KSA Last Mile Delivery Market Overview

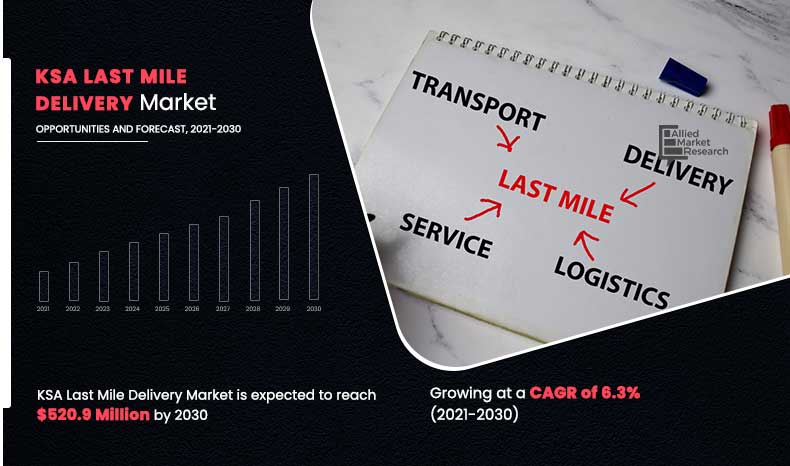

The KSA last mile delivery market was valued at USD 285.3 million in 2020, and is projected to reach USD 520.9 million by 2030, registering a CAGR of 6.3% from 2021 to 2030. The growth of the KSA last mile delivery is majorly driven by development of the e-commerce industry and increase in trading activities due to globalization. However, poor infrastructure & higher logistics costs and lack of control of manufacturers & retailers on logistics service are the factors that hamper the growth of the last mile delivery market.

Key Market Insights

- B2C Growth: B2C services are set to grow at a CAGR of 9.7% during the forecast period.

- Regular Delivery Leads: Regular delivery is expected to hold the largest market share in KSA.

- E-commerce Surge: E-commerce will be the fastest-growing end-use segment.

Market Size & Forecast

- 2030 Projected Market Size: USD 520.9 million

- 2020 Market Size: USD 285.3 million

- Compound Annual Growth Rate (CAGR) (2021-2030): 6.3%

On the contrary, surge in adoption of electric vehicles for cost effective delivery, introduction of autonomous vehicles for last mile delivery purpose, and increase in number of urban warehouses to meet the growing demands are some of the potential factors that are expected to offer remunerative opportunities for the expansion of the market in the near future. The Kingdom of Saudi Arabia serves as one of key destinations for start-ups among other countries such as New Zealand, and Japan. For instance, Aramex launched “Aramex Fleet,” which is a crowd shipping solution for last mile delivery. Innovations in last mile delivery services is one of the factors that is contributing toward the growth of the last mile delivery market in the Kingdom of Saudi Arabia.

Introduction

Last mile delivery, also known as last mile logistics, is the last leg of a journey comprising the movement of goods from a transportation hub or warehouse to the final delivery destination. Last mile delivery aims to deliver items to customers as quickly as possible while minimizing company costs. Last mile delivery accounts for more than ~50% of the total shipping cost.

Market Segementation

The KSA last mile delivery market is segmented into service type, delivery time, and end use. Depending on service type, the market is bifurcated into B2B and B2C. On the basis of delivery time, it is segregated into regular delivery and express/same-day delivery. By end use, it is fragmented into e-commerce, retail & FMCG, healthcare, mails & Packages, and others.

By Service Type

B2C segment is projected as the most lucrative segment

Top Impacting Factors

Development of e-commerce industry

E-commerce refers to the buying and selling of goods by using internet. Same-day delivery service providers carry out shipping of products to consumers within 24 hours of placing an order. In addition, the e-commerce industry utilizes same-day delivery service to manage and oversee the supply chain of e-commerce companies, which allows these companies to focus on marketing and other business operations.

The COVID-19 pandemic positively impacted the e-commerce sector of Kingdom of Saudi Arabia, despite of the initial fluctuations, In the Kingdom of Saudi Arabia, the e-commerce market witnessed growth of 40% from 2015 to 2020. Moreover, about 77% of customers are shopping online since the outbreak of the pandemic in Saudi Arabia. This increase in online shopping has resulted in the adoption of cashless payments in Saudi Arabia rather than traditional cash-on-delivery payment. Furthermore, different segments of e-commerce are observing rapid growth in the Middle East. For instance, e-grocery shopping segment has seen a growth of 1.3% in 2020 as compared to 0.3 % in 2019. Thus, rapid development of the e-commerce industry act as a key growth driver of the market.

By Delivery Time

Regular Delivery is projected as the most lucrative segment

Imprecise postal address system

The major focus of last mile delivery is to deliver parcel or shipment to customers as fast as possible. Every Last mile delivery transaction requires at least one address where the shipment or parcel has to be delivered. However, most of the e-commerce companies the Kingdom of Saudi Arabia are facing the issue of delivery to inaccurate addresses, which, in turn, affects the delivery time of parcel as well as the revenue of companies. This acts as a key deterrent factor of the KSA last mile delivery market. However, government has started a “National Address” system to enable efficient receiving of services comprising of home delivery, e-commerce, and other services, which is expected to lessen the impact of the abovementioned restraint in the near future.

By End Use

E-commerce segment is projected as the most lucrative segment

Top Players

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the KSA Last Mile Delivery industry.

- Diggipacks

- CMA CGM Group

- Abdul Latif Jameel Logistics

- Careem

- Saudi Post

- Agility

- Salasa

- Smsa Express Transportation Company Ltd.

- Safe Arrival

- Kuehne+Nagel

- Naqel Express

- Aymakan

- Bahri

- Masar

- Zajil Express

- Thabit Logistics

- Ajex (Ajlan & Bros Holding Group)

- Aramex

- Saee

- Kintetsu World Express, Inc.

Key Benefits for Stakeholders

- This study presents analytical depiction of the KSA last mile delivery market analysis along with the current trends and future estimations to depict imminent investment pockets.

- The overall market opportunity is determined by understanding profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current market is quantitatively analyzed from 2020 to 2030 to benchmark the financial competency.

- The Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

KSA Last Mile Delivery Market Report Highlights

| Aspects | Details |

| By SERVICE TYPE |

|

| By DELIVERY TIME |

|

| By END USE |

|

| Key Market Players | ZAJIL EXPRESS, AYMAKAN, BAHRI, SAEE, NAQEL EXPRESS, THABIT LOGISTICS, CAREEM, KINTETSU WORLD EXPRESS, INC., ARAMEX, SAFE ARRIVAL, SMSA EXPRESS TRANSPORTATION COMPANY LTD., ABDUL LATIF JAMEEL LOGISTICS, CMA CGM GROUP, MASAR, KUEHNE+NAGEL, SAUDI POST, AJEX (AJLAN & BROS HOLDING GROUP), DIGGIPACKS, SALASA, AGILITY |

Analyst Review

According to the insights of various top-level CXOs in the KSA last mile delivery market, the market is supplemented by numerous developments carried out by the top last mile delivery service providers. The KSA last mile delivery market is expected to witness considerable growth, owing to the expansion of the e-commerce industry and rise in trade activities. Moreover, increase in income of consumers followed by the need to have a product available in a shorter time span has enabled manufacturers to opt for quick delivery of products. This has provided lucrative opportunities for the manufacturers to enter into strategic alliance with the same-day and express delivery service providers to deliver the products from one place to another in a shorter time span.

However, higher operational cost, imprecise postal address, and cash as a payment culture system hinder the market growth. Conversely, the adoption of electric vehicle and the introduction of autonomous vehicles for last mile delivery are some of the prominent factors, which are expected to offer potential growth opportunities for the last mile delivery market in the region.

Roadways appears to be the main transporation in Saudi Arabia

Saudi Arabia logistics industry accounts for the considerable share in the revenue pie of the Middle East logistics market

The sample for KSA Last Mile Delivery market report can be obtained on demand from the AMR website. Also, the 24*7 chat support and direct call services are provided to procure the sample report.

adoption of autonomous vehicles for last mile delivery services is foreseen to unlock new opportunities in the market in future

Post the pandemic, last-mile delivery market in the region is expected to grow considerbaly owing to the growing ecommerce indstry in the region

The company profiles of the top market players of KSA Last Mile Delivery market can be obtained from the company profile section mentioned in the report. This section includes analysis of top ten player’s operating in the KSA last mile delivery market.

Yes, the logistics industry in KSA is growing considerbly

B2C segment appears to be the most influencing segmen in KSA last mile delivery market.

Skipped

The key growth strategies adopted by the KSA Last Mile Delivery industry players includes product launch, business expansion, collaboration. These strategies opted by various industry players is leading to the growth of the KSA Last Mile Delivery market as well as the players.

Loading Table Of Content...