Lab Information Management Systems Market Statistics

The global Lab Information Management System Market Size was valued at $1,475.14 million in 2021 and is estimated to reach $4,155.34 million by 2031, growing at a CAGR of 10.9% from 2022 to 2031. Increase in research and development activities for drug discoveries, which has resulted in an increase in the adoption of lab information management systems across the world. As this system helps research & development labs to organize their samples and analyses into different groups for better analysis.

A laboratory information management system is also known as a laboratory management system, a software system that enables support laboratory operations that can track workflow and specimens, aggregate data for research or business intelligence purposes, and ensure laboratory operations are compliant with various regulations and standards. LIMS enables labs to produce accurate, reliable, reproducible, and faster data. These systems are widely used in various industries such as life science, chemicals, oil & gas, and other industries. Laboratory information management systems (LIMS) improve access to quality diagnostic testing and provide accurate, timely information for patient care, public health planning, and policy decisions. In addition, laboratory information management systems (LIMS) are recognized as a powerful tool to improve laboratory data management within the laboratories and reporting of data externally. They are widely used by medical laboratories in high-income countries.

Historical Overview

The market was analyzed qualitatively and quantitatively from 2018 to 2020. Most of the growth during this period was from Asia-Pacific, due to a rise in the number of research and development activities carried out mainly by biotech/pharma laboratories and contract research organizations. This has increased the demand for laboratory information management systems in this region and is the major factor that contributes to the growth of Lab Information Management System Market Size.

Market Dynamics

The key Lab Information Management System Market Trends are the increase in the technological advancements of lab information management systems such as cloud computing, artificial intelligence, and predictive analytics is the key factor that drives the growth market. These advanced technologies have enabled laboratories to streamline their operations, reduce costs, and increase productivity. For instance, cloud computing provides the ability to store a large amount of data in the cloud, which can be accessed from anywhere in the world. This has enabled laboratories to manage their data more efficiently and cost-effectively.

However, the high cost of the lab management information system and the lack of skilled professionals in the industries are the major factors that impact the Lab Information Management System Market Growth in upcoming years. On the other hand, the rapid development of healthcare infrastructures, along with the government’s support to digitalized services in developing countries such as China, India, and others are the key factors that provide lucrative Lab Information Management System Market Opportunity during the forecast period.

The overall impact of COVID-19 remains positive on the lab information management system market. As COVID-19 pandemic has become the most significant challenge across the world. Clinical laboratories and hospitals are finding it difficult to cope with the rapid influx of COVID-19 testing samples, impacting their ability to provide accurate testing. Thus, the implementation of automated solutions such as LIMS for hospitals and clinical laboratories is expected to relieve stress by promoting efficient testing of voluminous samples. For instance, during the COVID-19 pandemic, in December 2020, Indian Railways launched an integrated hospital management information system (HMIS) in South Central Railways and Northern Railways. The HMIS in railways has been developed in coordination with RailTel Corporation Limited. The objective of the HMIS is to provide a single window of clearance of hospital administration activity such as diagnostics, clinical, pharmacy, examinations, and industrial health.

Furthermore, various players operating in the laboratory information management systems market are adopting various key strategies such as collaboration with public and private sector organizations to employ advanced technologies for implementing COVID-19 testing capabilities. For instance, LabWare Technologies collaborated with the National Health Service to provide laboratory management software to healthcare settings across the UK.

Segmental Overview

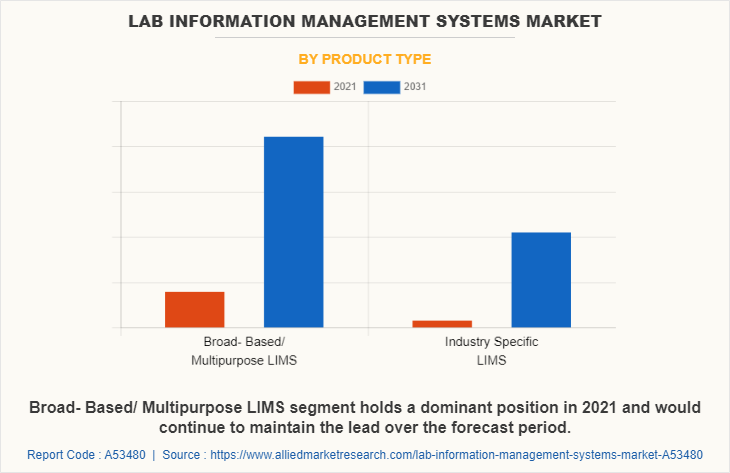

By Product Type

On the basis of product type, the lab information management system market is segmented into Industry-specific LIMS & broad-based/multi-purpose LIMS. In 2021, the multipurpose segment accounted for the largest share of the market. The dominance of the segment is attributed to rise in the adoption of broad-based/ multipurpose LIMS across the world. They can collect and share data securely and instantaneously from anywhere to any device.

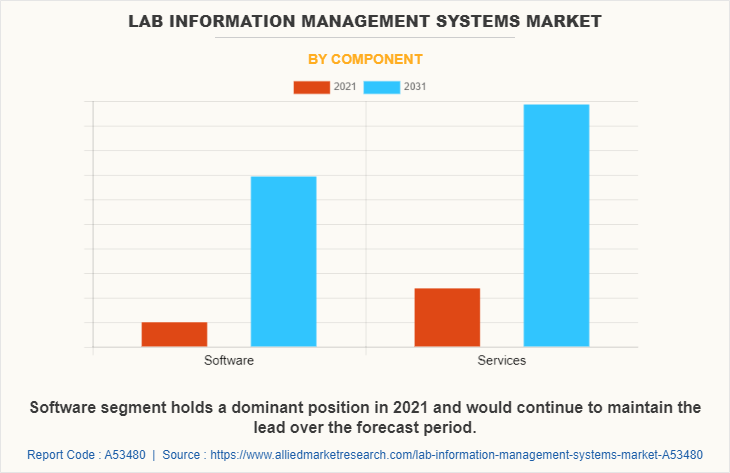

By Component

On the basis of component, the lab information management system market is classified into software and services. In 2021, the services segment exhibited the highest growth and is anticipated to lead the market during the forecast period, owing to increase in demand for consulting, implementation, integration, management, and other lab informatics services.

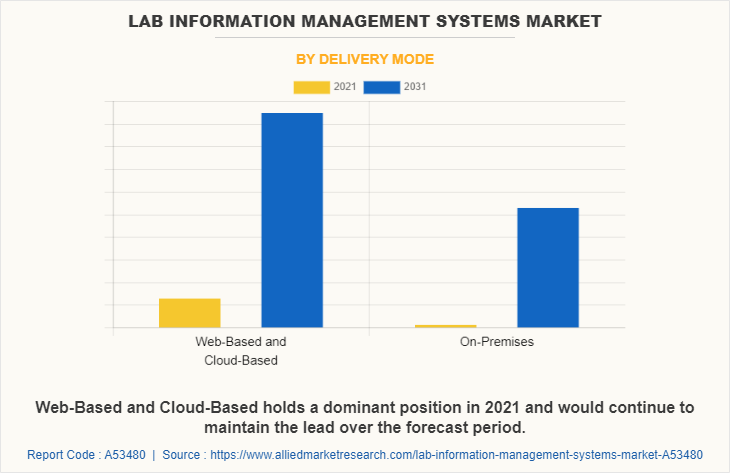

By Delivery Mode

On the basis of delivery mode, the lab information management system market is classified into on-premises, on- cloud, and web-based. In 2021, the on-cloud segment exhibited the Lab Information Management System Market Sharein 2021, owing to the rise in the adoption of On-cloud-based LIMS systems worldwide. It provides users with access to their data from any location and from any device and enables them to securely store and share data with other users.

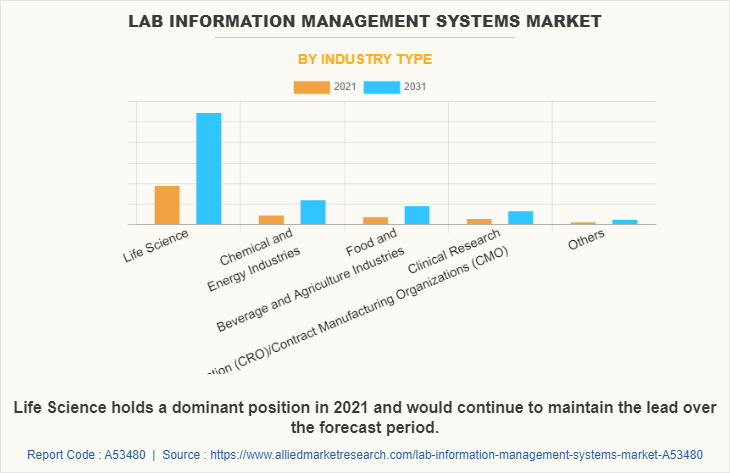

By Industry

By industry type, the lab information management system market is segmented into life science, chemical & energy industries, food, beverage & agriculture industries, and clinical research organizations/contract manufacturing organizations (CRO/CMO), and others. In 2021, the life science segment exhibited Lab Information Management System Market Share in 2021, owing to an increase in research and development activities in biopharmaceutical industries across the world.

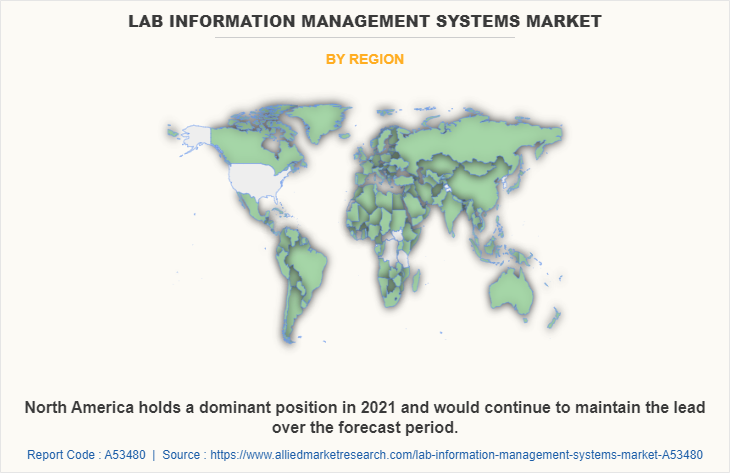

By Region

Lab information management system market analysis is done across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a majority of the lab information management system (LIMS) market share in 2021 and is anticipated to remain dominant during the forecast period, owing to the high adoption rate of technologically advanced lab information management system, increase in healthcare expenditure, and presence of major key players involved in the R&D activities.

Furthermore, the rise in the number of key players offering different lab information management systems to cater the specific needs of laboratories in the US .and Canada is the major factor driving the growth of the Lab Information Management System Industry. For instance, LabVantage Solutions offer a range of LIMS solutions, including their flagship “LabVantage 8” LIMS platform, which provides laboratories with a comprehensive, easy-to-use solution for managing laboratory data.

Asia-Pacific is expected to grow at the highest rate during the forecast period. Asia-Pacific is expected to register the fastest CAGR during the forecast period. The market growth in the Asia-Pacific region is supplemented due to rise in the number of research and development activities carried out by mainly biotech/pharma laboratories and contract research organizations has increased the demand for laboratory information management systems in this region is the major factor that contributes to the growth of the market.

Furthermore, the presence of major players such as Thermo Fisher Scientific, Inc., LabVantage Solutions, Inc., and Abbott laboratories offering various LIMS in this region is expected to drive the growth of the lab information management system (LIMS) market. For instance, Abbott laboratories offers a range of LIMS solutions designed specifically for clinical and research laboratories. In addition, LabCorp developed a LIMS that integrates with its proprietary laboratory information system (LIS) to provide a comprehensive solution. Moreover, the growing government initiatives and regulations in this region further boosts the growth of the Lab Information Management System Industry.

Recent Developments in the Lab Information Management System Market

- In 2022, Green Scientific Labs Holdings Inc. launched its new laboratory information management system (LIMS) for immediate use across all its laboratory operations.

- In 2021, CliniSys launched a new laboratory information management system for genomic laboratories in the UK. GLIMS Genomics has been designed to support the effective management of genomic laboratories.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the lab information management systems market analysis from 2021 to 2031 to identify the prevailing lab information management systems market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the lab information management systems market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global lab information management systems market trends, key players, market segments, application areas, and market growth strategies.

Lab Information Management Systems Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 4.2 billion |

| Growth Rate | CAGR of 10.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 297 |

| By Product Type |

|

| By Component |

|

| By Delivery Mode |

|

| By Industry Type |

|

| By Region |

|

| Key Market Players | Siemens AG, Agilent Technologies Inc., LabWare, Inc., Genetic Technologies Inc, Thermo Fisher Scientific Inc., PerkinElmer Inc., Illumina Inc., LabLynx, Inc, Abbott Laboratories, CrelioHealth Inc. |

Analyst Review

This section provides various opinions of the top-level CXOs in the lab information management system industry. Lab information management system market is expected to witness significant growth in the near future, owing to rise in large-scale implementation of laboratory information management systems in various industries, and increase in the number of samples generated for research and analysis, due to the rise in number of life-threatening diseases across the world is the key factor propels the growth of market.

According to the perspectives of CXOs, the surgical wound dressings market is expected to witness steady growth in the future. The rise in the adoption of broad-based/ multipurpose LIMS across the world is the key factor that propels the growth of the market. As they can collect and share data securely and instantaneously from anywhere to any device.

However, the high cost of the lab management information system (LIMS) and the lack of skilled professionals in the industry hamper the market growth. Moreover, developing countries are expected to offer lucrative growth opportunities to the key players. This is majorly attributed to factors such as improvement in healthcare facilities, rise in disposable income, and rapid improvement in economic conditions.

The upcoming trends are the increase in technological advancements of lab information management systems (LIMS) and rise in the demand for lab automation. Moreover, there is an increase in research and development activities for drug discoveries, has resulted in an increase in the adoption of lab information management systems across the world. As this system helps research & development labs to organize their samples and analyses into different groups for better analysis.

The total market value of Lab Information Management System market is $ 1,475.14 million in 2021

North America is the largest regional market for Lab Information Management Systems

The market value of Lab Information Management System market in 2031 was $4,155.34 million Million

include PerkinElmer Inc., Agilent Technologies Inc, Thermo Fisher Scientific Inc., Illumina Inc., Siemens AG, LabLynx, Inc, Genetic Technologies Inc. CrelioHealth Inc., LabWare, Inc., and Abbott Laboratories.

The base year for the report is 2021

Yes, Lab Information Management Systems market companies are profiled in the report

No, there is no value chain analysis provided in the Lab Information Management Systems market report

Loading Table Of Content...