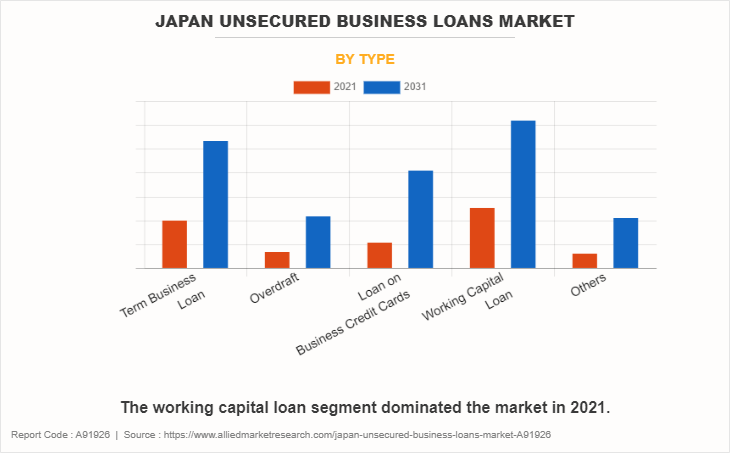

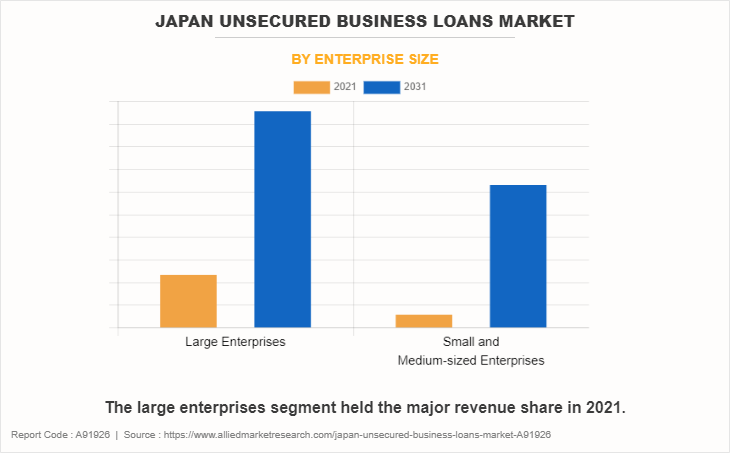

The Japan unsecured business loans market has witnessed significant growth during the projection period. The growth of the market is driven by various factors. Among these, increase in demand for working capital among businesses stands out as a primary driver. Small and medium-sized enterprises (SMEs) frequently depend on unsecured loans to sustain their day-to-day operations, and the convenient accessibility of such loans has played a significant role in their widespread adoption. In addition, the digitalization of financial services and widespread availability of fintech platforms have simplified the application and approval process for unsecured loans, thereby fostering expansion of the market.

Moreover, another factor that drives the entrepreneurial landscape in Japan is rise in the number of individuals who are embarking on business ventures. Many of these aspiring entrepreneurs rely on financial assistance to initiate their entrepreneurial endeavors. Unsecured loans, which offer flexible terms and have minimal collateral requirements, have emerged as a crucial source of support for these business owners.

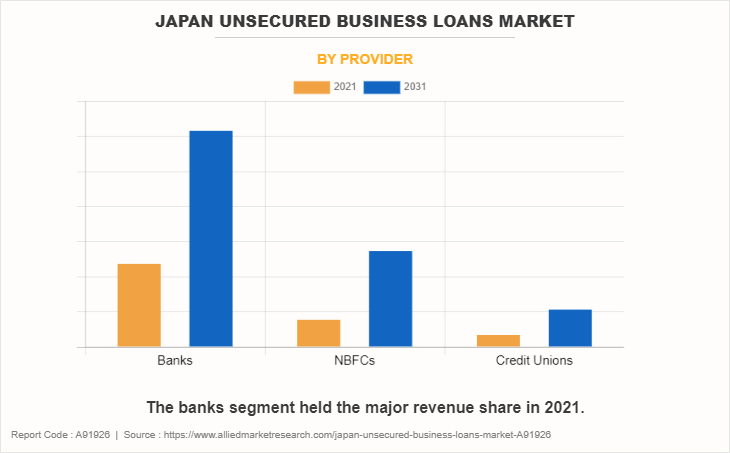

In addition, expansion of the unsecured business loans market has been significantly influenced by regulatory support provided by the government. The Japanese Government has implemented various policies and initiatives aimed at promoting lending to small businesses, thereby facilitating their access to funds. As a result, this favorable environment has attracted traditional banks, non-banking financial companies (NBFCs), and credit unions to participate in the market.

On the other hand, the market is not devoid of challenges. The primary restraint lies in the risk associated with unsecured loans. Lenders encounter a heightened level of risk in unsecured lending as they lack the security of collateral. This risk frequently results in elevated interest rates, which dissuade certain businesses, particularly smaller ones, from pursuing unsecured loans. Moreover, economic uncertainties, particularly in the aftermath of global events such as the COVID-19 pandemic, have magnified these risks. Lenders have adopted a more cautious approach, leading to more stringent eligibility criteria and reduced loan approval rates. Consequently, this has erected a barrier for businesses, particularly startups, in obtaining unsecured loans.

However, the Japan unsecured business loans market offers a plethora of growth opportunities. With the ongoing progress of digitalization, there exists a wide range of possibilities to enhance the application and approval procedures for unsecured loans. Fintech firms are in a favorable position to capitalize on these opportunities and simplify the lending process. Furthermore, government's emphasis on fostering entrepreneurship and aiding small businesses creates opportunities for financial institutions and governmental bodies to collaborate. Moreover, through joint efforts, they develop inventive lending schemes that cater to the distinct requirements of diverse business segments.

The Japan unsecured business loans market is anticipated to be significantly influenced by government regulations. The Japanese Government is projected to implement additional measures to aid small businesses in obtaining unsecured loans by reducing the barriers to entry. These regulations comprise of encouraging lenders to provide favorable conditions to SMEs and enhancing transparency in lending practices.

The market is segmented into type, enterprise size, and provider. Further, on the basis of type, the market is segregated into term business loan, overdraft, loan on business credit cards, working capital loan, and others. Depending on enterprise size, it is bifurcated into large enterprises, small and medium-sized enterprises. By provider, the market is classified into banks, NBFCs, and credit unions.

Lenders are growing emphasis on product innovation, particularly in the realm of unsecured loans. They are creating loan products that are tailored to meet the specific requirements of businesses, including short-term working capital loans, funding for specific projects, and trade finance solutions. These inventive offerings are designed to be adaptable, with terms and repayment structures that are customized to suit individual needs.

Moreover, in the Japan unsecured business loans market, significant R&D efforts are directed toward enhancing risk assessment models. Lenders are harnessing the power of artificial intelligence and big data analytics to bolster credit scoring and decision-making processes. This strategic approach aims to minimize default rates and enhance the overall efficiency of lending operations.

End-user perceptions of unsecured business loans in Japan are changing. Businesses now view unsecured loans as a viable alternative to traditional bank loans. The convenience of online applications and faster approval processes has made unsecured loans more appealing. However, it is crucial for lenders to prioritize transparency and fair lending practices to establish trust with borrowers.

Furthermore, in the unsecured loans market, lenders employ various pricing strategies. Interest rates vary significantly depending on factors such as the borrower's creditworthiness, loan amount, and repayment terms. Some lenders attract borrowers by offering competitive interest rates, while others differentiate themselves by providing additional services such as financial advisory.

The Porter’s five forces analysis analyzes the competitive scenario of the Japan unsecured business loans market and role of each stakeholder. These forces include the bargaining power of suppliers, bargaining power of buyers, threat of substitutes, threat of new entrants, and competitive rivalry.

The suppliers in the market are financial institutions and lenders, who hold significant bargaining power due to their control over the supply of unsecured loans. However, presence of various providers such as banks, NBFCs, and credit unions ensures a competitive landscape. On the other hand, the bargaining power of buyers or businesses seeking unsecured loans is considerable power with multiple options available to negotiate for better terms and interest rates. The availability of information about different loan products on digital platforms has empowered buyers.

SWOT analysis provides a comprehensive overview of the strengths, weaknesses, opportunities, and threats present in the Japan unsecured business loans market. The market boasts a wide array of unsecured loan products that cater to diverse business needs, making it attractive to a broad customer base, which is one of the major strengths. Moreover, government initiatives and regulations actively support the growth of the unsecured loans market, particularly for small and medium-sized enterprises (SMEs). In addition, integration of fintech solutions has streamlined the application and approval processes, resulting in an enhanced customer experience. However, lenders face increased risk when offering unsecured loans, which lead to higher interest rates and stricter approval criteria, poses weaknesses. Moreover, economic downturns impact borrowers' ability to repay their loans, thereby increasing the risk of defaults.

The market offers several growth opportunities. The ongoing digitalization and innovation in lending processes present opportunities for market growth and improved customer experiences. In addition, emergence of sustainability initiatives creates avenues for the development of green financing options within the unsecured loans market. On the other hand, shifts in government regulations significantly impact the lending landscape, affecting both loan providers and borrowers, poses a threat in the market. Moreover, intense competition among lenders results in aggressive pricing and terms, potentially impacting profitability.

Key players operating in the market are Mizuho Financial Group, Inc., Sumitomo Mitsui Banking Corporation, The Bank of Tokyo-Mitsubishi UFJ, Ltd., Shinsei Bank, Ltd., Resona Holdings, Inc., Mitsubishi UFJ Financial Group, Inc., Aozora Bank, Ltd., ORIX Corporation, Sumitomo Corporation, and ShinGinko Tokyo, Ltd.

Key Benefits For Stakeholders

- Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

- Analyze the key strategies adopted by major market players in Japan unsecured business loans market.

- Assess and rank the top factors that are expected to affect the growth of Japan unsecured business loans market.

- Top Player positioning provides a clear understanding of the present position of market players.

- Detailed analysis of the Japan unsecured business loans market segmentation assists to determine the prevailing market opportunities.

- Identify key investment pockets for various offerings in the market.

Japan Unsecured Business Loans Market Report Highlights

| Aspects | Details |

| Forecast period | 2021 - 2031 |

| Report Pages | 76 |

| By Type |

|

| By Enterprise Size |

|

| By Provider |

|

| Key Market Players | The Bank of Tokyo-Mitsubishi UFJ, Ltd., ShinGinko Tokyo, Ltd., Sumitomo Mitsui Banking Corporation, Mitsubishi UFJ Financial Group, Inc., Resona Holdings, Inc., Sumitomo Corporation, ORIX Corporation, Shinsei Bank, Ltd., Aozora Bank, Ltd., Mizuho Financial Group, Inc. |

The Japan Unsecured Business Loans Market is estimated to reach $992.1 billion by 2031

SMBC Trust Bank, Mizuho Bank, Bank of Tokyo-Mitsubishi UFJ, Sumitomo Mitsui Banking Corporation (SMBC), Aozora Bank, Shinsei Bank, Bank of Yokohama, Asuka Bank, Juroku Bank, Resona Bank are the leading players in Japan Unsecured Business Loans Market

1. Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

2. Analyze the key strategies adopted by major market players in japan unsecured business loans market.

3. Assess and rank the top factors that are expected to affect the growth of japan unsecured business loans market.

4. Top Player positioning provides a clear understanding of the present position of market players.

5. Detailed analysis of the japan unsecured business loans market segmentation assists to determine the prevailing market opportunities.

6. Identify key investment pockets for various offerings in the market.

Japan Unsecured Business Loans Market is classified as by type, by enterprise size, by provider

Loading Table Of Content...

Loading Research Methodology...