Isopropyl Alcohol Market Research - 2032

The global isopropyl alcohol market size was valued at $2.7 billion in 2022 and is projected to reach $5.9 billion by 2032, growing at a CAGR of 8.1% from 2023 to 2032. The expanding market for disinfectants and sanitizers significantly drives the demand for isopropyl alcohol. As isopropyl alcohol is a key ingredient in many disinfectant formulations, its use has increased in various sectors such as healthcare, food service, and personal care.

Key Report Highlighters:

- The isopropyl alcohol market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) and volume (Kilotons) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The isopropyl alcohol market is highly fragmented, with several players including Dow Chemical, Mistral Industrial Chemicals, INEOS Corporation, ReAgent Chemicals Ltd., LyondellBasell Industries, Linde Gas, Ecolab, Royal Dutch Shell, and ExxonMobil Corporation.

Introduction

Isopropyl alcohol, also known as isopropanol or 2-propanol is a colorless, flammable liquid with a strong odor. It is a type of alcohol commonly used as a solvent, antiseptic, and disinfectant. Isopropyl alcohol (C₃H₈O) has a molecular structure that includes a hydroxyl (-OH) group, which contributes to its alcohol properties. It is widely employed in various industries for cleaning, sanitizing, and as a key ingredient in personal care products, such as hand sanitizers and rubbing alcohol. Isopropyl alcohol is valued for its effectiveness in dissolving oils and resins that makes it a versatile substance in both household and industrial applications.

Various Applications Of Isopropyl Alcohol Market In The Chemicals Industry:

Isopropyl alcohol plays a significant role in the chemical industry, contributing to various processes and applications. Several factors contribute to isopropyl alcohol driving the growth of the chemical industry. Isopropyl alcohol is widely used as a solvent in the chemical industry. Isopropyl alcohol is utilized as a reaction medium or co-solvent in chemical reactions. Its ability to dissolve reactants and products enhances reaction rates and facilitates the synthesis of certain compounds.

In the extraction of chemicals from raw materials, such as plant materials or natural products, isopropyl alcohol is employed to isolate and concentrate specific compounds. It aids in the extraction of bioactive substances used in pharmaceuticals, flavors, and fragrances. Isopropyl alcohol is an effective cleaning agent in the chemical industry. It is used to clean equipment, glassware, and surfaces to ensure a clean and contamination-free environment for chemical processes. In the preparation of surfaces for various chemical treatments, isopropyl alcohol is used for cleaning and degreasing. This is particularly important in applications such as metal pre-treatment before coating or plating.

Isopropyl alcohol serves as an intermediate in the synthesis of various chemicals. It undergoes reactions to form other compounds, adding flexibility to its applications in the chemical manufacturing process. Isopropyl alcohol is compatible with a wide range of materials, including plastics, rubber, and certain metals. This compatibility makes it suitable for use in processes where different materials are involved. In polymer processing, isopropyl alcohol is employed for cleaning and degreasing surfaces, molds, and equipment. This helps ensure the quality and purity of the final polymer products.

Isopropyl alcohol's versatility as a solvent, cleaning agent, and reaction medium contributes to its widespread use in various processes within the chemical industry. Its role in chemical synthesis, extraction, and surface preparation positions it as a valuable component in many chemical applications, driving growth and efficiency in the industry. These properties are expected to boost isopropyl alcohol market growth in the near future.

Fluctuating Raw Material Prices:

One significant restraining factor in the isopropyl alcohol market is its dependency on raw material prices, particularly the cost of propylene, a key feedstock in its production. Isopropyl alcohol is derived from propylene through a catalytic process, and fluctuations in propylene prices directly impact the production costs of isopropyl alcohol. Variability in raw material prices lead to uncertainties in the overall cost structure for manufacturers and affect profit margins, thereby impacting the isopropyl alcohol market. Moreover, the isopropyl alcohol market faces challenges related to regulatory scrutiny and environmental concerns. Stringent regulations governing the production, handling, and disposal of isopropyl alcohol impose additional compliance costs on manufacturers.

The global awareness of hygiene and sanitation, especially in the wake of health crises, has led to surge in demand for disinfectants. Isopropyl alcohol, with its strong antiseptic properties, is a key ingredient in many disinfectant formulations. The ongoing emphasis on cleanliness in healthcare, households, and public spaces creates opportunities for the isopropyl alcohol market forecast.

Advancement Of Technology Boosting Isopropyl Alcohol Market Share:

The electronics and semiconductor industries rely on isopropyl alcohol for cleaning and decreasing electronic components. With the continuous advancement of technology and the increasing demand for electronic devices, it is expected to boost the demand for isopropyl alcohol in these industries. Isopropyl alcohol is used in the cosmetic and personal care industry in products such as lotions, toners, and hair care formulations. The growing beauty and personal care market, driven by consumer preferences for high-quality products, presents opportunities for isopropyl alcohol manufacturers during the forecast period.

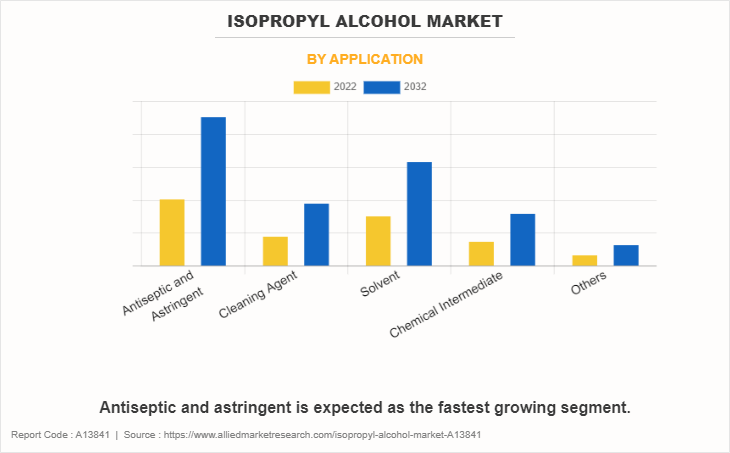

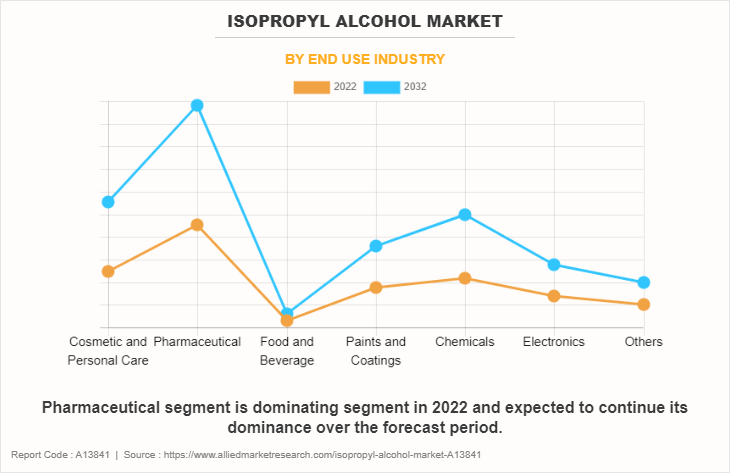

The isopropyl alcohol market is segmented on the basis of application, end-use industry, and region. By application, the market is segmented into antiseptic & astringent, cleaning agent, solvent, chemical intermediate, and others. Depending on end-use industry, it is categorized into cosmetics & personal care, pharmaceutical, food & beverage, paints & coatings, chemicals, electronics, and others. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

In 2022, the astringent & antiseptic segment dominated the market, accounting for the largest revenue share in 2022. This segment is expected to be the fastest growing segment during the forecast period. The heightened awareness of health and hygiene during the pandemic led to a substantial increase in the consumption of sanitizers, personal care items, and various pharmaceutical formulations containing isopropyl alcohol. This heightened demand is expected to persist, contributing to increased usage in both pharmaceutical and personal care product formulations.

One of the primary applications of isopropyl alcohol is in the formulation of antiseptics, capitalizing on its exceptional disinfectant properties. Globally, the preferred concentration for this purpose is 70% isopropyl alcohol, commonly utilized in the production of hand sanitizers.

The pharmaceutical segment accounted for the largest share of in 2022. Isopropyl alcohol is widely used in the pharmaceutical industry for its potent antiseptic and disinfectant properties. It is effective in killing bacteria and viruses, making it a crucial component in maintaining high standards of hygiene in pharmaceutical manufacturing processes. Pharmaceutical manufacturing requires stringent hygiene and sterilization to ensure the safety and quality of pharmaceutical products. Isopropyl alcohol is employed in various sterilization processes, including the cleaning and disinfection of equipment, containers, and production facilities.

The chemicals segment is expected to register the highest CAGR of 8.8%. The diverse applications of isopropyl alcohol in the chemical industry, ranging from solvent use to cleaning and reaction facilitation, contribute to its increasing demand. Its role in supporting various chemical processes and applications positions it as a crucial component in the chemical manufacturing landscape.

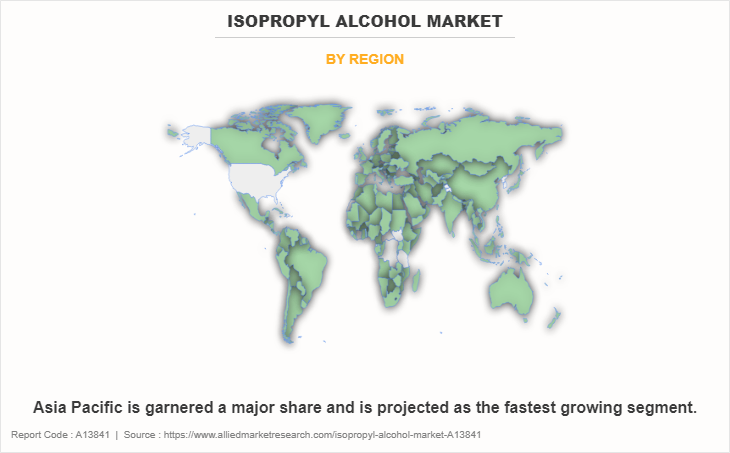

Asia-Pacific garnered the largest share in 2022 due to expansion of the pharmaceutical and healthcare sectors in the region. Isopropyl alcohol is a crucial component in pharmaceutical manufacturing, where it is used for sterilization, cleaning, and formulation of various pharmaceutical products. The rising population and increasing healthcare awareness contribute to the demand for pharmaceuticals, thereby driving the demand for isopropyl alcohol in Asia-Pacific.

Competitive Landscape

The major players operating in the global isopropyl alcohol market are Mistral Industrial Chemicals, Dow Chemical, Linde Gas, INEOS Corporation, Ecolab, Royal Dutch Shell, ExxonMobil Corporation, ReAgent Chemicals Ltd., and LyondellBasell Industries.

Regulatory Landscape:

- OSHA sets regulations in the U.S. to protect workers from occupational hazards. These regulations include guidelines for handling and using isopropyl alcohol, particularly in industries where exposure is common.

- Environmental Protection Agency (EPA) in the U.S.: The EPA regulates the environmental aspects of isopropyl alcohol, addressing issues such as emissions, disposal, and reporting requirements. Isopropyl alcohol is considered a volatile organic compound (VOC), and its release into the air is subject to regulatory controls.

- European Chemicals Agency (ECHA) in the European Union: ECHA oversees the registration, evaluation, authorization, and restriction of chemicals in the European Union. Isopropyl alcohol is subject to REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulations, ensuring its safe use and minimizing risks to human health and the environment.

- Health and Safety Executive (HSE) in the UK: The HSE in the UK provides guidelines and regulations related to occupational safety and health, including the handling of isopropyl alcohol in workplaces.

- Food and Drug Administration (FDA): In the U.S., the FDA regulates isopropyl alcohol when used in pharmaceuticals, cosmetics, and food contact applications. Specific requirements ensure product safety and quality.

- Pharmacopeias: Isopropyl alcohol specifications are often outlined in pharmacopeias, such as the United States Pharmacopeia (USP) and the European Pharmacopoeia, providing standards for pharmaceutical-grade isopropyl alcohol.

- Transportation Regulations: Organizations like the International Air Transport Association (IATA) and the U.S. Department of Transportation (DOT) provide guidelines for the safe transport of isopropyl alcohol, covering packaging, labeling, and handling procedures.

Mistral Industrial Chemicals

Mistral Industrial Chemicals is a significant player in the isopropyl alcohol market, focusing on high-quality chemical manufacturing and distribution. It leverages its established supply chain and customer relationships to provide tailored solutions, particularly for the pharmaceutical and cosmetic industries.

Dow Chemical

Dow Chemical is one of the leading producers of isopropyl alcohol, benefiting from its extensive research and development capabilities. Dow’s robust global distribution network enables efficient market penetration, though it faces intense competition from lower-cost producers.

Linde Gas

Linde Gas, part of the Linde Group, focuses on specialty gases and chemical products, including isopropyl alcohol. The company’s strengths lie in its expertise in gas applications and supply chain logistics, allowing it to serve high-demand sectors effectively, such as electronics and pharmaceuticals.

INEOS Corporation

INEOS Corporation is a major competitor in the isopropyl alcohol market, with a diversified portfolio that includes petrochemicals and specialty chemicals. The company's strong market presence is bolstered by its significant production capacity and investment in state-of-the-art manufacturing facilities.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the isopropyl alcohol market analysis from 2022 to 2032 to identify the prevailing isopropyl alcohol market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the isopropyl alcohol market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global isopropyl alcohol market trends, key players, market segments, application areas, and market growth strategies.

Isopropyl alcohol Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 5.9 billion |

| Growth Rate | CAGR of 8.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Application |

|

| By End use industry |

|

| By Region |

|

| Key Market Players | Huntsman Company, ExxonMobil Corporation, INEOS Group, ReAgent Chemicals Ltd, Mistral Industrial Chemicals, Ecolab, Royal Dutch Shell, LyondellBasell, Dow Chemical, Linde Gas |

Analyst Review

According to the insights of the CXOs of leading companies, the versatility of isopropyl alcohol, coupled with its essential roles in cleaning, disinfection, and manufacturing processes across industries, positions it as a key driver in the isopropyl alcohol market. The growing demand for products that prioritize hygiene and safety further contributes to the market growth.

However, the isopropyl alcohol market faces challenges related to regulatory scrutiny and environmental concerns. Stringent regulations governing the production, handling, and disposal of isopropyl alcohol impose additional compliance costs on manufacturers. In addition, environmental considerations, such as its classification as a volatile organic compound (VOC), have led to a focus on developing alternative, environmentally friendly solvents.

The CXOs further added that isopropyl alcohol finds application in the cosmetic and personal care sector, featuring prominently in the formulation of products like lotions, toners, and hair care items. The expanding beauty and personal care market, fueled by consumer preferences for premium-quality products, offers opportunities for manufacturers of isopropyl alcohol.

The global isopropyl alcohol market attained $2.7 billion in 2022 and is projected to reach $5.9 billion by 2032, growing at a CAGR of 8.1% from 2023 to 2032.

Asia-Pacific garnered the largest share in 2022 due to expansion of the pharmaceutical and healthcare sectors in the region

The major players operating in the global isopropyl alcohol market are Mistral Industrial Chemicals, Dow Chemical, Linde Gas, INEOS Corporation, Ecolab, Royal Dutch Shell, ExxonMobil Corporation, ReAgent Chemicals Ltd., and LyondellBasell Industries.

The primary driver of the isopropyl alcohol market is its widespread use as a key ingredient in hand sanitizers and disinfectants, fueled by the global emphasis on hygiene and health. The COVID-19 pandemic has further accelerated demand, making isopropyl alcohol a critical component in maintaining public health and safety.

The key opportunity for the isopropyl alcohol market lies in the expanding applications within the pharmaceutical and healthcare industries, driven by its effectiveness as a disinfectant and solvent in various medical processes.

The astringent and antiseptic segment is the leading application of the isopropyl alcohol market. The heightened awareness of health and hygiene during the pandemic led to a substantial increase in the consumption of sanitizers, personal care items, and various pharmaceutical formulations containing isopropyl alcohol. This heightened demand is expected to persist, contributing to increased usage in both pharmaceutical and personal care product formulations.

The isopropyl alcohol market is expected to witness a surge in demand due to its rising use of hand sanitizers and disinfectants, driven by increased awareness of hygiene. Additionally, innovations in manufacturing processes and sustainable sourcing methods are likely to shape future trends in response to growing environmental consciousness in the global market.

Loading Table Of Content...

Loading Research Methodology...