Laboratory Proficiency Testing Market Research, 2033

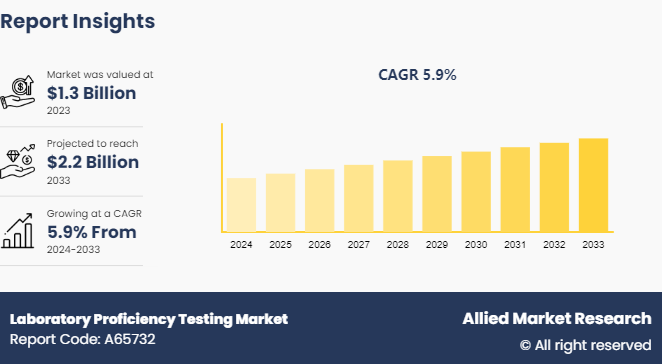

The global laboratory proficiency testing market size was valued at $1.3 billion in 2023, and is projected to reach $2.2 billion by 2033, growing at a CAGR of 5.9% from 2024 to 2033.

Market Overview

Laboratory proficiency testing is an external quality and accuracy assessment process involving the analysis of unknown samples from pharmaceuticals, microbiology, and others to ensure accurate lab testing results. Unlike internal quality control measures, proficiency testing offers a critical comparison and objective assessment of a laboratory's overall performance. This includes evaluating lab staff competencies, specimen handling procedures, equipment functionality, and results reporting accuracy. By participating in proficiency testing, laboratories can identify potential areas for improvement, benchmark their performance against external standards, and ensure that their testing processes meet the highest standards of accuracy and reliability. This comprehensive evaluation is essential for maintaining the integrity of lab results and enhancing the credibility of the laboratory's diagnostic capabilities.

Key Takeaways

- The laboratory proficiency testing market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major laboratory proficiency testing industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

Laboratory proficiency testing market growth is driven due to the increasing need for regular competence evaluation in hospitals. This trend ensures that laboratory practices remain accurate and reliable, vital for patient safety and effective treatment. Additionally, the growing adoption of cell-culture-based products, such as monoclonal antibodies, is driving this expansion. These advanced biotechnological products require rigorous testing standards to maintain their efficacy and safety, further emphasizing the importance of proficiency testing in modern healthcare settings. Consequently, the demand for proficiency testing services is steadily rising, reflecting its critical role in contemporary medical and biotechnological advancements.

However, laboratory proficiency testing faces significant challenges due to the limited availability of medical resources like limited trained professionals, advanced equipment for effective and efficient working, etc. This scarcity hampers the ability to conduct thorough and accurate evaluations, potentially impacting the reliability of diagnostic results and overall laboratory performance. Addressing this issue is crucial for maintaining high standards in medical testing.

Moreover, the growing adoption of laboratory proficiency testing (PT) is driven by stringent regulations, ensuring accuracy and reliability in test results. This trend offers laboratory proficiency testing market opportunity to enhance their quality standards and compliance, fostering trust and credibility in their analytical processes and thus progressing laboratory proficiency testing market forecast.

Analysis of Micro and Macro Economic Factors

The laboratory proficiency testing market is influenced by a combination of micro and macroeconomic factors that shape its dynamics and growth. At the microeconomic level, the market is impacted by factors such as the cost of participation for laboratories and the confidence they have in the proficiency testing outcomes provided by organizers. Laboratories invest significant resources, including labor and costs, in participating in proficiency tests, emphasizing the importance of a competent PT provider and a well-designed protocol. The choice of reference values, particularly the use of certified reference materials (CRMs) , plays a crucial role in ensuring the accuracy and reliability of proficiency testing results. However, the prohibitive costs and limited availability of CRMs pose challenges for laboratories, prompting them to seek alternative methodologies for establishing reference values.

On the macroeconomic front, broader economic trends and policies also influence the laboratory proficiency testing market. Economic factors such as overall market demand, government regulations, and funding allocations for research and development impact the uptake of proficiency testing services. For instance, increased regulatory scrutiny in industries such as healthcare and environmental monitoring can drive demand for proficiency testing to ensure compliance with standards and regulations. Additionally, fluctuations in funding for scientific research and quality assurance programs can affect the spending capacity of laboratories and their willingness to invest in proficiency testing services.

Market Segmentation

The laboratory proficiency testing market share is segmented into industry, technology, end use, and region. On the basis of industry, the market is divided into clinical diagnostics, pharmaceuticals, microbiology, cannabis, and others. As per technology, the market is segregated into cell culture, spectrometry, polymerase chain reaction, chromatography, immunoassays, and others. By end use the market is segmented on the basis of hospitals, contract research organizations, pharmaceutical & biotechnology companies, laboratories, and others. Region wise, the laboratory proficiency testing market share is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Country Market Outlook

The U.S. is witnessing significant growth in laboratory proficiency testing, driven by an increasing emphasis on quality assurance and regulatory compliance in healthcare and clinical diagnostics. This expansion is supported by the rising demand for accurate and reliable laboratory results, crucial for effective patient care and medical research. In addition, factors such as the implementation of stringent regulatory standards by bodies like the Clinical Laboratory Improvement Amendments (CLIA) and the College of American Pathologists (CAP) are major contributors to the market growth. Additionally, technological advancements in diagnostic testing and the escalating prevalence of chronic diseases necessitate precise lab testing, further fueling market growth. This trend highlights the critical role of proficiency testing in enhancing laboratory performance and ensuring diagnostic accuracy across the U.S. healthcare system.

In April 2022, Spex CertiPrep, part of Antylia Scientific, announced that NSI Lab Solutions, an ISO/IEC 17025, 17043, and 17034 accredited organization within Spex, partnered with the U.S. Pharmacopeia (USP) to offer a comprehensive proficiency testing (PT) program globally. This initiative enhances laboratory and analyst performance awareness, supports accreditation needs, fortifies quality management systems (QMS) , instills confidence across various industries, and assures regulators during product registration and lifecycle. NSI and USP developed diverse PT schemes, evaluated materials for measurement suitability, and created robust protocols to ensure assigned value accuracy and quality, leveraging NSI’s extensive expertise.

Competitive Landscape

The major players operating in the laboratory proficiency testing market size include LGC Limited, Randox Laboratories Ltd., Bio-Rad Laboratories, Inc., Merck KGaA, QACS, NSI Lab Solutions, Weqas, BIPEA, Absolute Standards, Inc., and INSTAND. Other players in the laboratory proficiency testing market include AOAC International, and others.

Recent Key Strategies and Developments

- In February 2024, LGC PT, a provider of proficiency testing services, dedicated to ensuring the accuracy and reliability of laboratory testing, launched their 2024 interactive online catalogue that offers swift access to scheme details and application forms. Featuring over 50 new samples, it includes tests for Salmonella and Listeria in meat, sterility in milk, PFAS in food, gluten in cake mix, and mycotoxins in spices, ensuring precision and reliability in testing.

- In January 2023, BIPEA, a European scientific organization dedicated to enhancing the analytical performance of laboratories, introduced Proficiency Testing Scheme (PTS) 20G, facilitating laboratories to assess analytical prowess via fish sample analysis. The scheme entails examining a 600g frozen fish using customary methodologies. Parameters include caloric value (moisture, ashes, water activity, pH, proteins, cholesterol, energy value) , freshness indicators (TVB-N, TMA) , mineral content (calcium, copper, iron, manganese, magnesium) , vitamin levels (tocopherols, B1, B2, PP) , fatty acid profile, and PremiTest. This comprehensive evaluation empowers laboratories to enhance precision and reliability in fish sample analysis, ensuring quality standards in food testing practices.

Industry Trends

- In January 2023, BIPEA introduced a new interlaboratory test, PTS 101D, enabling laboratories to detect Listeria spp and Listeria monocytogenes on stainless steel plate samples. In its first round, BIPEA provided three stainless steel plate samples for participating laboratories to analyze. Laboratories will determine the presence or absence of Listeria spp and Listeria monocytogenes using reference methods ISO 18593 and ISO 11290-1, or alternative methods. This initiative aims to standardize detection practices and ensure accuracy in identifying these pathogens.

- In October 2021, Biogenix Labs, a G42 Healthcare company, in collaboration with the Abu Dhabi Quality and Conformity Council (ADQCC) , launched the UAE's first Proficiency Testing (PT) program for COVID-19 external testing procedures. This initiative involved sending COVID-19 RT-PCR samples prepared by Biogenix Labs to over 15 government and private laboratories across the UAE. The ADQCC evaluated the results and provided feedback to ensure quality standards. The initial survey samples were tested on five different platforms, including LamPORE, which combines loop-mediated isothermal amplification with nanopore sequencing, enhancing the accuracy and reliability of the testing process.

Key Sources Referred

- BIPEA

- FAPAS

- RCPA (Royal College of Pathologists of Australasia) Quality Assurance Programs

- Bio-Rad Laboratories, Inc.

- LGC Limited

- Merck KGaA

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the laboratory proficiency testing market analysis from 2024 to 2033 to identify the prevailing laboratory proficiency testing industry opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the laboratory proficiency testing market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global laboratory proficiency testing market trends, key players, market segments, application areas, and market growth strategies.

Laboratory Proficiency Testing Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 2.2 Billion |

| Growth Rate | CAGR of 5.9% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Industry |

|

| By Technology |

|

| By Region |

|

| Key Market Players | BIPEA, Merck KGaA, Weqas, LGC Limited, Absolute Standards, Inc., INSTAND, QACS, Bio-Rad Laboratories, Inc., NSI Lab Solutions, Randox Laboratories Ltd. |

The growing adoption of laboratory proficiency testing (PT) is driven by stringent regulations, ensuring accuracy and reliability in test results.

The hospitals sub-segment is expected to dominate throughout the forecast period

North America region to held the dominant share of the market owing to the advanced healthcare infrastructure, rigorous regulatory standards, and continuous technological advancements in laboratory testing.

The laboratory proficiency testing market was valued at $1.25 billion in 2023.

The major players operating in the laboratory proficiency testing market include LGC Limited, Randox Laboratories Ltd., Bio-Rad Laboratories, Inc., Merck KGaA, QACS, NSI Lab Solutions, Weqas, BIPEA, Absolute Standards, Inc., and INSTAND.

Loading Table Of Content...