Language Translation Software Market Insights, 2031

The global language translation software market was valued at $9.3 billion in 2021, and is projected to reach $44.8 billion by 2031, growing at a CAGR of 17.3% from 2022 to 2031.

Increase in prevalence of smartphones around the globe and the rise in government investments are driving the growth of language translation software market share. However, alternative tools and free language translators accessibility limits the growth of this market. Conversely, expanding business communication needs are anticipated to provide numerous opportunities for the expansion of language translation software market forecast.

A language translation software is designed to facilitate and speed up the translator’s work by providing a stable and safe environment. Additionally, software for translation provides features, tools, and resources that may be utilised to streamline the entire translation process and produce high-quality translations rapidly. The finest translation software centralises translation itself as well as data analysis, reporting, content distribution, and project management. Furthermore, by switching from the laborious practise of blindly translating through a spreadsheet to a fully automated and transparent process, brands may use translation and localization tools to empower translators. The language translation software market is segmented into Component, Solution Type, Enterprise Size and Industry Vertical.

The global language translation software market is segmented on the basis of component, solution type, enterprise size, industry vertical and region. On the basis of component, it is segregated into solution and services. On the basis of solution type, it is segregated into rule-based machine translation, statistical based machine translation, and hybrid machine translation. On the basis of enterprise size, it is bifurcated into large enterprise and SMEs. By industry vertical, it is categorized into BFSI, IT & telecom, education, travel and tourism, manufacturing, healthcare, and other. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The global language translation software market is dominated by key players such as Languageline Solutions, Microsoft Corporation, Acolad, Alphabet Inc, Babylon Software, Inriver, International Business Machines Corporation, Lingotek, Apptek, and Global Linguist Solutions. These players have adopted various strategies to increase their market penetration and strengthen their position in language translation software industry.

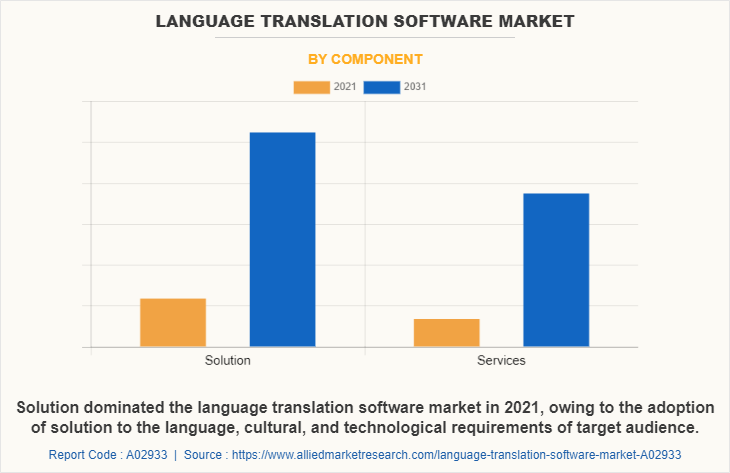

Depending on the component, the solution segment dominated the language translation software market share in 2021 and is expected to continue this trend during the forecast period, owing to rise in creating publishable quality translations for businesses to close the gap in internal and external multilingual communications. However, the services segment is expected to witness significant growth in the upcoming years, as it enable users the chance to communicate with a global audience and with human translation services, users can expand their worldwide reach in ways that have never been possible for a business.

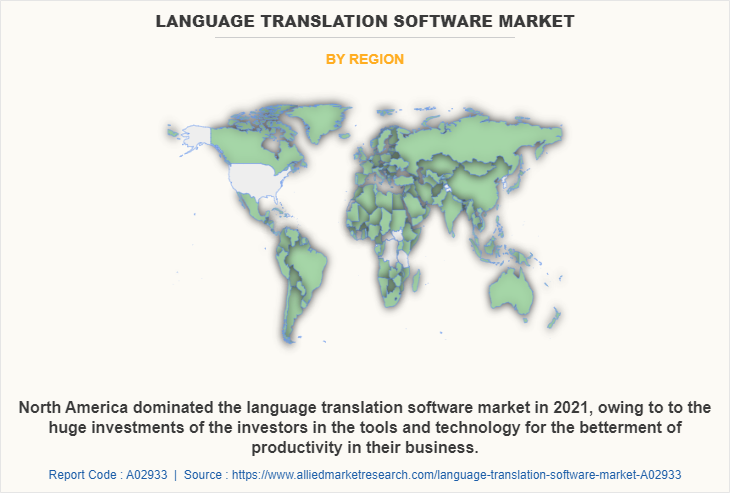

Region-wise, the language translation software market size was dominated by North America in 2021 and is expected to retain its position during the forecast period, owing to high demand for high-quality translation services, presence of a substantial industrial base in the U.S., government initiatives to promote innovation, and large purchasing power are some of the driving factors in the region. However, Asia Pacific is expected to witness significant growth during the forecast period, as various companies are also creating new technological advancements to improve the translation process, such as AI enabled translators. These elements are projected to propel market expansion. Thus, these factors are expected to witness considerable growth during the forecast period.

Top Impacting Factors -

Increase in prevalence of smartphones around the globe

The reason behind language translation software market growth is the rise in the adoption of smartphones and internet access in non-English speaking nations such as Spain, Russia, Mexico, and Brazil. Majorities of adults in each of the emerging and developing countries now use their personal smartphones. Moreover, apps for socializing and messaging have grown immensely popular. People around the world are trying to stay connected with different cultures and regions. This has significantly boosted the adoption of language translation software. Furthermore, most of the non-English speaking regions are increasingly using LTS in-built smartphones. Thus, many smartphone companies are adding this software with modifications to attract customers. This is anticipated to boost the market growth significantly.

Rise in Government investments

The modern world is turning into a global village. Moreover, there is a massive exchange of human resources between different countries. The main obstacles in this process are the variation in social norms, communication styles, and cultural norms, as well as language barriers. These distinctions are prominent among different countries and also among the distinct regions of the same country. People depend on the government for a variety of daily services, including banking, healthcare, trains, agriculture, public-sector businesses, employment opportunities, and government policies that are in their best interests. Therefore, the government attempts to provide a user-friendly interface that enables the public to access these services quickly. The government driven website's content must, however, be presented in "local languages", if it is intended for all citizens. The bulk of the populace is expected to become more aware as a result of the government's efforts. Localizing a website can help the governments to reach this goal. Hence, majority of the government organizations are investing on LTS to enhance relationship with fellow citizens.

Digital Capabilities

Language translation software is increasingly relevant in advanced technologies where advanced control techniques such as Statistical Machine Translation (SMT), Neural Machine Translation (NMT), Rule-based Machine Translation (RBMT) and Multimodal Machine Translation. In addition, a technique called statistical machine translation (SMT) uses statistical models to translate text from one language to another. To understand how words and phrases are translated from one language to another, SMT uses a significant quantity of multilingual text data. SMT systems typically use techniques such as Hidden Markov Models (HMMs) or Phrase-Based Models (PBMs) to analyze the bilingual text data and generate translations.

Additionally, SMT's ability to handle a broad variety of languages and ease of implementation are two of its primary advantages. However, idiomatic language, wordplay, and cultural allusions might be challenging for it to learn from the data. It can also result in translations that are semantically incorrect or that are not grammatically accurate. Many different organizations are shifting towards the machine translation technology to achieve more accurate result. For instance, according to the paper published in December 2021 by IEEE, in recent years, machine translation (MT) become very essential in many applications and achieved advances for almost all languages. Such features further expand the growth of the language translation software market.

End-User Adoption

The growing digitalization and increasing need of translation software is accelerating end-user adoption. Language translation software can be adopted by different end users such as individual consumers, businesses, and government organizations. Individual users of language translation software use it for a variety of personal purposes, including travel, intercultural communication, and language acquisition. Microsoft Translator and Google Translate are two well-known consumer-oriented language translation programmes. For instance, StoryWeaver, a multilingual children’s storytelling platform. It currently hosts more than 50,000 open-licensed stories across reading levels in more than 300 languages from around the world.

Furthermore, the availability and quality of the software, the requirement for communication in several languages, and the cost of the programme are some of the variables that influence end user adoption of language translation software. The creation of more precise and user-friendly language translation software has expanded its use among end users in recent years as a result of developments in the field of natural language processing and the expansion of data availability. For instance, in January 2022, Kotozna Inc., a Japan-based software startup, debuted its latest digital concierge platform namely Kotozna In-room, that deciphers 109 different languages for hotels and travel markets. The system allows guests and hotel staff to communicate in real-time in their native tongues but have the messages translated to whatever language the person speaks. This unlocks new potentials and innovation value, enhancing the translation role and creating opportunities for translation software.

Government Initiatives

Various companies and government bodies are collaborating to strengthen R&D in the many industries with evolving productive alliances that lead to indigenous design, development, manufacturing, and deployment of cost-effective products and solutions. Additionally, government organizations also adopt language translation software for different purposes such as immigration services, diplomacy, and foreign trade.

For instance, in September 2020, the government of Estonia is to allocate one million euros for the development of machine translation software and a further €400,000 for creating an option to automatically add Estonian-language subtitles to television programs. The option to automatically add Estonian-language subtitles to television programs would bolster the availability of information for people who are unable to follow most live broadcasts in the Estonian language. Moreover, this initiative will augment the indigenous intellectual property and create new avenues for wider adoption and language translation products & solutions. Furthermore, the overall goal of government activities on language translation software industry is to foster the growth of the technology, encourage its use, and enhance the services offered to residents.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the language translation software market analysis from 2021 to 2031 to identify the prevailing language translation software market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the language translation software market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global language translation software market trends, key players, market segments, application areas, and market growth strategies.

Language Translation Software Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 44.8 billion |

| Growth Rate | CAGR of 17.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 451 |

| By Component |

|

| By Solution Type |

|

| By Enterprise Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Lingotek, Microsoft Corporation, LanguageLine Solutions, Acolad, Babylon Software, International Business Machines Corporation, apptek, inriver, Alphabet Inc, global linguist solutions |

Analyst Review

International contacts with clients, prospects, suppliers, stakeholders, manufacturers, and partners are significantly impacted by language translation software. Software for translating languages has developed over time to become more sophisticated and include additional capabilities. These range from extensive translation memories and real-time collaboration tools that help translators work consistently and complete projects more quickly where text is mechanically translated with minimum human involvement. Additionally, free translation tools like Google Translate and Microsoft Translator accurately translate written words, spoken words, dialogues, and even images. These advancements in language translation software led to market expansion.

Key providers in the language translation software market are Acolad, Apptek, Alphabet Inc, Babylon Software, Global Linguist Solutions, Inriver, IBM Corporation, Lingotek, Languageline Solutions and Microsoft Corporation. In addition, the upgrades in translation software are a significant reason for language translation market expansion. For instance, in December 2022, Google replaced the camera mode on the translate app with Google lens. Users have the option to change languages and can do this on any image already stored or click a new photo to translate the text. The idea seems to make the translation better as prior to the change, users had no option but to use the simple translate feature. Google Lens brings other features. Thus, these enhancements in language translation software have propelled the market growth.

The demand for language translation software grows as the digital world pushes harder for more shared and interconnected experiences and as businesses increasingly look to enter international markets. Post-editing, video translation, and transcreation are some of the significant trends in the worldwide language translation software market since they are scalable and economical. There is already a lot of content available in English but not nearly enough in other languages. As a result, key players are trying to introduce additional international and regional languages on language translation software. For instance, in April 2020, Microsoft Translator introduced real-time translation in five additional languages Gujarati, Marathi, Kannada, Malayalam and Punjabi. This takes the total number of Indian languages supported to 10, including Bengali, Hindi, Tamil, Telugu, and Urdu. With this, the service allows over 90% of Indians to access information and work in their native/preferred languages, making computing language-agnostic and more inclusive in the country. Therefore, language translation software can let people to experiment in different markets.

Many key players introduced advanced features to enhance the user experience. For instance, in May 2022, Document translation feature of Translator, a Microsoft Azure Cognitive Service,?added the ability to translate PDF documents containing scanned image content, eliminating the need for customers to preprocess them through an OCR engine before translation. It allows customers to translate entire documents and batches of documents into more than 110 languages and dialects while preserving the layout and formatting of the original file. Document translation supports a variety of file types, including Word, PowerPoint and PDF, and customers can use either pre-built or custom machine translation models. Such enhancements in language translation software have propelled the market growth.

Increase in prevalence of smartphones around the globe and the rise in government investments are driving the growth of the market.

Region-wise, the language translation software market was dominated by North America in 2021 and is expected to retain its position during the forecast period

The global language translation software market size was valued at $ 9.26 billion in 2021, and is projected to reach $ 44.83 billion by 2031, growing at a CAGR of 17.3% from 2022 to 2031.

The global language translation software market is dominated by key players such as Languageline Solutions, Microsoft Corporation, Acolad, Alphabet Inc, Babylon Software, Inriver, International Business Machines Corporation, Lingotek, Apptek, and Global Linguist Solutions. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Loading Table Of Content...