Intrauterine devises Market Research, 2031

The global Intrauterine Devices Market Size was valued at $3.0 billion in 2021 and is projected to reach $4.4 billion by 2031, growing at a CAGR of 3.8% from 2022 to 2031. The intrauterine device also called an intrauterine contraceptive device, is a T-shaped birth control device inserted into the uterus to prevent pregnancy by changing the way of sperm moves away from the egg. It is a form of long-acting reversible birth control. It is safe and effective for adolescents and those who did not have children. There are two types of intrauterine devices based on hormone release ability that include non-hormonal and hormonal devices. The copper-containing non-hormonal device is used as an emergency contraceptive within five days after unprotected sex with 99% effectiveness against pregnancy.

The copper intrauterine device plays an important role in preventing fertilization. The presence of copper acts as a spermicide within the uterus by increasing the level of copper ions, prostaglandins, and white blood cells within the uterus. Hormone-releasing intrauterine devices are contraceptive devices placed in a woman’s uterus to prevent pregnancy by continuously releasing a low dose of certain hormones such as progesterone. The hormonal intrauterine device is used as long-term contraception for the prevention of pregnancy.

The key factors that drive Intrauterine Devices Market Growth is an increase in the number of unplanned & unintended pregnancies, a surge in the number of unsafe abortion, and a rise in awareness regarding the use of the device. In addition, the upsurge in demand for intrauterine devices, an initiative taken by the government, and key payers in the R&D sector to develop advanced devices contribute to the growth of the market. Furthermore, the surge in the rate of unintended pregnancies and supportive government initiatives boost the market growth. Moreover, the growing inclination toward planned delayed pregnancy in the U.S. is projected to promote market growth. The adoption of novel strategies by the U.S. government to promote access to sexual & reproductive health services and products is expected to upsurge the inclination towards planned delayed pregnancy.

However, lack of awareness regarding intrauterine device use, and side effects of intrauterine devices such as bleeding and pain or discomfort are the key factors owing those women who have an intrauterine device removed, accounting for over half of all removals before the usual replacement time. Few patients also experience other side effects after the IUD is placed such as cramps, irregular periods, spotting between periods, heavier periods with stronger cramping, etc. impedes the growth of the intrauterine device market. Moreover, rising disposable income and demand for a healthy life in emerging economies provide Intrauterine Devices Market Opportunity for key market players. Furthermore, the presence of favorable regulatory scenarios, technological advancements, and implementation of favorable initiatives by the government. The ongoing advancements and innovations for enhancing the patient experience are anticipated to propel market growth.

The global Intrauterine Devices Market Size was valued at $3.0 billion in 2021 and is projected to reach $4.4 billion by 2031, growing at a CAGR of 3.8% from 2022 to 2031. The intrauterine devices market is segmented on the basis of type, age group, end-user, and region. By type, the market is classified into nonhormonal: copper-containing IUDs and hormonal: progestogen-releasing IUDs. By age group, it is categorized into 15–24 years, 25–34 years, 35–44 years, and above 44 years. By end-user, it is classified into hospitals, community health centers, clinics, and others. By region, it is analyzed across four regions, namely, North America, Europe, Asia-Pacific, and LAMEA.

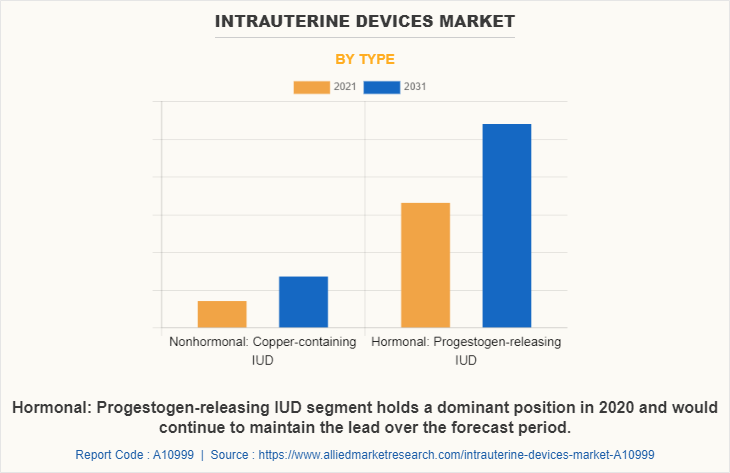

By Type Segment Review

By type, the intrauterine market is divided into non–hormonal: copper-containing intrauterine devices and hormonal: progesterone-releasing intrauterine devices. The hormonal: progestogen-releasing IUD segment holds the largest Intrauterine Devices Market Share in 2022 owing to the wide availability of intrauterine hormonal devices along with better efficiency to prevent unwanted pregnancy. Furthermore, these hormonal IUDs are recommended by healthcare professionals due to their several health benefits and better patient outcomes. Hormonal IUDs are considered to be highly safe owing to their non-contraceptive benefits and can be used by patients having heavy menstrual bleeding, endometriosis, anemia, fibroids, etc. Hormonal IUDs prevent pregnancies by thickening the mucus in the cervix as well as thins the lining of the uterus that partially suppresses ovulation. Therefore, the several advantages and health benefits offered by hormonal IUDs are expected to propel the demand for hormonal IUDs.

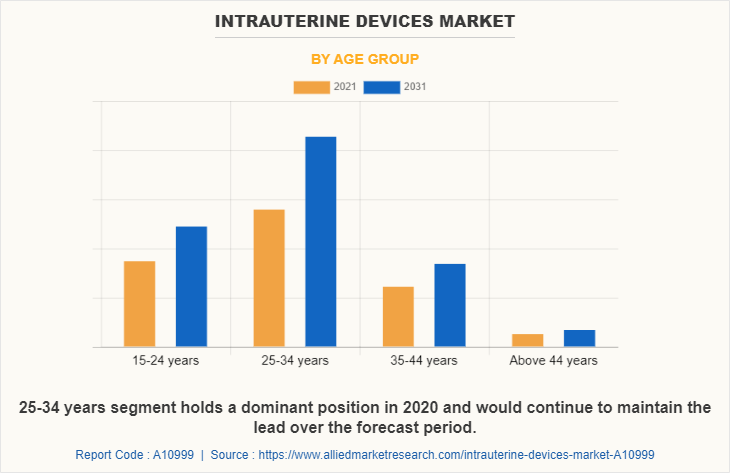

By Age Group Segment Review

By age group, the Intrauterine Devices Industry market is classified into 15-24 years, 25-34 years, 35-44 years, and above 44 years. The 25-34 years segment dominated the market in 2022 owing to an increase in awareness regarding intrauterine devices and rise in concern about adolescent sexual activity, as premarital and unplanned pregnancy often leads to premature discontinuation of schooling or abortion.

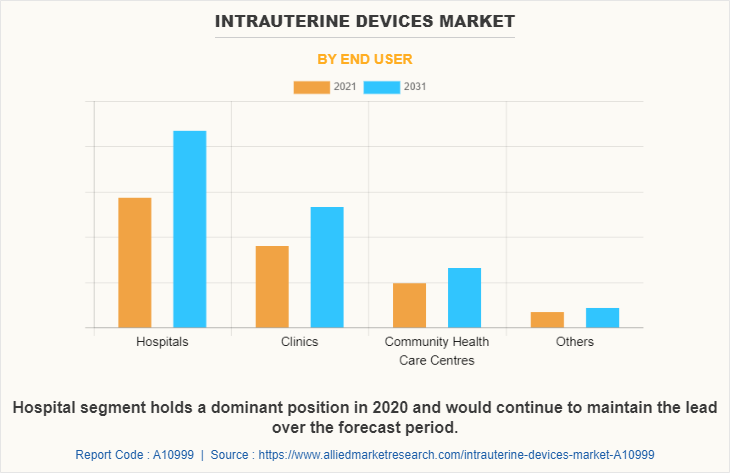

By End User Segment Review

By end-user, the Intrauterine Devices Industry market is categorized into hospitals, clinics, community health care centers, and others (ambulatory surgical centers). The hospital segment dominated the market in 2021 owing to a rise in the number of patient visits for family planning that drive the growth of the market during the forecast period.

By Region Segment Review

In 2021, Asia Pacific was the major revenue generator, owing to an increase in awareness about the benefits of using hormonal intrauterine devices, the high prevalence of unwanted pregnancy, and favorable regulatory scenarios. However, North America was the second-largest revenue generator in 2021, due to its well-established healthcare infrastructure and the presence of key market players in the region. North America is expected to grow at significant rates. According to the Center for Disease Control and Prevention (CDC), from 2018 to 2020, 72.2 million U.S. women aged between 19 and 49 used contraceptives. In addition, government initiatives have increased awareness regarding birth control and growth in affordability, which fuels the market growth.

The intrauterine devices market is segmented into Type, Age Group and End User.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the intrauterine devices market analysis from 2021 to 2031 to identify the prevailing intrauterine devices market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the intrauterine devices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global intrauterine devices market trends, key players, market segments, application areas, and market growth strategies.

Intrauterine Devices Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Age Group |

|

| By End User |

|

| By Region |

|

| Key Market Players | Pregna International Limited, DKT International, CooperSurgical Inc, Prosan International BV, Mona Lisa N.V.,, Bayer AG, Abviee Inc, Mona Lisa NV, Viatris Inc, Eurogine, S.L. |

| Other Players | Stryker Corporation |

Analyst Review

According to the opinions of the top-level CXOs, government initiatives to spread awareness of the benefits of family planning & birth control and prevention of unplanned pregnancy are expected to play a major role in the growth of the intrauterine devices market. Advancements in hormonal intrauterine devices & methods for the development of products with enhanced efficiency & fewer side effects and an increase in the use of contraceptive drugs & devices further boost the market growth. Moreover, hormonal intrauterine devices have piqued the interest of healthcare providers, due to the benefits offered by these devices along with higher efficiency to prevent unwanted pregnancy. However, the lack of reimbursement policies and the high cost of new hormonal intrauterine devices hamper the market growth. Currently, the hormonal intrauterine devices segment garners the highest revenue share in the intrauterine devices market.

Hospitals accounted for a significant share of the market, owing to rise in a number of patients visit for family planning. In addition, intrauterine device manufacturers have focused on marketing novel intrauterine devices for household users through various media such as television, the internet, and others.

The use of the hormonal contraceptive systems is highest in the Asia Pacific, owing to the rise in awareness about the benefits of using hormonal Intrauterine devices and favorable regulatory scenarios. Although the use of intrauterine devices in Europe and LAMEA is low, the adoption rate is expected to increase in the future, owing to the adoption of intrauterine device in these regions for unwanted pregnancies.

$2,992.73 million is the estimated industry size of Intrauterine Devices in 2021.

$4,374.3 million is the estimated industry size of Intrauterine Devices in 2030

No, value chain analysis is provided in the Intrauterine Devices market report

The upcoming trends in the Intrauterine Devices Market are an increase in the number of unplanned & unintended pregnancies, a surge in the number of unsafe abortion, and rise in awareness regarding use of device. In addition, an upsurge in demand for intrauterine devices, an initiative taken by the government, and key payers in the R&D sector to develop advanced devices contribute to the growth of the market.

The base year for the report is 2021

The forecast period in the report is from 2022 to 2031

AbbVie Inc. (Allergan Plc), Bayer AG, Cooper Companies Inc, and DKT International are the top companies to hold the market share in Intrauterine Devices.

The Asia Pacific is the largest regional market for intrauterine devices

Loading Table Of Content...