Japan Home Accessories Market Outlook - 2025

The Japan home accessories market size was valued at $9,425.7 million in 2017 and is expected to reach $12,203.5 million by 2025, growing at a CAGR of 3.4% from 2018 to 2025. Home accessories are electronic (analog or digital) equipment intended for everyday use in homes. Home accessories can be categorized into small appliance or brown goods consumer electronics. These are generally equipped with special connections such as electrical or have an i50nbuilt battery and thus, helps in mobility of the appliances around the house. Small appliances are semi-portable or portable machines and are generally used on platforms such as counter-tops and table tops. Some of the small appliances are clocks, and speakers among others. Consumer electronic devices are used for entertainment, communications, and home-office activities, such PCs, video game, recorder, and camera.

Improvement in economic conditions and increase in disposable income are substantial factors that propel the Japan home accessories market growth. Improved lifestyle and rise in buying power of consumers are the major impacts of high disposable income. Home accessories have become an integral part of our daily chores. A substantial number of consumers with high disposable income have been spending on household accessories including premium & smart appliances. The overall demand for home accessories has increased among urban households, as they help save time, simplify the work, and fuel the comfort level. Thus, improved standard of living, rise in need to ease daily chores, and surge in disposable income are projected to boost the penetration of home accessories, thereby driving the Japan home accessories industry growth. In the past few years, lifestyle of populace has changed mainly due to tremendous rise in the number of working women. This has led to increase in household income and improvement in the living standards.

Developments in technology, rapid urbanization, increase in the construction sector, rise in per capita income, improvement in living standard, surge in need for comfort in homes, changes in consumer lifestyle, and escalation in number of smaller households are the key factors that drive the growth of the Japan home accessories market. In addition, inclination of consumers toward eco-friendly & energy-efficient appliances further boost the growth of the Japan home accessories market. Moreover, factors such as government initiatives for energy-efficient appliance undertaken across Japan are expected to facilitate the adoption of energy efficient appliances in the recent years.

The Japan home accessories market is segmented based on product and distribution channel. Depending on product, the Japan home accessories market is classified into pc, camera, video camera, video games, recorder, and other home accessories. Based on distribution channel, the Japan home accessories market is classified into supermarket, specialty store, manufacturer store, and e-commerce company.

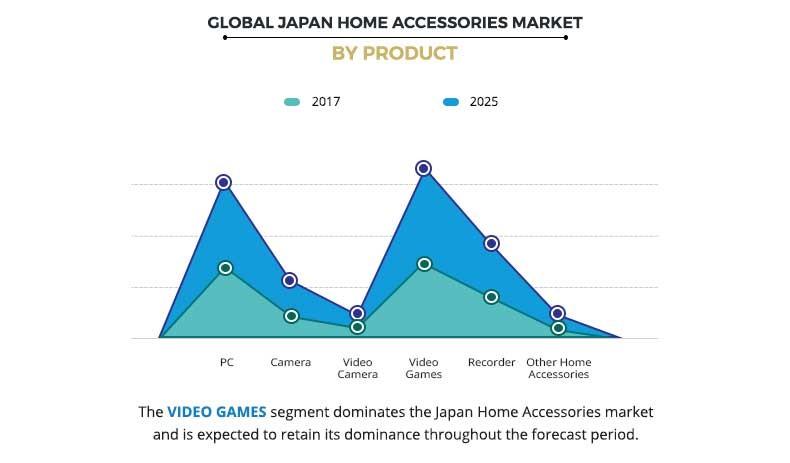

Based on product, the Japan home accessories market is classified into pc, camera, video camera, video games, recorder, and other home accessories. The video game segment accounted for the largest japan home accessories market share in 2017. The video game segment has witnessed significant growth over the years mainly owing to high engagement of youth. Easy availability of video games on different devices such as personal computers, tablets, and laptops, are expected to drive the video game market. Decrease in cost of video game hardware coupled with easy availability of games are expected to fuel their demand. In addition, several consumers these days prefer cross-functional devices that offer integrated features and capabilities in the same device. This has encouraged the development of multifunctional devices. Computers are extensively used in numerous application areas, ranging from business and education to entertainment. In addition, wide spread of education for computer knowledge helps in creating more demand for PC in the Japan market.

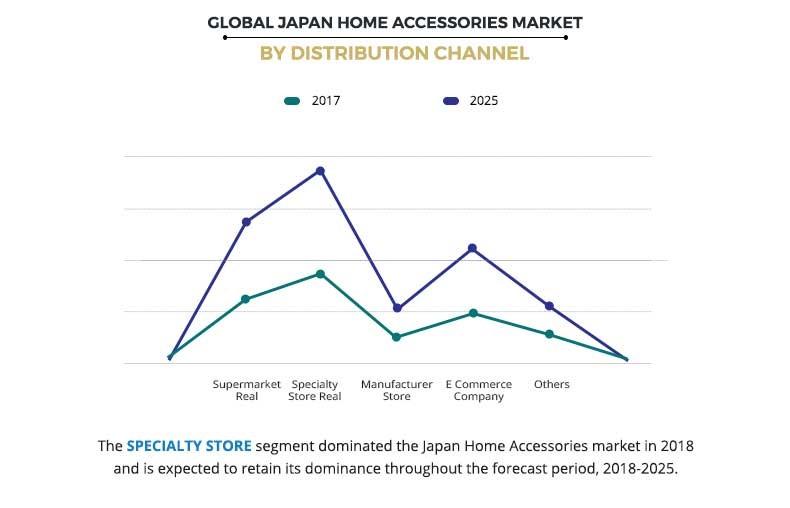

Based on distribution channel, the Japan home accessories market is classified into supermarket, specialty store, manufacturer store, and e-commerce company. The specialty store segment accounted for the largest japan home accessories market share in 2017. Consumers usually prefer to analyze and evaluate the product before purchase, thereby boosting the retail sales of the home accessories market through specialty store. Customers check the working of appliances in the stores and the type of accessories compatible with them. Therefore, specialty stores are projected to gain demand in the near future. In addition, e-commerce sales is expected to increase an rise in number of online shoppers, owing to availability of varied product options and price comparison on online shopping sites. This is useful for retailers due to zero expenditure on physical outlets or stores. One of the major reasons behind consumers preferring online shopping is that consumers can read reviews provided by other users and compare various products as well as their prices by different sellers.

Some of the key strategies adopted by Japan home accessories industry players in this market are acquisition, business expansion, partnership, collaboration, product launch, merger, joint venture, and agreement. Key players profiled in the report include Hewlett-Packard (HP), Dell, Lenovo Group Limited (Lenovo), Sony Corporation (Sony), Canon Inc. (Sony), Nikon Corporation, Samsung Electronics Co, Sharp Corporation (Sharp), Panasonic Corporation (Panasonic), and Olympus Corporation.

Key Benefits for Japan Home Accessories Market:

- This report provides a quantitative analysis of the current Japan home accessories market trends, estimations, and dynamics of the market from 2018 to 2025 to identify the prevailing market opportunities.

- An in-depth japan home accessories market analysis of the Japan home accessories market size helps determine the prevailing market opportunities.

- Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier–buyer network.

- The Japan home accessories market forecast is provided along with the information related to key drivers, restraints, and opportunities.

- A detailed analysis of the Japan home accessories market segments measures the potential of the market. These segments outline the favorable conditions for the market forecast.

Japan Home Accessories Market Report Highlights

| Aspects | Details |

| By Distribution Channel |

|

| Key Market Players | Olympus Corporation., SAMSUNG ELECTRONICS CO, SONY CORPORATION, LENOVO GROUP LIMITED, SHARP CORPORATION, NIKON CORPORATION, DELL, HEWLETT-PACKARD, Panasonic Corporation, CANON INC. |

Analyst Review

The Japan home accessories market is emerging at a considerable pace owing to several factors such as increase in compatibility of the appliances, enhanced internet penetration, changes in lifestyle patterns, and growth in concern about energy prices.

Moreover, videogames and camera segments are projected to register significant growth, due to rapid urbanization, increase in penetration of technology even in small cities, rise in disposable income, and improvement in standard of living.

Owing to increase in environmental concerns, consumers also prefer buying appliances that are eco-friendly and energy efficient. Therefore, manufacturers take steps to improve the product efficiency and reduce e-waste.

Loading Table Of Content...