Intraocular Lens Market Research, 2031

The global Intraocular Lens (IOL) Market size was valued at $3.8 billion in 2021, and is projected to reach $6.5 billion by 2031, growing at a CAGR of 5.6% from 2022 to 2031. An intraocular lens is a replacement for the natural lens in the eye that performs image focusing. The intraocular lens similar to natural lens that focuses light inside the eye. Intraocular lens is commonly used for vision correction as part of cataract surgery or refractive lens exchange. They can be used to correct hyperopia, myopia, presbyopia, and astigmatism.

Market Dynamics

Growth of the global IOL market is majorly driven by rise in prevalence of cataract surgery, rise in adoption of advanced premium intraocular lens, and development of new intraocular lens by large number of key players. According to the International Diabetes Federation, in 2021, approximately 537 million adults were living with diabetes. The total number of people living with diabetes is projected to rise to 643 million by 2045. Thus, rise in burden of diabetes is one of the reasons causing vision impairment, which is anticipated to foster the growth of the intraocular lens market. Furthermore, rise in geriatric population leads to various types of diseases, such as diabetes mellitus and increase in the number of ophthalmic issues are additional factors that fuel the growth of the intraocular lens market.

Furthermore, technological innovations in intraocular lens is expected to open intraocular lens market opportunity in upcoming years. For instance, in October 2021, Alcon Inc., a division of Novartis launched the AcrySof IQ Vivity IOL , the first and only presbyopia correcting intraocular lens with wave front shaping technology in India. Increase in number of product approvals will further provide lucrative opportunities for the expansion of the global intraocular lens market. However, unfavorable reimbursement situation for premium lens and postoperative problems such as refractive errors hinder the market growth.

The intraocular lens market is segmented into type, material, end user, and region. By type, the market is categorized into monofocal intraocular lens and premium intraocular lens. By material the market is fragmented into polymethylmethacrylate (PMMA), silicone, and hydrophobic and hydrophilic acrylic materials. On the basis of end user the market is classified into hospitals, ambulatory surgical centers, ophthalmology clinics, and eye research institute.

Segments Overview

Region wise, the IOL industry is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, and rest of LAMEA).

By Type

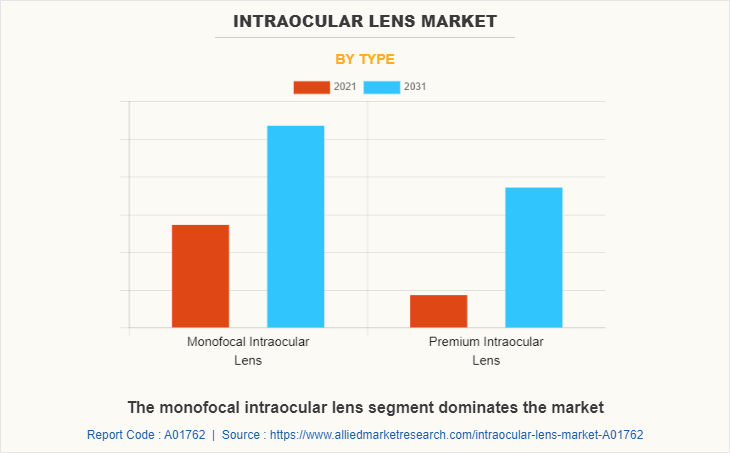

Depending on type, the monofocal intraocular lens segment dominated the marke in 2021, and will also continue dominating intraocular lens market size during the forecast period. Monofocal lens is preferred choice of numerous ophthalmologist and is also covered by the insurance providers. However, the premium intraocular lens segment is expected to witness fastest intraocular lens market growth during the forecast period, owing to their proficiency in treating patients with intricate retinal issues and improved visualization.

By Material

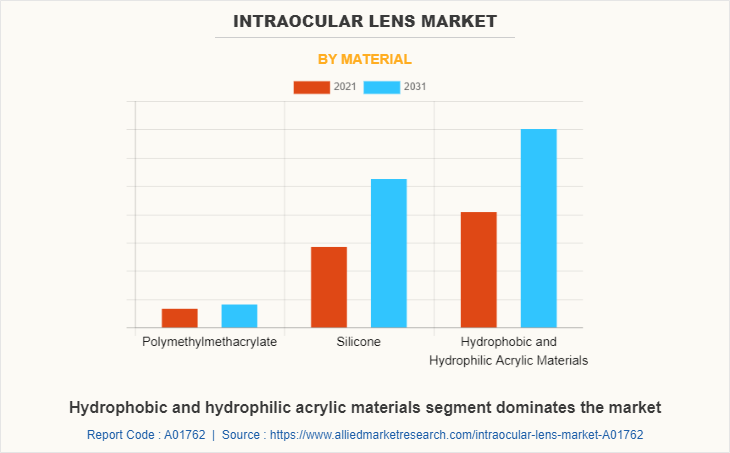

By material, hydrophobic and hydrophilic acrylic materials segment had the largest intraocular lens market share in 2021, owing to rise in usage of this lens material as it is easy to fold and ideally suited for microsurgery along with their excellent biocompatibility. However, silicone segment is considered to be the fastest growing segment during the intraocular lens market forecast period, due to technological improvements in refractive quality. Silicone material can be used with preloaded injectors that allow implantation through incisions smaller than 2.8 mm.

By End User

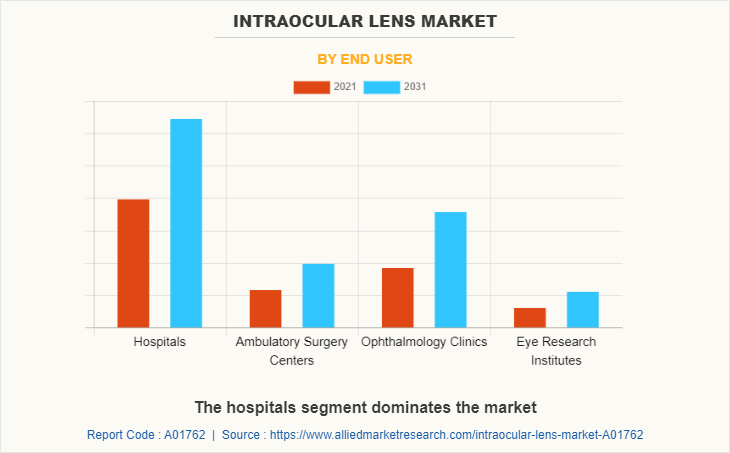

Depending on end user, the hospitals segment dominated the market in 2021, due to increase in number of cataract procedures performed in inpatient settings and latest medical technologies used in these settings. However, the ophthalmology clinics segment is expected to witness considerable growth during the forecast period, owing to increase in number of discrete ophthalmic clinics, reduced length of stay, and ease of scheduling appointments.

By Region

Region wise, North America garnered the major share in the intraocular lens market in 2021, and is expected to continue to dominate intraocular lens market size during the forecast period, owing to rise in cases of ophthalmic disorders and favorable reimbursement policies for cataract treatment. However, Asia-Pacific is expected to register the highest CAGR from 2022 to 2031, owing to large geriatric population base susceptible to cataract, with China and India leading this trend and budding awareness regarding advanced treatment options.

The key players that operate in the global intraocular lens industry include Alcon (Novartis AG), Bausch Health Inc., Carl Zeiss Meditech, EyeKon Medical Inc, Humanoptics, Hoya Corporation, Johnson & Johnson, Lenstec Inc., Rayner Intraocular Lens Ltd, and STAAR Surgical Company.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the intraocular lens market analysis from 2021 to 2031 to identify the prevailing intraocular lens market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the intraocular lens market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global intraocular lens market trends, key players, market segments, application areas, and market growth strategies.

Intraocular Lens Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Material |

|

| By End User |

|

| By Region |

|

| Key Market Players | Hoya Corporation, Lenstec Inc., Johnson & Johnson, EyeKon Medical Inc, Bausch Health Inc., Humanoptics, Rayner Intraocular Lens Ltd, Carl Zeiss Meditech, Alcon |

Analyst Review

This section provides the opinions of the CXOs of the companies operating in the global intraocular lens market. Based on the interviews conducted, the adoption of intraocular lens is expected to increase in near future due to rise in incidence of cataract, upsurge in geriatric population, and surge in adoption of premium lens despite its high cost. The intraocular lens market has piqued the interest of healthcare professionals, owing to technological advancements in these implants.

Furthermore, increase in awareness initiatives by various government and private organizations to eliminate avoidable blindness is expected to drive the growth of intraocular lens market. Moreover, adoption of premium intraocular lens has increased in the recent years, due to the advanced features, such as enhanced contrast sensitivity, improved visual performance, and reduced need of eye-glasses. However, unfavorable reimbursement scenario for premium intraocular lens and post-operative complications are expected to hamper the market growth. As per the CXOs, the use of these imaging modalities is highest in North America, owing to heavy expenditure by the government on healthcare and supportive reimbursement policies. It is followed by Europe and Asia-Pacific, respectively.

In addition, the market gains interest of healthcare companies, owing to focus on preventive facilities provided to patients who are undergoing critical treatment, which are more complex than other health conditions. This leads to increase in utilization of intraocular lens, driving the growth of the industry.

North America is expected to witness highest growth, in terms of revenue, owing to rise in cases of ophthalmic disorders, presence of key players, and growth in healthcare expenditure. Asia-Pacific is expected to register fastest CAGR during the forecast period, owing to large geriatric population susceptible to cataract, especially in countries like China and India. However, unfavorable reimbursement scenario for premium lens and postoperative complications, such as refractive errors are expected to hamper the market growth.

The intraocular lens market was valued $3,777.16 million in 2021 and is expected to reach $6,535.51 million by 2031.

Fixing intricate retinal issues and improved visualization post cataract surgery is the leading application of intraocular lens market.

Rise in adoption of advanced premium intraocular lens, and development of new intraocular lens by large number of key players is trending in the intraocular lens market.

North America is the largest regional market for intraocular lens.

The top companies to hold the market share in intraocular lens market include Alcon, Bausch Health Inc., Carl Zeiss Meditech, EyeKon Medical Inc, Humanoptics, Hoya Corporation, Johnson & Johnson, Lenstec Inc., Rayner Intraocular Lens Ltd, and STAAR Surgical Company.

Loading Table Of Content...