Italy has seen a significant rise in the demand for polyethylene terephthalate (PET) in recent years due to increase in use of PET in a variety of industries, including construction, medicine, automobile, and packaging. This is attributed to the fact that the properties of PET make them favorable for multiple uses. Moreover, companies operating in the Italy PET market are working on improving product design, innovating new products, and the usage of new technology to make the product attractive. All these developments are generating lucrative opportunities for the PET industry to expand in Italy.

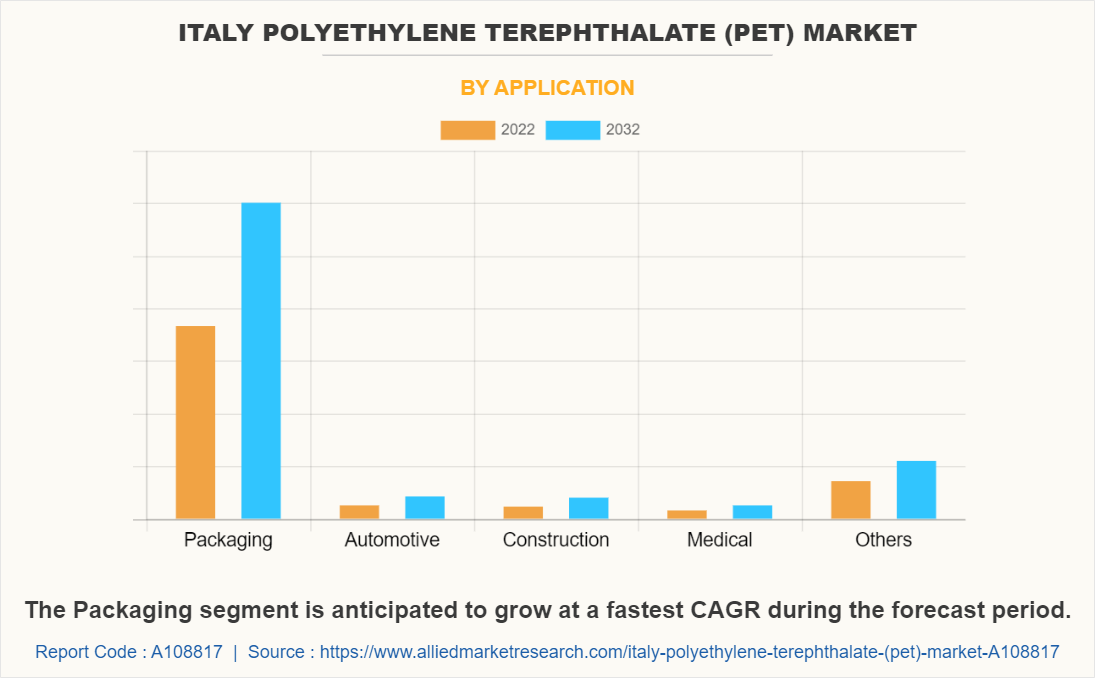

One of the primary driving factors of the Italy PET market is the increasing demand from the automotive sector due to the high-performance and lightweight of PET. Moreover, the product is lightweight and provides protection against water and corrosion, making it suitable for use in automotive components. Furthermore, in the packaging sector, PET is gaining popularity as it provides improved aesthetics, attractive shapes, and excellent transparency. In addition, in the medical sector, PET is being used for multiple purposes, including the production of drug components, medical appliances, implants, and medical packaging, which is expected to drive the growth of the Italy PET market.

On the other hand, factors restraining the growth of the Italy PET market are high cost of PET products. Furthermore, the presence of various substitutes such as polyvinyl chloride and polylactic acid is likely to hamper the growth of the Italy PET market.

On the other hand, factors restraining the growth of the Italy PET market are high cost of PET products. Furthermore, the presence of various substitutes such as polyvinyl chloride and polylactic acid is likely to hamper the growth of the Italy PET market.

In Italy, PET resin producers are introducing innovative products in the market to meet the demand of end users. Furthermore, acquisitions and investments by the leading companies in PET manufacturing are expanding the range of production across the country. For instance, in October 2019, INEOS Styrolution, a key player in the market, acquired Cyklop International, which is a manufacturer of packaging materials. The acquisitions show that the key players are developing their production capabilities. Moreover, many companies are investing in research and development activities to introduce new products with improved properties at significantly less prices.

The Porter's five forces model analyzes the intensity of competition, bargaining power of suppliers, bargaining power of buyers, threat of substitutes, and threat of new entrants. This analysis is beneficial for both buyers and sellers to devise strategies accordingly.

In the Italy PET market, suppliers' bargaining power is considered as high as the demand for the product is relatively low. This may result in the company to accept whatever terms are being offered by the supplier irrespective of the quality. In addition, the bargaining power of buyers is high due to the presence of multiple substitutes, which limits the revenue generation of the PET market in the country. The threat from new entrants is relatively low owing to high capital investment in the PET manufacturing process. In this market, key players have established their brand recognition, and have various agreements and partnerships with significant companies, which may reduce competition.

The companies operating in the Italy PET market are adopting strategies such as product/service launches, acquisitions, business expansions, partnerships, and investment opportunities to gain a competitive edge over their rivals. M&G Chemicals has invested more than EUR 1 billion in its PET manufacturing plant in Ravenna, Italy. In 2018, SABIC, a petrochemical giant, announced an investment of USD 1 billion in an integrated chemical complex in Gelsenkirchen, Germany, which will support the supply of PET compounds across Europe. Indorama Ventures has taken initiatives to reduce raw material costs and expand its production business across the country. It invested $140 million for the Green Polyethylene Terephthalate (PETG) plant in Italy in 2017.

Reliance Industries Limited, the largest petrochemical manufacturer in India, purchased the PET production plant in Mantova, Italy, from SABIC in 2018. A Malaysian energy and chemicals company, Petronas Chemicals Group, invested EUR 60 million to expand its existing PTA and PET production in 2014. Qatar Petroleum announced its plans to invest in the development of a new polyester production line at an existing unit belonging to its subsidiary, Qatar Vinyl Company, located in Mesaieed Industrial City.

Neste, a Finnish oil refining and marketing company, invested in advanced PET and polypropylene production site in Rotterdam. Lotte Chemical Corporation announced an investment worth $980 million to expand its petrochemical production at its Kalama, Washington and Longview sites in the U.S. in 2018. Byco Industries opened a new PET plant in Pakistan in 2020. Versalis, wholly owned subsidiary of Eni, expanded its styrenics production capacity in 2017.

Key Benefits For Stakeholders

- Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

- Analyze the key strategies adopted by major market players in italy polyethylene terephthalate (pet) market.

- Assess and rank the top factors that are expected to affect the growth of italy polyethylene terephthalate (pet) market.

- Top Player positioning provides a clear understanding of the present position of market players.

- Detailed analysis of the italy polyethylene terephthalate (pet) market segmentation assists to determine the prevailing market opportunities.

- Identify key investment pockets for various offerings in the market.

Italy Polyethylene Terephthalate (PET) Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 70 |

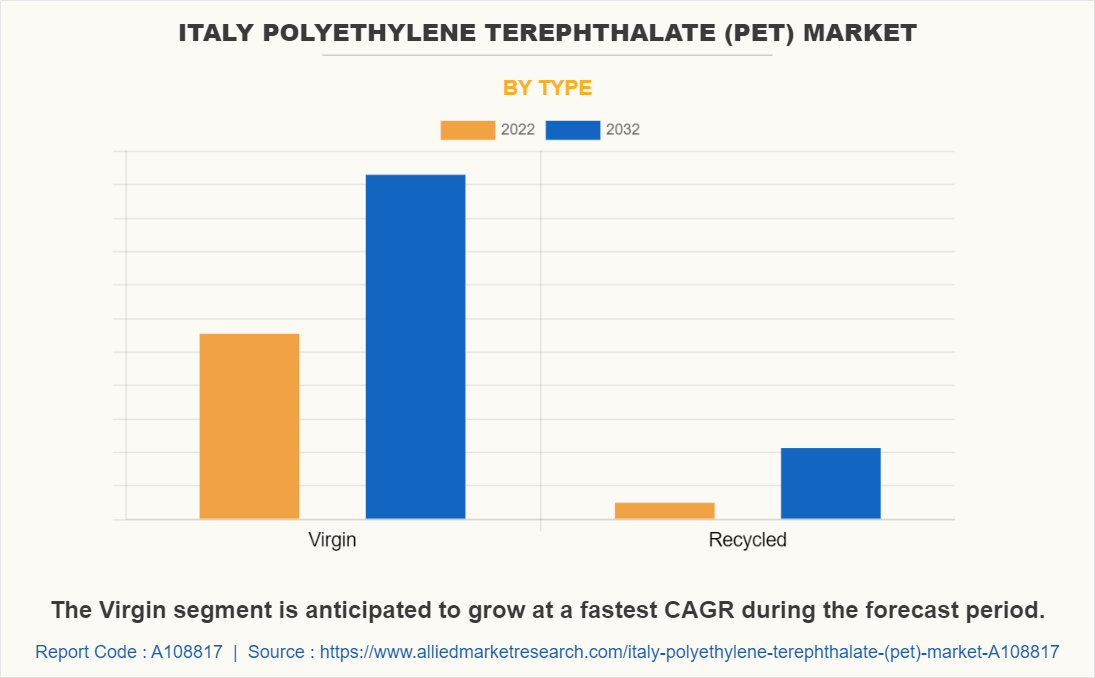

| By Type |

|

| By Application |

|

| Key Market Players | Qatar Petroleum, Neste, Byco Industries, Lotte Chemical Corporation, INEOS, Reliance Industries Limited, Indorama Ventures, SABIC, M&G Chemicals, Versalis (Eni) |

The Italy Polyethylene Terephthalate (PET) Market is projected to grow at a CAGR of 5.1% from 2022 to 2032

M&G Chemicals, Indorama Ventures, Reliance Industries Limited, SABIC, INEOS, Versalis (Eni), Byco Industries, Qatar Petroleum, Neste, Lotte Chemical Corporation are the leading players in Italy Polyethylene Terephthalate (PET) Market

1. Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

2. Analyze the key strategies adopted by major market players in italy polyethylene terephthalate (pet) market.

3. Assess and rank the top factors that are expected to affect the growth of italy polyethylene terephthalate (pet) market.

4. Top Player positioning provides a clear understanding of the present position of market players.

5. Detailed analysis of the italy polyethylene terephthalate (pet) market segmentation assists to determine the prevailing market opportunities.

6. Identify key investment pockets for various offerings in the market.

Italy Polyethylene Terephthalate (PET) Market is classified as by type, by application

Loading Table Of Content...

Loading Research Methodology...