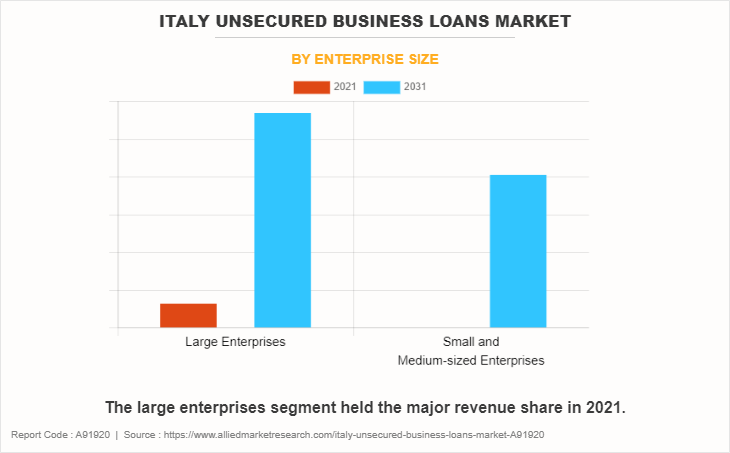

The Italy unsecured business loans market is expected to witness significant growth during the forecast period. The Italy unsecured business loans market is majorly driven by entrepreneurial landscape in Italy and rise in number of the individuals who are embarking on business ventures. The nation has a rich tradition of family-owned businesses, which often require unsecured loans for expansion, working capital, or other exigencies. This dynamic entrepreneurial landscape is further invigorated by government initiatives that promote SMEs' growth. These initiatives create fertile ground for unsecured business loans, driving demand in the market.

However, economic fluctuation is restricting the market growth. Lenders have to deal with issues related to risk assessment and determining interest rates, which restrain the market growth. In addition, stringent government regulations regarding the unsecured business loans is expected to retrain the market growth.

On the other hand, rapid digital transformation and expansion of financial technology (FinTech) companies are emerging as key players in the unsecured business loans sector. In addition, financial companies offer quick, efficient, and tech-driven lending solutions, harnessing the power of data analytics and artificial intelligence to assess borrowers' creditworthiness. This is expected to create significant opportunities for the market expansion.

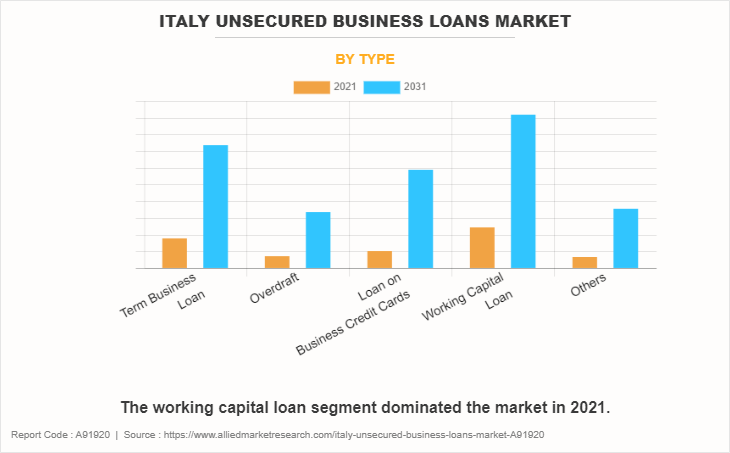

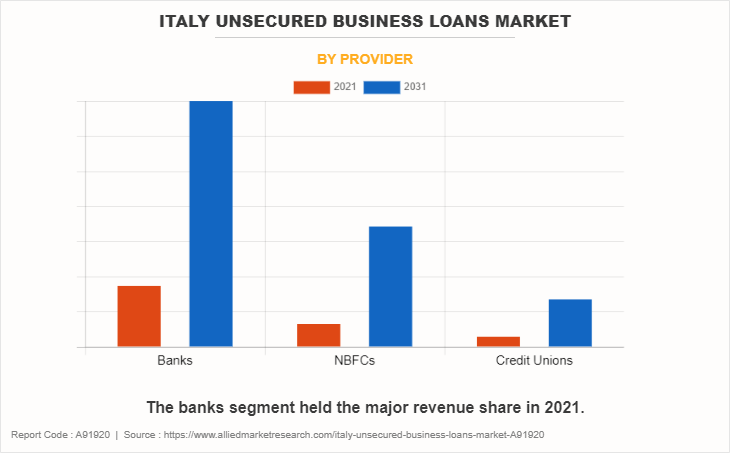

The Italy unsecured business loans market is segmented into type, enterprise size, and provider. On the basis of type, the market is divided into term business loan, overdraft, loan on business credit cards, working capital loan, and others. By enterprise size, the market is bifurcated into large enterprises, small and medium-sized enterprises. Depending on the provider, the market is classified into banks, NBFCs, and credit unions.

The confluence of economic, technological, and regulatory factors ensures that the unsecured business loans market in Italy is poised to witness notable growth. For instance, the advent of FinTech is set to redefine the lending landscape, making unsecured business loans more accessible and efficient. Small businesses are expected to benefit from these trends, as they gain access to a wider range of financing options. The post-pandemic landscape has made businesses acutely aware of the importance of liquidity and working capital. This awareness is expected to drive a surge in demand for unsecured working capital loans, as businesses seek to fortify their financial positions in a world marked by uncertainty.

Key regulations play a pivotal role in shaping the Italy unsecured business loans market. The Italian Government has established measures to support SMEs, such as guarantee schemes and grants. These initiatives aim to facilitate access to credit, particularly in challenging economic times. However, they also come with a complex web of eligibility criteria and application processes, which businesses must navigate. Additionally, the European Union's regulatory framework affects Italy's financial sector, influencing lending practices and risk assessment.

Qualitative insights into the Italy unsecured business loans market reveal a myriad of factors at play. New product development is a crucial element, as lenders constantly seek innovative solutions to meet the evolving needs of businesses.

Research and development in the market are not limited to technologies but encompass risk assessment models. Lenders are investing in advanced credit scoring algorithms

The Porter's five forces analysis of Italy unsecured business loans market states that the competitive rivalry among existing players is intense, with banks, NBFCs, and credit unions vying for market share. The entry of FinTech firms adds an intriguing dimension, intensifying competition and driving innovation. While large enterprises often have more leverage in negotiating terms, SMEs can still exert bargaining power by exploring multiple lending options.

The threat of substitutes is a perplexing aspect. Traditional lenders face competition from a range of alternative financing sources, from crowdfunding platforms to peer-to-peer lending. These alternatives can siphon borrowers away from traditional lenders, adding complexity to the market landscape. The bargaining power of buyers plays a pivotal role. In a highly competitive market, borrowers have more options, allowing them to negotiate for better terms and lower interest rates. The SWOT analysis identifies and analyzes the strengths, weaknesses, opportunities, and threats of the Italy unsecured business loans market. The strength of the market is to create a fertile ground for unsecured business loans. The weaknesses include economic volatility, complex regulatory frameworks, and the potential for increased competition. The economic instability in Italy poses a challenge, as lenders must constantly assess & reassess the risk of lending to businesses. Opportunities in the market are numerous, including the growth of digital lending platforms, surge in demand for working capital loans, and evolving regulations that encourage responsible lending. Threats to the market include economic downturns, regulatory changes, and the emergence of alternative financing sources. Economic fluctuations can lead to higher default rates, posing a threat to lenders.

The key players operating in the Italy unsecured business loans market include UniCredit S.p.A., Intesa Sanpaolo S.p.A., Banca Monte dei Paschi di Siena S.p.A., Banco BPM S.p.A., BPER Banca S.p.A., Mediobanca S.p.A., Credito Emiliano S.p.A. (Credem), UBI Banca S.p.A., Cassa di Risparmio di Genova e Imperia (Carige), and Banca Popolare di Sondrio S.C.p.A.. These key players have adopted several strategies to gain strong foothold in the competitive market such as acquisition strategy, product development, diversification, market strategy, digital strategy, and consumer strategy.

Key Benefits For Stakeholders

- Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

- Analyze the key strategies adopted by major market players in Italy unsecured business loans market.

- Assess and rank the top factors that are expected to affect the growth of Italy unsecured business loans market.

- Top Player positioning provides a clear understanding of the present position of market players.

- Detailed analysis of the italy unsecured business loans market segmentation assists to determine the prevailing market opportunities.

- Identify key investment pockets for various offerings in the market.

Italy Unsecured Business Loans Market Report Highlights

| Aspects | Details |

| Forecast period | 2021 - 2031 |

| Report Pages | 76 |

| By Type |

|

| By Enterprise Size |

|

| By Provider |

|

| Key Market Players | UniCredit S.p.A., Intesa Sanpaolo S.p.A., BPER Banca S.p.A., UBI Banca S.p.A., Banca Monte dei Paschi di Siena S.p.A., Credito Emiliano S.p.A. (Credem), Banco BPM S.p.A., Cassa di Risparmio di Genova e Imperia (Carige), Banca Popolare di Sondrio S.C.p.A., Mediobanca S.p.A. |

The Italy Unsecured Business Loans Market is projected to grow at a CAGR of 16.4% from 2021 to 2031

UniCredit S.p.A., Intesa Sanpaolo S.p.A., Banca Monte dei Paschi di Siena S.p.A., Banco BPM S.p.A., BPER Banca S.p.A., Mediobanca S.p.A., Credito Emiliano S.p.A., UBI Banca S.p.A., Cassa di Risparmio di Genova e Imperia, and Banca Popolare di Sondrio are the leading players in Italy Unsecured Business Loans Market

1. Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

2. Analyze the key strategies adopted by major market players in italy unsecured business loans market.

3. Assess and rank the top factors that are expected to affect the growth of italy unsecured business loans market.

4. Top Player positioning provides a clear understanding of the present position of market players.

5. Detailed analysis of the italy unsecured business loans market segmentation assists to determine the prevailing market opportunities.

6. Identify key investment pockets for various offerings in the market.

Italy Unsecured Business Loans Market is classified as by type, by enterprise size, by provider

Loading Table Of Content...

Loading Research Methodology...