Intravenous Immunoglobulin Market Overview:

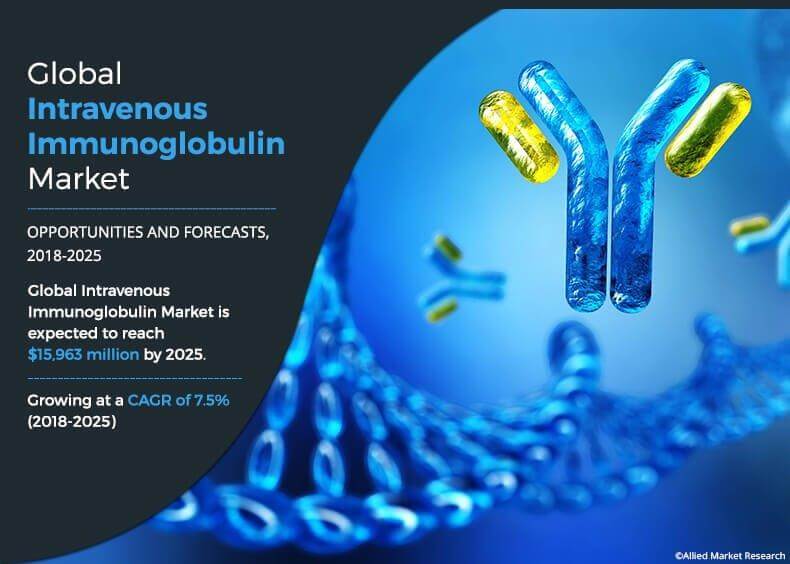

The global intravenous immunoglobulin market was valued at $8,995 million in 2017, and is projected to reach $15,964 million by 2025, registering a CAGR of 7.5% from 2018 to 2025. Immunoglobulins (IGs) are glycoproteins produced in the blood plasma in response to antigens, which are foreign to the host system. They are highly complex entities and specific in their action. They are obtained from blood by fractionation process and purified for therapeutic and nontherapeutic applications. Different classes of immunoglobulin such as IgG, IgA, and IgM are used for the treatment of various immunological and neurological diseases.

The major factors driving the growth of the intravenous immunoglobulin market includes significant rise in geriatric population & number of hemophilic patients, improved technologies pertaining to the immunoglobulin production, and enhanced purification techniques (with better plasma yield). Furthermore, surge in prevalence diseases such as chronic inflammatory demyelinating polyneuropathy (CIDP), hypogammaglobulinemia, and others is expected to boost the market growth. However, stringent government regulations toward the use of intravenous immunoglobulin products and high risk of side effects associated with them are expected to hamper the growth of the market. On the contrary, high adoption of intravenous immunoglobulins for the treatment of various diseases is expected to create lucrative opportunities in the near future.

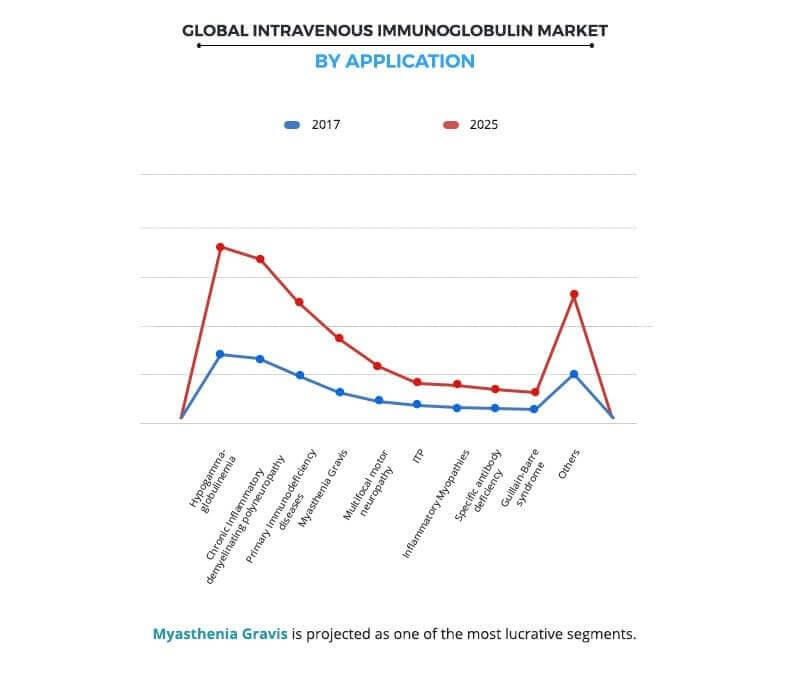

Application segment review

Based on application, the global intravenous immunoglobulin market is divided into hypogammaglobulinemia, chronic inflammatory demyelinating polyneuropathy, immunodeficiency diseases, myasthenia gravis, multifocal motor neuropathy, idiopathic thrombocytopenic purpura, inflammatory myopathies, specific antibody deficiency, Guillain-Barre syndrome, and others. The hypogammaglobulinemia segment was the highest contributor to the market in 2017, and is anticipated to maintain its dominance throughout the forecast period. This is attributed to the significant rise in the prevalence of hypogammaglobulinemia disorder across the globe over the years. For instance, hypogammaglobulinemia is the most common chronic immune defect in patients with lymphoproliferative disorders (LPDs). Its incidence rate is ~2 per 100,000 population yearly, globally.

Region segment review

Based on region, the intravenous immunoglobulin market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America is the largest contributor toward the global market, followed by Asia-Pacific. These regions collectively occupy almost 75% of the global market revenue. Presence of the largest plasma production facilities and high adoption rate in the developed countries majorly boost the market growth. However, LAMEA is projected to register the highest growth rate during the forecast period.

The report provides extensive competitive analysis and profiles of key market players that includes Baxter international Inc., CSL Ltd., Grifols S.A, Octapharma AG, Kedrion Biopharma Inc., LFB group, Biotest AG, China Biologics Products, Inc., Takeda Pharmaceuticals, and Bayer Healthcare.

Other players in the value chain include Hualan Biological Engineering Inc., Omrix Biopharmaceuticals Ltd., Behring GmbH, Shanghai RAAS Blood Products Co., Ltd., Option Care Enterprises, Inc., ADMA Biologics, Inc., and BioScrip, Inc.

Key Benefits for Intravenous Immunoglobulin Market:

- The study provides an in-depth analysis of the global intravenous immunoglobulin market with the current trends and future estimations to elucidate the imminent investment pockets.

- A comprehensive analysis of the factors that drive and restrict the market growth is provided.

- A comprehensive quantitative analysis of the industry is provided from 2018 to 2025 to assist stakeholders to capitalize on the prevailing market opportunities.

- An extensive analysis of the key segments of the industry helps to understand the trends in the global allergy treatment market.

- Key players and their strategies are provided to understand the competitive outlook of the industry.

Intravenous Immunoglobulin (IVIG) Market Report Highlights

| Aspects | Details |

| By APPLICATION |

|

| By PRODUCT |

|

| By Region |

|

| Key Market Players | CSL LIMITED, BIOTEST AG, KEDRION BIOPHARMA INC., BAXTER INTERNATIONAL INC., LFB SA (LFB BIOTECHNOLOGIES SAS), TAKEDA PHARMACEUTICAL COMPANY LIMITED, GRIFOLS S.A., BAYER AG, CHINA BIOLOGIC PRODUCTS, INC., OCTAPHARMA AG |

Analyst Review

Intravenous immunoglobulin (IVIG) is widely being used for the treatment of deficiency disorders such as hypogammaglobulinemia, Kawasaki disease, multifocal motor neuropathy, and chronic inflammatory demyelinating polyneuropathy. Rise in immunoglobulin deficiency and disorders such as hypogammaglobulinemia, myasthenia gravis, and others drives the use of immunoglobulins in clinical settings globally. GAMUNEX-C, Flebogamma DIF 5% & 10%, Gammaplex, and Kiovig are the key regulated products approved for use in therapy settings. Several off-label products are available in the market that include Gammagard Liquid intravenous, Gammagard S/D intravenous, and Bivigam intravenous.

The intravenous immunoglobulin market is an oligopolistic market, as it is dominated by prominent players such as Grifols, CSL, Takeda Pharmaceuticals Baxter International, and Octapharma. In addition, these companies have a strong hold in the blood fractionation industry, and hence play a key role in determining the cost of blood product commodities such as albumin, fibrinogen, and other plasma entities.

The administration of immunoglobulins is the highest in North America, owing to increase in adoption of immunoglobulin products, rise in awareness toward the benefits of using immunoglobulin therapies among healthcare providers, and increase in disposable income. Although the use of immunoglobulin in LAMEA is low, the adoption rate is expected to increase due to rise in disposable income, surge in healthcare expenditure, and government initiative to enhance the healthcare departments. These aforementioned factors significantly contribute toward the growth of the market.

Loading Table Of Content...