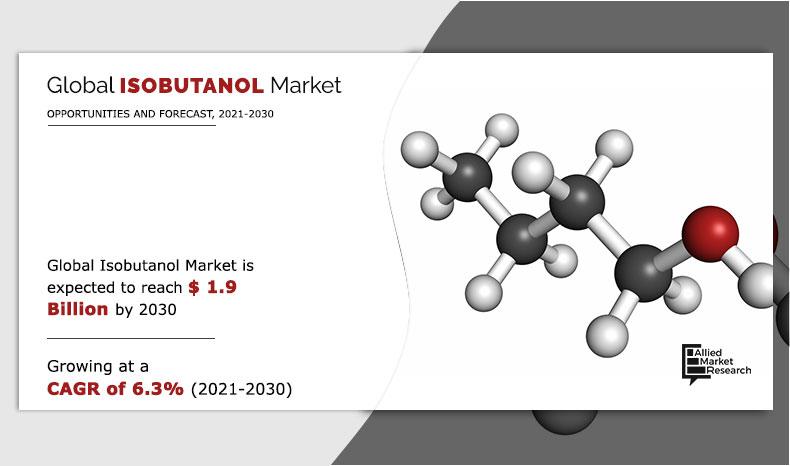

Isobutanol Market Outlook - 2021–2030

The global isobutanol market size was valued at $1.0 billion in 2020, and is projected to reach $1.9 billion by 2030, at a CAGR of 6.3% from 2021 to 2030.

Isobutanol is an organic molecule with the chemical formula (CH3)2CHCH2OH. It is a primary alcohol with the molecular formula (CH3)2CHCH2OH. It is a clear, flammable liquid that is mostly employed as a solvent and chemical intermediary in the production of a wide range of chemical formulations. It is easily soluble in a wide range of regular solvents, including ketones, alcohols, ether, gycols, aromatic hydrocarbons, and aldehydes, despite its low miscibility in water. Isobutanol also serves as an extractant, additive, humectant, dehydrating agent, and starting material.

Rise in demand from end users such as chemical and oil & gas, as well as features such as limited miscibility and medium volatility, is one of the important drivers of isobutanol market growth. Increased use of isobutyl acetate by industries such as food processing, lacquer, and others, as well as increased applications from the paint & coatings industry, propel the growth of the isobutanol market. Increased production of bio-isobutanol as a cost-effective alternative will also open up new opportunities for the market to expand. However, strict rules and regulations surrounding the use of isobutyl acetate in food processing and cosmetics operate as market limitations for isobutanol.

The global isobutanol market analysis has been done on the basis of product, application, and region. By products, the isobutanol market is divided into synthetic isobutanol, bio based isobutanol, and others. On the basis of application, the market is divided into oil & gas, solvents & coatings, chemical intermediate, pharmaceuticals, and others. Region wise, it is studied across North America, Europe, Asia-Pacific, and LAMEA.

The manufacturers studied and profiled in the report include BASF SE, Eastman Chemical Company, Gevo, Ineos Group Holdings S.A., Mitsubishi Chemical Holdings Corporation, OQ Chemicals Gmbh, Petronas Chemicals Group Berhad, Sasol Limited, The Andhra Petrochemicals Limited, and The Dow Chemical Company.

Isobutanol market, by product

By product, the bio based isobutanol segment was the leading product segment with a demand share exceeding 63.3% of total value in 2020. Favorable government policies supporting environmental friendly chemical production in mature economies of Europe and North America may be attributed to the rapid growth.

By Product

Bio based Isobutanol is projected as the most lucrative segment.

Isobutanol market, by application

By application, oil & gas is anticipated to witness the fastest growth over the forecast period owing to rising jet fuels and other downstream products demand such as diesel and gasoline.

By Application

Oil & Gas is projected as the most lucrative segment.

Isobutanol market, by region

By region, the isobutanol market analysis has been done where Asia-Pacific dominates the market due to increased demand for isobutanol in the automotive, chemical, solvent, and coating sectors. The isobutanol market in Asia-Pacific is also being driven by increased urbanization and purchase.

By Region

Asia Pacific holds a dominant position in 2019 and would continue to maintain the lead over the forecast period.

Key benefits for stakeholders

- Porter’s five forces analysis helps analyze the potential of buyers & suppliers and the competitive scenario of the isobutanol industry for strategy building.

- It outlines the current isobutanol market trends and future estimations from 2020 to 2030 to understand the prevailing opportunities and potential investment pockets.

- The major countries in the region have been mapped according to their individual revenue contribution to the regional market.

- The key drivers, restraints, & isobutanol market opportunities and their detailed impact analysis are explained in the study.

- The profiles of key players and their key strategic developments are enlisted in the report.

Impact of COVID-19 on the global isobutanol market

- Some of the major economies suffering from the COVID-19 crisis include Germany, France, Italy, Spain, the UK, Norway, and others. Many industries have been shut down due to lack of raw material availability and disruptions in the supply chain, owing to the virus outbreak. The worldwide lockdown has suspended the oil & gas, solvents & coatings and chemical intermediate activities, which results in declining demand for isobutanol.

- Manufacture of synthetic isobutanol and bio based isobutanol and other products across the globe came to a halt due to unavailability of raw materials, shortage of labor, and others. This is expected to hamper the isobutanol market growth.

- The isobutanol end-use sectors are experiencing challenges as a result of the COVID-19 outbreak, such as delays in getting surfactants from producers due to material import and export restrictions. Raw material deliveries are being delayed, which is causing delays in delivery to customers.

- Furthermore, the COVID-19 epidemic is having an effect on the automotive and construction industries. The production of automotive has been halted, resulting in a significant loss in the whole automotive sector. The need for paint and coatings has decreased dramatically as a result of the drop in vehicle manufacturing, which has had a considerable influence on the isobutanol market.

Key Market Segments

By Product

- Synthetic Isobutanol

- Bio based Isobutanol

- Others

By Application

- Oil & Gas

- Solvents & Coatings

- Chemical Intermediate

- Pharmaceuticals

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- Spain

- Italy

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- South Korea

- Australia

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Saudi Arabia

- South Africa

- Rest of LAMEA

Key players in the global isobutanol market are:

- BASF SE

- Eastman Chemical Company

- Gevo

- Ineos Group Holdings S.A.

- Mitsubishi Chemical Holdings Corporation

- Oq Chemicals Gmbh

- Petronas Chemicals Group Berhad

- Sasol Limited

- The Andhra Petrochemicals Limited

- The Dow Chemical Company

Isobutanol Market Report Highlights

| Aspects | Details |

| By PRODUCT |

|

| By APPLICATION |

|

| By Region |

|

| Key Market Players | OQ CHEMICALS GMBH, INEOS GROUP HOLDINGS S.A., BASF SE, EASTMAN CHEMICAL COMPANY, SASOL LIMITED, Gevo, THE DOW CHEMICAL COMPANY, PETRONAS CHEMICALS GROUP BERHAD, The Andhra Petrochemicals Limited, Mitsubishi Chemical Holdings Corporation |

Analyst Review

The global isobutanol market is anticipated to witness growth during the forecast period, owing to rise in demand form oil & gas, solvents & coatings, chemical intermediate, and pharmaceuticals products such as synthetic isobutanol, bio based isobutanol, and others. Bio based isobutanol was the leading commodity segment in 2020, with a market share of 63.3%. Increase in demand for products across various applications, including solvents & coatings and petrochemicals, is anticipated to push industry growth in the near future, specifically in the developing economies such as India and China. Oil & gas were the leading product group and constituted 45.5% of the overall value of the industry in 2020. Due to the rapid development of the petrochemical industry, especially in the Middle East and the Asia-Pacific, the chemical intermediate is anticipated to gain market share in the coming years. The isobutanol market in Asia-Pacific is anticipated to expand at a fast pace during the forecast period due to the steady expansion of the paints and coatings & chemicals industries in the region.

Growing isobutanol demand across various end-use industries such as oil & gas and chemical intermediates is expected to drive its demand over the forecast period.

Increasing vehicle production along with growing consumption of isobutanol based coating is estimated to drive the demand for the market over the assessment period.

The market players are adopting various growth strategies and also investing in R&D extensively to develop technically advanced unique products which are expected to drive the market size.

Asia-Pacific region will provide more business opportunities for isobutanol market in coming years

Application segment holds the maximum share of the isobutanol market

BASF SE, Eastman Chemical Company, Gevo, Ineos Group Holdings S.A., Mitsubishi Chemical Holdings Corporation are the top players in isobutanol market.

Oil & gas and chemical intermediate industry are the potential customers of isobutanol industry

The global isobutanol market was valued at $ 1.9 Billion in 2028

Loading Table Of Content...