Invisible Orthodontics Market Research, 2031

The global invisible orthodontics market Size was valued at $4.6 billion in 2021, and is projected to reach $34.7 billion by 2031, growing at a CAGR of 22.6% from 2022 to 2031. Orthodontics is a branch of dentistry that deals with the diagnosis, prevention, and correction of misaligned teeth and jaws. It involves the use of appliances, such as braces, to straighten teeth and correct the bite, or the way the teeth come together. Orthodontic treatment can address a wide range of dental issues, including crooked or crowded teeth, overbites and underbites, crossbites, and gaps between teeth. The most common orthodontic treatment involves the use of braces, which are typically made of metal or clear brackets that are attached to the teeth and connected by wires. Invisible orthodontics are of three types, clear braces, clear aligners and lingual braces.

Market Dynamics

Increased use of invisible orthodontics for cosmetic dentistry and rise in dental problems such as diastema, crowded teeth, open bites, crossbite, overbite, and underbite are anticipated to drive market expansion. In addition, increase in awareness of invisible orthodontics around the globe has surged its demand, therefore fueling the expansion of the market.

Increased aesthetic standards around the world is the reason for the ever-increasing demand for cosmetic dentistry, which has resulted in the widespread acceptance of invisible orthodontics. These treatments may include tooth whitening, porcelain veneers, dental bonding, crowns, implants, braces, and other orthodontic operations. A person's teeth and smile should look and perform better, which is the aim of aesthetic dental therapy. In addition, there have been significant technological breakthroughs in the invisible orthodontics business. This has resulted in the creation of new and improved invisible orthodontics devices, like clear aligners, lingual braces, and self-ligating braces, which are more aesthetically pleasing and pleasant than conventional metal braces. These improvements have also increased treatment efficiency, resulting in quicker treatment times and better accuracy. Furthermore, rise in awareness of invisible orthodontics has been a major drive for the growth of the invisible orthodontics market. In addition, the prevalence of dental disorders such as anterior and posterior cross bite has further increased the demand for invisible orthodontics.

For instance, according to national library of medicines, the prevalence of anterior crossbite was 7.8% and posterior crossbite was 9.0% in 2022. Crossbites is a condition in which the upper and lower teeth do not contact or bite properly, which is a malocclusion (bite problem). Crossbites can be caused by tooth position, jaw position, or a combination of both. However, high cost of invisible orthodontics and side effects associated with it are key factors anticipated to hamper the market growth.

The outbreak of COVID-19 has disrupted workflows in the healthcare sector around the world. The disease has forced several industries to shut down temporarily, including several sub-domains of the healthcare sector. The pandemic reduced accessibility to dental clinics. Thus, dentists noted a marked decrease in patient visits during the lockdown. This was due to cancellation of medical treatments due to lockdown and the economic stress faced by majority of the population.

Global Invisible Orthodontics Market Segmental Overview

The invisible orthodontics market size is segmented into type, age group, end user, and region. By type, the market is categorized into clear braces, clear aligners and lingual braces. By end user, the market is classified into hospitals, dental clinics and others. By age group, the segment is divided into teens, adults and children. Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

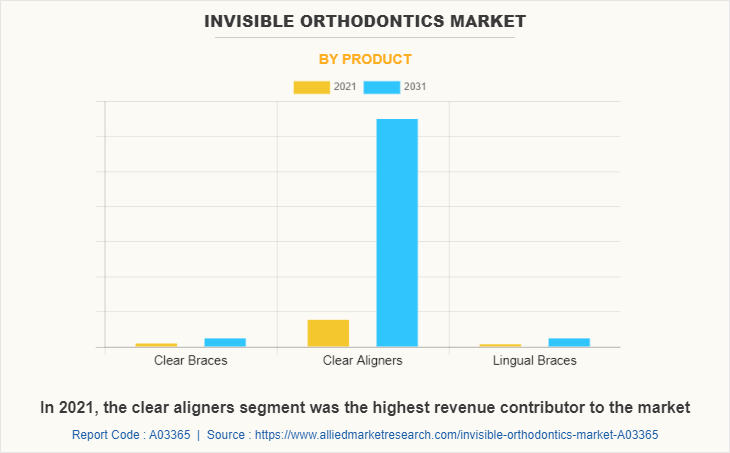

By Product Type

On the basis of product type, the invisible orthodontics market share is categorized into clear braces, clear aligners and lingual braces. In 2021, the clear aligners segment was the highest revenue contributor to the market, and is expected to dominate the market during the forecast period owing to its nearly invisible appearance making clear aligners a popular option for people who want to straighten their teeth discreetly.

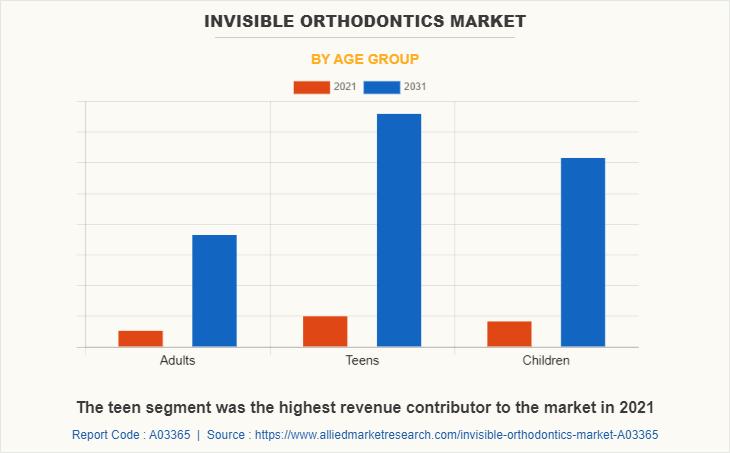

By Age Group

On the basis of age group, the invisible orthodontics market share is categorized into adults, teens, and children. The teen segment was the highest revenue contributor to the market in 2021 and is expected to dominate the market during the forecast period. This is attributed tothe reason that among all the age groups teens are the ones who are most conscious about their appearance making them the largest contributors in the segment.

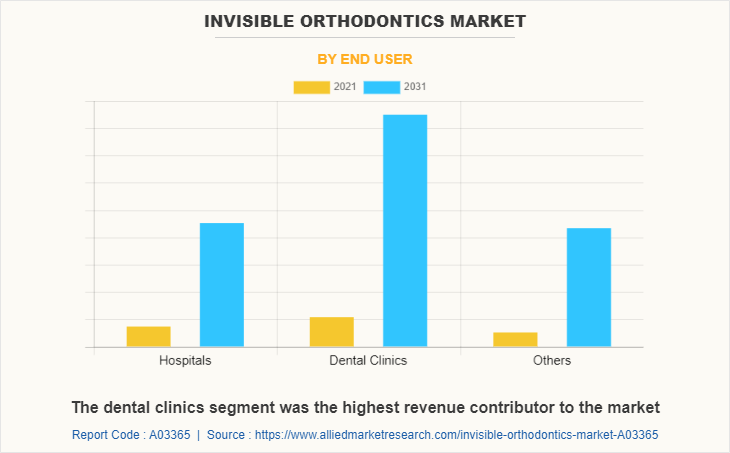

By End User

On the basis of end user, the invisible orthodontics market is categorized into hospitals, dental clinics and others. The dental clinics segment was the highest revenue contributor to the market in 2021. However, the others segment is expected to be fastest growing segment during the Invisible Orthodontics Market forecast period, owing to increase in use of clear aligners by dental hygienists, specialists, and lab technicians. Rise in healthcare expenditure also boosts the growth of the others segment in the invisible orthodontic market.

By Region

By region, the invisible orthodontics market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America was the highest revenue contributor to the market in 2021. This is attributed to surge in focus on teeth smile, cosmetic dentistry and presence of key players, and availability of high-quality healthcare system & modern medical technologies.

However, Asia-Pacific is expected to register a fastest growth in CAGR during the forecast period, owing to presence of large malocclusion patient population, increase in awareness regarding use of aligners for teeth alignment, and surge in public–private investments for unmet medical needs. Furthermore, rise in medical tourism for treatment of various neurological disorders is expected to drive the growth of the market. In addition, the market growth in this region is attributable to presence of key players in the region. Asia-Pacific offers profitable opportunities for key players operating in the invisible orthodontics market, thereby registering the fastest growth rate during the forecast period, owing to the developments in infrastructure of industries, rise in spending for cosmetic dentistry, as well as well-established presence of domestic companies in the region. In addition, rise in contract manufacturing organizations within the region provides great opportunity for new entrants in this region.

Competition Analysis

Competitive analysis and profiles of the major players in the invisible orthodontics market, such as 3M Company, Align Technology, Inc., Avinent Implant Systems S.L., Dentsply Sirona Inc., Henry Schein Inc., Institute Straumann AG, G&H Orthodontics Inc., Ormoc Corporation, Lingual Systems GmbH, and Dentaurum GmbH & Co. KG. are provided in the report. Major players have adopted acquisition, and product launch as key developmental strategies to improve the product portfolio of the invisible orthodontics market

Recent Product Launches in the Invisible Orthodontics Market

- In July 2021, 3M Oral Care introduced Clarity Aligners Flex + Force, a new aligner system that empowers orthodontists to choose from two unique aligner materials in one treatment design and gives patients a customized treatment experience.

- In May 2022, Align Technology, Inc. introduced Invisalign Outcome Simulator Pro, the next generation of its advanced patient communication tool. This enables doctors to show patients their potential new smile after Invisalign treatment, using in-face visualization and/or a 3D dental view

- In March 2022, Dentsply Sirona introduced SureSmile VPro, SureSmile Retainers, and SureSmile Whitening Kit as part of its clear aligner treatment offerings in the U.S.

- In February 2022, Ormco Corp. announced its Spark Clear Aligners Release 12, offering industry-leading clinical enhancements, product optimization, and case-planning improvements to give doctors more flexibility, efficiency, and control.

- In December 2020, Ormco Corp. announced the official release of its SparkTM Clear Aligner System in the U.S.

- Some Examples of Collaboration In The Market

- In March 2020, AVINENT collaborated with the company MEDIT Corp. to offer a new digitalization proposal for clinics and laboratories adapted to their needs. Medit is specialized in 3D measurements and CAD/CAM solutions for dental clinics and laboratories, including intraoral scanners, based on their own cutting-edge, patented technology.

What are the Recent Product Upgradation in the Invisible Orthodontics Market?

- In September 2022, Align Technology, Inc. had introduced Invisalign Virtual Care AI, its next-generation remote monitoring solution with new artificial intelligence-assisted capabilities that streamline workflows for doctors and their staff.

- In March 2022, Align Technology, Inc. announced the new Cone Beam Computed Tomography (CBCT) integration feature for ClinCheck digital treatment planning software. The CBCT integration feature helps doctors confidently expand diagnosis and treat a broader range of cases with Invisalign clear aligners by increasing visibility and control of a patient's underlying anatomical structures during the digital treatment planning process.

- In January 2021, Ormco Corp. unveiled Spark Clear Aligner Release 10, its most substantial upgrade yet, introducing proprietary features not previously available with clear aligner therapy, as well as a suite of enhancements to its Approver software and case management portal, designed to give orthodontists greater start-to-finish control and flexibility for more predictable and efficient treatment planning.

Recent Acquisitions in the Invisible Orthodontics Market

- In July 2022, Henry Schein, Inc. has announced it has completed the acquisition of Condor Dental Research Company SA (Condor Dental), a dental distribution company that serves dental general practitioners, specialists, and laboratories in Switzerland.

Recent Partnerships in the Invisible Orthodontics Market

- In may 2022, Align Technology, Inc. announced an agreement with Asana, Inc., a leading work management platform for teams. The strategic partnership will offer Invisalign-trained doctors in the U.S. a new workflow solution, Asana SmilesTM for Align.

- In December 2022, Henry Schein, Inc. announced a partnership with the Biotech Dental Group. Henry Schein and Biotech Dental will partner to bring Biotech Dental's full line of high-quality software, products, and services, including dental prostheses, clear aligners, dental implants, regenerative solutions, and biomaterials, to more dentists and dental laboratories, as well as new geographies.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current Invisible Orthodontics industry Trends, estimations, and dynamics of the invisible orthodontics market analysis from 2021 to 2031 to identify the prevailing invisible orthodontics market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the invisible orthodontics industry segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global invisible orthodontics market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global invisible orthodontics market trends, key players, market segments, application areas, and Invisible Orthodontics Market Growth strategies.

Invisible Orthodontics Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 34.7 billion |

| Growth Rate | CAGR of 22.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 370 |

| By Product |

|

| By Age Group |

|

| By End User |

|

| By Region |

|

| Key Market Players | Avinent Group, Henry Schein Inc., 3M Company, Dentaurum GmbH & Co. KG, G&H Orthodontics, Institut Straumann AG, Dentsply Sirona Inc., Align Technology, Inc., LingualSystems GmBH, Ormco Corp. |

Analyst Review

Analyst’s review section provides various opinions of top-level CXOs in the global invisible orthodontics market. According to the insights of CXOs, an increase in demand for invisible orthodontics and a rise in investments for invisible orthodontics globally is expected to offer profitable opportunities for the expansion of the market. In addition, favorable government initiatives and higher spending for invisible orthodontics, has piqued the interest of several companies to develop invisible orthodontics.

CXOs further added that increase in adoption of invisible orthodontics for cosmetic dentistry and rise in prevalence of dental diseases, diastema, crowded teeth, open bites, crossbite, overbite, and underbite are expected to boost the growth of the market. In addition, increase in awareness of invisible orthodontics across the globe has surged its demand, thus driving the growth of the market. Further, Invisible orthodontics has evolved significantly in recent years with the development of new technologies and materials The use of clear and comfortable aligners, 3D printing technology, and software for custom treatment planning has made invisible orthodontics a preferred option for many patients thereby driving the growth of the market.

Furthermore, North America is expected to witness highest growth, in terms of revenue, owing to increase in adoption of invisible orthodontics by physicians & patients, rise in number of dental diseases and developments in healthcare infrastructure. Upsurge in healthcare expenditure in the emerging economies is anticipated to offer lucrative opportunities for the market expansion. However, Asia-Pacific is anticipated to witness notable growth, owing to increase in investments for development of invisible orthodontics and increase in number of key players manufacturing invisible orthodontics.

Few upcoming trends of Invisible Orthodontics Market include the increased utilization of clear braces for all age groups

The teen segment was the highest revenue contributor to the market in 2021 and is expected to dominate the market during the forecast period

North America was the highest revenue contributor to the market in 2021

The global invisible orthodontics market was valued at $4.6 billion in 2021, and is projected to reach $34.7 billion by 2031, growing at a CAGR of 22.6% from 2022 to 2031.

Align Technology, 3M Company and Henry Schein are few major players operating in the Invisible Orthodontics market

Asia-Pacific is expected to register a fastest growth in CAGR during the forecast period

Yes, the competitive landscape included in the Invisible Orthodontics market report

High cost of novel materials used in clear braces and aligners coupled with low awareness among general population might restrain the market growth

Loading Table Of Content...