automation, and the presence of major e-commerce players.

$15.2 billion is the estimated industry size of Intralogistics Containers.

Gebhardt Intralogistics Group and Raymond Corporation are the top companies to hold the market share in Intralogistics Containers.

Loading Table Of Content...