Investment Banking Market Research, 2032

The global investment banking market was valued at $78.9 billion in 2022, and is projected to reach $213.6 billion by 2032, growing at a CAGR of 10.8% from 2023 to 2032.

Investment banking refers to a specialized sector within the financial industry that focuses on providing a range of financial services to corporations, institutions, and governments. Investment banks primarily act as intermediaries between companies seeking capital and investors looking to deploy their funds. They offer a wide array of services, including underwriting securities offerings, facilitating mergers and acquisitions, providing financial advisory services, conducting market research and analysis, and managing risk. Investment banks play a crucial role in raising capital for businesses through activities such as initial public offerings (IPOs), bond issuances, and syndicated loans.

They also provide strategic advice and expertise in complex financial transactions, assisting clients in making informed decisions about their corporate strategies, capital structure, and potential investments. Investment banking involves a combination of financial analysis, transaction execution, relationship management, and industry knowledge to support clients in achieving their financial goals and navigating the complexities of the global financial markets.

The investment banking market is driven by global economic growth and increasing market activity which propels the demand for investment banking services as businesses seek capital for expansion, mergers, and acquisitions. In addition, technological advancements and digital transformation in the financial sector serve as another driver, enabling investment banks to streamline processes, improve efficiency, and expand their reach. Furthermore, the growing demand for capital raising, mergers and acquisitions, and financial advisory services fuels the need for investment banking expertise.

However, the investment banking market also faces restraints such as regulatory constraints and compliance requirements, which impose strict rules and increase operational costs. Furthermore, intense competition and investment banking market saturation are further challenges as investment banks strive to differentiate themselves in the competitive landscape. On the contrary, an opportunity for investment banking lies in expanding into emerging markets with untapped potential and growing economies. These emerging markets in developing countries provide avenues for revenue diversification, accessing new client bases, and participating in infrastructure development projects.

The report focuses on growth prospects, restraints, and trends of the investment banking market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the investment banking market.

Segment Review

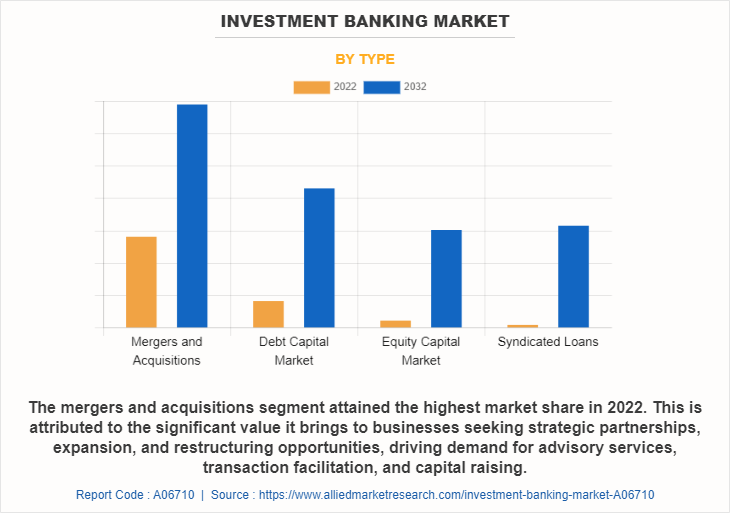

The investment banking market size is segmented on the basis of type, enterprise size and region. On the basis of type, the investment banking market is bifurcated into mergers and acquisitions, debt capital market, equity capital market, and syndicated loans. On the basis of enterprise size, it is bifurcated into large enterprises and small and medium-sized enterprises. On the basis of region, it is analysed across North America, Europe, Asia-Pacific, and LAMEA.

Based on type, the mergers and acquisitions segment attained the highest market share in the investment banking industry in 2022. This can be attributed to the increasing number of corporate mergers, acquisitions, and strategic partnerships globally. Furthermore, companies are seeking to expand their operations, consolidate market share, and diversify their portfolios through M&A activities. Thus, the investment banks play a vital role in facilitating these transactions, providing financial advisory services, conducting due diligence, and structuring deals. On the other hand, the syndicated loans segment is expected to be the fastest growing segment in the investment banking market during the forecast period. This projected growth can be attributed to the fact that syndicated loans offer companies a convenient way to raise large amounts of capital for diverse purposes such as expansion, refinancing, and working capital. With the global economy recovering from the COVID-19 pandemic, companies are increasingly seeking financing options to fuel their growth plans.

Syndicated loans provide a flexible and efficient financing solution, attracting both corporate borrowers and institutional lenders. In addition, technological advancements and digital platforms have simplified the syndication process, making it more accessible and cost-effective. Therefore, these factors, along with the rising demand for capital infusion, are expected to drive the growth of the syndicated loans segment in the investment banking market share.

Based on region, North America attained the highest market share in 2022 and emerged as the leading region in the investment banking market. This can be attributed to the fact that North America, particularly the U.S., has a well-established and mature financial sector, with prominent financial centers like Wall Street in New York City. The region benefits from a robust economy, a favorable regulatory environment, and deep capital markets, which attract a significant volume of investment banking activities.

Furthermore, North America is home to numerous multinational corporations, driving demand for investment banking services such as capital raising, M&A transactions, and financial advisory. On the other hand, the Asia-Pacific region is projected to be the fastest-growing region for the investment banking market during the forecast period. This growth can be attributed to the fact that Asia-Pacific region is witnessing rapid economic growth, fueled by emerging markets like China, India, and Southeast Asian countries. These economies are experiencing expanding middle-class populations, rising disposable incomes, and increasing capital market activities, creating opportunities for investment banking services. In addition, government initiatives aimed at attracting foreign investments, infrastructure development projects, and financial market reforms contribute to the region's growth potential in the investment banking market.

The report analyzes the profiles of key players operating in the Investment banking market such as Bank of America Corporation, Barclays, Citigroup Inc., Credit Suisse, Deutsche Bank AG, Goldman Sachs, HSBC Group, JPMorgan Chase & Co, Morgan Stanley., and UBS. These players have adopted various strategies to increase their market penetration and strengthen their position in the investment banking market.

Market Landscape and Trends

The investment banking market offers a dynamic and competitive landscape with several market trends. There is a growing emphasis on technology and digital transformation within the industry. Investment banking policies offered by bamks are leveraging advancements such as artificial intelligence, machine learning, and automation to streamline processes, enhance operational efficiency, and deliver innovative solutions to clients. This trend is driven by the need for faster, more accurate data analysis, improved risk management, and enhanced client experiences. Another prominent trend is the increasing focus on sustainable and responsible investment practices. Environmental, social, and governance (ESG) considerations are gaining significance, prompting investment banks to incorporate ESG factors into their investment strategies and advisory services. This shift is driven by evolving investor preferences, regulatory requirements, and a broader recognition of the importance of sustainability in long-term value creation.

Furthermore, the investment banking market is witnessing a rise in cross-border transactions and international expansion. Globalization has facilitated increased cross-border capital flows, mergers, and acquisitions, creating opportunities for investment banks to provide advisory services and facilitate complex cross-border transactions. Moreover, regulatory compliance remains a significant focus within the investment banking sector. Regulatory bodies continue to enhance and enforce regulations to ensure transparency, mitigate systemic risks, and protect investors. Investment banks must navigate evolving regulatory landscapes, implement robust compliance frameworks, and invest in sophisticated risk management systems to maintain compliance and mitigate legal and reputational risks, such factors drive the investment banking service.

Top Impacting Factors

Global Economic Growth and Increasing Market Activity

One of the key drivers of the investment banking market is global economic growth. As economies expand, businesses seek capital for expansion, mergers and acquisitions, and other financial transactions. This heightened market activity creates a favorable environment for investment banking services. Furthermore, growing economies typically experience increased demand for investment banking services, such as underwriting securities, facilitating corporate finance transactions, and providing financial advisory services. Investment banks play a crucial role in connecting businesses with investors, facilitating capital flows, and supporting economic growth in investment banking domain. Therefore, economic growth and increasing market activities are a major driving factor for the investment banking market growth.

Technological Advancements and Digital Transformation in the Financial Sector

The industry is undergoing a significant transformation due to advancements in technology. Digital innovations have revolutionized financial services, enabling faster, more efficient, and cost-effective transactions. Thus, investment banks are leveraging technologies like artificial intelligence, machine learning, and automation to streamline processes, enhance risk management, and provide personalized services to clients. In addition, digital platforms and online trading have democratized access to financial markets, attracting a broader customer base. These technological advancements enable investment banks to deliver innovative products and services, improve operational efficiency, and expand their reach, thereby driving the investment banking market demand.

Growing Demand for Capital Raising, Mergers and Acquisitions, and Financial Advisory Services

Investment banks play a vital role in facilitating capital raising activities, mergers, and acquisitions (M&A), and providing financial advisory services to corporations. Investment banks assist in underwriting securities offerings, issuing bonds, or arranging syndicated loans as businesses seek funding for expansion or strategic initiatives in investment banking companies. The increase in complexity of financial transactions and the need for specialized expertise in areas such as valuation, due diligence, and negotiations drive the demand for investment banking services. Furthermore, mergers and acquisitions are another significant drivers as companies engage in consolidation activities to gain market share, expand into new geographies, or diversify their operations. Investment banks provide advisory services, facilitate negotiations, and help structure and execute M&A transactions, driving the demand for their expertise driving the investment banking adoption.

Regulatory Constraints and Compliance Requirements

The investment banking industry operates within a highly regulated environment, governments and regulatory bodies impose strict rules to ensure transparency, protect investors, and maintain the stability of financial markets. Therefore, compliance with regulations such as anti-money laundering (AML), know-your-customer (KYC), and various securities laws can be complex and resource-intensive for investment banks. These regulatory constraints and compliance requirements pose challenges and increase operational costs for investment banking firms, thereby hampering market growth.

Intense Competition and Market Saturation

The investment banking market is characterized by intense competition among established players and the emergence of new entrants. Large global investment banks, regional players, and boutique firms all compete for market share and lucrative deals. Therefore, the industry's competitive landscape is continually evolving, with firms seeking to differentiate themselves by offering specialized services, industry expertise, or leveraging technological advancements. The intense competition and market saturation can limit the revenue growth potential for investment banks, particularly in mature markets. Therefore, firms must continually adapt, innovate, and differentiate their offerings to maintain a competitive edge in the investment banking market outlook.

Expansion into Emerging Markets with Untapped Potential and Growing Economies

Investment banking firms have numerous opportunities by expanding into emerging markets. These markets often have significant growth potential, rising middle-class populations, and increasing capital market activities. Emerging economies present opportunities for investment banks to offer their expertise in capital raising, financial advisory services, and supporting local businesses' expansion plans. As these economies mature and their regulatory frameworks develop, investment banking services become more sought after. Therefore, expanding into emerging markets allows investment banks to capture new revenue streams, diversify their client base, and capitalize on the growth prospects offered by these economies. In addition, investment banks can leverage their global presence and network to establish a strong foothold in emerging markets. The investment banking challenge lies in navigating complex financial markets while delivering innovative solutions for clients, amidst increasing regulatory pressures and market volatility. Furthermore, by expanding their operations and services into these regions, investment banks can enhance their competitive advantage and gain a first-mover advantage over their competitors in investment banking companies.

Report Coverage & Deliverables

Type Insights

The report explores various types of investment banking services, including advisory services, underwriting, mergers & acquisitions, and capital raising. It provides a comprehensive analysis of each type and its role in driving market demand.

Technology Insights

Examines the role of technology in investment banking growth, focusing on digital transformation, AI-driven analytics, blockchain, and automation. The analysis highlights how these innovations enhance operational efficiency and customer experience, driving market expansion.

Application Insights

Analyzes the investment banking share across different applications such as corporate finance, wealth management, and trading. It provides insights into the growing demand for customized financial solutions across various sectors.

Regional Insights

Offers a detailed examination of investment banking value across regions, including North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. The report highlights regional market size, growth trends, and key economic drivers shaping the investment banking landscape.

Key Companies & Market Share Insights

Provides a comprehensive overview of major players in the investment banking market, including their market share, strategic initiatives, and recent developments. It analyzes how top companies maintain competitive positioning in a rapidly evolving industry.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the investment banking market forecast from 2023 to 2032 to identify the prevailing investment banking market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the investment banking market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global investment banking market trends, key players, market segments, application areas, and market growth strategies.

Investment Banking Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 213.6 billion |

| Growth Rate | CAGR of 10.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 234 |

| By Type |

|

| By Enterprise Size |

|

| By Region |

|

| Key Market Players | Credit Suisse Group, Deutsche Bank AG, Barclays PLC, UBS AG, HSBC Group, Morgan Stanley, Goldman Sachs Group, JPMorgan Chase & Co, BANK OF AMERICA CORPORATION, Citigroup Inc. |

Analyst Review

The investment banking market is a dynamic and highly competitive sector within the financial industry. It encompasses various financial services such as capital raising, mergers and acquisitions, advisory services, and trading activities. Market conditions in investment banking are influenced by factors such as global economic trends, regulatory changes, technological advancements, and investor sentiment. In recent years, several growth trends have shaped the investment banking market such as the increasing globalization of economies has led to cross-border transactions and a rise in international mergers and acquisitions, creating opportunities for investment banks to provide advisory and financing services. Furthermore, the emergence of emerging markets, particularly in Asia-Pacific, has presented new growth avenues for investment banking activities, as these regions experience rapid economic development and increased capital market activities. Moreover, the continued integration of technology into investment banking operations has been a significant growth driver. Fintech innovations, such as online trading platforms, algorithmic trading, and blockchain technology, have transformed the way investment banks operate, enhancing efficiency, reducing costs, and expanding market access. In addition, sustainable finance and environmental, social, and governance (ESG) considerations have gained prominence in the investment banking market. There has been an increasing focus on socially responsible investing, green bonds, and sustainable investment products, driven by both investor demand and regulatory initiatives.

Furthermore, market players are adopting various strategies for enhancing their services in the market and improving customer satisfaction. For instance, on March 2023, The European Investment Bank (EIB) and state-owned Indian Renewable Energy Development Agency (IREDA) Limited are exploring a partnership on financing of renewable energy and green hydrogen projects in India. This collaboration will provide much-needed support for the development of Renewable Energy and Green Hydrogen projects in India, helping to open up new opportunities for the country’s citizens and advancing the Government of India’s goal of achieving 50% of its installed energy capacity from non-fossil fuels by the year 2030. These strategies by the market players operating at a global and regional level will help the market to grow significantly during the forecast period.

Some of the key players profiled in the report include Bank of America Corporation, Barclays, Citigroup Inc., Credit Suisse, Deutsche Bank AG, Goldman Sachs, HSBC Group, JPMorgan Chase & Co, Morgan Stanley., and UBS. These players have adopted various strategies to increase their market penetration and strengthen their position in the investment banking market.

The investment banking market offers a dynamic and competitive landscape with several market trends. There is a growing emphasis on technology and digital transformation within the industry. Investment banks are leveraging advancements such as artificial intelligence, machine learning, and automation to streamline processes, enhance operational efficiency, and deliver innovative solutions to clients.

North America is the largest regional market for investment banking market

The global investment banking market was valued at $78,920.51 million in 2022 and is projected to reach $ 213,572.57 million by 2032, growing at a CAGR of 10.8% from 2023 to 2032

Bank of America Corporation, Barclays, Citigroup Inc., Credit Suisse, Deutsche Bank AG, Goldman Sachs, HSBC Group, JPMorgan Chase & Co, Morgan Stanley., and UBS

Loading Table Of Content...

Loading Research Methodology...