Intramedullary Nails Market Research, 2032

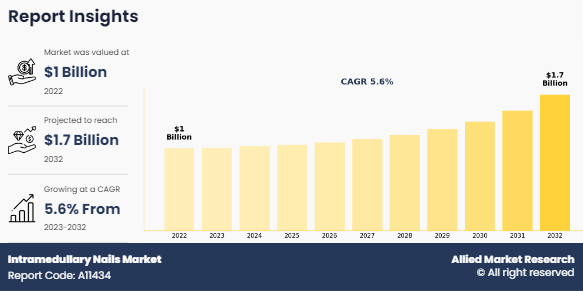

The global intramedullary nails market size was valued at $1 billion in 2022, and is projected to reach $1.7 billion by 2032, growing at a CAGR of 5.6% from 2023 to 2032. An intramedullary nail, also known as an intramedullary rod or IM nail, is a surgical implant used in orthopedic surgery to stabilize fractures of long bones, especially in the femur, tibia, and humerus. It consists of a metal rod or nail that is inserted into the medullary canal (the central cavity) of the bone. Once inserted, the nail provides internal fixation, supporting the bone and allowing for suited healing. Intramedullary nailing is a common approach used to treat fractures that are often too unstable to be treated with traditional casting or external fixation methods. This surgical method helps promote faster healing, reduce pain, and allow for early mobilization of the affected limb.

Robot-assisted surgeries offer unparalleled precision and accuracy in implant placement, including intramedullary nails. This precision ensures optimal alignment and positioning of the nail within the medullary canal, reducing the risk of complications and promoting better outcomes for patients. Robot-assisted surgery often enables minimally invasive techniques, which can result in smaller incisions, reduced tissue trauma, and faster recovery times. This is particularly beneficial in orthopedic procedures like intramedullary nailing, where minimizing disruption to surrounding tissues can enhance postoperative recovery and reduce complications.

The combination of precision, minimally invasive techniques, and enhanced visualization provided by robot-assisted surgeries often leads to improved surgical outcomes for patients undergoing intramedullary nailing procedures. This includes reduced rates of complications, faster recovery times, and better long-term functional outcomes. All these factors are anticipated to drive the intramedullary nails market growth.

Intramedullary nailing is a widely employed method for treating fractures of long bones like femoral and tibial fractures. However, it comes with numerous challenges and risk factors. These include iatrogenic fractures, femur straightening, medial gap opening, leg-length inequality, penetration of the distal anterior femoral cortex, delayed or nonunion, instability of the inserted nail, shortening, and soft tissue irritation, particularly with longer nails. In cases of implant-related complications, such as infection, implant failure, or non-union, revision surgery may be necessary.

Revision procedures carry inherent risks, including anesthesia complications, increased surgical complexity, prolonged recovery, and reduced likelihood of successful outcomes. Depending on the location and length of the intramedullary nail, patients may experience limitations in joint mobility or range of motion, particularly in weight-bearing joints. Restricted motion can impact activities of daily living, functional outcomes, and patient satisfaction. These factors are anticipated to restrain the intramedullary nails industry growth during the forecast period.

The increasing demand for minimally invasive surgeries has a significant impact on the intramedullary nailing market, presenting both challenges and opportunities. Patients increasingly prefer minimally invasive surgical procedures due to shorter hospital stays, quicker recovery times, and reduced post-operative pain and scarring. Therefore, there is a growing preference for intramedullary nailing over traditional open surgeries for long bone fractures like femoral and tibial fractures.

The need for minimally invasive surgeries has led to advancements in surgical techniques and instrumentation, including intramedullary nailing systems. Manufacturers are developing innovative devices that allow for smaller incisions, less tissue trauma, and more precise implant placement, catering to the needs of surgeons performing minimally invasive procedures.

The key players profiled in this report include Stryker, B. Braun Melsungen AG, Zimmer Biomet, Smith+Nephew, Johnson & Johnson, Orthopaedic Implant Company, Orthofix Holdings, Inc., Wright Medical Group N.V., Advanced Orthopaedic Solutions, and Aysam Ortopedi & Tibbi Cihazlar.

Investment and agreement are common strategies followed by major market players. For instance, in July 2022, Orthofix Medical Inc., a medical device company, and LimaCorporate S.p.A., a global orthopedic company, announced a licensing partnership for the U.S. market to provide a novel solution for patients with the challenging condition of chronic high dislocation of the hip. The partnership combines the unique limb-lengthening technology of Orthofix’s patented Fitbone intramedullary nail system with LimaCorporate’s proprietary, patient specific, 3D-printed pelvic fixation device.

The intramedullary nail market is segmented on the basis of product type, material, application, end user, and region. By product type, the market is divided into upper bone extremities and lower bone extremities. By material, the market is classified into stainless steel and titanium. By application, the market is classified into femoral intramedullary nail, tibial intramedullary nail, gamma intramedullary nail, and others. By end user, the market is classified into hospitals, specialty clinics, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

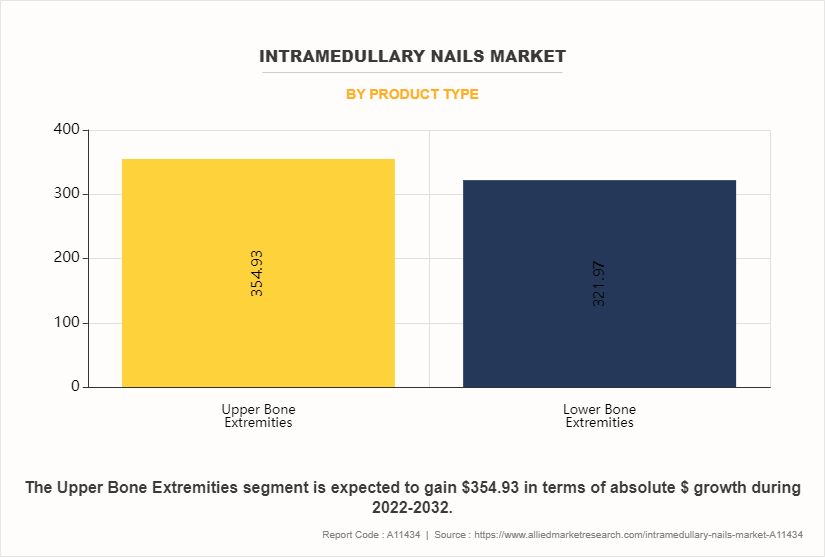

By Product Type

The upper bone extremities sub-segment dominated the market in 2022. Continuous advancements in intramedullary nail designs, materials, and surgical techniques contribute to improved patient outcomes and surgeon satisfaction. Innovations such as anatomically contoured nails, locking mechanisms, and minimally invasive insertion methods enhance the effectiveness and ease of use of intramedullary nails for upper extremity fractures, driving market growth. The rise in sports participation and recreational activities has led to an increased incidence of upper extremity fractures among athletes and active individuals. Intramedullary nails offer a reliable and efficient method of fracture stabilization, particularly for athletes seeking a rapid return to activity, thus contributing to intramedullary nails industry growth.

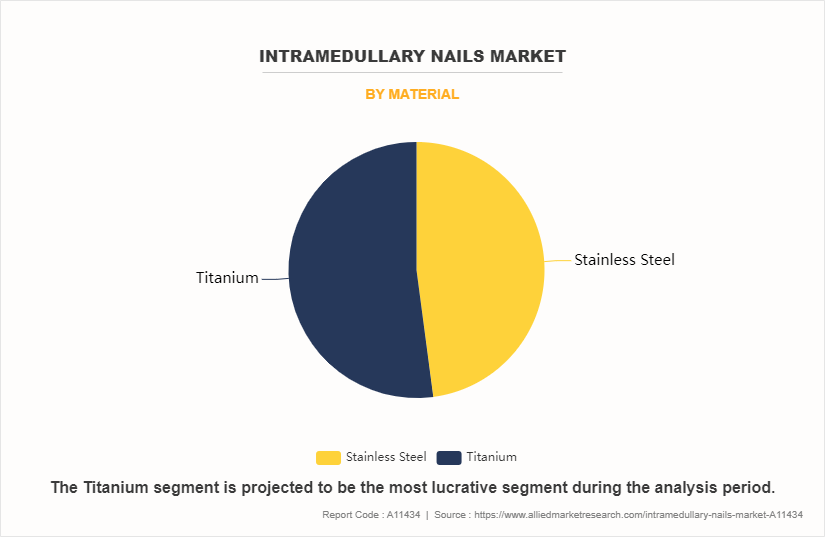

By Material

The titanium sub-segment dominated the global intramedullary nails market size in 2022. Titanium is a biologically inert biomaterial, as it remains unchanged in the human body when inserted. When it comes into contact with air or water, it is characterized by a surface layer of titanium dioxide that protects and stabilizes the metal. These elements have an effect on growth of the market, and hence titanium implants are currently gaining significance in various developed economies owing to their low cost.

A significant portion of the growth during this phase can be credited to the numerous advantages offered by titanium as an implant material, particularly its exceptional biocompatibility, strength, rigidity, enhanced strain-bearing capacity, and superior corrosion resistance when compared to traditional materials.. It is also non-allergic, non-magnetic, and non-radio-opaque and conveniently adheres to the bone without any external covering.

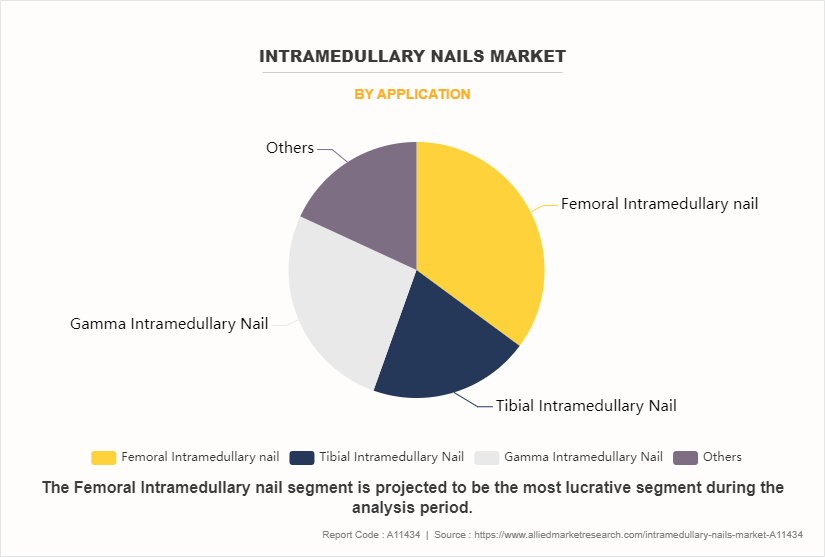

By Application

The femoral intramedullary nail sub-segment dominated the global intramedullary nails market share in 2022. A femoral intramedullary nail is a medical device used in orthopedic surgery to treat fractures of the femur (thigh bone). It is inserted into the intramedullary canal of the femur to provide stability and support during the healing process. The market for intramedullary nails, including femoral intramedullary nails, is influenced by various factors driving its growth.

As the global population ages and lifestyles change, the incidence of fractures, including femoral fractures, is expected to rise. This leads to a higher demand for orthopedic implants such as intramedullary nails. Ongoing advancements in surgical techniques, including minimally invasive procedures and computer-assisted surgery, are driving the adoption of intramedullary nails. These techniques result in reduced surgical trauma, shorter recovery times, and improved patient outcomes.

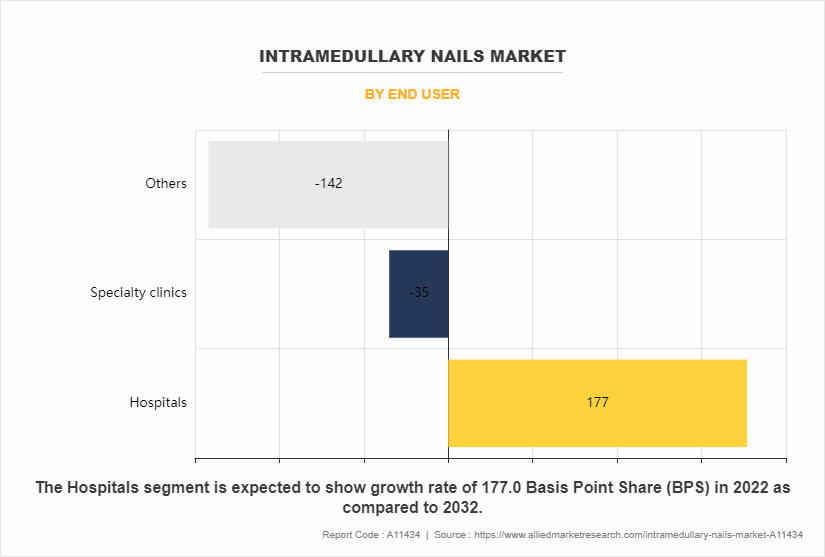

By End User

The hospitals sub-segment dominated the global intramedullary nails market share in 2022. Hospitals witness a significant portion of their patient population comprising senior adults who are more susceptible to femoral fractures due to age-related factors like osteoporosis and decreased bone density. As the global population ages, hospitals experience a higher demand for orthopedic interventions, including femoral intramedullary nailing, to address fractures in elderly patients. Hospitals prioritize patient-centered care and strive to meet patient preferences and expectations regarding treatment options and outcomes. Femoral intramedullary nails offer advantages such as faster recovery, reduced pain, and improved mobility compared to traditional fracture fixation methods, contributing to patient satisfaction and the preference for these implants within hospitals

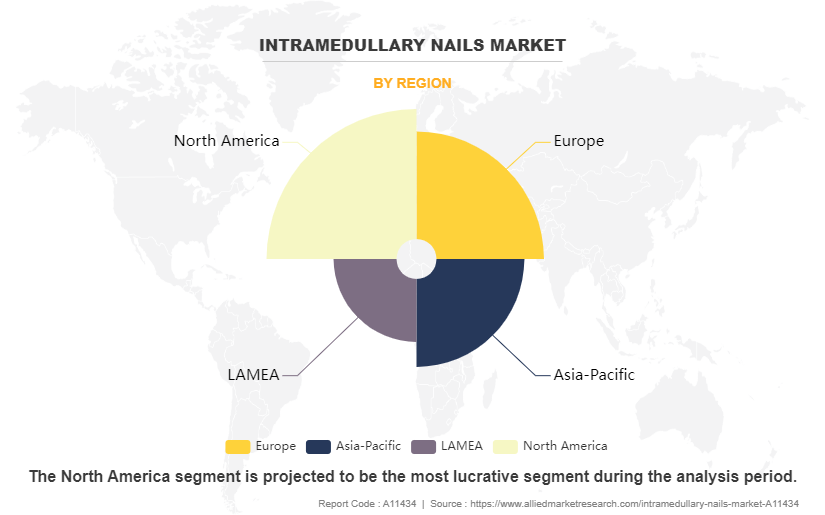

By Region

North America dominated the global intramedullary nail market in 2022. In recent years, most orthopedic trauma and reconstruction device companies witnessed income positive outcomes through an increasing number of regulatory approvals. For example, Globus Medical, Inc., a U.S.-based corporation, received extra than eighty-two FDA product approvals. Furthermore, the growth in attention within the area due to government and personal association collaborations has contributed to the market growth. For instance, in October 2021, ExsoMed Corporation, a privately held U.S.-based medical device company specializing in orthopedic solutions for hand surgery, disclosed the successful treatment of 10,000 metacarpal fractures using the INnate Intramedullary Threaded Nail. The INnate nail, tailored for minimally invasive fixation of metacarpal fractures, has been instrumental in achieving this milestone.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the intramedullary nails market analysis from 2022 to 2032 to identify the prevailing intramedullary nails market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the intramedullary nails market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global intramedullary nails market trends, key players, market segments, application areas, and market growth strategies.

- Based on region, North America registered the highest market share share in 2022 and is projected to maintain its position during the intramedullary nails market forecast period.

Intramedullary Nails Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1.7 billion |

| Growth Rate | CAGR of 5.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 350 |

| By Application |

|

| By End User |

|

| By Product Type |

|

| By Material |

|

| By Region |

|

| Key Market Players | Stryker, Wright Medical Group N.V., Aysam Ortopedi & Tibbi Cihazlar, Zimmer Biomet, B. Braun Melsungen AG, Smith+Nephew, Advanced Orthopaedic Solutions, Orthofix Holdings, Inc., Orthopaedic Implant Company, Johnson & Johnson |

Ongoing advancements in materials science, implant design, and surgical techniques contribute to the development of more efficient and versatile intramedullary nails. Enhanced features like better biocompatibility, reduced risk of complications, and improved durability are projected to create several growth opportunities.

The major growth strategies adopted by intramedullary nail market players are investment and agreement.

Asia-Pacific is projected to provide more business opportunities for the global intramedullary nail market in the future.

Stryker, B. Braun Melsungen AG, Zimmer Biomet, Smith+Nephew, and Johnson & Johnson Limited are the major players in the intramedullary nail market.

The stainless-steel sub-segment of the material acquired the maximum share of the global intramedullary nail market in 2022.

The potential customers of the intramedullary nail industry include various stakeholders within the healthcare ecosystem, each playing a specific role in the adoption, utilization, and distribution of these orthopedic implants.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global intramedullary nail market from 2022 to 2032 to determine the prevailing opportunities.

Fracture fixation is the primary application driving the adoption of intramedullary nails. These implants are commonly used for stabilizing and aligning fractures in long bones such as the femur, tibia, and humerus. Intramedullary nails provide rigid internal fixation, promoting faster healing and rehabilitation compared to external fixation methods.

Loading Table Of Content...

Loading Research Methodology...