IoT In Construction Market Research: 2031

The Global IoT in Construction Market Size was valued at $11.2 billion in 2021, and is projected to reach $44.2 billion by 2031, growing at a CAGR of 14.6% from 2022 to 2031. IoT in the construction sector serves the primary aim of utilizing electronically connected machinery and software to assure the best possible use of resources, a well-thought-out technical strategy, and managed construction costs. IoT offers a platform where workers, inventory, and equipment may connect to a centralized server that controls and tracks their operations in real-time. Currently, the construction sector uses a wide range of gadgets for varied purposes.

Market Dynamics

There is a loT of labor and hazard involved in the building industry. According to the Occupational Safety and Health Administration (OSHA), a division of the U.S. Department of Labor, there are approximately 252,000 construction sites in the United States that employ around 6.5 million people. Compared to the national average for all other U.S. industries, construction has a significantly greater rate of fatal injuries. Construction sites frequently have risked such trench collapse, falls, scaffold collapse, insufficient protective equipment, repetitive motion injuries, and others.

Real-time safety management on sites is made possible by integrating IoT into construction and using smart wearables like smart glasses, wearable sensors, safety vests, wearable hexo-skeletons, smart helmets, and others. In addition, active monitoring of data with such wearable technologies allows measurement of breathing rate, heart rate, as well as active monitoring of worker's body response to certain work environment. For instance, In March 2021, Cority, a global enterprise environmental, health, and safety (EHS) software supplier, has collaborated with 3M's Personal Safety Division for providing a Connected Safety technology to the worker.

Connected Safety is a 3M Internet of Things (IoT) platform that combines digital and physical products to help organizations connect workers, places, and equipment to improve worker safety, compliance workflows, and safety process automation. So, benefits like microsleep avoidance, fall prevention, intelligent gas monitoring, vital sign tracking, and others may increase demand for IoT-based wearables on construction sites, which fuels the expansion of the IoT in construction industry.

IoT-based solutions connect construction sites by utilizing sensors, drones, CCTV cameras, and Radio-frequency Identification (RFID) tags. This makes it possible to get statistics about the workforce, inventories, and ongoing activities in real-time. Sensors and RFID tags on materials provide effective workflows, proactive material ordering, equipment servicing, monitoring of equipment usage, and preventive maintenance, among other benefits. Effective time management reduces equipment and staff downtime on construction sites, which prevents delays and saves time and money.

Also, according to studies by the US company McGraw Hill Construction, 97% of contractors in Japan who use building information modelling (BIM) have reported a positive return on investment (ROI). Together with additional benefits, these businesses have demonstrated a 41% drop in errors, a 21% increase in project estimation accuracy, a 23% improvement in waste management, a 31% drop in reworks, and more. BIM and other IoT technologies are thus implemented to increase productivity and efficiency on building sites, which in turn fuels the expansion of IoT in the construction business.

Most third-party businesses involved in business operations maintain the information technology systems and networks. Data processing and maintenance involving connected IoT devices is vulnerable to coordinated and targeted cyberattacks. The integrity and confidentiality of the data are compromised as a result. Such cyberattacks may harm consumers' reputations, which may result in fines, legal action from the government, litigation with third parties, and other consequences in addition to informational harm.

For instance, in March 2021, Microsoft accused a Chinese cyberspy organization of attacking its mail server software. Hafnium, a group believed to be state-sponsored and operating out of China, was given high confidence credit by Microsoft's Threat Intelligence Center for carrying out the attacks. Such flaws pose a serious risk to IoT implementation, particularly in the construction sector. Thus, rising security threats in connected devices restrain the growth of IoT in the construction market.

Although the application of robotics in the construction industry is not new, the commercial application of robots on building sites is still extremely limited. Integration of robotic technologies in the construction industry assists in reducing dependence on human labor for construction activities including bricklaying, plastering, surveying, welding, and others.

Further, robotic machines involve the use of technologies such as artificial intelligence, cloud-based solution, IoT, and others which makes it easy to collect real time data on site without the assistance of special instruments. In addition, remote monitoring and controlling features of robots reduce fatalities, and help in obtaining more efficiencies. For instance, in May 2021 – Honeywell has launched a cloud-based solution for building owners and managers that simplifies and combines operational and business data to back up better decision-making, drive greater efficiencies, and achieve sustainability goals. Thus, the increase in demand for robotics in construction is anticipated to boost the IoT in construction market growth.

Segmental Overview

The IoT in construction market is segmented on the basis of application, end user, component, and region. Based on application, the market is fragmented into asset monitoring, predictive maintenance, fleet management, wearables, and others. According to end user, the market is categorized into residential and non-residential. By component, the market is classified into hardware, software, connectivity, and services.

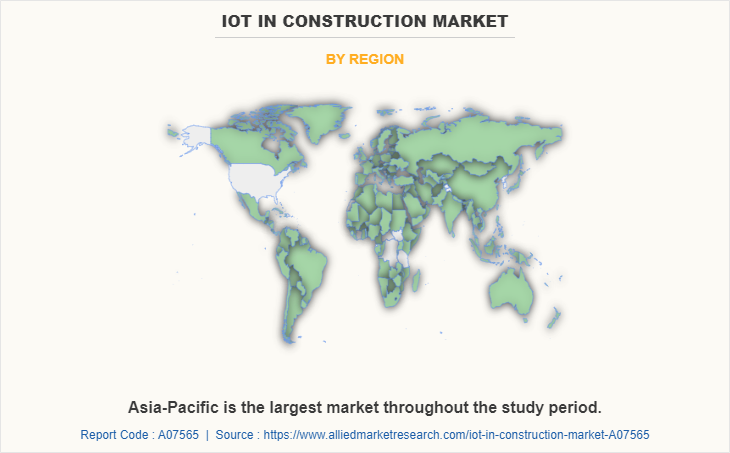

By region, the IoT in construction Market has been analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, UK, France, and rest of Europe), Asia-Pacific (China, Japan, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

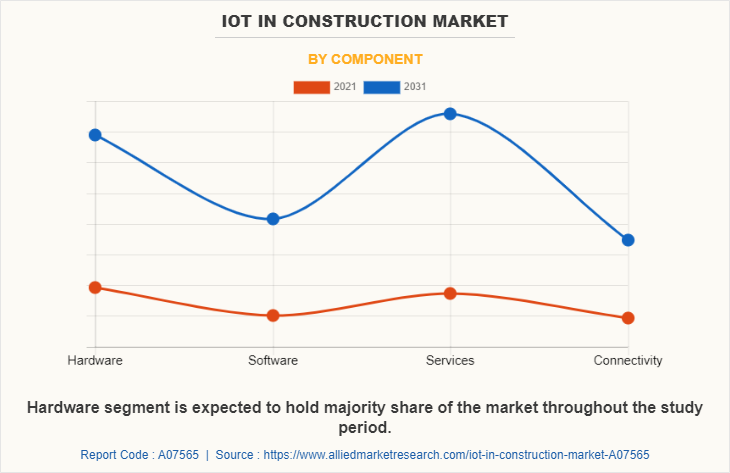

By Component:

The IoT in construction market is categorized into hardware, software, connectivity, and services. The hardware components include RFID tag, sensor, intelligent system, and other hardware components. Software allows controlling and monitoring of the equipment and the connected devices. It includes smart safety & security system software, remote management & logistics solutions, asset performance management solutions, data & operation management solutions, connectivity solutions, and analytics solutions.

The services include support and maintenance of the mining operations, consulting, and system integration (deployment services). These services assist in improving the construction operations, as well as help in maintaining the equipment quality. Connectivity solutions include utilization of wide range of data products, fiber optics, connectors, and cabling, which ensures continuous mining operations. Connectivity can also be obtained from wireless mediums, including 4G/5G networking, grid systems, and others. The hardware segment is expected to be the largest revenue contributor during the forecast period. The services segment is expected to exhibit the highest CAGR share in the component segment in the IoT in construction market during the forecast period.

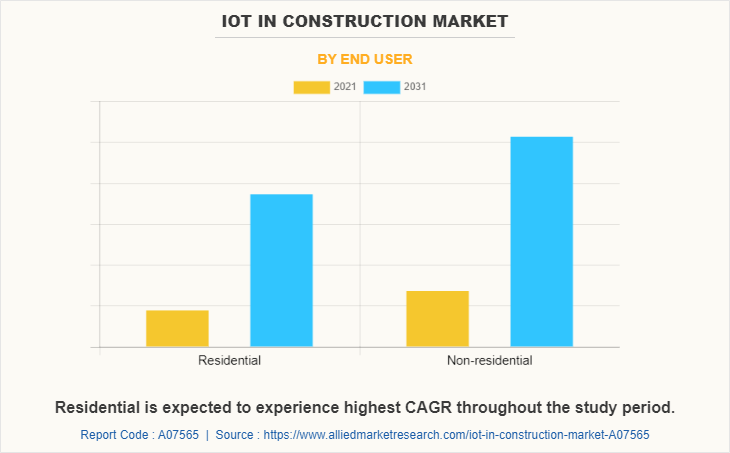

By End User:

The IoT in construction market is classified as residential and non-residential. Residential buildings include construction of residential complexes, condos, independent houses, and others. Construction projects such as hospitals, hotels, industrial buildings, infrastructure, and others are considered in non-residential construction segment. The non-residential segment is expected to account for the largest revenue during the forecast period, and the residential segment is expected to exhibit the highest CAGR share in end user industry segment in the IoT in construction market during the forecast period.

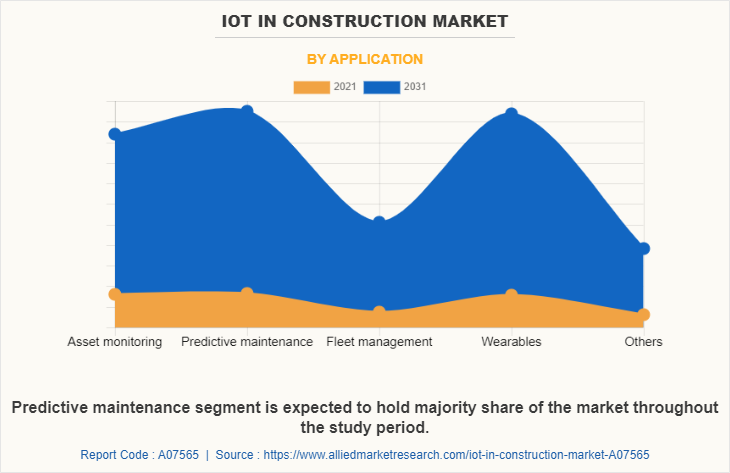

By Application:

The IoT in construction market is classified into asset monitoring, predictive monitoring, fleet management, wearables, and others. Asset monitoring or asset management in construction deals with organization of drawings, documents, plans, tools management, equipment management, and others. Predictive maintenance systems monitor the condition and performance of a machine or equipment on construction site which not only improves the working life of the equipment but also helps in avoiding untimely failure which can cause project delays or accidents.

It is carried out by data collection through various sensors and software. Fleet management is also called telematics, offers solutions such as fleet management, vehicle tracking, fleet safety, driver behavior, economical driving, and others. It includes use of sensors, RFID tags, related software, and services, which provide real-time data collection related to fuel management, predicted maintenance, king, and others. Wearables often gather environmental, biological, and physical data to improve worker safety and prevent accidents on construction sites.

Modern electronic gadgets known as construction wearables can be worn on the body or on the clothing of construction workers as personal protective equipment. The others segment includes use of augmented reality (AR), virtual reality (VR) products, 3D printing, remote services, operational intelligence, and other IoT based technologies utilized on construction sites. The predictive maintenance segment is expected to account for the largest revenue during the forecast period, and the wearables segment is expected to exhibit the highest CAGR share in application segment in the IoT in construction market during the forecast period.

By Region:

The IoT in construction market forecast is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, Asia-Pacific had the highest revenue in IoT in construction market share and also is expected to exhibit the highest CAGR during the forecast period.

COMPETITION ANALYSIS

The major players profiled in the IoT in construction market include Advanced Opto-Mechanical Systems and Technologies Inc., Autodesk, Inc., CalAmp Corporation, Hexagon AB, Hilti Corporation, Oracle Corporation, Pillar Technologies, Inc., Topcon Corporation, Trimble, Inc., and Triax Technologies, Inc.

Major companies in the market have adopted product launch, acquisition and partnership as their key developmental strategies to offer better products and services to customers in the IoT in construction market.

Some examples of acquisition and expansion in the market

In March 2020, Hilti acquired substantial assets of Concrete Sensors company, which provides connected devices, services, and software that assist in improving decision making and accelerating construction schedules that help in better understanding of the concrete curing process. The acquisition helps in enhancing Hilti’s focus on IoT technologies in construction.

In September 2022, Hexagon AB has acquired iConstruct Pty Ltd, a developer of Building Information Modelling software used in commercial, infrastructure and industrial construction, iConstruct Pro, is a construction automation tool that enables integration, accessibility and control of design and construction information held within different BIM models, combining all data into a single 3D model.

Some examples of product launch and product development in the market

In October 2020, Autodesk launched the Building Connected construction management software in the UK, Australia, Ireland, and New Zealand. The software streamlines the bidding process and bounds the Autodesk Construction Cloud builders’ network for professionals.

In February 2021, Oracle launched a new range of solutions for the construction industry, using artificial intelligence (AI) to analyze project data. This suite of applications is designed to help users detect risks and make more informed project decisions.

In March 2021, Oracle developed its new Oracle fusion cloud supply chain and manufacturing platform. The updates include IoT Asset monitoring and IoT production monitoring capabilities that enable customers to monitor key characteristics of their assets and gain a full view of their production line output.

In February 2020, Hilti launched the IoT enabled smart fasteners with the Tracefast technology at the World of Concrete trade show in Las Vegas, U.S. The connected fasteners use data matrix code (DMC) which allows the workers on site to scan the code with the Hilti Connect App to allow easy documentation of screws, bolts, and anchors on the job site.

In October 2021, Hilti Corporation launched a new Jaibot, a semi-autonomous mobile ceiling drilling robot, for the construction industry. The Hilti Jaibot is used in the construction industry to tackle productivity, labor safety, and reduce labor shortage challenges. The main motto of the product launch is to digitize the construction sites.

Some examples of investment and collaboration in the market

In April 2020, AOMS has partnership with the company PCL Construction based in Canada. by means of this partnership is aimed towards enhancing Job Sight Insights (JSI) on PCL’s cloud-based platform. The platform also includes additional sensor technology including assessment of gases, vibration, sound, concrete maturity and strength, and other parameters.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the IoT in construction market analysis from 2021 to 2031 to identify the prevailing iot in construction market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the iot construction market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global iot in construction market trends, key players, market segments, application areas, and market growth strategies.

IoT in Construction Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 44.2 billion |

| Growth Rate | CAGR of 14.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 220 |

| By Application |

|

| By End User |

|

| By Component |

|

| By Region |

|

| Key Market Players | Hexagon AB, CalAmp Corporation, Trimble, Inc., Oracle Corporation, Topcon Corporation, Pillar Technologies, Inc., Hilti Corporation, Advanced Opto-Mechanical Systems and Technologies Inc., Autodesk, Inc., Triax Technologies, Inc. |

Analyst Review

According to the insights of the CXOs of leading companies, the IoT in construction market has a significant scope in Asia-Pacific. China is the largest shareholder of the IoT in construction industry, owing to the large manufacturing and connectivity infrastructure and a strong foothold in the construction industry. In addition, the South Korean government is also promoting inclusion of smart construction technologies to develop their residential and non-residential infrastructure by increasing funding. For instance, one of the leading Korean engineering firms, Dasan Consultants, used the 3DEXPERIENCE platform using the BIM design approach. It made a switch from 2D modelling to 3D modelling, which assisted in centralizing databases and secure sharing of data within stakeholders.

Moreover, the inclusion of IoT in construction with the use of smart wearables such as smart glasses, wearable sensors, safety vests, wearable, and smart helmets enable real-time safety management on sites. In addition, active monitoring of data with such wearable technologies allows measurement of breathing rate, heart rate, as well as active monitoring of worker's body response to certain work environment.

In addition, around 83% of contractors are convinced that wearable technologies can boost site safety; thereby, reducing fatal injuries on jobsites including fall prevention, which account for around 30% of all construction injuries.

Many competitors in the IoT in construction market have adopted product launch as their key developmental strategy to expand their geographical foothold and upgrade their product technologies. For instance, in July 2020, the company Triax Technologies based in the U.S. launched the Intrinsically Safe (IS) variant of its IoT solution for application on construction sites. The IS version is available Spot-r network and Proximity Trace hardware products, which offer contact tracing and social distancing technologies on construction sites during the COVID-19 pandemic. Similarly, in February 2021, Oracle launched a range of solutions for the construction industry, using artificial intelligence (AI) to analyze project data. By means of this launch, it provides a suite of applications designed to help users detect risks and make more informed project decisions.

The global IoT in construction market was valued at $11,156.4 million in 2021, and is projected to reach $44,215.7 million by 2031, registering a CAGR of 14.6% from 2022 to 2031.

The forecast period considered for the global IoT in construction market is 2022 to 2031, wherein, 2021 is the base year, 2022 is the estimated year, and 2031 is the forecast year.

The latest version of global IoT in construction market report can be obtained on demand from the website.

The base year considered in the global IoT in construction market report is 2021.

The major players profiled in the IoT in construction market include Advanced Opto-Mechanical Systems and Technologies Inc., Autodesk, Inc., CalAmp Corporation, Hexagon AB, Hilti Corporation, Oracle Corporation, Pillar Technologies, Inc Topcon Corporation, Trimble, Inc., and Triax Technologies, Inc.

The top ten market players are selected based on two key attributes - competitive strength and market positioning.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Based on component, the services segment dominated the market in 2021.

Loading Table Of Content...

Loading Research Methodology...