Italy B2B2C Insurance Market Outlook – 2026

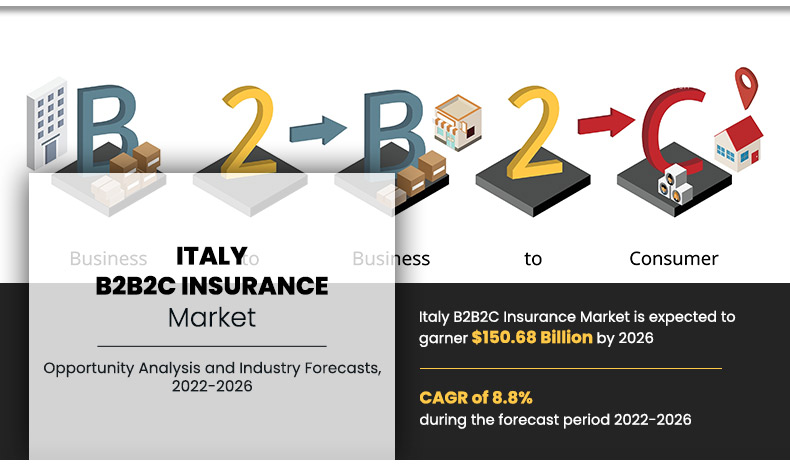

The Italy B2B2C insurance market size was valued at $86.56 billion in 2017, and is projected to reach $150.68 billion by 2026, growing at a CAGR of 8.8% from 2022 to 2026.

The life insurance and general insurance service sectors make up the B2B2C insurance industry, which comprises of sales of B2B2C insurance services by companies, single proprietors, and partnerships. The phrase "business-to-business-to-consumer" (B2B2C) insurance refers to sale of life and general insurance goods and services through means of non-insurance intermediaries other than conventional insurance intermediaries like brokers, independent financial advisers, and agents. A direct selling of insurance to consumers is also a part of the same.

The primary driving factor for the B2B2C business in Italy is the rise in awareness of the unmet need for coverage, along with the expansion of B2B2C insurance companies in the country. The need for B2B2C coverage services is on an increase due to the exponential rise of many other industries, including retail, automobile industry, and other industries in Italy. The Italy B2B2C insurance market, however, is constrained in its expansion by longer underwriting processes and claim settlement. On the other hand, rise in urban populations coupled with increase in disposable income is expected to foster the growth of the Italy B2B2C market. Moreover, the rise in awareness and need for B2B2C services for protection, safety, and fidelity is anticipated to propel the market growth owing to surge in e-commerce, sales, and retail services through digital platforms.

The report focuses on growth prospects, restraints, and trends of the Italy B2B2C insurance market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the Italy B2B2C insurance market outlook.

Segment Review

The Italy B2B2C insurance market is segmented into insurance type, application, industry vertical. By insurance type, the market is differentiated into life insurance and non-life insurance. By application, it is fragmented into individuals and Corporates/Group. By industry vertical, it is classified into travel, automotive, utilities, retail, healthcare and others.

By insurance type, the life insurance segment acquired majority of the share in the Italy B2B2C insurance market size. This is attributed to the fact that life insurance plans have lower premiums as insurance company assumes less risk since customer is only insured for a set time period. Moreover, rise in awareness among the people in the region about protection coverage by insurance drives the growth of the market. Furthermore, in Italy, life insurance policies are increasingly used as an investment by high-net-worth individuals looking to minimize estate taxes. Thus, these are the major trends for life insurance in the market.

Key players operating in the Italy B2B2C insurance market include Allianz Partners, ASSICURAZIONI GENERALI S.P.A., Aviva, Berkshire Hathaway Inc., BNP Paribas Fortis, Munich RE, Prudential Financial, Inc., Swiss Re, The Digital Insurer, and Zurich. These players have adopted various strategies to increase their market penetration and strengthen their position in the Italy B2B2C insurance industry.

COVID-19 Impact Analysis

The COVID-19 outbreak had a negative effect on the market for Italy B2B2C insurance. Due to travel limitations, insurance distribution has been negatively impacted by the pandemic, particularly in the travel and tourism sector. Moreover, the B2B2C insurance market has been impacted by the sharp fall in aircraft traffic. The COVID-19 disaster has accelerated the ongoing trend of the creation of digital insurance platforms. Furthermore, some of the reasons anticipated to propel the Italy B2B2C insurance market during the forecast period include an increase in urban population, a rise in consumer awareness of insurance services, and an increase in disposable income.

Top Impacting Factors

Rise in Consumer Awareness About Insurance

Presently, factors impacting the growth of the B2B2C insurance industry include rising urban population and rising disposable income. Middle-class populations in developing countries are expanding quickly and have better spending habits and expectations for value-added services. Italy is gaining demand for insurance services, which is likely to drive the Italy B2B2C insurance market, as this service is influencing them to opt for better lifestyles with financial assistance services. Additionally, increasing awareness and dependency of consumers on insurance services for overall safety, protection, and reliability of life and non-life insurance services is likely to drive the Italy B2B2C insurance market. Moreover, the growing need among industrial companies to increase their customer base and market share along with expanding their network is driving the growth of the market. Therefore, rise in consumer awareness is one of the major driving factors of the Italy B2B2C insurance market.

By Insurance Type

Life Insurance segment accounted for the highest market share in 2017.

Increase in Adoption of Advanced Analytics and Techniques

The increasing use of advance analytics and technology has led to the increase in the Italy B2B2C insurance market. Advanced analytics can detect and mitigate risk in the real-time that helps organizations to identify the risk swiftly. Advanced analytics also contributes to analyze and influence customer behavior. For instance, in health insurance, companies can analyze the health of a person by collecting the data from the IoT devices and wearable such as fitness tracker and then assess the risk.

Advanced analytics and techniques can be used in general insurance as well as life insurance, providing early claim prediction, increase persistency on the policies, and fraud detection. Therefore, the increase adoption of advanced analytics and techniques has been a driving factor for Italy B2B2C insurance market growth.

Rising Demand for More Channel of Distribution

The Covid-19 pandemic has profoundly affected how people engage among themselves across various industries and geographies. As a result, this change will affect insurance distribution both in the near term, as physical distancing measures continue, and in the longer term. Many insurance companies have already taken steps to address short-term or immediate impacts of COVID-19, further, moving employees to a remote setup and expanding online customer service channels. Now, insurers are focused on the next set of challenges, which includes how to reconstruct distribution in a more remote world. Hence, building an improved and strong channel of distribution around the B2B2C insurance solutions is one of the major drivers of the Italy B2B2C insurance market share.

By Industry Vertical

Healthcare segment accounted for the highest market share in 2017.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the Italy B2B2C insurance market forecast from 2017 to 2026 to identify prevailing Italy B2B2C insurance market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the Italy B2B2C insurance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as Italy B2B2C insurance market trends, key players, market segments, application areas, and market growth strategies.

Italy B2B2C Insurance Market Report Highlights

| Aspects | Details |

| By Insurance Type |

|

| By Application |

|

| By Industry Vertical |

|

| Key Market Players | Munich RE, Allianz Partners, Berkshire Hathaway Inc., BNP Paribas Fortis, Zurich, Aviva, Prudential Financial, Inc., ASSICURAZIONI GENERALI S.P.A., The Digital Insurer, Swiss Re |

Analyst Review

The B2B2C insurance market is expanding as a result of the expanding population in and around Italy. In addition, since there is an increase in the number of confirmed cases of various diseases, people in the nation are becoming aware of health and life insurance and its advantages.

The Italy B2B2C insurance market had a moderate impact of COVID-19 owing to disruptions in supply chains and service gap. However, digitalization in insurance industry has aided the growth of the market. Furthermore, technological advancements such as integration of AI and ML are expected to boost the growth of the market in future.

The Italy B2B2C insurance market is fragmented with the presence of regional vendors such as Allianz Partners, ASSICURAZIONI GENERALI S.P.A., Aviva, Berkshire Hathaway Inc., BNP Paribas Fortis, Munich RE, Prudential Financial, Inc., Swiss Re, The Digital Insurer, and Zurich. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. With increase in awareness & demand for Italy B2B2C insurance across the globe, major players are collaborating their product portfolio to provide differentiated and innovative products.

The Italy B2B2C insurance market is estimated to grow at a CAGR of 8.8% from 2022 to 2026.

The Italy B2B2C insurance market is projected to reach $150.68 billion by 2026.

To get the latest version of sample report

To get the latest version of sample report

Rise in awareness of the unmet need for coverage, along with the expansion of B2B2C insurance companies in the country.

The key players profiled in the report include Allianz Partners, ASSICURAZIONI GENERALI S.P.A., Aviva, Berkshire Hathaway Inc., BNP Paribas Fortis, and many more.

On the basis of top growing big corporations, we select top 10 players.

The Italy B2B2C insurance market is segmented on the basis of insurance type, application, industry vertical.

Non-life Insurance, segment would exhibit the highest CAGR of 11.2% during 2022-2026.

Loading Table Of Content...