IoT Testing Market Overview

The global iot testing market was valued at USD 1.9 billion in 2022, and is projected to reach USD 30.4 billion by 2032, growing at a CAGR of 32.6% from 2023 to 2032.

The increase in demand for IP testing of IoT devices is a key driver for the growth of the IoT testing market. The proliferation of IoT devices across industries has led to intricate ecosystems with diverse devices, platforms, and communication protocols. IP testing ensures that devices can effectively communicate with one another, fostering interoperability and avoiding communication breakdowns. As IoT networks expand, the ability to handle increased network traffic becomes even more important. Furthermore, increased deployment of microservices and rise in importance of DevOps are other factors driving the growth of the IoT testing market.

However, lack of consistency among standards for interconnectivity and interoperability is a major factor hampering the growth of the market. The absence of consistent standards leads to a diverse array of communication protocols, data formats, and connectivity mechanisms. This complexity complicates testing environments, requiring testing providers to support a multitude of variations. Moreover, the lack of standardized protocols and interfaces slows down the testing process and overall product development lifecycle. This extended time-to-market can hamper the competitiveness of IoT solutions. Contrarily, the increase in adoption of smart city concepts presents a significant opportunity for the IoT testing industry. Smart cities encompass a wide array of IoT applications, including smart transportation, energy management, waste management, public safety, and more. Each application domain demands specialized testing to validate its unique functionalities and interactions. In addition, smart cities generate massive volumes of data from various sources. Testing services that validate data accuracy, integrity, and analytics algorithms are vital to extracting meaningful insights.

Introduction

IoT (Internet of Things) testing is the comprehensive process of evaluating and verifying the functionality, performance, security, and overall quality of IoT devices, systems, and applications. IoT testing ensures that interconnected devices can effectively communicate, exchange data, and operate as intended within complex IoT ecosystems. This testing process is vital for delivering reliable and seamless IoT solutions that meet user expectations and industry standards.

The report focuses on growth prospects, restraints, and trends of the IoT testing market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the IoT testing market.

Segment Review

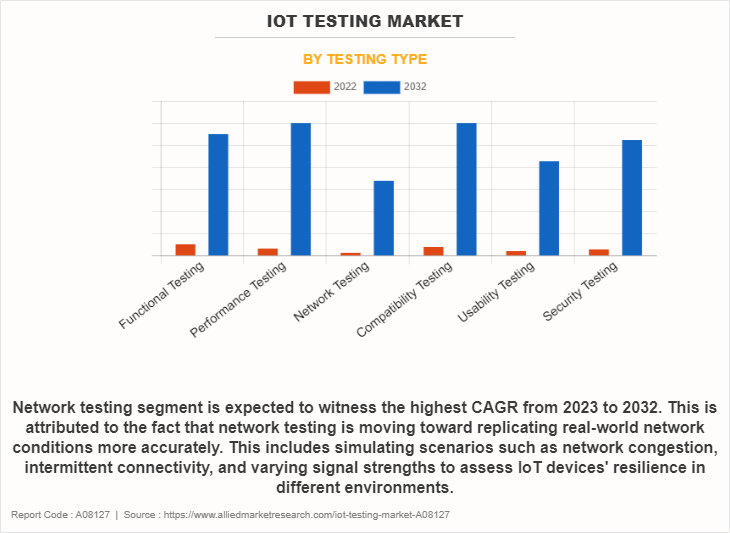

The IoT testing market is segmented on the basis of service type, testing type, application, and region. On the basis of service type, it is categorized into professional service and managed service. By testing type, it is divided into functional testing, performance testing, network testing, compatibility testing, usability testing, and security testing. As per application, it is categorized into smart building and home automation, capillary networks management, smart utilities, vehicle telematics, smart manufacturing, smart healthcare, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of testing type, the functional testing segment attained the highest IoT testing market size in 2022. With the growing number of cyber threats targeting IoT devices, applications, and data, testing methodologies are evolving to include comprehensive security testing. This involves assessing vulnerabilities, encryption mechanisms, and authentication protocols to safeguard IoT ecosystems.

On the basis of region, North America held the highest IoT testing market share in 2022. Owing to increasing number of connected devices and the potential for cyberattacks, there has been a strong emphasis on integrating robust security testing into IoT solutions. This includes testing for vulnerabilities, encryption, authentication, and access control.

Key Market Players

IoT testing key players such as AFour Technologies, Apica, Novacoast, Inc., Capgemini SE, Happiest Minds, HCL Technologies Limited, Infosys, Keysight Technologies, Praetorian, and Rapid7. These players have adopted various strategies to increase their market penetration and strengthen their position in the IoT testing market.

Top Impacting Factors

Rise in importance of DevOps

DevOps methodologies emphasize continuous integration and continuous delivery (CI/CD), allowing for faster and more frequent releases of IoT applications and firmware. As IoT devices become more integral to various industries, the need for rapid development and deployment is critical. This accelerated pace demands efficient and automated testing to ensure the quality and reliability of IoT solutions. In addition, the increased connectivity of IoT devices amplifies security risks. DevOps practices emphasize security as a shared responsibility, from development to deployment. Testing solutions that cover security vulnerabilities, data privacy, and regulatory compliance are vital to ensure secure IoT implementations.

Furthermore, DevOps promotes the automation of various testing stages, from unit tests to end-to-end tests. For IoT systems comprising a multitude of devices with different functionalities, automated testing is essential to validate interactions, data flow, and interoperability. This approach reduces the manual effort required for comprehensive IoT testing. Therefore, these trends are driving the IoT testing market growth.

Increase in Demand for IP Testing of IoT Devices

The proliferation of IoT devices across industries has led to intricate ecosystems with diverse devices, platforms, and communication protocols. IP testing ensures that devices can effectively communicate with one another, fostering interoperability and avoiding communication breakdowns. As IoT networks expand, the ability to handle increased network traffic becomes even more important. IP testing assesses how devices perform under varying loads, ensuring that they can scale to accommodate higher data volumes without performance degradation.

Furthermore, effective IP testing scrutinizes the quality of data transmission, encompassing factors such as data integrity, latency, and packet loss. Ensuring optimal data transmission is crucial for the accurate and reliable functioning of IoT applications. In addition, IP testing ensures that IoT devices adhere to regulatory requirements related to data transmission and communication. Compliance with industry standards enhances market acceptance and mitigates legal risks. Therefore, these factors are driving the growth of the IoT testing market.

The Increased Deployment of Microservices

Microservices provide a platform for developing enterprise applications including IoT, increase the productivity of applications at an astonishing rate, and help in the quick delivery of applications; thereby increasing the flexibility, reliability, availability, and scalability of the applications. Furthermore, it helps to reduce time to market and shorten the software development life-cycle (SDLC) of IoT applications. In addition, microservices are majorly driven by the need for agility and the re-composing of applications enabling experimentation and demands to support new delivery platforms such as the web, mobile web, native apps, and others.

Moreover, the increased adoption of microservices architecture within IoT solutions has ignited a demand for specialized testing services. The intricate nature of microservices-driven IoT systems necessitates meticulous testing to ensure seamless interactions, scalability, security, and overall functionality. Therefore, these trends are driving the growth of the IoT testing market.

Lack of Consistency Among Standards for Interconnectivity and Interoperability

The absence of consistent standards leads to a diverse array of communication protocols, data formats, and connectivity mechanisms. This complexity complicates testing environments, requiring testing providers to support a multitude of variations. Moreover, the lack of standardized protocols and interfaces slows down the testing process and overall product development lifecycle. This extended time-to-market can hamper the competitiveness of IoT solutions. In addition, diverse standards can introduce security vulnerabilities. Ensuring robust security measures across devices requires additional testing efforts to address potential weak points stemming from inconsistent standards. Furthermore, the lack of consistency among standards for interconnectivity and interoperability significantly hampers the growth of the IoT testing market.

Increasing Demand for API Monitoring

Application programming interface play a critical role in enabling communication and data exchange between various components of IoT systems, making API monitoring essential for ensuring the seamless functionality, performance, and security of interconnected devices and applications. Moreover, APIs serve as the communication backbone for IoT systems, enabling devices to interact, share data, and execute commands. Monitoring APIs ensures the integrity of this communication, which is fundamental to the overall functionality of IoT solutions.

In addition, as IoT systems scale to accommodate a larger number of connected devices, API performance must scale as well. Monitoring APIs under varying loads and conditions will become essential to verify their scalability and consistent functionality. Furthermore, automated API monitoring tools that continuously assess API health align with the fast-paced nature of IoT development and deployment. IoT testing providers can offer such automated monitoring solutions to cater to the industry's demand for efficiency and agility. Therefore, these factors will enhance growth prospect for the industry.

The Increase in Adoption of Smart City Concepts

Smart cities encompass a wide array of IoT applications, including smart transportation, energy management, waste management, public safety, and more. Each application domain demands specialized testing to validate its unique functionalities and interactions. In addition, smart cities generate massive volumes of data from various sources. Testing services that validate data accuracy, integrity, and analytics algorithms are vital to extracting meaningful insights. Moreover, smart city systems handle sensitive data and control critical infrastructure. Testing services that address security vulnerabilities, encryption, and access controls are vital to safeguarding citizen data and public safety.

Furthermore, the dynamic nature of smart cities demands constant innovation. IoT testing providers that offer innovative testing approaches and technologies can position themselves as catalysts for smart city advancement. Therefore, the escalating adoption of smart city concepts creates substantial opportunities for the IoT testing market.

Market Landscape and Trends

The widespread adoption of IoT across industries is a primary driver of the IoT testing market. As more devices and applications are connected, the need for robust testing to ensure functionality, security, and interoperability becomes paramount. The increasing number of connected devices makes IoT ecosystems susceptible to cyber threats. Security testing is gaining prominence, encompassing assessments of device security, data encryption, authentication mechanisms, and prevention of unauthorized access. In addition, edge computing is becoming integral to IoT architectures. Testing edge devices, communication protocols, and data processing at the edge is gaining significance to ensure efficient and reliable edge functionality.

Furthermore, the rollout of 5G networks is poised to accelerate IoT growth by providing high-speed, low-latency connectivity. IoT testing is evolving to include assessments of IoT devices' compatibility with 5G networks. Moreover, the increasing adoption of smart city concepts has evolved the great potential of IoT in energy and utilities, waste management, and infrastructure. The investment in IoT-enabled infrastructure is expected to accentuate the demand for security testing services for those assets, which may further foster the demand for managed services in these sectors. Therefore, the IoT testing industry is constantly evolving, with new trends emerging as technology advances.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the IoT testing market forecast from 2022 to 2032 to identify the prevailing market opportunities.

Market research is offered along with information related to key drivers, restraints, and opportunities of IoT testing market outlook.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the IoT testing market segmentation assists in determining the prevailing IoT testing market opportunity.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes an analysis of the regional as well as global IoT testing market trends, key players, market segments, application areas, and market growth strategies.

IoT Testing Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 30.4 billion |

| Growth Rate | CAGR of 32.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 436 |

| By Service Type |

|

| By Testing Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Keysight Technologies, Novacoast, Inc., Praetorian, Infosys, Happiest Minds Technologies, HCL Technologies Limited, Capgemini SE, Rapid7, Inc., Apica, AFour Technologies |

Analyst Review

As per the insights of the top-level CXOs, IoT testing includes functional and integration testing relevant to the specifics of distributed architectures, performance testing to check how applications handle large volumes of streaming data, security testing at the application gateway, and IoT device levels. The availability of highly reliable internet access and the quick adoption of interconnected devices in manufacturing industries also contribute to the market's growth. Significant R&D expenditures are being made to enhance the necessary network connectivity infrastructure and IoT testing technologies & services, which support the market shares. In addition, smart devices and IoT in the retail sector help companies enhance the customer experience to drive more conversions, altering the day-to-day store operations and increasing the managed services in this sector. Furthermore, managed IoT testing service providers see emerging technology as a significant business opportunity for the next few years. Among managed IoT testing services, security testing will have a more substantial market share than other testing services.

The CXOs further added that market players are adopting strategies such as acquisition for enhancing their services in the market and improving customer satisfaction. For instance, in March 2023, Rapid7 Inc. acquired Minerva Labs, a leading provider of anti-evasion and ransomware prevention technology. Customers accessed enhanced detection and response capabilities across their cloud, on-premises, and extended attack surfaces with Rapid7 Managed Detection and Response (MDR) services. With this acquisition, Rapid7 aims to organize enhanced ransomware prevention, further enhancing its industry-leading managed threat detection capabilities. Customers will be able to further consolidate their security investments. This strategy was implemented to strengthen Rapid7 Inc.’s position in the IoT testing market. Therefore, such strategies are expected to boost the growth of the IoT testing market in the upcoming years.

Moreover, some of the key players profiled in the report are Qualcomm Technologies, Inc., Thales, ZTE Corporation, Rohde & Schwarz, MediaTek Inc., Nokia, Telefonaktiebolaget LM Ericsson, Intelsat, Spirent Communications, and Keysight Technologies. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Rise in importance of DevOps, increase in demand for IP testing of IoT devices, and the increased deployment of microservices contribute towards the growth of the market.

The IoT testing market is projected to reach $30.37 billion by 2032.

The key growth strategies of IoT testing players include product portfolio expansion, mergers & acquisitions, agreements, business expansion, and collaborations.

The key players profiled in the report include IoT testing market analysis includes top companies operating in the market such as AFour Technologies, Apica, Novacoast, Inc., Capgemini SE, Happiest Minds, HCL Technologies Limited, Infosys, Keysight Technologies, Praetorian, and Rapid7.

The IoT testing market is estimated to grow at a CAGR of 32%.6 from 2023 to 2032.

Loading Table Of Content...

Loading Research Methodology...