IP Multimedia Subsystem Market Insights:

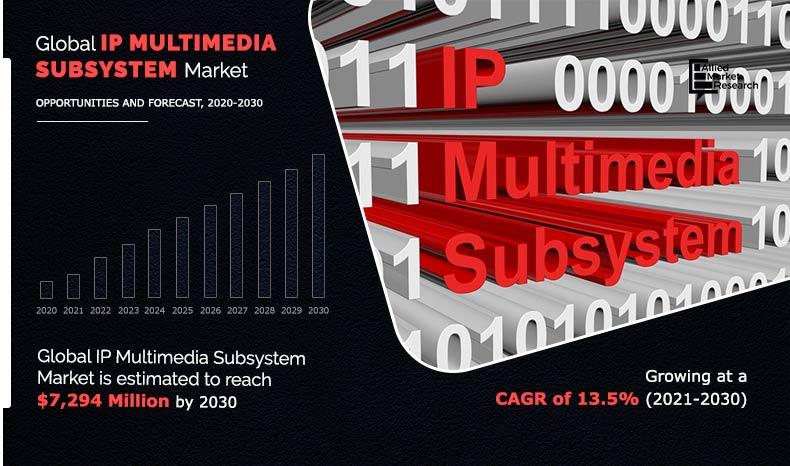

The global IMS market size was valued at USD 2.1 billion in 2020, and is projected to reach USD 7.2 billion by 2030, registering a CAGR of 13.5% from 2021 to 2030.

Governments and private enterprises in developing countries are eager to expand the country's networking infrastructure and, as a result, are investing more resources in cellular network markets, broadening the scope for future applications, with the IP Multimedia Subsystem (IMS) market being one of the industries seeking to benefit from this and have greater opportunities for growth in such markets.

In 2020, the global IP Multimedia Subsystem market share was dominated by the product, and is expected to maintain its dominance in the upcoming years. This is due to mobile operators using a wide range of IMS solutions to provide a variety of applications, including Voice over LTE (VoLTE), Voice over Wireless Fidelity (VoWiFi), Rich Communication Services (RCS), and Integrated Communications-as -a -Service (UCaaS).

Within the market, service segment is estimated to emerge as the fastest growing segment. The growing demand for VoLTE and LTE services and global standards for network infrastructure and services are the drivers for this IP multimedia subsystem market. Demand for music and video-on-demand services has also increased due to changes in customer preferences, improved internet speeds and the proliferation of smartphones. In addition, 5G is expected to launch new utility cases such as smart cities, smart agriculture, logistics and public security agencies.

The report focuses on the growth prospects, restraints, and IP multimedia subsystem market analysis. The study provides Porter’s five forces analysis of the IP Multimedia Subsystem industry to understand impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the network security IP Multimedia subsystem market trends.

By Technology

Services segment is projected as one of the most lucrative segments.

Segment Review:

The IMS industry is primarily bifurcated on the basis of component, operators and region. Based on component, the market is bifurcated into product and services, while on the basis of operators the market is bifurcated into fixed operators and mobile operators. Based on the regions, the market covers North America, Europe, Asia Pacific and LAMEA.

By Region

APAC is projected as one of the most significant region.

Top Impacting Factors:

Factors such as increasing data traffic in global cellular network and growing focus on improving cellular network infrastructure are the major factors that is driving the IP multimedia subsystem market. However, longer deployment time of telecom infrastructure and high cost and maintenance in telecommunication equipment is restraining the overall growth, Further, advancement in the field of telecom and rapid transformation within the industry is set to create a lucrative opportunity for the overall IMS market.

Advancements in the field of telecom

Recent innovations in the telecommunications sector will present significant prospects for the IP multimedia subsystem domain. Telecom technologies such as VoLTE and VoWiFi, which leverage the IP Multimedia Subsystem (IMS) paradigm to let customers conduct voice calls while simultaneously utilizing data network LTE, have reinforced the IMS model in the modern telecom business.

The IP Multimedia Subsystem (IMS) network architecture, which was first presented in 1999 and received some criticism from telecom operators at that time for being too sophisticated and expensive to deploy for the time's telecommunications standard, gained success with LTE networks in the early 2010s. Furthermore, emerging telecom network technologies such as 5G networks, which operate on the IP Multimedia Subsystem (IMS) concept, are expected to fuel the growth of the IP multimedia subsystem market growth in the coming years.

The rapid transformation of the telecommunications industry

The telecommunication industry has witnessed some heavy changes in the past few decades. The telecommunications industry has evolved from a highly complex network of discretely controlled small local network elements to independently managed, virtualized communications and cloud infrastructure. This industry transformation is expected to continue throughout the next decade. This presents significant prospects for the IP Multimedia Subsystem (IMS) network model, which is presently powering critical industrial networks (such as VoLTE and VoWiFi networks) as well as the 5G cellular networks (which are currently being deployed across the world). The IP multimedia subsystem (IMS) market is expected to expand in the next few years, as the number of applications enabled by the model grows.

Key Benefits For Stakeholders:

- The study provides an in-depth analysis of the IP Multimedia Subsystem market growth along with current trends and future estimations to elucidate imminent investment pockets.

- Information about key drivers, restraints, and opportunities and their impact analysis on the IMS market size is provided in the report.

- Porter’s five forces analysis illustrates the potency of buyers and suppliers operating in the IMS industry.

- The quantitative analysis of IP Multimedia Subsystem market for the period 2020–2030 is provided to determine the IP multimedia subsystem market forecast.

IP Multimedia Subsystem Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Operators |

|

| By Region |

|

| Key Market Players | NEC Corporation, Nokia, Cisco Systems, Inc., Oracle Corporation, ZTE Corporation, Athonet srl, Ericsson, Huawei Technologies Co., Ltd., Cirpack, International Business Machines Corporation |

Analyst Review

According to CXOs of the major companies, the increasing adoption of cloud platforms by communications operators for switching analog networks to Internet protocol networks has further enhanced the need for IP multimedia subsystems in the region. In addition, the region sees a rapid increase in smart technologies, such as smart cities, autonomous vehicles, IoT applications, home automation, industrial automation, intelligent processing technology, and more. These factors are expected to drive market growth. Moreover, acceptance of 5G across the region and increase in investments of major mobile operators in the region is providing ample opportunities for market growth in the region.

In addition, the Government of India is busy providing a platform for the growth of telecommunications companies. For example, the Government of India has introduced the ‘Digital India’ program, in which all sectors such as health care, manufacturing, etc., are expected to be connected through internet. As a result of this initiative, the IP multimedia subsystem (IMS) services market is expected to grow at a much higher rate in the Asia-Pacific region.

The IP Media Subsystem market is competitive and comprises a number of regional and global vendors competing based on factors such as cost of solutions & services, reliability, efficiency of products, and support services. The market is concentrated with major players consuming 45-50% of the share. The degree of concentration is expected to remain same during the forecast period. In November 2017, Athonet launched the S-GW local breakout function, which enables low latency videos, caching, and content management at the network edge, using standard 3GPP-compliant interfaces and open APIs. The feature also enables local breakout for other edge computing services that require low latency, security, and optimization of data flows

Loading Table Of Content...