IoT Telecom Services Market Statistics, 2031

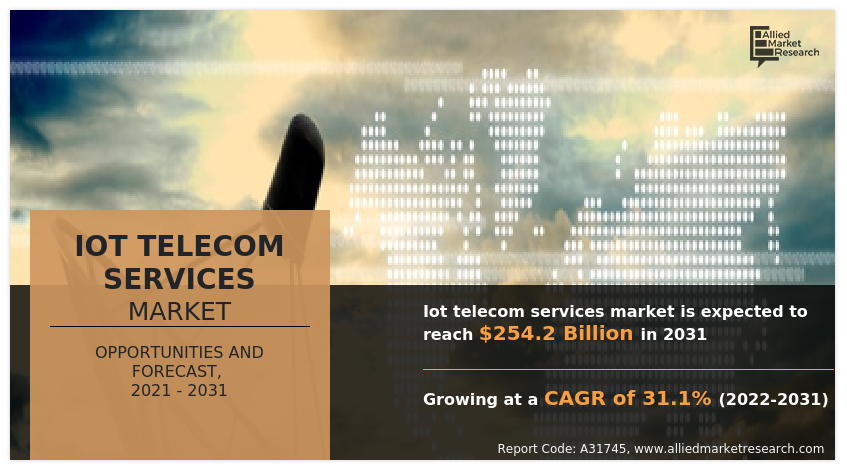

The global IoT telecom services market was valued at $17.4 billion in 2021, and is projected to reach $254.2 billion by 2031, growing at a CAGR of 31.1% from 2022 to 2031.

Surge in as increase in adoption of technological advancement and innovation and IoT powered smart cameras for security primarily drive the growth of the IoT telecom services market. However, lack of guidelines for spectrum allocation hampers the market growth to some extent. Moreover, adoption of blockchain technology is expected to provide lucrative opportunities for the IoT telecom services market forecast.

IoT telecom services market has been growing significantly owing to huge adoption of IoT devices and new technological advancements. IoT platforms are utilized for a variety of corporate objectives and application cases. Therefore, adopting novel, forward-thinking, and customized strategies is essential. For telecom companies looking to embrace the digital age, gain a significant competitive edge, and take full advantage of the opportunities that contemporary technology presents, the deployment of IoT-based initiatives is now a need. With the use of IoT-based technology, the method of gathering data in real-time may be changed to improve performance, utilize fewer resources, and prevent human factor errors. Accelerated speed and enhanced bandwidth are also results of the collaboration between telecom and IoT companies. Without slowing down communication speed or limiting capacity, IoT protocols and 5G interconnection may broadcast information from thousands of devices to many consumers. These factors drive the IoT telecom services market and are anticipated to grow further in the future. The IoT telecom services market is segmented into Connectivity, Network Management Solution, Service Type and Application.

The global loT telecom services market is segmented on the basis of connectivity, network management solution, service type, and application. On the basis of connectivity, it is divided into cellular technology, LPWAN, NB-IoT and FR-Based. On the basis of network management solution, it is classified into network performance monitoring and optimization, network traffic management and network security management. On the basis of service type, it is divided into business consulting services, devices and application management solution, installation and integration services, IoT billing and subscription management and M2M billing management. On the basis of application, it is classified into smart building and home automation, capillary network management, industrial manufacturing and automation, vehicle telematics, energy and utilities, smart healthcare and others (transportation). Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players profiled in the IoT telecom services industry are Telstra, Orange, Sequans Communication, Telus Corporation, MediaTek Inc, LM Ericsson Telephone Company, Vodafone Idea Ltd, Sierra Wireless, Puresoftware Ltd, and T-Mobile. These players have adopted various strategies to increase their market penetration and strengthen their position in the IoT telecom services industry.

By Connectivity

Cellular technology domiated the IoT telecom services market in 2021,owing to rise in 4G technology, which plays a significant role in rise of data and voice communication.

Depending on connectivity, the cellular technology segment, dominated the IoT telecom services market share in 2021, and is expected to maintain its dominance in the upcoming years. However, LPWAN is expected segment is expected to witness highest growth, owing to extensive adoption of IoT telecom service market to strengthen LPWA Network (LPWAN) technologies, which provide a low-cost, low-power wireless option with global reach and robust built-in security.

By Region

North America dominated the market in 2021, owing to rising adoption of smart connected devices and technologies.

North America is anticipated to account for the largest share of the IoT telecom services market size during the forecast period, owing to rise in awareness regarding data security among banks, insurance firms, financial institutions and rise in number of cyberattacks aiding the growth of the IoT telecom services market. However, Asia Pacific is expected to witness significant growth during the forecast period, owing to adopting of security solutions to implement new technologies and to overcome online frauds, which is expected to fuel the market growth in this region. Furthermore, several major IoT telecom services solution providers including Telstra, Orange, Sequans Communication, Telus Corporation, MediaTek Inc, LM Ericsson Telephone Company, Vodafone Idea Ltd, Sierra Wireless, are introducing new products & services to protect cyber-attacks & other data thefts in the telecom sector.

Top Impacting Factors

Technological advancement and innovation

Over time, there has been an increase in demand for better connectivity because of technical development and expanding innovation. This is anticipated to accelerate IoT adoption in the telecom industry and foster market expansion. The need for technology that can enhance data management has also increased along with the amount of data related to telecommunications. Manufacturers also stress the significance of IoT and wireless connectivity. An increase in telco adoption, the penetration of smart connected devices, the necessity for network bandwidth control, and the automation of communication processes are expected to boost the market for IoT telecom services. Additionally, throughout the course of the projection period, the growth of next-generation wireless networks, the adoption of smart technologies, and distributed applications are expected to offer growth potential to the telecom IoT market.

IoT-powered smart cameras for security

Security can be a serious worry when expensive equipment is used in remote areas. In addition, various resources, including fuel and batteries, are used to power the machinery in far-off places. For telecom organizations, equipment and consumable resource theft can be expensive. Therefore, telecom businesses need to make sure that efficient security protocols are put in place. IoT-powered smart cameras can be installed at remote sites by telecom firms. Smart cameras have the ability to spot on-site tampering and instantly notify the necessary authorities. Beacons and RFID badges can also be used by telecom firms to secure the perimeter and prevent unwanted access. This technique can be used by telecom firms to set up a geofence for their IoT devices. The installation of a geofence will help build a networked barrier. A geofence has made it easier to build an IoT-enabled barrier that only enables authorized people to pass through. As a result, the use of IoT in telecom firms can facilitate the creation of security standards that are more effective.

Technological Trends

The telecom industry's tendency toward integrating IoT makes it possible to create services with excellent connection. IoT in the telecom sector is highlighting a variety of distinctive and worthwhile revenue-building potential. Smart telecom operators are being motivated by this change to create new plans and integrate digital technology into their operations. Recent trends indicate that one in four sizable firms sell data on official internet data marketplaces. Particularly telecom businesses can benefit from potentially profiting on their access to the enormous collection of data amassed through their infrastructure.

Telcos also play a significant role in the rapidly expanding market for smart homes and buildings thanks to IoT. In order to position their company as a third-party reseller for specialized consumer apps and services for this industry, telecom companies can provide the bandwidth and network resources that connect security components (like locks, cameras, alarms, and appliances), utilities (like heating and air conditioning), and appliances (like locks, cameras, and alarms). Offering custom network solutions is one way for CSPs to capitalize on IoT. These businesses are able to connect every component of the intricate manufacturing environment. This could include flow metres or temperature sensors, which provide the advantages of increased production efficiency, complete supply chain visibility, and cost reduction.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the IoT telecom services market analysis from 2021 to 2031 to identify the prevailing iot telecom services market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the IoT telecom services market growth segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global iot telecom services market trends, key players, market segments, application areas, and market growth strategies.

IoT Telecom Services Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 254.2 billion |

| Growth Rate | CAGR of 31.1% |

| Forecast period | 2021 - 2031 |

| Report Pages | 260 |

| By Connectivity |

|

| By Network Management Solution |

|

| By Service Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | LM Ericsson Telephone Company, telstra, TELUS Corporation, Sequans Communications, Sierra Wireless, Vodafone Idea Ltd, T-Mobile, Orange, MediaTek Inc, puresoftware ltd |

Analyst Review

According to insights of the CXOs from top organizations across the globe, adoption of loT in telecom sector boosts the efficiency in production as well as cuts consumption, reducing manpower and allows smart development. The Internet of Things connects billions of devices and data globally and successfully bridges the digital and physical worlds, allowing telcos to change their business models and take the lead in their respective markets.

Furthermore, transforming the role of mobile network providers in providing the connection between users and devices is the meaning of the practical leverage of Internet of Things technology in the telecom sector. Since there are many ways for network operators to exploit and profit from Internet of Things advancements, businesses must adopt IoT-based solutions to improve their processes. Thus, demand for loT in energy is expected to increase during the forecast period.

On the contrary, prominent market players are exploring new technologies and applications to meet increase in customer demands. Product launches, collaborations and acquisitions are expected to enable them to expand their product portfolios and penetrate different regions: For instance, February 2,019, Nokia and Saudi Telecom Company (STC) partnered to deploy a 5G network with Nokia's end-to-end IoT solutions.

For instance, in February 2021, Telus partnered with Eseye. This partnership enrich the Telus IoT offering by integrating its pioneering AnyNet Connectivity Platform into the Telus portfolio and provides a white labelled global IoT connectivity solution that delivers ubiquitin.

Upcoming trends of IoT telecom services market are increase in adoption of technological advancement and innovation and IoT powered smart cameras for security.

North America is the largest regional market for IoT telecom services.

The global IoT telecom services market was valued at $17,356.24 million in 2021, and is projected to reach $254,177.23 million by 2031, registering a CAGR of 31.1% from 2021 to 2031.

The key players operating in the market include Telstra, Orange, Sequans Communication, Telus Corporation, MediaTek Inc, LM Ericsson Telephone Company, Vodafone Idea Ltd, Sierra Wireless, Puresoftware Ltd, and T-Mobile. Furthermore, it highlights the strategies of the key players to improve market share and sustain competition.

Loading Table Of Content...

Loading Research Methodology...