Islamic Finance Market Overview

The global islamic finance market was valued at $2.5 trillion in 2023, and is projected to reach $7.7 trillion by 2033, growing at a CAGR of 12% from 2024 to 2033. Growing demand for Sharia-compliant financial services, supportive regulations, product innovation, and rising awareness of Islamic banking principles globally, contribute to the growth of the market.

Market Dynamics & Insights

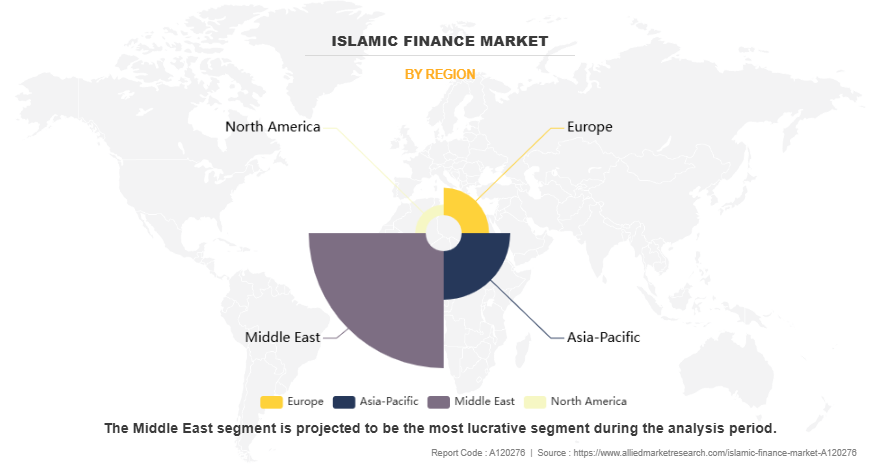

- The islamic finance industry in Middle East held a significant share of 53% in 2023.

- The islamic finance industry in Canada is expected to grow significantly at a CAGR of 26.5% from 2024 to 2033.

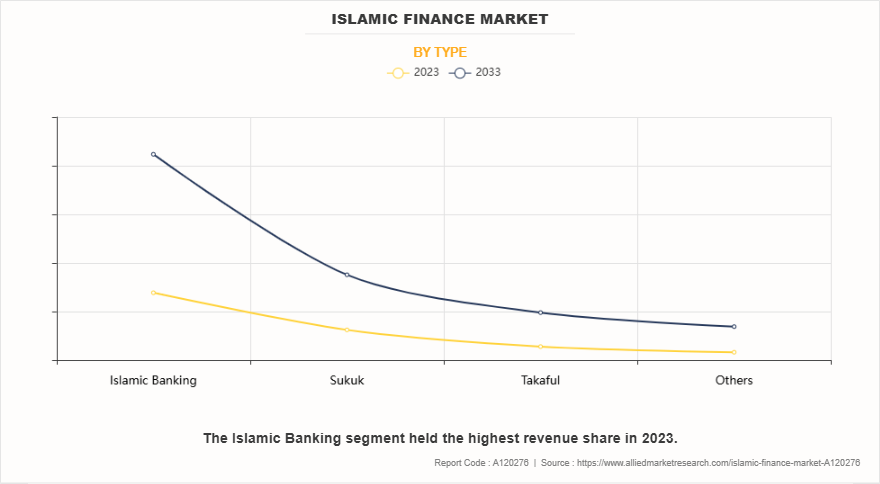

- By type, the islamic banking segment dominated the market, accounting for the revenue share of 57% in 2023.

- By end user, the individual segment dominated the industry in 2023 and accounted for the largest revenue share of 71%.

Market Size & Future Outlook

- 2023 Market Size: $2.5 Trillion

- 2033 Projected Market Size: $7.7 Trillion

- CAGR (2023-2032): 12%

- Middle East: Largest market in 2023

- North America: Fastest growing market

What is Meant by Islamic Finance

The Islamic finance market is growing as a key part of the global financial system. It is based on ethical principles, risk-sharing, and interest-free transactions, ensuring fairness in financial dealings. This system follows Shariah law, which prohibits interest (riba), excessive uncertainty (gharar), and speculative activities (maysir). Instead, it promotes profit-sharing, asset-backed financing, and investments that support real economic growth. Islamic finance is expanding worldwide, attracting individuals, businesses, and governments looking for ethical and sustainable financial solutions.

In addition to investment opportunities, the Islamic finance market is playing a crucial role in promoting financial inclusion. By emphasizing risk-sharing models and providing alternatives to interest-based lending, Islamic financial institutions have been successful in reaching underserved populations, particularly in developing economies. Microfinance initiatives based on Islamic principles, such as Qard Hasan (interest-free loans) and Waqf (endowment funds), are empowering small businesses, entrepreneurs, and low-income households, contributing to economic empowerment and poverty reduction. Moreover, the integration of sustainable development goals (SDGs) within Islamic finance has created new opportunities for socially responsible investing. Many Islamic financial institutions are actively funding projects focused on renewable energy, affordable housing, and education, aligning their strategies with global efforts to achieve long-term economic sustainability.

Growing demand for sharia-compliant financial products and government support and regulatory frameworks are the factors expected to propel the growth of the global Islamic finance market. Moreover, innovation in Islamic financial products are expected to provide lucrative opportunities for the growth of the market during the forecast period. On the contrary, lack of standardization and regulatory harmonization and complex product hamper the growth of the Islamic finance market.

Key Takeaways:

- By type, the Islamic banking segment accounted for the largest Islamic finance market share in 2023.

- By end user, the individual segment accounted for the largest Islamic Finance Market Size in 2023.

- Region wise, Middle East generated the highest revenue in 2023.

Islamic Finance Market Segment review

The Islamic finance market is segmented on the basis of deployment type, end user, and region. On the basis of type, it is divided into Islamic banking, Sukuk, Takaful, and others. By end user, it is categorized into individual and business. On the basis of region, it is analyzed across North America, Europe, Middle East and Rest of world.

On the basis of type, the Islamic banking segment attained the highest growth in 2023, owing to its well-established presence, extensive customer base, and wide range of Sharia-compliant financial services. Islamic banks offer essential services like savings accounts, home financing, auto loans, and business funding, making them the primary choice for individuals and businesses seeking interest-free financial solutions. On the other hand, the others segment is attributed to be the fastest-growing segment during the forecast period, as rising demand for ethical investments, sustainable finance, and financial inclusion. Islamic investment funds are gaining popularity as more investors look for socially responsible and Sharia-compliant investment options. Similarly, Islamic microfinance is expanding rapidly by providing small loans and financial services to underserved communities, especially in developing regions. The combination of these factors is fueling rapid growth in this segment.

Region wise, the Middle East attained the highest growth in 2023 in islamic finance market, owing to its strong cultural and religious ties to Sharia-compliant financial practices. Countries like Saudi Arabia, the UAE, and Qatar have well-established Islamic banking systems, extensive Islamic bound markets, and supportive government policies that have strengthened the region's dominance. Additionally, the presence of major Islamic financial institutions and global investment hubs further contributes to this leadership. On the other hand, the North America region is attributed to be the fastest-growing segment during the islamic finance market forecast period, owing to increasing awareness of Islamic finance principles, rising demand for ethical investing, and a growing Muslim population seeking Sharia-compliant financial solutions. Financial institutions in North America are expanding their Islamic finance offerings, while innovative fintech platforms are improving access to these services, making the region a key growth market for Islamic finance, driving the high growth of this region.

The report focuses on growth prospects, restraints, and analysis of the global Islamic finance market trend. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the global ,arket.

Competition Analysis

Competitive analysis and profiles of the major players in the Kuwait Finance House, Al Rajhi Bank, Maybank Islamic Berhad, Dubai Islamic Bank, Abu Dhabi Islamic Bank, Boubyan Bank, Bank Alfalah Limited, Alinma Bank, Bank Islam Malaysia Berhad, Qatar Islamic Bank, PT Bank Syariah Indonesia Tbk, Dukhan Bank, CIMB ISLAMIC BANK BERHAD, GFH Financial Group, Turkiye Emlak Katilim Bankasi, Jordan Islamic Bank, Al Baraka Group, PT Bank Muamalat Indonesia TBK, Alrayan Bank Group, and Bank Islam Brunei Darussalam Berhad. These major players have adopted various key development strategies such as business expansion, new product launches, and partnerships, which help drive the growth of the Islamic finance market globally.

What are the Recent Developments in the Islamic finance Industry:

In July 2024, Ethos, a UK-based Islamic and ethical finance start-up, partnered with core banking vendor Thought Machine to power its provision of mobile-ready “seamless and real-time Shariah-compliant financial solutions”. The company is to leverage the vendor’s cloud-based Vault Core platform to launch a deposit account service and home purchase plan mortgage service supporting Shariah-compliant Mudaraba, and Musharakah and Ijarah structures respectively.

What are the Top Impacting Factors in Islamic Finance Market

Growing Demand for Sharia-Compliant Financial Product

As awareness of Islamic financial principles continues to grow, consumers are increasingly seeking financial products that align with their ethical and religious beliefs. Sharia-compliant financial solutions adhere to Islamic law, which prohibits interest (riba), excessive uncertainty (gharar), and investments in businesses considered unethical (such as those involving alcohol, gambling, or pork-related products). This ensures that financial activities promote fairness, transparency, and risk-sharing. The rising Muslim population, particularly in regions like the Middle East, Southeast Asia, and parts of Africa, has significantly contributed to this demand and grow the islamic finance industry. Moreover, even non-Muslim investors are showing interest in Islamic finance due to its emphasis on ethical investing and socially responsible practices. As a result, banks and financial institutions are expanding their portfolios to include Sharia-compliant offerings such as Islamic bonds, Murabaha (cost-plus financing), and Takaful (Islamic insurance). This growing demand has also encouraged global financial hubs, including London, Dubai, and Kuala Lumpur, to develop robust frameworks that support islamic financial services. By offering Sharia-compliant products, financial institutions can tap into new customer segments, enhance their market reach, and meet the evolving preferences of ethically conscious investors. This trend continues to play a vital role in driving innovation and expansion within the global Islamic finance sector.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the islamic finance market analysis from 2023 to 2033 to identify the prevailing islamic finance market opportunities.

- The market research is offered along with information related to key drivers, restraints, and islamic finance market opportunity.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the islamic finance market segmentation assists to determine the prevailing market opportunities and islamic finance market outlook

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global islamic finance market trends, key players, market segments, application areas, and islamic finance market growth strategies.

Islamic Finance Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 7.7 trillion |

| Growth Rate | CAGR of 12% |

| Forecast period | 2023 - 2033 |

| Report Pages | 306 |

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Bank Islam Malaysia Berhad, Alinma Bank, Dubai Islamic Bank, Qatar Islamic Bank, Bank Islam Brunei Darussalam Berhad, AlRayan Bank Group, Jordan Islamic Bank, Dukhan Bank, Turkiye Emlak Katilim Bankasi, Boubyan Bank, PT Bank Muamalat Indonesia TBK, CIMB ISLAMIC BANK BERHAD, Al Baraka Group, Maybank Islamic Berhad, al rajhi bank, PT Bank Syariah Indonesia Tbk, Abu Dhabi Islamic Bank, Kuwait Finance House, GFH Financial Group, Bank Alfalah Limited |

Analyst Review

The Islamic finance market growth is driven by its emphasis on ethical finance, risk management, and sustainable economic practices. As global financial system evolve, CXOs are increasingly recognizing Islamic finance as a strategic avenue for diversification, innovation, and long-term value creation. The Islamic finance market offers access to a rapidly growing pool of investors and consumers in regions such as the Middle East, Southeast Asia, and parts of Africa. These markets are witnessing rising demand for Shariah compliant financial products, making it crucial for executives to align their offerings with Islamic finance principles. By adopting solutions such as Islamic bonds for capital raising or Mudarabah and Musharakah models for partnerships, financial institutions can attract more customers. Additionally, emerging trends in fintech, blockchain, and digital banking are creating new ways to deliver Shariah-compliant products with enhanced customer experiences. Companies who embrace these technologies can gain a competitive edge by offering seamless digital solutions that cater to tech-savvy consumers in both Muslim-majority and non-Muslim markets. Further, establishing dedicated Shariah advisory boards, integrating compliance frameworks, and maintaining transparency in product development are crucial steps for organizations seeking to build credibility in the Islamic finance market. Companies prioritizing these governance measures not only ensure regulatory compliance but also strengthen trust among investors and clients.

For instance, in August 2024, KFH successfully completed the merger between Kuwait Finance House and the formerly Ahli United Bank - Kuwait. With the integration of both banks' operations into a single, unified system, the combined entity entered a new chapter of success, achievement, and industry leadership. The integration process was completed in record time with high efficiency, reinforcing KFH's position as the benchmark for banks in Kuwait and the region. Following its landmark cross-border acquisition of Ahli United Bank, Bahrain, one of the largest deals in the region, KFH concluded the largest-ever merger in Kuwait’s banking sector.

The global Islamic finance market was valued at $2.5 trillion in 2023 and is estimated to reach $7.7 trillion by 2033, growing at a CAGR of 12% from 2024 to 2033.

Growing demand for sharia-compliant financial products are the upcoming trends of the Islamic Finance Market in the globe.

Innovation in Islamic Financial Products is the leading application of the Islamic Finance Market.

Middle East is the largest regional market for Islamic Finance.

Kuwait Finance House, Al Rajhi Bank, Maybank Islamic Berhad, Dubai Islamic Bank, Abu Dhabi Islamic Bank, Boubyan Bank, Bank Alfalah Limited, Alinma Bank, Bank Islam Malaysia Berhad, Qatar Islamic Bank, PT Bank Syariah Indonesia Tbk, Dukhan Bank, CIMB ISLAMIC BANK BERHAD, GFH Financial Group, Turkiye Emlak Katilim Bankasi, Jordan Islamic Bank, Al Baraka Group, PT Bank Muamalat Indonesia TBK, Alrayan Bank Group, and Bank Islam Brunei Darussalam Berhad. are the top companies to hold the market share in Islamic Finance.

Loading Table Of Content...

Loading Research Methodology...