Automotive Keyless Entry System Market Insights, 2032

The global automotive keyless entry system market size was valued at $2.5 billion in 2022, and is projected to reach $7.4 billion by 2032, growing at a CAGR of 11.9% from 2023 to 2032.

Automotive keyless entry system is the new generation vehicle access control system that utilizes a remote or handheld device for locking and unlocking the vehicle. From certain distance proximity, automotive end user can lock and unlock the automotive by emitting the determined programmed signals. Automotive keyless entry system operates on a pre-defined programming for the advanced security of the vehicle, mostly designed by the automotive OEM. The demand for automotive keyless entry system is directly influenced by the automotive production and sales activities across the globe, as automotive keyless entry system is one of the key components of the modern vehicles for improved safety. Moreover, in modern vehicles, automotive OEMs are inclining toward smart technology to cater to the changing demand for end users, which in turn support the growth for automotive keyless entry system.

Report Key Highlighters:

- The automotive keyless entry system market study covers 14 countries. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The automotive keyless entry system market share is moderately fragmented among several players including Alps Alpine Co., Ltd., Continental AG, Denso Corporation, HELLA GmbH & Co. KGaA., Microchip Technology Inc., Mitsubishi Electric Corporation, NXP Semiconductors, Robert Bosch GmbH, Kiekert AG, Valeo S.A., Marquardt Management SE, and Tokai Rika

The automotive keyless entry system market is segmented into Technology, Vehicle Type, Device, Sales Channel and Product Type. Factors such as adoption of smart technology for vehicle safety and improved convenience, and product development to cater to changing demand pattern are expected to drive the growth of the automotive keyless entry system market. However, high cost of the keyless entry system, and decrease in production and sale of automotive hamper the market growth. On the contrary, agreements and contracts with automotive OEMs for long term business opportunities, and growth in developing nations are projected to offer lucrative growth opportunities for the market players.

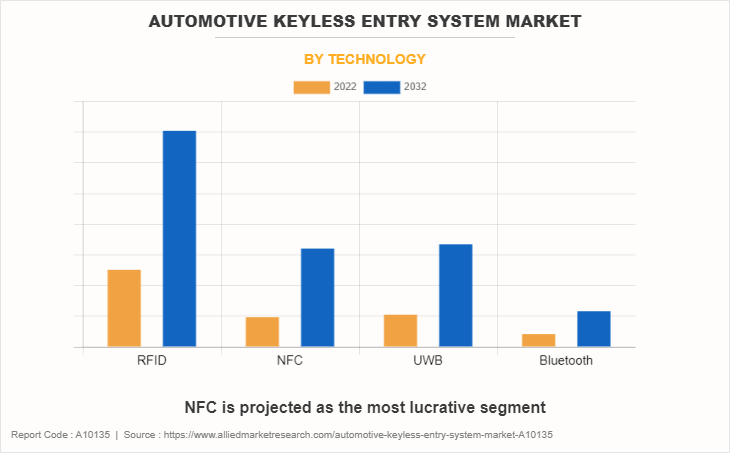

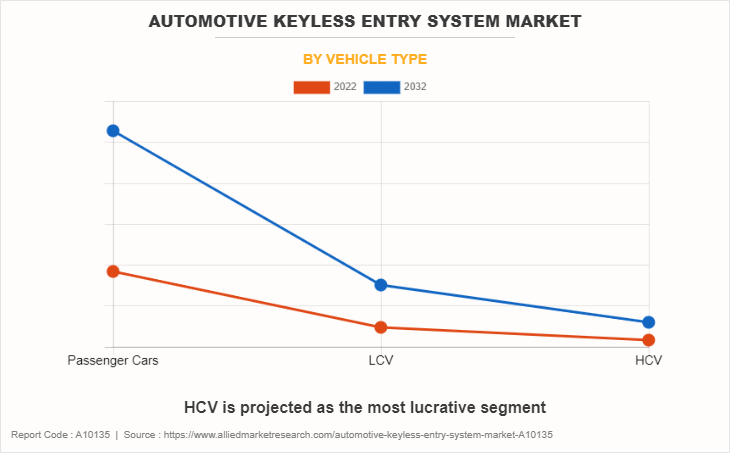

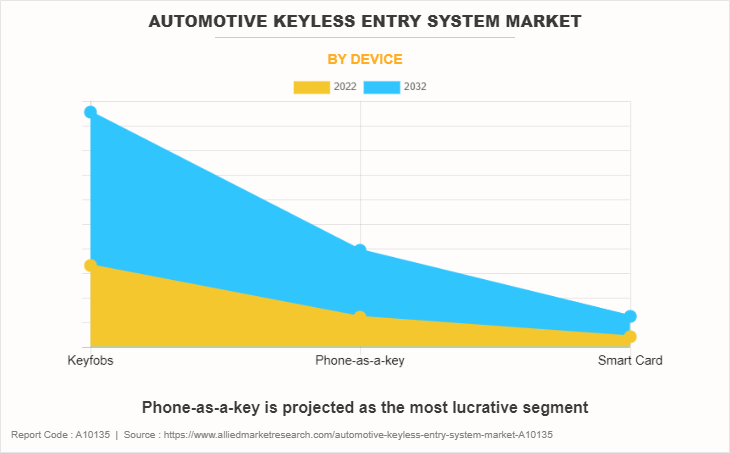

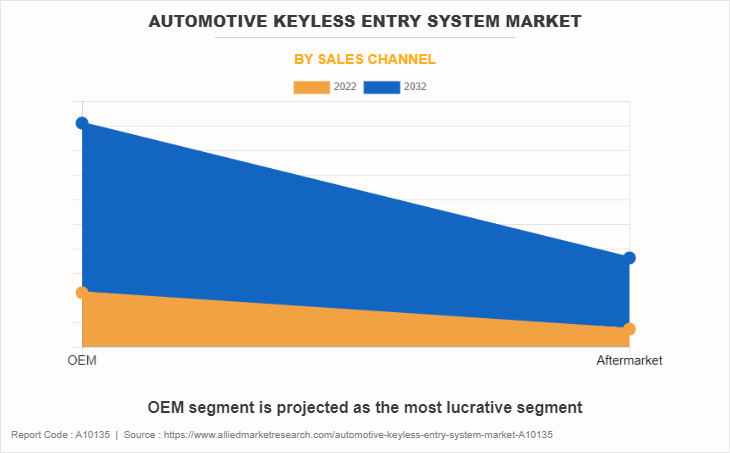

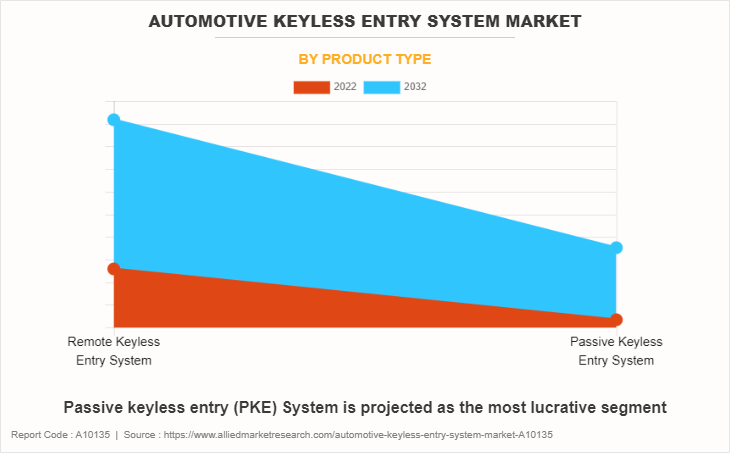

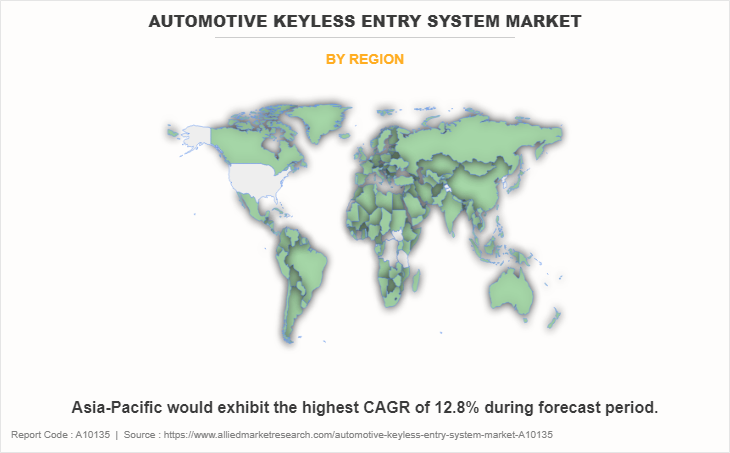

The global automotive keyless entry system market is segmented on the basis of sales channel, vehicle type, product type, technology, device type, and region. Depending on sales channel, the market is segregated into OEM and aftermarket. By vehicle type, it is categorized into passenger cars, LCV, and HCV. Depending on product type, it is fragmented into remote keyless entry (RKE) system and passive keyless entry (PKE) system. By technology, the market is divided into NFC, UWB, Bluetooth, and RFID. By Device type, it is divided into Keyfobs, Phone-as-key, and smart card. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Asian consumers are increasingly embracing connected car technologies, driven by the desire for enhanced safety, convenience, and other similar advanced features. The demand for remote and passive keyless entry systems is on the rise in countries such as China, Japan, South Korea, and India.

The production activities of vehicles are expected to have a direct influence on the overall demand for keyless entry system technology in vehicles. Moreover, increase in penetration of electric vehicles is expected to support the growth of automotive keyless entry system in the coming years. China and India are expected to witness considerable growth; thereby, considered emerging regions for automotive keyless entry system.

In recent years, new generation vehicles are being equipped with automotive keyless entry systems, which are expected to propel the market growth during the forecast period. For instance, in January 2022, Huawei released the world’s first Bluetooth and NFC-supported digital car keys in China. They are enabled with smart technologies, including automotive keyless entry systems. They enable unlock and lock of the car from a distance away and also support NFC (even without phone battery) for unlocking the car. In addition, the market in the region is characterized by partnerships and collaborations between automakers and technology companies. These collaborations aim to develop and implement safety car solutions and advanced keyless entry systems.

Key Developments

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- In July 2023, Microchip announced a $300 million multi-year investment plan to expand its presence in India. Funding for infrastructure, engineering labs, talent acquisition, and assistance for regional technology groups and educational institutions are all part of the expansion.

- In March 2022, Continental AG supplied the transceiver modules for the BMW iX electric vehicle. Transceivers with ultrawideband radio technology provide an essential building block for keyless access to the vehicle via smartphone.

- In February 2022, Faurecia completed its $6 billion acquisition of Hella to strengthen its EV and self-driving businesses. The acquisition is expected to enable Faurecia to strengthen its capabilities and expand its foothold in electrification and self-driving technologies.

- In August 2022, NXP Semiconductors introduced the NCJ37x Secure Element (SE), an automotive-qualified secure microcontroller designed for a variety of security-critical automotive applications such as smart access key fobs, Qi 1.3 authentication, and car-to-cloud communication. This opens up new applications for smart fobs, such as storing digital keys for many cars on the fob. The product will help the manufacturer to gain its hold in the automotive market.

Adoption of smart technology for vehicle safety and improved convenience

The adoption of smart technology, including smart key cards and phone-as-a-key functionality, is a significant advancement in the automotive industry that offers both, enhanced safety and convenience for vehicle owners. Smart key cards and phone-based access systems have revolutionized the traditional concept of car keys, providing drivers with a seamless and futuristic way to interact with their vehicles. For instance, in May 2021, Google worked with BMW and other automakers to develop a digital key that will let car owners lock, unlock, and start a vehicle from their Android smartphone The digital key is one of many new features coming to Android 12, which is the latest version of the company’s mobile operating system.

Moreover, the automotive keyless entry system is the next-gen automotive locking solution that provides an anti-theft solution for which key players are in partnerships and contracts with companies operating in security systems. For instance, in May 2022, Alps Alpine Co., Ltd. announced the joint development of a wireless digital key system with Giesecke+Devrient GmbH, a German company that develops security solutions. This co-developed system complies with the Car Connectivity Consortium (CCC) global standard. Both companies plan to expand sales of the system with the aim of adopting it for vehicles to be launched in the market in 2025.

Rise in number of vehicle thefts and vandalism incidents

Rise in vehicle theft and vandalism incidents has raised concerns over the security of automotive keyless entry systems. For instance, in 2022, according to the U.S. Department of Transportation, more than 1 million vehicles were stolen in the U.S. While these systems offer convenience, they have become susceptible to advanced hacking techniques like relay attacks. To counter these threats, manufacturers are implementing technological solutions. Advanced encryption algorithms and secure key exchange protocols are being integrated into keyless entry systems to protect against unauthorized access. Biometric authentication, using fingerprint or facial recognition, adds an extra layer of security by ensuring that only authorized users can access the vehicle.

Moreover, multi-factor authentication, combining different credentials for access, strengthens the system's security further. To combat vandalism and theft, some keyless entry systems are equipped with GPS tracking and remote immobilization features, enabling prompt vehicle recovery and prevention of unauthorized use. With ongoing technological advancements, keyless entry systems aim to offer enhanced security and peace of mind for vehicle owners.

High cost of the Passive Keyless Entry System

Increase in need for operational efficient, high-end technology enabled vehicle safety, rise in concern toward vehicle safety, and effective operation ability for access of the vehicle are expected to increase the demand for automotive keyless entry system. For instance, smart passive keyless entry system may cost around $200 to $400. However, high costs might drive innovation in the market, leading to the development of alternative entry systems that offer similar convenience but at a lower cost. This could include improvements to traditional keyless entry systems or the emergence of new entry technologies. The keyless entry system is integrated with various high end technologies such as Bluetooth system, sensors, operating software, and electronic control panels, to regulate the operations. These subsystems of keyless entry are associated with high cost, which eventually increases the cost of automotive keyless entry systems to be used in automobiles; thus, restraining the growth of the automotive keyless entry system market during the forecast period.

Increase in penetration of keyless entry for passenger cars

As automotive technology continues to evolve, keyless entry systems have become a sought-after feature for modern consumers. The convenience and ease of use offered by keyless entry systems have led to a growing demand among car buyers, driving the adoption of this technology in a wide range of passenger vehicles. The rise in popularity of keyless entry systems creates a lucrative market for manufacturers and suppliers. With a larger customer base, keyless entry system providers can capitalize on economies of scale, leading to potential cost reductions and increased profitability. For instance, in July 2023, Tata Motors launched two new variants in its Altroz lineup to enhance the appeal and value of this premium hatchback with remote keyless entry standard features across all manual petrol variants of the Altroz. Similarly, in November 2022, Audi India launched the Audi Q5 special edition keyless entry system for customer comfort and car safety.

Furthermore, increase in demand for keyless entry systems encourages technological advancements and innovation within the market. Manufacturers will be compelled to invest in R&D to enhance security, functionality, and user experience of these systems. This, in turn, fosters healthy competition, driving continuous improvement and ensuring that consumers benefit from cutting-edge features.

Major automobile manufacturers are investing heavily in keyless entry access systems and launching new models and new versions of old models with keyless entry access system technology. For instance, in January 2022, the Renault Megane E-Tech Electric launched an unlocking procedure triggered by a unique key card that unlocks the car, pops out the flush door handles, and activates a lighting welcome sequence, all when the car detects the card anywhere within a short 360-degree radius of the vehicle.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive keyless entry system market analysis from 2022 to 2032 to identify the prevailing automotive keyless entry system market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive keyless entry system market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive keyless entry system market trends, key players, market segments, application areas, and market growth strategies.

Automotive Keyless Entry System Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 7.4 billion |

| Growth Rate | CAGR of 11.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 367 |

| By Technology |

|

| By Vehicle Type |

|

| By Device |

|

| By Sales Channel |

|

| By Product Type |

|

| By Region |

|

| Key Market Players | NXP Semiconductors, Kiekert AG, Robert Bosch GmbH, Mitsubishi Electric Corporation, Valeo SA, HELLA GMBH AND CO. KGAA, ALPS ALPINE CO., LTD., Tokai Rika Co., Ltd., Denso Corporation, Marquardt Management SE, Continental AG, Microchip Technology Inc. |

The global automotive keyless entry system market was valued at $2,450.9 million in 2022, and is projected to reach $7,347.3 million by 2032.

Key players covered in the report include Alps Alpine Co., Ltd., Continental AG, Denso Corporation, HELLA GmbH & Co. KGaA., Microchip Technology Inc., Mitsubishi Electric Corporation, NXP Semiconductors, Robert Bosch GmbH, Kiekert AG, Valeo S.A., Marquardt Management SE, and Tokai Rika.

Asia-Pacific is the largest regional market for automotive keyless entry system

Remote keyless entry system is the leading application of automotive keyless entry system market

The significant factors impacting the growth of the automotive keyless entry system market include the adoption of smart technology for vehicle safety and improved convenience, Product development to cater to changing demand pattern, and rise in number of vehicle thefts and vandalism incidents.

Loading Table Of Content...

Loading Research Methodology...