The global Intravenous Therapy and Vein Access Market size was valued at $22.8 billion in 2020 and is projected to reach $37.5 billion by 2030, growing at a CAGR of 5.1% from 2021 to 2030. Intravenous (IV) therapy is the process of infusion of liquid substances such as electrolytes, medicines, nutrition, and blood-based products directly into the veins as a therapeutic treatment. IV therapy-based treatment is the fastest way of delivering fluids to different parts of the body. This treatment is used for diseases, including heart attack, stroke, and poisoning. The patient in such cases should receive medication at the earliest, and hence IV medication is prescribed. Therefore, some of the drugs prescribed intravenously include chemotherapy drugs antibiotics, antifungal drugs, pain medications, immunoglobulin medication, and drugs for low blood pressure. IV therapy works fast, is easy to monitor, and prevents side effects to the gastrointestinal system. provides quick immune system response and relief from chronic diseases compared to the oral mode of medication. can be easily monitored and comprises an infusion pump that controls the volume of a substance to be administered in the body.

The Intravenous Therapy and Vein Access Market trends include a rise in the incidence of chronic diseases, growth in road accidents, and a surge in trauma cases. In addition, an increase in healthcare expenditure and healthcare insurance are expected to fuel the Intravenous Therapy and Vein Access Market growth during the forecast period. However, the lack of experienced healthcare professionals restricts the market growth. Conversely, the rise in critical care therapies and the increase in the geriatric population are the key factors that provide Intravenous Therapy and Vein Access Market opportunity.

Furthermore, an increase in the number of approved IV drugs that are used for therapy drives the growth of the market. For instance, according to the journal of New England Journal of Medicine (NEJM), the Artesunate injection was approved by Food and Drug Administration (FDA) in June 2020 for the treatment of malaria.

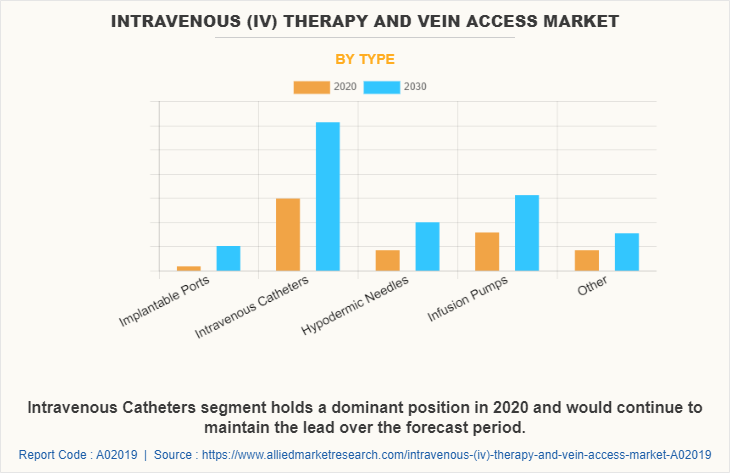

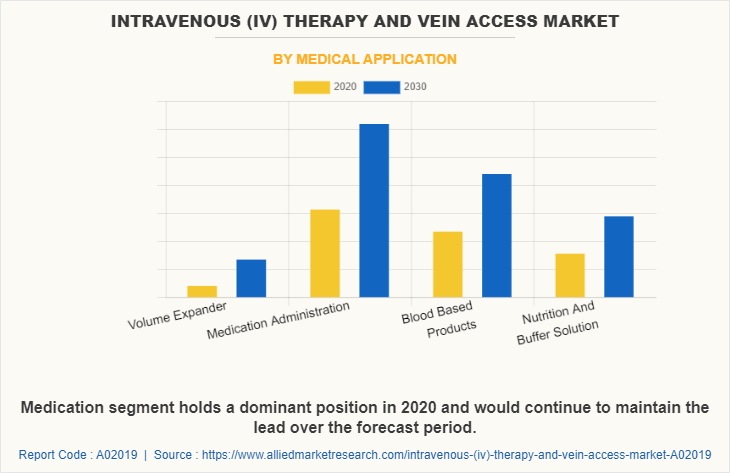

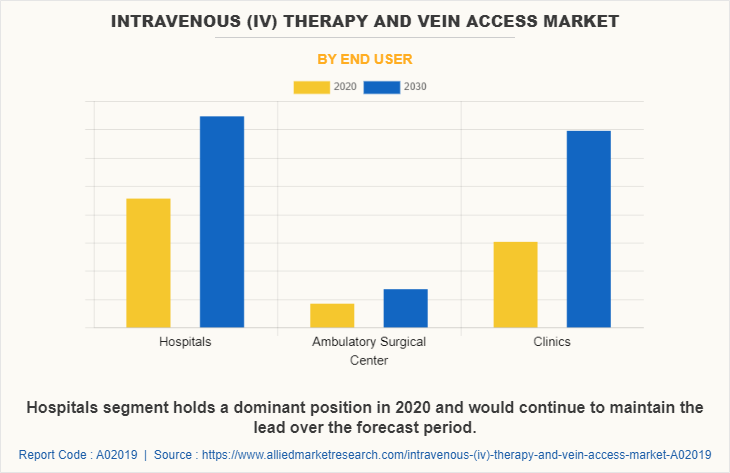

The Intravenous Therapy and Vein Access Market is segmented on the basis of type, medical application, and region. Depending on the type, the market is classified into implantable ports, IV catheters, hypodermic needles, infusion pumps, and others. According to medical application, the market is categorized into volume expanders, medication administration, blood-based products, and nutrition & buffer solutions. As per end-user, the market is fragmented into hospitals, ambulatory surgical centers, and clinics. Region-wise, the Intravenous Therapy and Vein Access Market analysis is done across North America, Europe, Asia-Pacific, and LAMEA.

By Type Segment Review

According to type, the Vein Access Industry market is classified into implantable ports, IV catheters, hypodermic needles, infusion pumps, and others. The IV catheters are the fastest growing product segment. The growth of the IV catheter market is fueled by rising in the use of IV catheters during surgical procedures for IV therapies and during the transfer of blood, medicine, and other nutrients to different parts of the body are the key factors driving the growth of the market.

By Medical Application Segment Review

According to medical applications, the Intravenous Therapy and Vein Access Market market is classified into volume expanders, medication administration, blood-based products, and nutrition & buffer solutions. The medication administration segment held the highest market share, owing to the high usage of IV therapy for transferring medicines for diseases such as diabetes, and cancer.

By End-User Segment Review

As per end-user, the Intravenous Therapy Industry is fragmented into hospitals, ambulatory surgical centers, and clinics. The hospital segment held the highest market share, owing to an increase in the number of surgeries performed compared to ambulatory surgical centers and clinics.

By Region Segment Review

Region-wise, the IV therapy & vein access market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America was the highest Intravenous Therapy and Vein Access Market share in 2020, owing to an increase in the pool of patient population, a rise in prevalence of road accidents, the surge in trauma cases, and an increase in government investments in the development of better healthcare facilities and R&D activities.

The key players operating in the global IV therapy & vein access market include Becton, Dickinson & Company, Braun Melsungen AG, Terumo medical corporation, Teleflex Medical Inc., Medtronic Inc., Angiodynamic, Inc.., Smith& Nephew Plc., Pfizer Inc., Insulet Corporation, and Fresenius SE& CO. KGAA.

The other players (the profiles of these players are not covered in the report) in the value chain include Baxter International Inc., iRadimed Corporation, BioScrip, Inc., Grifols, S.A., JW Life Science Co. Ltd., BRIEF-Sichuan Kelun Pharmaceutical Co. Ltd., CVS Health Corporation, and Vifor Pharma Group.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the intravenous (iv) therapy and vein access market analysis from 2020 to 2030 to identify the prevailing intravenous (iv) therapy and vein access market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the intravenous (iv) therapy and vein access market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global intravenous (iv) therapy and vein access market trends, key players, market segments, application areas, and market growth strategies.

Intravenous (IV) Therapy and Vein Access Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Medical Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Teleflex, smiths medical, Medtronic Inc, Cardinal Health Inc., Fresenius SE and Co. KGaA., terumo corporation, Pfizer Inc, Baxter international plc, AngioDynamics, Inc., B. Braun Melunsung |

Analyst Review

According to CXOs, utilization of intravenous (IV) therapy and vein access is expected to witness a significant rise across the globe, owing to increase in prevalence of chronic disease such as diabetes, cardiovascular disease, autoimmune disorder and rise in geriatric population. IV therapy is the process of infusion of liquid substances such as electrolytes, medicines, nutrition, and blood-based products directly into the veins as a therapeutic treatment.

The key factors that drive the growth of IV therapy and vein access devices market include rise in incidence & prevalence of chronic diseases, growth in road accidents, and surge in trauma cases. In addition, increase in healthcare expenditure and healthcare insurance is expected to fuel the market growth during the forecast period. However, lack of experienced healthcare professionals restricts the market growth. On the contrary, rise in critical care therapies along with increase in geriatric population are the key factors driving the growth of market.

Furthermore, increase in adoption of IV therapy & vein access products and surge in number of approvals IV drugs used for therapy are the key factors driving the growth of market. For instance, the Artesunate injection was approved by Food and Drug Administration (FDA) on June 2020 for treatment of malaria.

North Aerica is the largest regional market for Intravenous (IV) Therapy and Vein Access

The top key players operating in the global IV therapy & vein access market include Becton, Dickinson & Company, Braun Melsungen AG, Terumo medical corporation, Teleflex Medical Inc., Medtronic Inc., Angiodynamic, Inc.., Smith& Nephew Plc., Pfizer Inc., Insulet Corporation, and Fresenius SE& CO. KGAA.

The Upcoming trends that drive the growth of the IV therapy and vein access devices market include a rise in incidence & prevalence of chronic diseases, growth in road accidents, and surge in trauma cases. In addition, an increase in healthcare expenditure and healthcare insurance is expected to fuel the market growth during the forecast period. However, the lack of experienced healthcare professionals restricts the market growth. Conversely, the rise in critical care therapies and increase in the geriatric population is the key factor driving the growth of market.

The Intravenous (IV) Therapy and Vein Access market was valued at $22,808.93 million in 2020

The total market value of Intravenous (IV) Therapy and Vein Access Market is $37,537.18 million by 2030

No, there is no value chain analysis provided in the Intravenous (IV) Therapy and Vein Access Market Market report

Loading Table Of Content...