Inventory Management Software Market Research, 2032

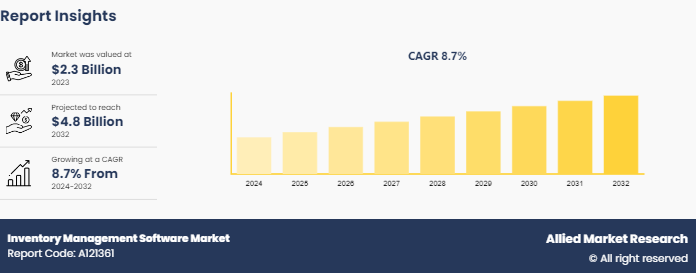

The global inventory management software market was valued at $2.3 billion in 2023, and is projected to reach $4.8 billion by 2032, growing at a CAGR of 8.7% from 2024 to 2032. The global inventory management software market is experiencing growth due to several factors such as surge in adoption of business process automation for seamless inventory control and monitor changing supply costs, recalculate stock levels, and have a knowledge of the whole process.

Market Introduction and Definition

The inventory management software includes solutions designed to track, manage, and optimize the storage, ordering, and use of inventory, ensuring that businesses maintain optimal stock levels while minimizing costs and inefficiencies. These software solutions integrate advanced technologies such as artificial intelligence (AI) , the Internet of Things (IoT) , and blockchain to provide real-time data, predictive analytics, and seamless automation. They are crucial for various industries, including retail, manufacturing, healthcare, and logistics, where efficient inventory management is vital for operational success. The market has witnessed substantial growth due to the increase in complexity of supply chains and the rise in demand for automated, digital solutions that enhance accuracy and efficiency. Inventory management software helps maintain the delicate balance between supply and demand, reduces waste, prevents stockouts, and improves overall customer satisfaction as businesses strive to meet consumer demands swiftly and cost-effectively. The integration of cloud-based solutions further accelerates market growth, providing scalability, flexibility, and accessibility. Consequently, the inventory management software market is poised for continued expansion, driven by technological advancements and the ever-increasing need for precise inventory control in a competitive global market.

Key Takeaways

The inventory management software industry study covers 20 countries. The research includes a segment analysis of each country in terms of value ($million) for the projected period.

More than 1,500 product literature, industry releases, annual reports, and other such documents of major inventory management software industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key market dynamics

The global inventory management software market size is experiencing growth due to several factors such as the increasing complexity of supply chains and the rising adoption of e-commerce platforms that require efficient inventory tracking and management. The integration of advanced technologies like artificial intelligence (AI) , the Internet of Things (IoT) , and blockchain enhances the capabilities of inventory management solutions, making them more attractive to businesses seeking to optimize their operations. However, the high cost of software and services, along with increasing security concerns, restrain market development. In addition, the market faces challenges related to the implementation and training costs associated with these advanced systems. Despite these challenges, the surge in trend toward cloud-based solutions and ongoing strategies for innovative investments in developing countries provide ample opportunities during the inventory management software market forecast period.

The inventory management software market growth is driven by the need for streamlined operations across various industries, including retail, manufacturing, and healthcare. Leading players such as SAP SE, Oracle Corporation, and Microsoft Corporation offer comprehensive suites of software solutions tailored to manage various aspects of inventory operations, including real-time tracking, predictive analytics, and supply chain optimization. Cloud-based solutions have gained popularity due to their flexibility, scalability, and cost-effectiveness. Moreover, the COVID-19 pandemic has further accelerated the adoption of digital technologies to enhance operational efficiency and ensure business continuity.

PESTLE Overview: Global Inventory Management Software Market

Although the growth of the inventory management software market size has been rapid in recent years, the industry is influenced by a range of political, socioeconomic, and legal factors. The inventory management software market benefits from supportive government policies promoting digitalization and automation across industries. Economically, the growing e-commerce sector and the need for efficient supply chain management drive market growth, though high implementation costs can be a barrier for some businesses. Socially, the increasing consumer demand for fast, accurate order fulfillment boosts the adoption of advanced inventory solutions. Technologically, innovations such as AI, IoT, and blockchain enhance software capabilities, making inventory management more efficient and appealing to businesses. Environmentally, the emphasis on sustainable practices and reducing waste encourages companies to adopt inventory management solutions that optimize resource use. Legally, stringent regulations related to data security and privacy pose challenges but also drive improvements in software security features. In addition, compliance with international trade regulations impacts the global deployment of these solutions. Overall, while challenges such as high costs and security concerns exist, the market is poised for growth due to supportive political environments, economic demands for efficiency, technological advancements, social shifts towards quicker service expectations, environmental sustainability efforts, and evolving legal frameworks.

Market Segmentation

The inventory management software market is segmented into deployment mode, application, enterprise size, industry vertical, and region. On the basis of deployment mode, the market is divided into on-premise and cloud. On the basis of application, the market is divided into inventory control and tracking, order management, scanning and barcoding, asset management, and others. As per enterprise size, the market is bifurcated into large enterprises and small and medium enterprises (SMEs) . On the basis of industry vertical, the market is categorized into manufacturing, retail and consumer goods, healthcare and life sciences, energy and utilities, automotive, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The North America inventory management software market share is set to experience significant growth during the forecast period. This region, which held the highest market share in 2023, is expected to continue dominating the global market. Several factors contribute to this outlook. The presence of major market players, such as Oracle Corporation, Microsoft Corporation, and SAP SE, drives innovation and adoption of advanced inventory management solutions. In addition, the widespread adoption of e-commerce and the need for efficient supply chain management in industries like retail, manufacturing, and healthcare fuel demand for these software solutions. Technological advancements, particularly the integration of AI, IoT, and blockchain, enhance the capabilities of inventory management software, making it more attractive to businesses. The aging population in North America, particularly the baby boomer generation, increases the demand for healthcare services and products, necessitating efficient inventory management to handle medical supplies and equipment. Moreover, North American businesses are continuously innovating to meet evolving consumer needs, offering personalized customer experiences, self-service options, and advanced analytics for inventory optimization. Despite challenges such as high implementation costs and data security concerns, the market is expected to grow due to the increasing trend toward cloud-based solutions, which offer flexibility, scalability, and cost-effectiveness. Furthermore, ongoing strategies for innovative investments, particularly in developing sectors, provide additional opportunities for market expansion. Overall, the North America inventory management software market is poised for robust growth, driven by technological advancements, strong market player presence, and increasing demand for efficient inventory. The size and diversity of the market create opportunities for software providers to offer specialized solutions tailored to different segments and niches.

In September 2023, Afresh Technologies announced the launch of its inventory management solution. The Afresh platform transforms ordering and inventory management across grocers' fresh departments with solutions purpose-built for the complexities of fresh food. With Afresh, teams save time and increase accuracy using intelligent apps that allow multiple users to take inventory simultaneously and alert users in real time of suspected errors. Corporate teams also gain access to a web portal to review automatically generated, store-specific inventory guides and validate ending inventory results. In addition, customers have seen an average of 31% time savings on their next order after taking ending inventory.

In February 2024, Cloud software company Zoho, launched a new point of sale (POS) solution brand Zakya for small and medium retail businesses to streamline their day-to-day operations and easily monitor them from one place. The solution, according to Zoho, can be implemented in under an hour for businesses with thousands of items in inventory. Zakya includes POS billing app which also allows retail stores to bill even when used offline. During peak hours, sales personnel can use the Zakya POS billing app to parallelly bill customers and shorten the checkout queue.

Industry Trends:

In April 2024, AvanSaber launched a new inventory management system, StockVR. This technology combines the capabilities of virtual reality (VR) and augmented reality (AR) to offer businesses an approach to managing their stock. With its immersive interface, the StockVR platform allows users to virtually access warehouse spaces, inspect products up close, and monitor stock levels with accuracy. One of the features of StockVR is its ability to integrate with existing inventory systems, ensuring a smooth transition for businesses looking to adopt VR and AR solutions.

In July 2023, Trimble announced the launch of LIMS PRO, a new cloud-hosted version of its widely used Log Inventory and Management System (LIMS) to manage sawmill raw material procurement. As a cloud-based log settlement solution, LIMS PRO is designed to improve operational visibility for mills. It enables small- and medium-sized forest product companies to realize productivity and growth gains that only large companies have historically been able to afford by digitizing lumber supply chain workflows. In addition, this robust business management software streamlines contracts, receiving, inventory and settlement processes into a single platform, providing forestry companies with a complete picture of their operations.

Competitive Landscape

The major players operating in the inventory management software market include Zoho Corporation Pvt. Ltd., IBM Corporation, Oracle Corporation, Lightspeed, CIN7 Ltd., Linnworks, and Brightpearl. Other players in the inventory management software market include Intuit Inc., Acumatica, Inc., Fishbowl, and others.

Recent Key Strategies and Developments

In June 2023, E-commerce enablement Software as a Service (SaaS) platform Unicommerce launched its advanced inventory management solution with real-time inventory synchronization. In addition, the solution enables the rerouting of unfulfilled orders by automatically reallocating the orders to next warehouse or store basis real-time availability of inventory across multiple stores and warehouses. Furthermore, it offers brand the option to pre-compute the availability of bundled stocks per facility to boost the fulfillment rate of bundled orders, improve product procurement and ensure advance order placement and optimize inventory available across multiple facilities.

In September 2023, Afresh Technologies, the world's leading fresh food technology company, announced the launch of its inventory management solution. The Afresh platform transforms ordering and inventory management across grocers' fresh departments with intelligent and connected solutions purpose-built for the complexities of fresh food. Afresh inventory management minimizes the time and cost of taking ending inventory for customers like Fresh Thyme and Heinen's, delivering accurate financials while pairing seamlessly with Afresh store ordering to save teams time and drive higher profits.

Key Sources Referred

National Retail Federation (NRF)

Supply Chain Management Association (SCMA)

Council of Supply Chain Management Professionals (CSCMP)

American Production and Inventory Control Society (APICS)

Material Handling Industry of America (MHIA)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the inventory management software market analysis from 2024 to 2032 to identify the prevailing inventory management software market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the inventory management software market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global inventory management software market trends, key players, market segments, application areas, and market growth strategies.

- The study provides an in-depth analysis of the global inventory management software market forecast along with current & future trends to explain the imminent investment pockets.

Inventory Management Software Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 4.8 Billion |

| Growth Rate | CAGR of 8.7% |

| Forecast period | 2024 - 2032 |

| Report Pages | 200 |

| By Deployment Mode |

|

| By Application |

|

| By Enterprise Type |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Lightspeed, Intuit Inc., Acumatica, Inc., Zoho Corporation Pvt. Ltd., CIN7 Ltd., Brightpearl, Fishbowl, IBM Corporation, Oracle Corporation, Linnworks |

The inventory management software Market is estimated to grow at a CAGR of 8.7% from 2024 to 2032.

The inventory management software Market is projected to reach $4.8 billion by 2032.

The inventory management software Market is expected to witness notable growth due to several factors such as surge in adoption of business process automation for seamless inventory control and monitor changing supply costs, recalculate stock levels, and have a knowledge of the whole process.

The key players profiled in the report include Intuit Inc., Acumatica, Inc., Fishbowl, Zoho Corporation Pvt. Ltd., IBM Corporation, Oracle Corporation, Lightspeed, CIN7 Ltd., Linnworks, and Brightpearl.

The key growth strategies of inventory management software Market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...