Jet Fuel Market Research, 2031

The global jet fuel market size was valued at $187.8 billion in 2021, and jet fuel industry is projected to reach $296.4 billion by 2031, growing at a CAGR of 4.7% from 2022 to 2031.

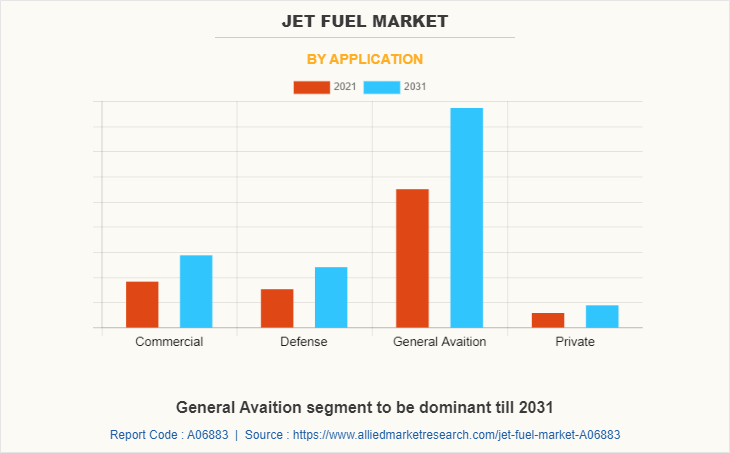

The jet fuel market is segmented into Application and Fuel Grade.

Jet fuels are aviation fuels used mainly by the U.S. and other North Atlantic Treaty Organization (NATO) nations for military establishments. Other fuels called Jet A and Jet A-1 are closely related fuels used by commercial airlines. Jet fuel is the third most important transportation fuel. It is a middle-distillate product that is used for jets (commercial and military) and is used around the world in cooking and heating (kerosene). When used as a jet fuel, some of the critical qualities of gasoline are freeze point, flash point, and smoke point. Commercial jet fuel has a boiling point range of approximately 190–275°C and that of military jet fuel is 55–285°C.

The presence of tourism, passenger travel, business travel, and freight transportation for a variety of industries, including consumer electronics, government, and food are all possible with commercial aircraft. Commercial aircrafts are an important part of the global aviation system that helps to generate long-term improvements in economic, social, and environmental efficiency. In 2021, around 5.7 billion gallons of jet fuel was used by the commercial aircrafts and was also second largest jet fuel market application after general aviation. In addition, government initiatives to promote the commercial aircraft market and expansion of airports in developing countries, including Africa, China, India, and Singapore, are projected to provide lucrative opportunities for prominent market players.

Air traffic is anticipated to grow at a significant rate in the future, which is projected to increase the demand for commercial aircraft across the globe, owing to increase in air traffic, improvement in air network, reduction in fuel prices, and surge in traveling frequencies through the air. According to the International Civil Aviation Organization (ICAO), by 2035, passenger traffic and freight volume is expected to increase. Factors such as growth in disposal income of the middle-class population and emergence of low-cost airlines led to an increase in number of airline passengers. In addition, as the number of airline passengers rises, demand for commercial aircraft services increases at a significant rate. The major countries such as Canada, the U.S., Brazil, Indonesia, Philippines, China, Saudi Arabia, and India witness a rise in number of air passengers. Surge in passengers and increase in utilization of air transportation for various purposes are expected to drive the jet fuel market growth.

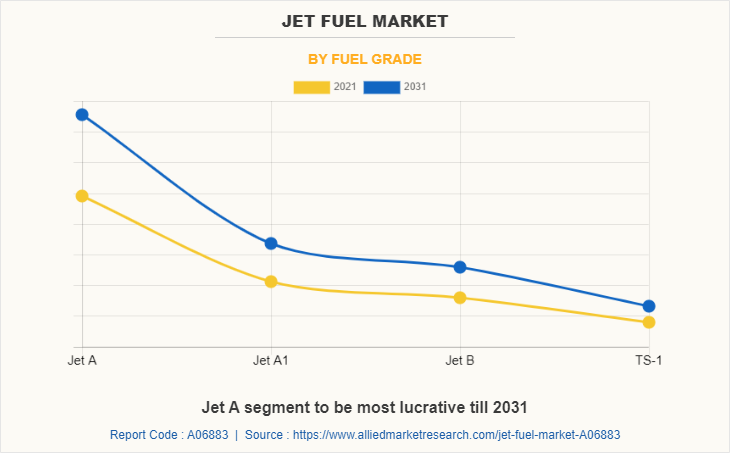

On the basis of fuel grade, the market is segmented into Jet A, Jet A-1, Jet B, and TS-1. In addition, on the basis of application, it is segmented into commercial, defense, general aviation, and private.

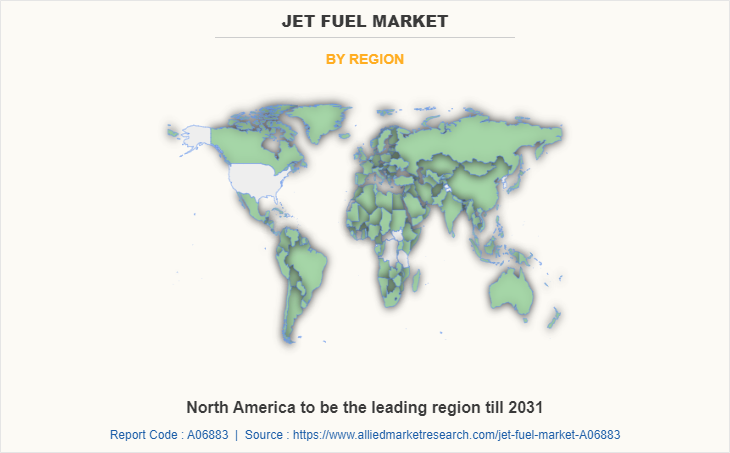

Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA. Presently, North America accounts for the largest share of the market, followed by Europe and Asia-Pacific.

The major companies in this report includes Allied Aviation, Amyris Inc., Archer Daniels Midland Company, Bharat Petroleum Co. Ltd, BP, Cheveron, Corbion N.V, Exxon Mobil, Gazprom Neft PJSC, Honeywell International Inc., Primus Green Energy Inc., Qatar Jet Fuel, Royal Dutch Shell, Total Energies, and Valero Energy Corporation. Rapid development of industrialization, modernization and spread of information through internet led to the development of tourism industry, which in turn has fuelled the demand for jet fuel. Additional growth strategies such as expansion of production capacities, acquisition, partnership and research & innovation in the development of aircrafts in commercial and military, which led to attain key developments in the global jet fuel market trends.

North America is analyzed across the U.S., Canada, and Mexico. A significant portion of the market share is held by the U.S, followed by Canada and Mexico. General Aviation included a total of 440,000 general aircraft flying worldwide (GAMA), as of 2019, ranging from two-seat training aircraft and utility helicopters to intercontinental business jets. Over 211,000 general planes are based in the U.S, which leads to it being dominant in the sector. Furthermore, the defense sector consumes a large amount of aviation fuel. On average, the U.S Air Force consumes approximately 2 billion gallons of aviation fuel annually, about 81% of the total Air Force energy budget. With around $732 billion on military spending in 2019, the U.S is leading in defense expenditure. The above mentioned initiatives are expected to be the major factors driving the growth of the market in this region during the forecast period.

The jet A segment dominates the global jet fuel market share. Jet A fuel is one of the jet fuel types that has been used in the U.S. since 1950s and is made up of pure kerosene. This type of fuel has a flash point higher than 100 0F, with an auto-ignition temperature of 410 0F. Furthermore, it has freezing point of -40 0F, which is higher than jet A-1 type fuel. Jet fuel of type A is widely used in the civil aviation industry. The return of the Boeing 737MAX into service and the recovery in domestic demand helped the OEMs in obtaining more orders and increasing aircraft deliveries in 2021. On the other hand, though the orders and deliveries of general aviation aircraft witnessed a decline in 2020 as compared to 2019, there is a growth in demand for helicopters and business jets to transport medical supplies, cargo charter operations, and VIP transport. This above mentioned activities are expected to provide ample opportunities for the development of the market.

The general aviation segment dominates the global jet fuel market. General aviation is a term which encompasses all types of aviation besides military and commercial airlines. It includes various business models and all private flying transportation vehicles. General aviation encompasses most of the world’s flying. According to some sources, there are around 440,000 general aviation aircrafts around the world today, of which half of them are present in the U.S. The rapid industrialization and development in technology have created the need for the faster transportation services, hence general aviation comes in to services which further drives the demand for jet fuel market. General aviation consists of chartered flights, private flights, and other purpose flights. The presence of ever increasing demand for the above mentioned special service flights has led to increase in demand for the jet fuel. The presence of above mentioned advantages is expected to drive the growth of the market.

COVID-19 analysis:

COVID-19 has severely impacted the global economy with devastating effects on global trade, which has simultaneously affected households, business, financial institution, industrial establishments and infrastructure companies. The novel coronavirus has affected several economies ad caused lockdown in many countries which has limited the growth of the market. The shutdown of industrial manufacturers led to decline in the demand for solar related equipment in most of the countries across the world, which led to decline in demand for the jet fuel market. The decrease in utilization of power in the industrial facilities across the globe during the outbreak has a negative impact on the development of the market.

After global vaccination, the governments of various countries have taken initiatives to launch policies to improve the tourism sector, which have led to surge in the air transportation. The willingness of an individual to spend money over leisure after the pandemic lockdown has had a positive impact on the market. The presence of above mentioned activities and change in policies due to outbreak of pandemic has a positive impact on the development of the market during the forecast period.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the jet fuel market analysis from 2021 to 2031 to identify the prevailing jet fuel market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the jet fuel market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global jet fuel market trends, key players, market segments, application areas, and market growth strategies.

Jet Fuel Market Report Highlights

| Aspects | Details |

| By Application |

|

| By Fuel Grade |

|

| By Region |

|

| Key Market Players | Valero Marketing and Supply, Solazyme, Qatar Jet Fuel Company, Honeywell International Inc., TotalEnergies SE, Bharat Petroleum Corp Ltd, Gazprom Neft PJSC, BP Plc., Amyris, Allied Aviation Services, Inc., Primus Green Energy, Archer Daniels Midland Company, Exxon Mobil Corporation, Shell PLC, Chevron Corporation |

Analyst Review

The global jet fuel market is expected to witness increased demand during the forecast period. This is attributed to rise in demand for jet fuel from various emerging economies and military sector.

Introduction of new flight routes (domestic and international) and investments from government in the field for construction of new airports also fosters the jet fuel market growth. Furthermore, there is an increase in the demand from developing economies from Asia-Pacific region such as China and India, owing to increased disposable income encouraging people to opt for air transport, boom in tourism industry, and rise in air traffic.

In-addition, demand from North America also largely contributed to the market growth owing to presence of key market players and increased investment for development from government in the region. Jet fuel is capable of enduring high temperature environment and is corrosion resistant, which makes it suitable for use at high altitudes. However, fluctuating crude oil prices and strict rules & regulation regarding carbon emissions impact the production process and limits the market growth.

Rise in demand for air transportation from military and commercial sector and increase in affordability of the air transportation are the key factors boosting the Jet Fuel Market growth

The market value of Jet Fuel in 2031 is expected to be US$ 296.4 Billion

Allied Aviation, Amyris Inc., Archer Daniels Midland Company, Bharat Petroleum Co. Ltd, BP, Cheveron, Corbion N.V, Exxon Mobil, Gazprom Neft PJSC, Honeywell International Inc., Primus Green Energy Inc., Qatar Jet Fuel, Royal Dutch Shell, Total Energies, and Valero Energy Corporation.

General aviation application is projected to increase the demand for Jet Fuel Market

The global jet fuel market is segmented on the basis of by fuel grade, application and region. On the basis of fuel grade, the market is segmented into Jet A, Jet A-1, Jet B, and TS-1. In addition, on the basis of application, it is segmented into commercial, defense, general aviation, and private. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Initiatives toward R&D in reducing carbon emissions is the Main Driver of Jet Fuel Market

After global vaccination, the governments of various countries have taken initiatives to launch policies to improve the tourism sector, which have led to surge in the air transportation. The willingness of an individual to spend money over leisure after the pandemic lockdown has had a positive impact on the market. The presence of above mentioned activities and change in policies due to outbreak of pandemic has a positive impact on the development of the market during the forecast period.

Loading Table Of Content...