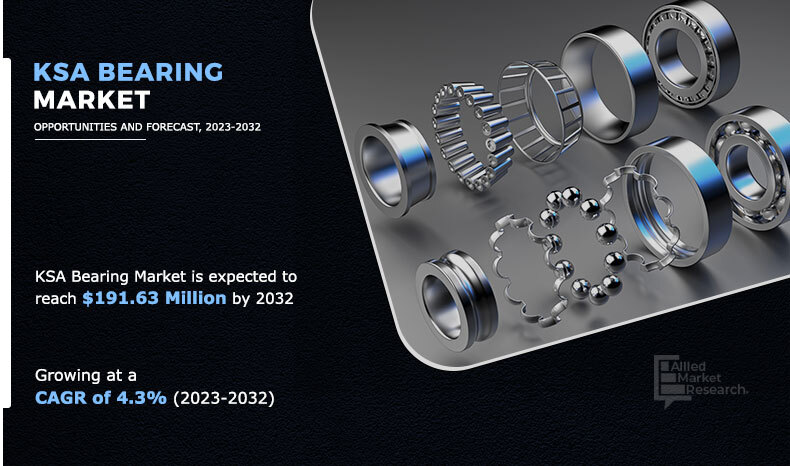

KSA Bearing Market Statistics: 2032

The KSA bearing market size was valued at $127.12 million in 2022, and is projected to reach $191.63 million by 2032, registering a CAGR of 4.3% from 2023 to 2032.

Report Key Highlighters

- The KSA Bearing market study covers one country. The research includes segment level analysis in terms of value ($million) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of the KSA markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The key players in the KSA Bearing market are NSK Ltd., Schaeffler AG, NTN Corporation, SKF, Iljin Bearing, RKB Bearing, JTEKT Corporation, THE TIMKEN COMPANY, IKO International, and RUBIX GROUP. The companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

Bearings are mechanical components that facilitate rotational or linear movement while reducing friction and sustaining weights. They are extensively used in machinery, vehicles, and equipment that require regulated motion, as they reduce the friction between rotating or sliding elements, allowing them to operate more smoothly.

Bearings major function is to enable linear or rotational movement along with handling high stress. They are a vital components in automobiles, aerospace, and industrial applications, and are responsible for efficient and smooth running of the vehicle and industrial machineries. Furthermore, they allow the desired motion and compel relative motion, thereby ensuring high fuel efficiency and speed enhancement.

By Type

Tapered Bearing is projected as the most lucrative segment

The growth of the KSA bearing market is majorly driven by surge in automobile production and sales, rise in investment in railways, and increase in emphasis on renewable power generation. However, fluctuation in raw material prices and high maintenance cost as well as increase in trend of vehicle electrification hinder the KSA bearing market growth. On the contrary, development of additive manufacturing technologies & materials to manufacture bearings and emergence of sensor bearing technology are anticipated to offer remunerative opportunities for the expansion of the KSA bearing market during the forecast period.

The railway industry in Saudi Arabia is emphasizing on reducing the cost and enhancing the service life of rails, which is boosting the demand for bearings. Bearing are used in railway gearbox to dampen the shocks and vibrations that are caused due to the force generated by traction motor and wheels running on tracks. Thus, severe operating conditions increases engine maintenance and down time. Furthermore, recent developments in bearings have fueled the demand for bearing in the railway industry. For example, tapered roller bearings are used to support pinion shafts that require regular adjustments, and expert maintenance has been developed that reduces maintenance cost and enhances cage strength.

By Distribution Channel

Original Equipment Manufacturers (OEMs) is projected as the most lucrative segments

Saudi Arabia is further planning to grow its railway infrastructure over the span of next 10 years. The country has set a goal for connecting Red Sea and Arabian Gulf ports with a railway track stretching 8,000 km by 2030. The plan further outlines the country ambition to increase its passenger capacity to over 3 million alongside carrying 50 million tons of freight. Similarly, on February 2024, the Government of Saudi Arabia signed an agreement with Stadler—a Swiss railway manufacturing company. The agreement will look after the design, development, and maintenance of next generation of passenger trains in the country. According to the agreement, Stadler will develop 20 new trains each with a capacity of 320 passengers, which will be made in accordance to Saudi Arabia’s harsh weather condition and will be deployed between routes of Riyadh and Dammam. Thus, rise in railway spending and increase in focus toward railway maintenance and service act as the key driving forces of the KSA bearing market.

By End User

Automotive is projected as the most lucrative segments

Additionally, the integration of sensor units in bearings is a recent development among vehicle manufacturer aiming to improve overall vehicle performance. The most common sensor bearings are used in automobile wheel applications. Most automobile hub unit bearings feature speed sensors that provide wheel speed data to the anti-lock braking system (ABS) and traction control units of vehicles. Furthermore, sensor-bearing allows digital monitoring of rotation speed, axial movement, deceleration, acceleration, and load carrying capability in passenger and commercial vehicles.

For instance, in June 2022, NTN Corporation announced the launch of its sensor-integrated bearing. The bearing is capable of wirelessly transmitting information such as temperature, rotational speed, and vibrations. These bearing can be used in anti-lock braking system (ABS), and also for use in high speed vehicles as well as off-highway and construction vehicles. Furthermore, sensor ball bearings can be employed in many automotive applications such as road rollers, forklifts, and electric vehicle motors. In addition, benefits such as small size, robustness, ease of installation, and cost-effectiveness with a wide range of applications are expected to create remunerative opportunities for the expansion of the KSA bearing industry in the near future.

The KSA bearing market is segmented into type, distribution channel, end user, machine type, group, and size. Depending on type, the market is fragmented into ball bearing and tapered bearing. On the basis of distribution channel, it is bifurcated into original equipment manufacturers (OEMs) and aftermarket. By end user, it is segregated into automotive, industrial, aerospace, and others. As per machine type, it is classified into ICE vehicles, electric vehicles, industrial machinery, and aerospace machinery. According to group, it is categorized into group 1, group 2, and group 3. On the basis of size, it is divided into 30–40, 41–50, 51–60, 61–70, and 70 & above.

Key Developments

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- On October 2023 NTN Corporation developed smallest hydrodynamic bearing “Hydrodynamic BEARPHITE” with an inner diameter of 0.6 mm. This bearing helps in improvement of quietness and long operating life of micro fan motors for small-sized mobile devices such as high-performance smartphones & wearable devices that are becoming increasingly faster & higher capacity.

- On November 2022 JTEKT Corporation with its subsidiary, Koyo Sealing Techno Co., Ltd. developed JTEKT Ultra Earth Bearing (JUEB). JUEB is a conductive ball bearing for eAxle motors with a function of conductivity in BEVs.

- On September 2022 NSK Ltd. completed its business expansion in Toyama, Japan. The NSK Takaoka Plant produces parts for bearings used in the infrastructure sector, such as wind turbines, railway, construction, and mining machinery. This strategy enables NSK to meet customer needs with state-of-the-art facilities, producing even higher quality products.

- On October 2022 NSK Ltd. developed J-Type Robustdyna angular contact ball bearings. It supports heavy cutting & highspeed performance in a single product for efficient machining of general and automotive parts as well as a longer service life and reduced carbon emissions in manufacturing.

Surge in automobile sales and production

All moving parts of automobiles require bearings to function, which enhance the performance of vehicles, bear heavy loads, and reduce friction. Some major sub-systems where bearings are used include engines, gearboxes, transmissions, wheels, steering, electrical motors, and pumps. With the growing inclination toward electric vehicle, automobile companies are planning to strengthen their presence in the Middle East.

For instance, on October 20, 2023, Hyundai Motor Co. and its sibling Kia Corp. announced their plan to acquire 20% of share in the Middle East by 2030, which is 70% more as compared to 2022 sales. The companies are aiming to sale 550,000 cars units annually by end of 2030. They are anticipating a sale of 350,000 units of Hyundai Motor by 2032 and 210,000 units of Kia by 2030. The automakers are further planning to add more electric vehicles (EVs) in their product offering to penetrate the market. For instance, Hyundai Motor aims to double its EV lineup from the current six models by 2027 to up its EV sales to over 15% of its total car sales in the Middle East by 2032. Similarly, Kia Corp. plans to release 15 EV models in the price range between $30,000 and $80,000 by 2027. In the first 6 months of 2023, Hyundai Motor and Kia ranked second and fourth, respectively, in terms of sales volume in Saudi Arabia. With increasing consumer shift toward EV and growing car sales, the market for KSA bearing is anticipated to show strong growth rate during the forecast period.

Fluctuation in raw material prices and high maintenance cost

The cost of raw materials acts as the key concern for manufacturers operating in the bearing market. Raw materials on an average account for around 60% of bearings manufacturer’s revenue. The raw material price of automotive bearing continuously fluctuates depending on the market economic condition. For instance, due to Russia–Ukraine war, the prices for raw materials especially steel increased significantly. For instance, in 2021 and 2022, the cost of raw materials such as steel and iron increased significantly. In 2022, Ukraine exported 1.32 million of pig iron, which was 69% less as compared to 2021. The reduction in metal mining resulted in increased price of raw materials globally, thus impacting the KSA bearing market. Furthermore, extreme price volatility of raw materials is becoming a challenge for companies to remain competitive and assure sustainable margins. As high-grade steel and alloy steel are the primary raw materials used for manufacturing bearings, bearings price is highly correlated with the global steel price movement. Thus, fluctuation of raw material price creates challenges for the bearing manufactures to produce bearings in comparative price and high quality. In addition, bearings require regular maintenance to prevent failure and prolong their service life, which increase the maintenance costs. Therefore, factors such as fluctuating raw material prices and regular maintenance cost hinder the growth of the market.

Development of additive manufacturing technologies & materials to manufacture bearings

Additive manufacturing provides industry players with a lightweight and cost-effective alternative to build complicated bearing components. Furthermore, additive 3D printing enables for the incorporation of greater complexity into a bearing design, thereby boosting its performance. For instance, Bowman International, a UK-based bearings manufacturer, modified a bearing cage utilizing additive 3D printing technology to add additional rolling parts to the bearing, thus extending its overall service life. Furthermore, 3D printing allows for the construction of lightweight bearings, which would be difficult and time-consuming to achieve using traditional manufacturing technologies.

Furthermore, several industry players are strategically collaborating with technology players to develop additive manufacturing processes. For instance, in July 2018, Bowman International entered into partnership with AMFG (an automation software specialists) to strengthen additive manufacturing division by taking on AMFG’s AI powered automation software to enhance production of bearings and sintered components. Furthermore, using sophisticated bearing materials such chrome steel in high-precision ball bearings increases product hardness and wear resistance. The use of tungsten carbide improves stress and impact handling qualities while also needing minimum lubrication to perform efficiently in high-temperature applications. Thus, the development of additive manufacturing methods as well as the usage of sophisticated materials are expected to provide prospective growth possibilities for the KSA bearing market throughout the forecast period.

KSA Bearing Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Distribution Channel |

|

| By End User |

|

| By Machine Type |

|

| By Group |

|

| By Size |

|

| Key Market Players | ILJIN Co., Ltd, NTN Corporation, Rubix, JTEKT Corporation, SKF, NSK Ltd, RKB Bearing Industries, Schaeffler AG, IKO International, The Timken Company |

Analyst Review

The KSA Bearing Market was valued at $127.12 million in 2022, and is projected to reach $191.63 million by 2032, registering a CAGR of 4.3 from 2023 to 2032.

Development of additive manufacturing technologies & materials are the upcoming trends in KSA Bearing Industry

The sample for KSA Bearing Market report can be obtained on demand from the AMR website. Also, the 24*7 chat support and direct call services are provided to procure the sample report

Automotive is the most influencing segment growing in the KSA Bearing report

The company profiles of the top market players of the market can be obtained from the company profile section mentioned in the report. This section includes analysis of top ten player’s operating in the industry

Contracts & product developments are the key strategies adopted by the top players in the market.

Loading Table Of Content...